The iGaming industry thrives on fast, seamless transactions. Players demand instant deposits, quick withdrawals, and a frictionless experience across multiple platforms. Yet, many operators still rely on legacy payment systems—outdated infrastructures that are slow, rigid, and ill-equipped to handle the complexities of modern digital transactions.

As competition intensifies and player expectations grow, sticking with these antiquated systems is no longer just an inconvenience—it’s a direct threat to profitability.

Legacy payment solutions come with a host of risks, from transaction delays and high processing fees to regulatory challenges, security vulnerabilities, and hidden fees. These hidden fees, often imposed by banks, can range from 2% to 3% of the total transaction and, along with foreign exchange conversion charges, significantly inflate the costs associated with cross-border transactions. SMEs, in particular, face these high costs, which can erode profitability and create additional financial strain. Additionally, 14% of all cross-border payments are never completed, leading to an average cost of $12 per failed transaction. More critically, they create frustrating experiences for players, leading to higher abandonment rates and lost revenue opportunities.

This article explores the hidden pitfalls of outdated payment methods and demonstrates how modern, integrated payment platforms—like those from Corytech—can help iGaming businesses stay ahead by enhancing user experience, optimizing financial operations, and ensuring compliance with evolving regulations.

If you’re a payment service provider (PSP), iGaming operator, or decision-maker looking to retain players, streamline payments, and boost profitability, this guide is for you. We’ll break down:

-

The key risks of using legacy payment solutions

-

How outdated systems impact player retention and revenue

-

The advantages of upgrading to modern payment orchestration platforms

-

Real-world insights into how seamless transactions drive growth in iGaming

Let’s dive into why modernizing your payment infrastructure isn’t just an option—it’s a necessity.

The Changing Landscape of Payment Solutions in iGaming

Emergence of Modern Payment Technologies

The iGaming industry is evolving rapidly, and so are the payment technologies that power it. As players demand instant transactions, enhanced security, and greater flexibility, outdated payment infrastructures struggle to keep up. Forward-thinking operators are adopting modern payment solutions to stay competitive and meet evolving expectations.

Here’s how technological advancements are reshaping iGaming payment ecosystems:

1. Cryptocurrency & Blockchain Transactions

The rise of crypto payments in iGaming has transformed how players deposit and withdraw funds. Cryptocurrencies like Bitcoin, Ethereum, and stablecoins offer:

-

Instant transactions with no banking delays

-

Lower processing fees compared to traditional card payments

-

Enhanced privacy for players in regions with gaming restrictions

-

Reduced fraud risks due to blockchain’s transparent and immutable nature

-

Flexible payment options, including credit cards and digital wallets, increase convenience during purchase

Operators integrating crypto payment methods gain access to a global player base, allowing seamless international payments and cross-border transactions without the complexities of fiat currency conversions.

2. Unified Payment Processing

Legacy systems often require multiple integrations with banks, PSPs, and compliance tools, creating operational bottlenecks. Modern payment orchestration platforms simplify this by providing:

-

A single interface for multiple payment providers

-

Smart transaction routing to optimize approvals and reduce declines

-

Multi-currency support for a seamless international player experience

-

Flexible payment options, including multiple payment methods such as cards, e-wallets, and local payment methods

By leveraging unified payment processing, operators can increase transaction success rates, cut costs, and enhance player retention through smooth financial interactions.

3. AI-Driven Payment Automation

Automation is playing a pivotal role in fraud prevention, risk assessment, and compliance management. AI-powered payment solutions bring:

-

Real-time fraud detection using machine learning algorithms

-

Dynamic risk management that adapts to transaction patterns

-

Automated [LINK 1] compliance for faster player verification

-

Intelligent chargeback mitigation to protect operators’ revenue

-

Robust fraud protection features, which safeguard both customers and businesses from potential threats.

-

Real-time fraud detection using machine learning algorithms

-

Dynamic risk management that adapts to transaction patterns

-

Automated KYC/AML compliance for faster player verification

-

Intelligent chargeback mitigation to protect operators’ revenue

With automated payments, businesses reduce manual errors, improve transaction efficiency in processing payments, and offer faster withdrawals—a key factor in keeping high-value players engaged.

