In the fiercely competitive world of online gaming, every second counts. Players expect fast, frictionless experiences—from gameplay to withdrawals. A single payment hiccup can mean frustration, abandoned transactions, and, ultimately, lost customers.

Smooth, hassle-free payments are not just a convenience—they’re a critical factor in player retention and satisfaction. Operators that eliminate friction from deposits, withdrawals, and in-game purchases gain a powerful edge, ensuring players keep coming back for more. Integrating solutions that accept payments seamlessly across various platforms and devices enhances customer satisfaction and retention.

This article explores the biggest pain points players face when transacting online, the must-have elements of a seamless payment experience, and how the Zero-Stress Payments Approach is transforming the industry.

As a leader in payment innovation, Corytech is redefining what’s possible in iGaming transactions. From instant withdrawals to multi-currency flexibility, our solutions ensure every transaction is seamless. Payment processors must ensure their systems are easy to integrate with existing business technologies, enabling operators to adopt new solutions without disrupting their workflows. Want to see what’s next? Join us at SiGMA Rome 2025, where we’ll showcase the future of stress-free payments.

Understanding the Modern Player’s Expectations

Shifting Consumer Behavior

The New Standard: Speed, Security & Frictionless Payments

Today’s players expect transactions to be as seamless as the games they play. Whether accepting payments, making a deposit, cashing out winnings, or purchasing in-game assets, they demand: Offering mobile-friendly payment solutions is crucial as over 70% of retail website traffic comes from mobile devices.

-

Instant Transactions – Slow payments lead to abandoned sessions and lost revenue.

-

Secure Processing – Players need to trust that their funds and personal data are protected.

-

Zero Friction – Fewer steps, fewer redirects, and a smooth UX keep players engaged.

For operators, meeting these expectations isn’t just a perk—it’s a necessity for retention.

Key Trends Shaping Player Preferences

-

The Rise of Mobile-First Gaming

-

The majority of transactions now happen on mobile. Players expect fully optimized, one-tap payment experiences.

-

Solutions like biometric authentication (Face ID, fingerprint) and digital wallets enhance security and convenience.

-

Offering mobile-friendly payment solutions is crucial as over 70% of retail website traffic comes from mobile devices. This trend underscores the importance of ensuring seamless payment experiences across all mobile platforms. Businesses should align with how customers prefer to transact during the online payment experience to increase satisfaction and loyalty.

-

The Fiat-Crypto Convergence

-

Players want flexibility—traditional payment options (cards, bank transfers) alongside crypto wallets.

-

Instant crypto-to-fiat conversion is becoming a must-have to bridge regulatory gaps.

-

Stablecoins are emerging as a preferred choice for faster, cost-effective transactions.

By adapting to these shifts, operators can reduce churn, boost engagement, and maximize lifetime value. In the next section, we’ll break down the essential elements of a truly seamless payment experience.

