Globalization has transformed the financial landscape, allowing merchants to expand their reach beyond borders and tap into new demands. However, one challenge that many businesses face when going global is managing myriad currencies. Fortunately, there is a solution to this problem: implementing multi-currency endorsement.

According to a report by Accenture, 90% of consumers prefer to blow the whistle on websites that display prices in their local currency. This means that if your business is present overseas in multiple countries but only displays prices in one currency, you could be skimming over potential sales. In fact, a study by Shopify found that businesses that implemented multi-currency support saw a 10% increase in sales, on average.

But it's not just about increasing sales. Multi-currency sustainability can also help businesses mitigate the perils posed by currency volatilities. When a business operates in numerous countries, it's vulnerable to currency alternations that can potentially erode its revenue and result in a diminution of profit margins. According to an investigation provided by Forrester Research, in 2022 about 31% of US online shoppers and 26% of European clients picked goods cross-border. By suggesting to vendees the power to pay in their regional currency, businesses can mitigate this risk and stabilize their cash flow.

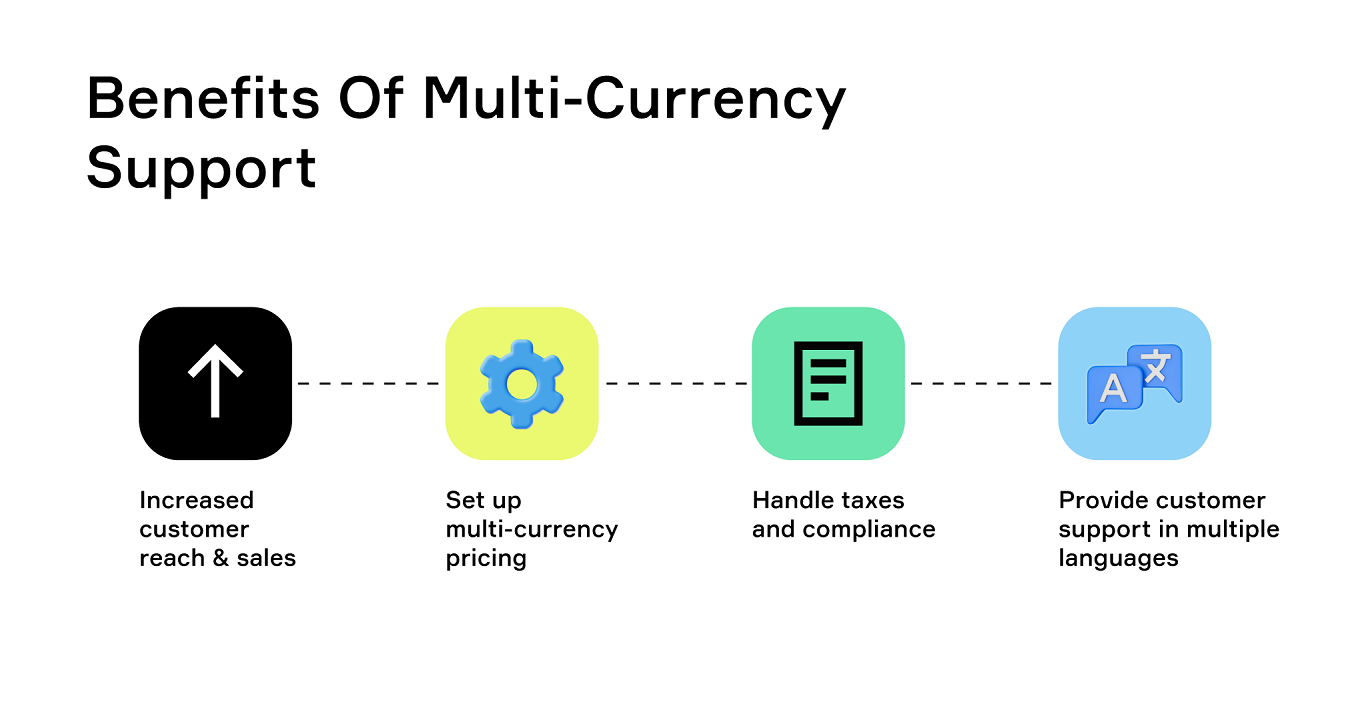

Benefits of multi-currency support

Multi-currency support is the bee's knees when it comes to global commerce. Not only can it help you reach more consumers and boost your sales game, but it can also make your customers feel like kings and queens with a shopping experience that's as smooth as silk. As 33% of clients are likely to abandon a purchase if pricing is in U.S. dollars only, according to Shopify. It’s not unusual for businesses to hold more than one bank account; today, even the average American consumer has five bank accounts. Let's take a closer look at some of the dope benefits of multi currency accounts.