The Shift Toward Faster, Secure, and Flexible Payments

The adoption of crypto, unified payment processing, and automation isn’t just a trend—it’s becoming a necessity in iGaming. Players expect instant deposits, hassle-free withdrawals, and top-tier security. Operators that modernize their payment infrastructure gain a competitive edge, while those clinging to legacy systems risk losing both players and profits. Research shows that 63% of customers prefer to use integrated payments when making purchases, highlighting the growing demand for seamless and efficient payment solutions.

Legacy Payment Systems

What Are Legacy Payment Systems?

Legacy payment systems refer to outdated financial infrastructures that were once the backbone of online transactions but have since become inefficient, rigid, and unable to meet the evolving needs of the iGaming industry. These systems typically include:

-

Traditional bank transfers with slow processing times

-

Credit and debit card payments reliant on outdated verification methods

-

Limited PSP integrations that restrict player payment options

-

On-premise payment gateways requiring significant maintenance

-

Batch-based settlements that delay fund availability

Why Were Legacy Payment Systems the Industry Standard?

Historically, these systems were the foundation of digital payments, providing:

✅ Security & Regulation Compliance – Traditional banking networks ensured financial security and regulatory oversight.

✅ Global Acceptance – Credit cards and bank transfers provided accessibility to a wide player base.

✅ Familiarity & Trust – Players and operators trusted well-established payment methods like Visa, Mastercard, and bank wires.

However, while these advantages once made legacy systems indispensable, today’s players demand speed, flexibility, and seamless transactions that these systems can no longer provide.

The Decline of Legacy Payment Systems: Facts & Figures

Despite their historical dominance, legacy payment methods are losing ground due to their inefficiencies and limitations. Consider these industry insights:

-

Transaction Speed Issues: While modern payment solutions process withdrawals in minutes, legacy bank transfers can take 3 to 5 business days, leading to player frustration and drop-offs. A recent report by VISA shows that 63% of online gamblers abandon platforms that have slow withdrawals. For SMEs, the average settlement time for global payments also remains at three to five business days, further highlighting the inefficiencies of traditional systems.

-

High Processing Fees: Traditional PSPs and card networks charge 2-4% per transaction, whereas crypto and direct bank payments offer fees as low as 0.5-1%, significantly reducing operator costs.

-

Fraud & Chargeback Risks: Legacy credit card transactions result in an estimated $1.8 billion in chargeback fraud annually across the online gaming sector, forcing operators to absorb high dispute resolution costs.

-

Regulatory Challenges: Many legacy PSPs struggle to adapt to evolving gaming regulations across jurisdictions. In contrast, modern fintech solutions offer built-in compliance automation, reducing risks for operators.

The Growing Competitive Disadvantage

As iGaming trends shift toward instant, flexible, and low-cost payments, operators sticking with legacy systems face:

❌ Player churn due to slow deposits & withdrawals

❌ Higher operational costs from excessive fees & chargebacks

❌ Increased regulatory risks from compliance complexities

❌ Limited market expansion due to restricted payment options

In contrast, modern payment orchestration platforms like Corytech offer faster processing, multi-currency support, fraud prevention, and seamless integration with multiple PSPs—ensuring iGaming operators stay competitive.