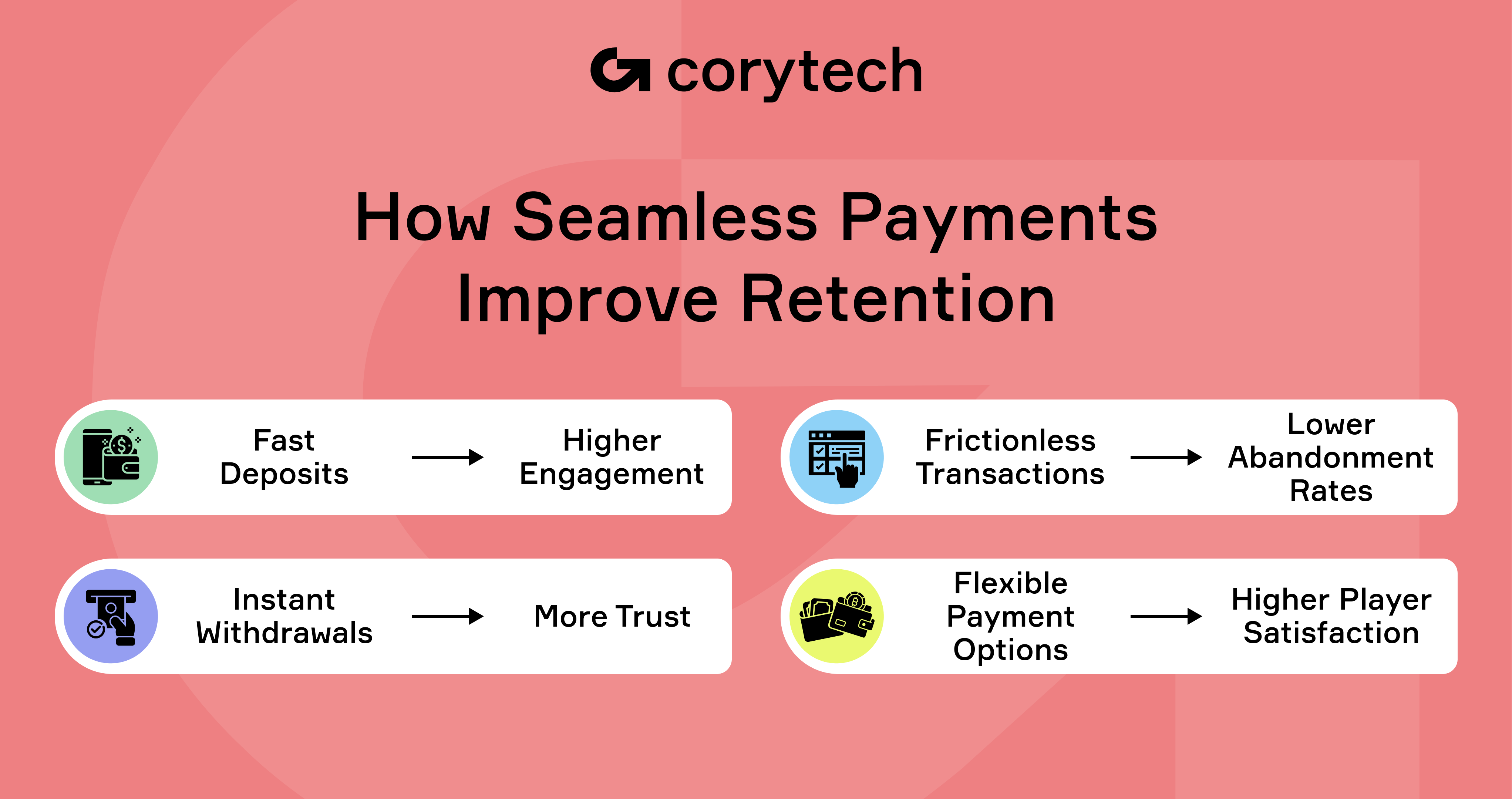

The Role of Payments in Player Retention

How Seamless Payments Drive Loyalty

In iGaming, every interaction matters—including payments. Positive customer experiences, especially a smooth, hassle-free payment experience, directly influence player retention by:

-

Building Trust – Fast deposits and withdrawals reassure players that they are dealing with a reliable platform.

-

Encouraging Repeat Play – When transactions are quick and seamless, players are more likely to return and keep engaging.

-

Reducing Abandonment – If payments are complicated or delayed, players may switch to a competitor that offers a smoother process.

A frictionless payment experience isn’t just about convenience—it’s a key factor in long-term player loyalty.