Increased customer reach and sales

Think of multi-currency support as a passport to global markets. By letting your customers pay in their own currencies, you're opening up your doors to a whole new crowd. And let's face it, people are more likely to drop some cash when they don't have to stress about exchange rates and sneaky fees. By offering multi-currency wallets, businesses can provide a more convenient and comfortable shopping experience for buyers, which can ultimately drive sales. In fact, a study by Shopify found that businesses that implemented multi-currency accounts saw a 10% increase in sales, on average.

Improved customer satisfaction

Usually, people want to see prices in their local currency and have the option to pay in it. When you give your vendees the freedom to pay in their own currencies, you're telling them that you care about their experience. They'll appreciate the fact that you're keeping things real and not trying to sneak in any extra charges. And happy shoppers mean more repeat biz and word-of-mouth referrals.

Ediz Ozturk, the founder of international fitness and apparel brand Doyoueven, admits that one of the challenges the company has identified with scaling globally was instilling customer trust. And 73% of consumers say a good experience is key in influencing their brand loyalties. By offering a seamless and convenient payment experience, businesses can set themselves apart from competitors and establish themselves as leaders in the market. Can't beat that with a stick.

Enhanced market competitiveness

Implementing a multicurrency merchant account can help businesses to gain an edge in a crowded and highly competitive market. By reaching a wider customer base and competing with other businesses that operate in multiple countries, businesses can establish themselves as global players and increase their chances of success.

Reduced currency conversion costs

Finally, multicurrency support can help businesses to reduce currency conversion costs. Converting currencies can be a real pain in the neck, especially when the exchange rates are all over the place. But with multi-currency support, you can save some serious dough by converting currencies at competitive rates. And when you combine that with the fact that you won't have to pay for sneaky fees or other hidden costs, you're looking at some serious savings that can help you keep your biz running like a well-oiled machine.

.png)

How to implement multi-currency support

So, you are a savvy business owner and you've decided to implement multicurrency settlement in your online store. Good for you! It's a smart move that can help you expand your customer base and grow your sales. But how do you actually go about implementing it?

Choose the right payment gateway

First things first, you need to make sure that your payment gateway supports multi-currency payments. Shopping cart abandonment is already a huge problem for online stores, with abandonment rates typically averaging between 68% and 75%. This is the service that will process your transactions and handle currency conversions. Some popular payment gateways that offer multicurrency support include PayPal, Stripe, Corytech, and Authorize.net. Make sure to research and compare their fees, features, and customer reviews to choose the one that suits your business needs.

Set up multi-currency pricing

Once you've chosen your payment gateway, you need to set up your multi-currency pricing. This means determining the exchange rates for your products and displaying the prices in your customers' local currencies. You can use a third-party plugin or app to automate the process, or you can do it manually by using an online currency converter. Be sure to regularly monitor and update your exchange rates to ensure you're charging the right amount for your products.

Handle taxes and compliance

When dealing with international vendees, it's important to comply with the tax laws of the countries you're selling to. Make sure to research the tax regulations in each country and determine whether you need to charge any additional taxes or fees. You may also need to register for tax purposes in some countries. It's best to consult with a tax expert or an international business lawyer to make sure you're following the laws and avoiding any legal issues.

Provide customer support in multiple languages

Last but not least, it's important to provide customer support in the languages of the countries you're selling to. This means having multilingual customer service representatives who can assist customers in their preferred languages. You can also use automated translation tools or hire professional translators to localize your website and marketing materials. This will help you build trust with your international customers and improve their shopping experience. In fact, just 16% of online shoppers would return to purchase from an eCommerce store after a negative experience.

As a result, implementing multicurrency wallets can be a game-changer for your business. By choosing the right payment gateway, setting up multi-currency pricing, handling taxes and compliance, and providing multilingual customer support, you can take your online store to the next level and tap into new markets. So, don't be afraid to take the leap and go global!

Best practices for managing multiple currencies

Handling a handful of currencies can be a tricky business, but with the right moves and savvy strategies, you can smash it out of the park. In this article, we'll break down three essential tips for conquering the currency game.

Monitor exchange rates on a regular basis

First things first, stay on top of the exchange rates like a boss. Keep a close eye on each currency's value and stay sharp on any fluctuations that could mess with your game plan. By doing this, you'll be able to hustle with confidence and make wise choices on when to cash in your chips, hold on tight, or pivot to another currency.