Risks and Drawbacks of Legacy Payment Solutions

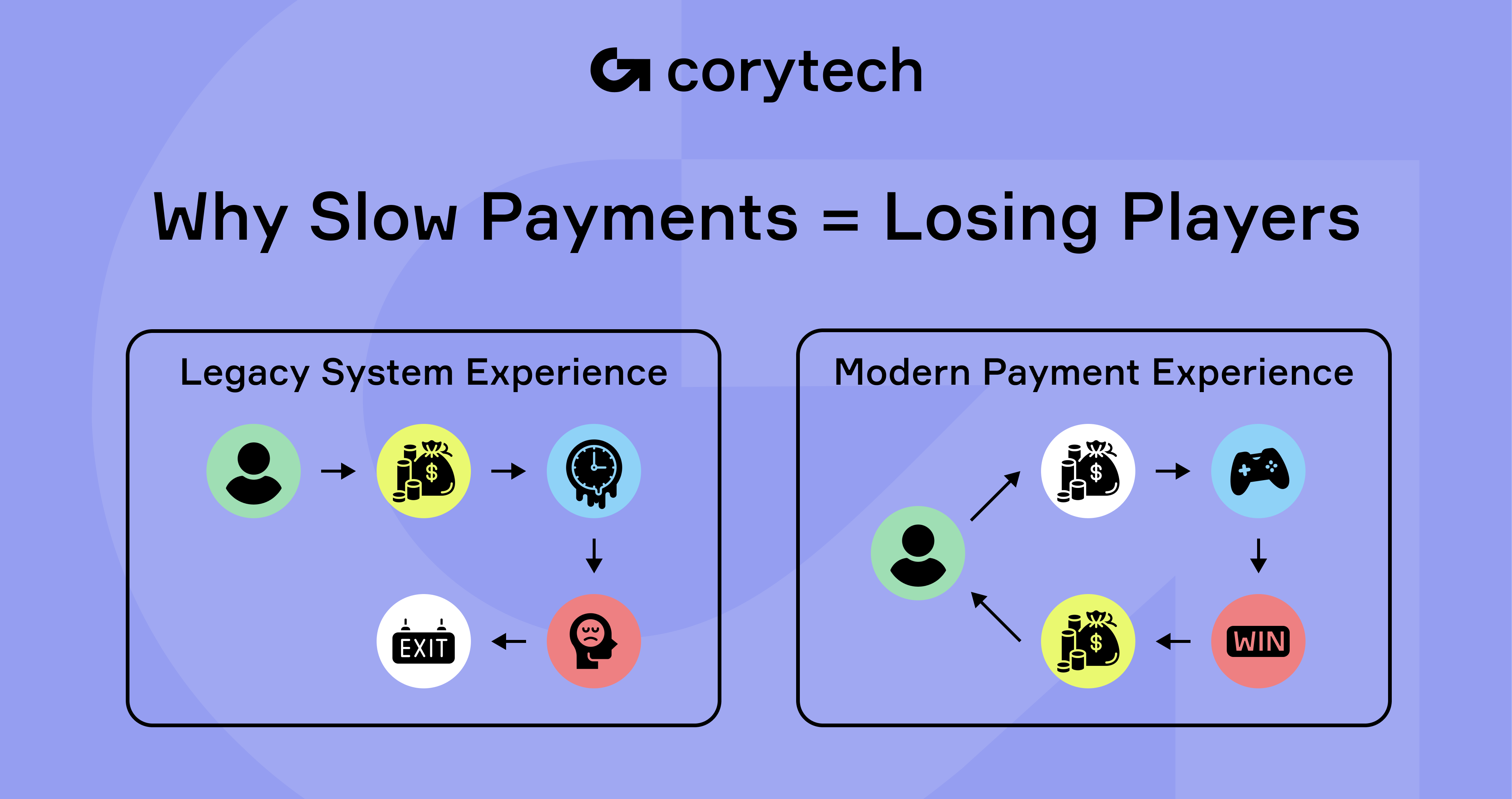

Deteriorating Player Experience

In the competitive iGaming industry, a seamless payment experience is essential for player retention. However, legacy payment systems often introduce unnecessary friction, leading to transaction abandonment and lost revenue.

Slow Deposits and Withdrawals

Players expect instant access to their funds, but traditional payment systems often introduce delays when they process payments. Bank transfers can take three to five business days, card payments may require manual fraud checks, and e-wallet transactions can be slowed by outdated verification processes. Studies show that 69% of players prioritize instant withdrawals, and more than 60% will switch platforms if payout times are too slow.

High Decline Rates and Payment Failures

Legacy systems rely on outdated banking infrastructures that struggle with cross-border transactions, currency conversions, and fraud prevention. This results in increased rejection rates, failed transactions, and additional verification steps that frustrate users. A study by the UK Gambling Commission found that 30% of players permanently abandon a platform after experiencing multiple payment failures.

Poor Mobile Optimization

With mobile gaming generating over half of iGaming revenue, payment solutions must be optimized for fast and intuitive mobile transactions. Legacy systems often require lengthy form-filling, have non-responsive interfaces, and suffer from slow processing speeds. Platforms that implement frictionless mobile payment experiences see up to 30% higher player retention rates.