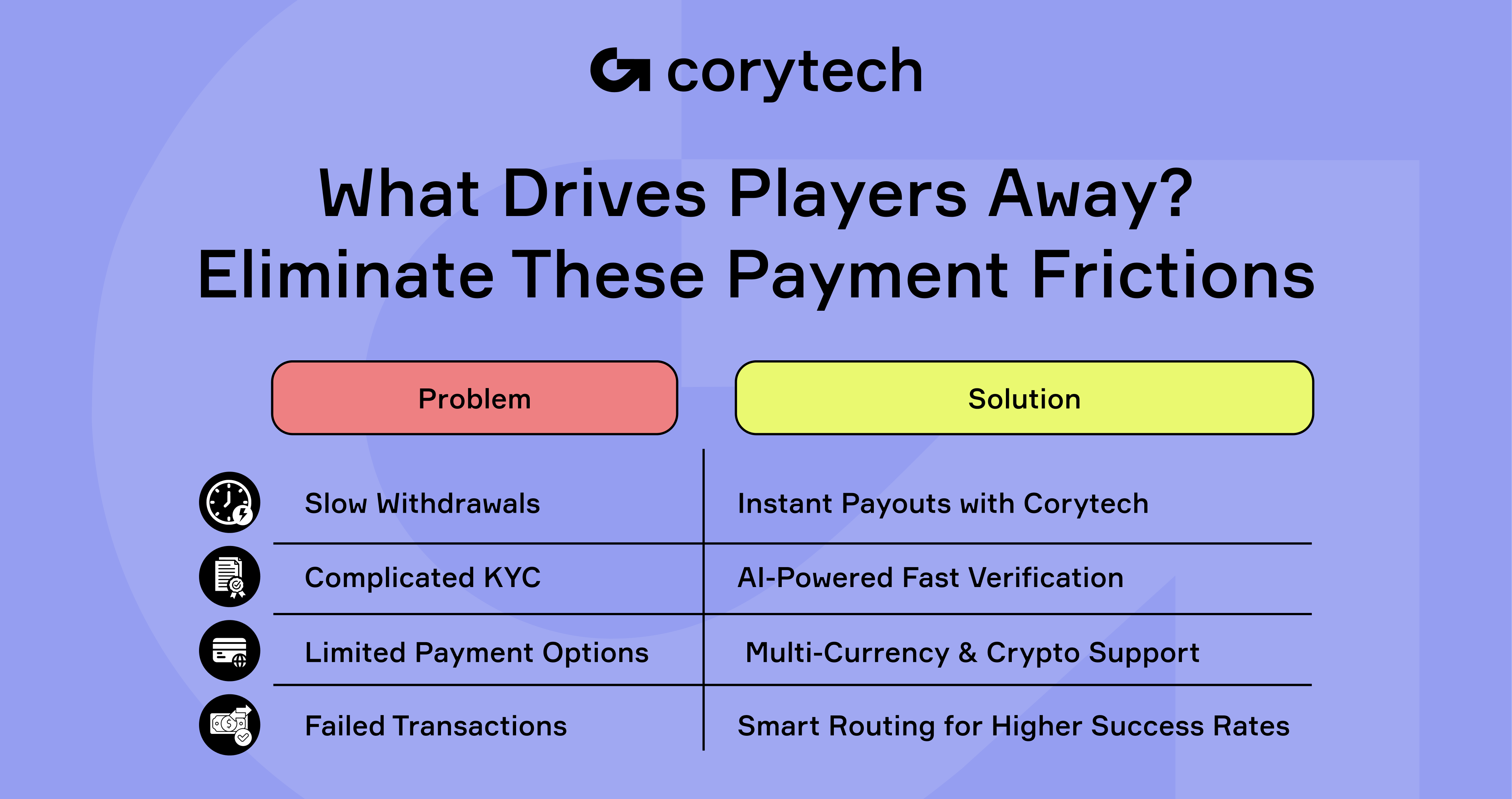

Common Friction Points That Drive Players Away

-

Slow Processing Times

-

Problem: Long withdrawal waiting periods frustrate players.

-

Solution: Instant payouts and real-time transaction tracking improve trust and satisfaction.

-

Cumbersome Verifications

-

Problem: Lengthy KYC (Know Your Customer) procedures can cause drop-offs.

-

Solution: Automated, AI-driven identity verification speeds up the process without compromising security.

-

Complex or Unintuitive Interfaces

-

Problem: Confusing payment flows, excessive redirects, and too many steps create friction.

-

Solution: Streamlined, mobile-friendly designs with one-click transactions improve usability.

-

Limited Payment Options

-

Problem: Players prefer a variety of payment methods, including crypto, e-wallets, and local banking solutions.

-

Solution: Offering multi-currency, multi-method support ensures players can deposit and withdraw using their preferred method.

By eliminating these pain points, operators can create an environment where players feel valued, leading to higher engagement, reduced churn, and increased lifetime value. A 5% growth in customer retention equates to a rise in company profits by 25% to 95%, highlighting the importance of an optimized payment system and seamless payment experiences.

Next, we’ll explore the must-have elements of a seamless payment experience and how operators can implement them effectively.

Core Elements of Seamless Payment Experiences

Speed and Efficiency

Instant Transactions: Meeting Player Expectations

For today’s players, processing payments with speed is everything. Long processing times for deposits or withdrawals create frustration and can drive players to competitors with faster alternatives. Operators must prioritize:

-

Instant Deposits – Enabling players to fund their accounts in real time keeps engagement high.

-

Fast Withdrawals – Quick payouts reinforce trust and enhance the overall gaming experience.

-

Automated Approvals – Leveraging AI-driven fraud detection allows for swift yet secure transactions. Transparent pricing increases customer trust and reduces complaints.

Optimized Conversion Paths: Ensuring Payment Success

A seamless payment experience means no failed transactions or unnecessary retries. Techniques like:

-

Cascading Routing – If one payment method or processor fails, the system automatically reroutes the transaction to another, minimizing disruptions.