Manage currency risks

Next up, don't sleep on currency risks. Dealing with multiple currencies means you're exposed to a range of risks from fluctuating exchange rates that could seriously impact your bottom line. Don't take that risk lightly, make sure to stay on your toes and be ready with a solid plan to weather any unexpected changes in the currency market. Whether it's hedging your bets or having a contingency plan at the ready, make sure you've got all your bases covered.

Provide clear and accurate pricing information

Last but not least, always give your customers complete information on pricing. When working with multiple currencies, you've got to make sure everyone's singing from the same hymn sheet. Be crystal clear on prices in each currency, and give your clients the lowdown on any fees or charges associated with currency conversion. This way, there won't be any confusion, and everyone will be happy to play ball.

Managing multiple currencies takes some serious know-how, a keen eye for detail, and the ability to adapt to any curveballs. By sticking to these tips, you can be a total baller when it comes to managing multiple currencies and come out on top every time.

Corytech Payment Solution for multi-currency uphold

Corytech proposes a variety of financial prospects to all types of businesses.

Seamless Cross-Border Payments

Corytech is the ultimate payment solution for businesses seeking to navigate the murky waters of cross-border transactions. This platform suggests a plethora of features, including multi-currency patronage, which makes it a breeze for businesses to send and receive payments across various countries and currencies. With Corytech, you can throw away those old-fashioned banking methods that often leave you high and dry.

Currency Conversion and Secure Transactions

The platform ensures that you won't have to jump through hoops or pay through the nose for currency conversion fees. Corytech provides real-time pivotal rates and transaction tracking, allowing businesses to keep their fingers on the pulse of their payments. Plus, the platform is user-friendly and incredibly secure, making it the go-to choice for businesses that want to hit the ground running in foreign markets. So, if you're looking to break into new markets and expand your horizons, then Corytech is the perfect payment solution to bank on.

Save on Currency Conversion Fees and Keep More Profits

Corytech is the cash cow of payment solutions for businesses seeking to avoid taking a hit on currency conversion fees. This top-tier platform supports 10+ currencies and offers highly competitive exchange rates, meaning businesses can keep more money in their pocket. With Corytech, businesses can sit pretty and let the platform take care of all the heavy lifting, including real-time currency conversion.

The system ensures that businesses receive the most up-to-date exchange rates, giving them an edge in their global transactions. And if that's not enough, Corytech is as safe as houses, thanks to its robust security features that keep financial fraudsters at bay. So if you're looking for a payment solution that's the bee's knees when it comes to saving you money on currency conversions and protecting your financial assets, then Corytech is the way to go.

Multi Currency FAQ

Why do businesses benefit from using multiple currencies?

Businesses benefit from using numerous currencies because it allows them to operate globally and reach new markets without the burden of converting currencies or incurring high fees. With multiple currencies, businesses can make and receive payments in local currencies, which can lead to increased sales, faster transactions, and reduced costs. Providing innumerable currencies also allows businesses to manage foreign exchange risks and hedge against currency fluctuations.

Does Corytech payment gateway support multiple currencies?

Yes, Corytech payment gateway supports multiple currencies, making it a top choice for businesses that operate globally. The platform supports over 10 currencies and offers highly competitive exchange rates, ensuring businesses can transact without incurring high fees. Additionally, Corytech provides real-time currency conversion, allowing businesses to keep up-to-date with exchange rates and reduce the risk of currency fluctuations. Overall, Corytech offers a versatile and reliable payment solution for businesses that need to make and receive payments in multiple currencies.

What’s Next?

Emotionally, multi-currency endorsement can also improve customer satisfaction and build brand loyalty. When customers are able to shop and pay in their local currency, they feel more comfortable and confident in their purchases. This can lead to repeat business and positive reviews, which can ultimately drive growth and success for your business. In conclusion, multi-currency support is a critical tool for businesses looking to expand globally. By presenting buyers with the ability to shop and pay in their local currency, businesses can increase sales, reduce risk, and improve customer satisfaction. So, if you're planning to take your business global, don't overlook the importance of multi-currency support.

Corytech is a game-changer for any business seeking a versatile and fully-featured payment solution. The platform offers multi-currency support, competitive exchange rates, real-time currency conversion, and robust security features. With Corytech, businesses can easily make and receive payments in different currencies, enabling them to expand their global reach and increase sales. The platform is user-friendly and accessible, making it easy for businesses to manage their cross-border transactions without any hassle. Whether you are a small business or a large enterprise, Corytech can help you streamline your payment operations and take your business to the next level. Request a personalized demo today to see how Corytech can transform your business and help you reach new heights.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)