Why a Frictionless Payment Journey Matters

A smooth, fast payment process leads to higher player satisfaction, lower churn rates, and an increased lifetime value for each player. By upgrading to modern payment solutions, operators can eliminate unnecessary delays and friction, keeping players engaged.

Security Vulnerabilities and Compliance Challenges

As cyber threats and regulatory requirements evolve, legacy payment systems increasingly expose operators to fraud, data breaches, and compliance risks. Secure payment solutions, on the other hand, protect sensitive customer information, reducing the risk of data breaches and fraud. This added layer of security is essential for maintaining player trust and safeguarding financial transactions.

Higher Fraud Risks Due to Outdated Security Protocols

Older payment systems lack real-time fraud detection mechanisms and secure payment methods, making them more vulnerable to cybercriminals. Common weaknesses include static, rule-based fraud detection instead of AI-driven monitoring, weak encryption, and higher rates of chargeback fraud. The iGaming industry loses an estimated $1.8 billion annually due to fraudulent chargebacks, with legacy systems contributing significantly to the issue.

Compliance Gaps in AML/KYC Regulations

With regulatory frameworks becoming stricter, legacy systems struggle to meet Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements. Many fail to verify player identities in real time, detect suspicious transactions, or adapt to changing compliance rules. A 2023 report from the European Banking Authority found that over 40% of gaming operators using outdated payment solutions faced compliance fines or temporary suspensions due to AML/KYC failures. Modern ecommerce payment gateways often offer robust fraud protection features, safeguarding both customers and businesses.

Data Breach and Cyberattack Risks

Cybercriminals frequently target legacy payment systems due to outdated security protocols. Threats such as phishing, Distributed Denial-of-Service (DDoS) attacks, and data breaches can expose sensitive player financial information. The financial sector reports that a single data breach costs an average of $5.9 million, with iGaming operators being particularly vulnerable.

How Modern Payment Solutions Solve These Challenges

Advanced payment systems offer AI-driven fraud detection, automated AML/KYC compliance, and blockchain-based security enhancements. These innovations protect transactions, reduce fraud risks, and ensure operators remain compliant with evolving regulations.