-

Smart Payment Orchestration – Dynamically selecting the best-performing payment provider based on success rates, player location, and currency type ensures maximum acceptance rates.

By implementing these strategies, operators can reduce failed transactions, lower abandonment rates, and maintain player trust.

Security Without Compromise

Balancing Security and Usability

Players expect both security and ease of use. Operators must strike the right balance by:

-

Implementing Multi-Factor Authentication (MFA) – Ensuring security without adding excessive friction.

-

Using [LINK 1] & Encryption – Protecting sensitive data while keeping transactions seamless.

-

AI-Driven Fraud Prevention – Identifying suspicious activity in real time without disrupting legitimate players.

-

API Technology – Enabling customers to securely store their payment details, which simplifies future transactions and enhances user convenience.

-

Implementing Multi-Factor Authentication (MFA) – Ensuring security without adding excessive friction.

-

Using Tokenization & Encryption – Protecting sensitive data while keeping transactions seamless.

-

AI-Driven Fraud Prevention – Identifying suspicious activity in real time without disrupting legitimate players.

-

Integrating a Payment Gateway – Facilitating secure and seamless online financial transactions, enhancing customer satisfaction and increasing sales.

A smooth experience doesn’t mean compromising security—it means integrating it intelligently.

Building Trust Through Transparency

Trust is a key driver of retention. Players are more likely to stay on platforms that:

-

Clearly Communicate Security Measures – Displaying SSL encryption, fraud prevention tools, and secure payment processing logos reassures players.

-

Offer Real-Time Transaction Tracking – Allowing users to monitor their deposits and withdrawals eliminates uncertainty.

-

Simplify KYC Verification – Using AI-powered ID verification speeds up approval times without sacrificing compliance.

-

Encrypt Sensitive Data – Ensuring that sensitive information is protected to avoid data breaches during online payments.

By making security visible, intuitive, and effective, operators can foster trust without adding complexity.

A Unified Payment Ecosystem

Seamless Integration of Fiat and Crypto through Payment Gateway

Players want choice and flexibility when it comes to electronic payments. A truly seamless ecosystem supports: Providing just one payment option is almost guaranteed to lose a sale.

-

Multi-Currency Transactions – Allowing players to deposit, play, and withdraw in fiat, crypto, or stablecoins.

-

Real-Time Crypto-to-Fiat Conversion – Enabling players to use their preferred currency while ensuring compliance and reducing volatility risks.

-

Cross-Border Compatibility – Supporting global payments without unnecessary restrictions.

-

Personalized Payment Experiences – 78% of customers are more likely to do business with a brand again if they offer a personalized experience, making tailored payment options a key differentiator.

By integrating fiat and crypto payments into a single, cohesive platform, operators remove barriers and enhance player convenience.

A Simplified User Experience

The best payment systems are designed with the player journey in mind. This means:

-

Fewer Steps – Reducing unnecessary fields and making payment flows as intuitive as possible. The best way to optimize payment experiences is to simplify the checkout process, eliminating obstacles that could deter users.

-

One-Click Payments – Enabling pre-saved payment details for repeat transactions.

-

Mobile Optimization – Ensuring a flawless experience across all devices, especially on mobile.

-

Guest Checkout Option – Improving the payment experience for customers who do not wish to create an account. 76% of customers are frustrated when they don't encounter personalized experiences when interacting with brands.

A well-designed, frictionless payment process isn’t just a competitive advantage—it’s an essential part of a thriving iGaming platform. Nearly 70% of consumers browse online websites, add products to their shopping carts, then abandon their orders.

Why the Zero-Stress Payments Approach Works

What Is the Zero-Stress Payments Approach?

Redefining the Payment Experience in iGaming

The Zero-Stress Payments Approach is Corytech’s strategic framework designed to eliminate friction, delays, and uncertainty from payment processes. It ensures that every transaction—deposit, withdrawal, or in-game purchase—is fast, seamless, and reliable.

This approach is built on a deep understanding of modern players' expectations: speed, security, and simplicity. Research shows that:

-

69% of online players say slow withdrawals negatively impact their trust in a platform. (Paysafe, 2023)

-

56% of users abandon a transaction if they encounter friction in the payment process. (Baymard Institute, 2024)

-

iGaming operators see a 30% boost in retention when they offer instant withdrawals. (Juniper Research, 2023)

-

77% of consumers consider a company’s customer experience just as important as the quality of its products and services.