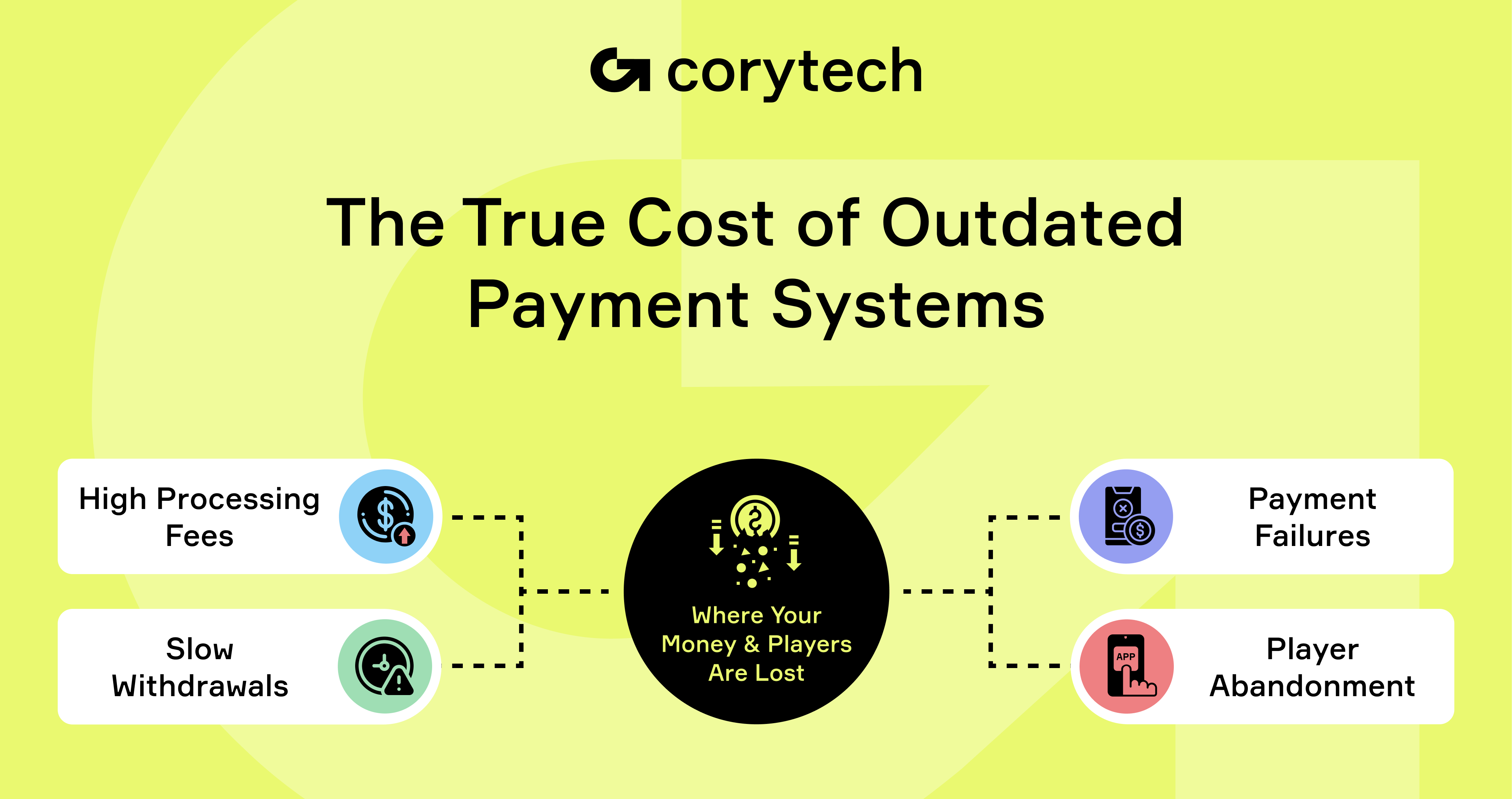

Hidden Costs of Legacy Payment Systems

While legacy payment systems may seem reliable, their inefficiencies come with significant hidden costs that directly impact an operator’s bottom line. These costs accumulate over time, reducing profitability and making it difficult for businesses to scale effectively.

Manual Processing Overheads

Many legacy systems require manual intervention for payment reconciliation, fraud checks, and regulatory compliance. This reliance on manual processes results in:

-

Increased labor costs for payment processing teams

-

Slower transaction approvals, leading to delayed withdrawals

-

Higher risks of human error, which can cause disputes and chargebacks

A report by Juniper Research found that automating payment workflows can reduce operational costs by up to 30%, yet many operators using legacy systems still rely on outdated, labor-intensive processes.

Higher Transaction Fees

Legacy payment providers often charge higher processing fees due to multiple intermediaries involved in transactions, including hidden fees that can significantly inflate costs. These costs include:

-

Card payment processing fees (typically 2-4% per transaction)

-

Cross-border transaction fees, which can increase costs by up to 3%

-

Currency conversion charges, affecting international players

-

Chargeback fees, which can range from $20 to $100 per dispute

By comparison, modern payment solutions leverage direct bank transfers, crypto payments, and AI-driven fraud prevention to minimize these costs. Operators that optimize payment processing can save millions annually by reducing unnecessary transaction expenses. Payment processing fees, which vary based on the gateway, can significantly impact a business's profitability, making the choice of payment solutions critical.

Increased Downtime and Technical Maintenance

Older payment infrastructures require frequent maintenance, updates, and troubleshooting, leading to:

-

Payment gateway outages that prevent deposits and withdrawals

-

Longer recovery times when technical failures occur

-

Additional IT costs for system upkeep

Most payment gateway providers charge a combination of fixed transaction fees and monthly fees, adding to the financial burden of maintaining outdated systems.

According to a McKinsey report, payment downtime can cost businesses an average of $250,000 per hour, with larger iGaming platforms losing even more in missed player transactions and abandoned bets.

Profitability Impact of Legacy Payment Inefficiencies

The cumulative effect of manual labor, high fees, and downtime results in significant financial losses. In contrast, modern payment orchestration platforms streamline operations, lower costs, and improve revenue potential.

Competitive Disadvantage

As the iGaming industry evolves, operators using legacy payment solutions risk falling behind competitors that embrace faster, more efficient, and innovative payment technologies.

Losing Players to Competitors Offering Better Payment Experiences

Players today expect seamless, instant, and secure transactions. When an operator’s payment system causes delays, high fees, or failed transactions, frustrated users will seek alternatives. Research from Statista shows that 60% of online gamblers will switch platforms if they experience repeated payment issues.

Missing Out on Emerging Revenue Streams

Modern payment solutions enable operators to tap into new markets and accept payments through various preferences, including:

-

Cryptocurrency payments, expanding access to global players

-

Alternative payment methods (APMs) like digital wallets and instant bank transfers

-

Faster withdrawal options, attracting high-value VIP players

-

Regulatory-compliant payment processing, allowing expansion into new jurisdictions

Operators that fail to adapt to evolving payment trends will struggle to attract and retain players, while competitors offering cutting-edge solutions will capture larger market shares.

Reputation and Brand Trust Risks

A slow, outdated payment process can damage an operator’s reputation. In the age of social media and online reviews, complaints about slow withdrawals, high fees, and failed transactions can deter potential players. In contrast, platforms that invest in modern, player-friendly payment experiences enhance customer trust and long-term loyalty.

The Need for a Future-Proof Payment Strategy

To remain competitive, iGaming operators must modernize their payment infrastructure by adopting flexible, low-cost, and automated solutions. By doing so, they can:

-

Reduce operational costs and increase profit margins

-

Improve player retention and satisfaction

-

Expand into new markets with optimized payment options

-

Stay compliant with evolving financial regulations

Modern cross-border payment solutions also enhance speed and efficiency, particularly benefiting small and medium-sized enterprises (SMEs) engaged in international business.

-

Reduce operational costs and increase profit margins

-

Improve player retention and satisfaction

-

Expand into new markets with optimized payment options

-

Stay compliant with evolving financial regulations

The iGaming payment landscape is changing rapidly. Operators that fail to evolve will lose market share, while those who invest in innovation will thrive.

How Modern Payment Solutions Drive Profits and Enhance Player Retention

Streamlined Transactions and Superior User Experience

Modern payment solutions eliminate the frustrations of slow deposits, withdrawal delays, and high failure rates by offering:

-

Instant transactions using AI-driven routing and real-time settlement

-

Intuitive, mobile-first interfaces for seamless in-game payments

-

Personalized payment options, allowing players to choose their preferred method (cards, e-wallets, crypto, or bank transfers)

A report by Statista found that 73% of online gamblers prefer platforms that offer instant withdrawals, making fast and secure transactions, including the handling of payment details, a competitive necessity. Additionally, ecommerce payment gateways provide a flexible, efficient, and secure platform for online transactions, improving the checkout experience and overall business operations.

-

Instant transactions using AI-driven routing and real-time settlement

-

Intuitive, mobile-first interfaces for seamless in-game payments

-

Personalized payment options, allowing players to choose their preferred method (cards, e-wallets, crypto, or bank transfers)

A report by Statista found that 73% of online gamblers prefer platforms that offer instant withdrawals, making fast and secure transactions, including the handling of payment details, a competitive necessity.

Robust Security and Regulatory Compliance

Security breaches and non-compliance with regulations can lead to crippling fines and player distrust. Modern payment platforms integrate:

-

Multi-factor authentication (MFA) to prevent unauthorized access

-

AI-driven fraud detection, reducing fraudulent transactions by 50%

-

Automated AML/KYC compliance, cutting onboarding time by 40%

-

Secure payments to enable quick and safe money transfers, enhancing user confidence and efficiency

By adopting these measures, operators minimize chargebacks and fraud risks while ensuring seamless regulatory adherence.

Integration of Fiat and Crypto Solutions

The iGaming industry is seeing a surge in cryptocurrency adoption, with crypto transactions in gambling increasing by 88% over the past three years. Unified payment platforms now support both fiat and digital currencies, including popular digital wallet payment methods like Apple Pay, offering:

-

Global accessibility, bypassing banking restrictions

-

Lower transaction fees, compared to traditional credit card processing

-

Stablecoin integration, reducing volatility risks while maintaining fast settlement times

This hybrid approach attracts a wider player base and expands market reach.