-

69% of online players say slow withdrawals negatively impact their trust in a platform. (Paysafe, 2023)

-

56% of users abandon a transaction if they encounter friction in the payment process. (Baymard Institute, 2024)

-

iGaming operators see a 30% boost in retention when they offer instant withdrawals. (Juniper Research, 2023)

By removing pain points and delivering a smooth, intuitive payment experience, the Zero-Stress Payments Approach helps operators maximize player retention, lifetime value, and brand loyalty.

How Zero-Stress Payments Work in Practice

Cascading Routing Mechanism

Payment failures are a major pain point for businesses and customers alike, with up to 15% of online transactions failing due to network outages, insufficient funds, or technical issues (Source: ACI Worldwide). A cascading routing mechanism ensures that when a transaction is declined by one payment processor, it is automatically rerouted to an alternative channel, utilizing payment data to enhance sales insights and improve the overall payment experience, thereby increasing approval rates.

For instance, intelligent transaction routing can boost approval rates by up to 10% by dynamically selecting the most reliable payment channel based on factors such as currency type, transaction size, and real-time processor performance (Source: McKinsey & Company). This ensures a smoother payment flow and minimizes customer frustration.

Seamless Integration

Zero-stress payments rely on seamless integration between fiat and cryptocurrency payment systems, ensuring that users can transact effortlessly, regardless of their preferred currency. According to Chainalysis, the global crypto payment market surpassed $1 trillion in 2023, with businesses increasingly adopting hybrid payment solutions.

By integrating both traditional and digital currencies into a single payment interface, businesses can offer users a frictionless experience. Studies indicate that merchants who support crypto payments see a 40% increase in cross-border transactions, as digital assets help bypass traditional banking restrictions and costly FX fees (Source: Deloitte).

User Assurance

Trust is a key factor in payment success. A study by PYMNTS.com found that 52% of online shoppers abandon their purchase if they feel the payment process is not secure. Zero-stress payments address this issue by minimizing disruptions and providing real-time transaction status updates, multi-factor authentication (MFA), and transparent security policies.

By implementing advanced fraud prevention measures, including AI-driven risk assessments, businesses can reduce chargebacks by up to 70% (Source: Visa). Clear communication regarding security features further reassures customers, fostering long-term trust and loyalty.

Business Benefits of Zero-Stress Payments

Enhanced Conversion Rates

Research shows that 68% of online shoppers abandon their carts due to payment friction (Source: Baymard Institute). Zero-stress payments combat this by reducing processing delays, ensuring smooth authentication, and offering multiple payment options, allowing customers to use their preferred payment method.

Merchants who optimize payment experiences see an average conversion rate improvement of 20-30%, as faster and more reliable transactions encourage customers to complete their purchases (Source: Checkout.com).

Increased Player Retention

In iGaming and online betting, a seamless payment experience is crucial. A report by Juniper Research found that users who experience payment delays are 35% less likely to return to a platform. By offering instant deposits and rapid withdrawals, operators can improve customer satisfaction and boost retention rates.

Additionally, implementing automated refund and dispute resolution processes can increase player lifetime value by up to 25%, as users feel more confident in the platform’s reliability (Source: H2 Gambling Capital).

Operational Efficiency

Manual payment troubleshooting costs businesses millions annually, with an estimated $117 billion lost globally due to payment failures and inefficiencies (Source: Accenture). Zero-stress payments eliminate these costs by automating error resolution, fraud detection, and transaction monitoring.

By leveraging machine learning algorithms, businesses can detect fraud patterns 40% faster than traditional manual reviews, reducing the need for extensive customer support interventions (Source: Mastercard). This leads to a 25-30% decrease in operational costs while maintaining a smooth, reliable payment ecosystem.

By implementing zero-stress payments, businesses can significantly improve customer satisfaction, boost revenue, and enhance operational efficiency, creating a win-win situation for both merchants and users.

Best Practices for Implementing Seamless Payments

User-Centric Design Principles

Intuitive Interfaces

A smooth payments experience starts with an intuitive interface. Studies show that 88% of users are less likely to return to a website after a poor user experience (Source: Toptal). Payment interfaces should blend familiar design elements—such as autofill, one-click checkouts, and responsive layouts—with modern features like biometric authentication and embedded payment links.