Operational Efficiency and Cost Reduction

By leveraging automation and AI-driven payment orchestration, modern solutions help operators:

-

Reduce manual processing costs by up to 35%

-

Optimize transaction routing, lowering failure rates

-

Minimize chargebacks and fraud disputes, increasing revenue retention

Efficient payment processing doesn’t just enhance the player experience—it directly improves an operator’s bottom line.

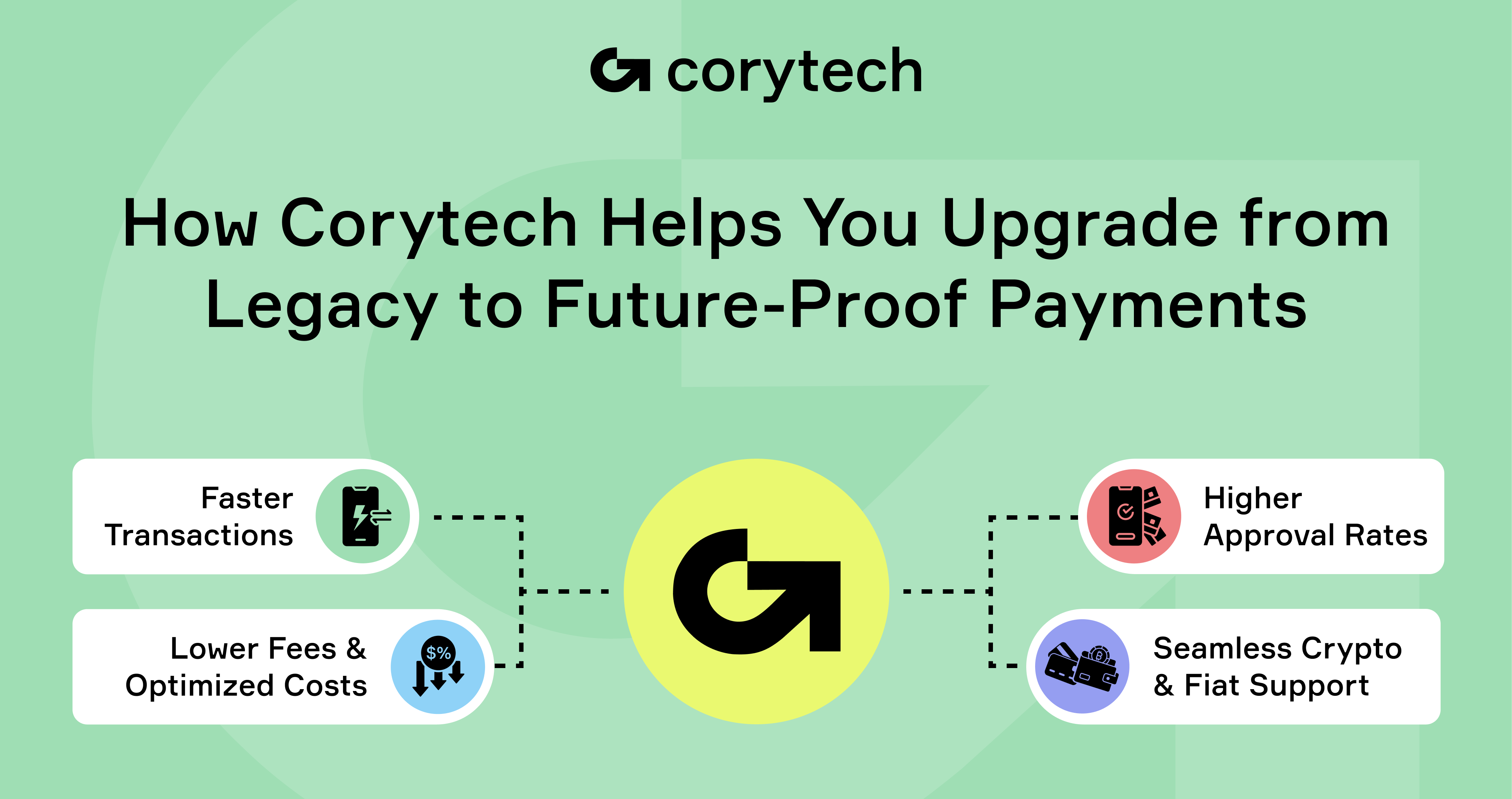

Corytech’s Approach to Modernizing Payment Solutions

Overview of Corytech’s Integrated Payment Platform

Corytech’s platform is designed to eliminate legacy inefficiencies and offer a future-proof solution for iGaming operators. Key features include:

-

Unified fiat and [LINK 1], supporting multiple currencies

-

Smart transaction routing, increasing approval rates and reducing decline rates

-

User-friendly dashboards, providing real-time transaction insights

-

Ecommerce payment gateway integration, which acts as an intermediary technology layer between an ecommerce website and a payment processor, securely transmitting payment information for authorization and settlement

-

Unified fiat and crypto processing, supporting multiple currencies

-

Smart transaction routing, increasing approval rates and reducing decline rates

-

User-friendly dashboards, providing real-time transaction insights

By replacing fragmented legacy systems with an all-in-one payment orchestration platform and payment processor, Corytech helps businesses scale without payment roadblocks.

Advanced Security and Compliance Features

Corytech integrates cutting-edge security measures to mitigate fraud risks and simplify compliance:

-

End-to-end encryption, ensuring secure transactions

-

Automated KYC/AML compliance, reducing regulatory fines

-

AI-powered fraud detection, analyzing transactions in real time

A merchant account is essential for managing funds securely before they reach a business account, and it can significantly impact international payment capabilities and transaction fees.

With cyber threats on the rise, operators need proactive security measures to protect their businesses and players.

Future-Proofing Your Business

Corytech’s payment solutions are designed to adapt to evolving industry trends and regulatory landscapes, offering:

-

Seamless API integration, allowing scalability without downtime

-

Regular updates, ensuring compliance with the latest financial regulations

-

Support for emerging payment technologies, such as blockchain and instant bank transfers

By investing in flexible, scalable payment solutions, operators future-proof their operations and stay ahead of the competition.

.png)

Strategic Recommendations for Industry Leaders

Conducting a Payment Infrastructure Assessment

Operators should perform a gap analysis of their current payment systems by evaluating:

-

Transaction speed and success rates, including how quickly funds are transferred to the business bank account

-

Payment method coverage (fiat, crypto, alternative payment methods)

-

Fraud prevention and security features

Identifying these inefficiencies is the first step in optimizing payment performance.

Developing a Roadmap for Transition

To ensure a smooth transition from legacy to modern systems, businesses should:

-

Define key pain points and identify payment bottlenecks

-

Adopt a phased integration approach, minimizing downtime

-

Train teams on new technologies and payment processors to maximize operational efficiency

This structured approach helps businesses implement modern solutions with minimal disruption.

Measuring Impact and ROI

To track the effectiveness of new payment systems, operators should monitor:

-

Transaction success rates and processing speeds

-

Chargeback reduction percentages

-

Customer retention improvements

Operators using modern payment solutions report up to a 25% increase in transaction volume and 30% higher player retention rates.

Partnering with a Technology Leader like Corytech

Working with a specialized payment provider like Corytech ensures:

-

Ongoing support and system optimizations

-

Access to the latest payment technologies

-

Custom solutions tailored to specific iGaming needs

Operators that partner with a forward-thinking payment provider gain a long-term competitive edge.

What’s Next?

-

Legacy payment systems create slow, costly, and inefficient transactions

-

Modern payment solutions enhance security, speed, and scalability

-

Corytech’s AI-driven, integrated platform streamlines payments and reduces costs

-

Future-proofing payment infrastructure ensures long-term success

-

The right online payment gateway can offer valuable analytics to help businesses understand customer behavior and improve sales, while also supporting multiple payment methods and currencies

The future of iGaming payments is real-time, flexible, and highly secure. Operators that fail to innovate risk losing market share, while those that embrace AI-driven, multi-currency solutions will stay ahead in an evolving industry.

To learn more about Corytech’s payment orchestration platform, schedule a free consultation or demo today.

Visit Corytech’s website to explore how modern payment solutions can revolutionize your business.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)