Companies that implement simplified checkout flows see an average 35% increase in conversion rates (Source: Baymard Institute). For example, Apple Pay and Google Pay reduce checkout times by over 60%, significantly improving completion rates.

Continuous Feedback

User testing and continuous iteration are essential to refining the payment experience. A/B testing on checkout processes has been shown to increase transaction completions by up to 25% (Source: Statista).

By analyzing drop-off points in the payment funnel, businesses can proactively address friction points. Implementing real-time feedback mechanisms—such as transaction success indicators, error message explanations, and customer support integration—enhances trust and usability.

Optimizing Backend Processes

Robust Infrastructure

A resilient backend ensures high transaction volumes are processed efficiently, even during peak demand. According to Accenture, global payment transaction volumes are expected to exceed $3.5 trillion by 2026, necessitating high-performance systems from both merchants and financial institutions.

Key infrastructure optimizations include:

-

Cloud-based payment processing for scalability and redundancy

-

API-first payment gateways for seamless integration with various payment providers

-

24/7 system monitoring and real-time failover mechanisms to prevent downtime

For example, payment orchestration platforms using cloud-native architectures experience 99.99% uptime, ensuring uninterrupted transactions (Source: McKinsey & Company).

Automation and Smart Routing

Automated systems significantly reduce payment friction. Smart routing can increase authorization rates by up to 15% by directing transactions through the most efficient payment networks (Source: Visa).

Best practices include:

-

Cascading routing to ensure transactions don’t fail due to temporary processor downtime

-

AI-driven fraud detection to prevent false declines, which affect 1 in 10 legitimate transactions (Source: Worldpay)

-

Dynamic currency conversion (DCC) to optimize cross-border transactions, reducing forex-related drop-offs

Ensuring Compliance Without Friction

Streamlined Verification

AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements are crucial but should not hinder the user experience, especially when handling recurring payments. According to a Finextra report, 30% of users abandon transactions due to lengthy KYC procedures.

Optimizing verification processes includes:

-

Biometric authentication (facial recognition, fingerprint scanning) for instant identity verification

-

AI-driven document verification that reduces manual review time from 48 hours to under 5 minutes (Source: RegTech Analyst)

-

Progressive KYC, where low-risk users face fewer verification steps, improving onboarding conversion rates by 40%

Transparent Processes

Clear communication about compliance measures reassures users and fosters trust. Research from Deloitte suggests that 57% of consumers are more likely to complete transactions when security protocols are explicitly stated.

Effective strategies include:

-

Real-time status updates on KYC/AML checks to eliminate uncertainty

-

Tooltips and FAQs within the payment interface to educate users about security requirements

-

Compliance certifications displayed prominently (PCI-DSS, GDPR compliance badges) to reinforce security credibility

By implementing these best practices, businesses can create a seamless, secure, and user-friendly payment ecosystem, driving higher conversions and long-term customer loyalty.

Leveraging Corytech’s Expertise for Superior Payment Solutions

Overview of Corytech’s Payment Solutions

Innovative Offerings

Corytech stands at the forefront of payment innovation with its all-in-one payment orchestration platform designed to seamlessly handle both fiat and cryptocurrency transactions. By integrating multiple payment rails, Corytech ensures businesses benefit from:

-

Faster transaction processing through optimized routing and cascading mechanisms

-

Flexible payment options supporting credit/debit cards, bank transfers, e-wallets, and cryptocurrencies

-

Automated risk management powered by AI-driven fraud detection

With the global digital payments market projected to reach $12.55 trillion by 2027 (Source: Statista), Corytech’s comprehensive platform provides businesses with future-proof, scalable solutions tailored for high-risk industries like iGaming.

Zero-Stress Payments as a Differentiator

Corytech’s Zero-Stress Payments Approach ensures that transaction failures are minimized, optimizing conversion rates and enhancing player retention. Features like cascading routing, automated KYC/AML verification, and multi-currency support eliminate common friction points, positioning Corytech as a leader in frictionless payments for iGaming and fintech businesses.

With over 15% of online transactions failing due to processing issues (Source: ACI Worldwide), Corytech’s approach directly addresses payment drop-offs, reducing failure rates by up to 40% through intelligent payment routing.

Future-Ready Infrastructure

Scalability and Adaptability

As payment regulations and technology evolve, Corytech ensures businesses stay ahead with:

-

Cloud-native infrastructure for instant scalability

-

Real-time compliance updates aligned with global regulatory changes

-

AI-powered fraud prevention that adapts to emerging threats

With the European iGaming market expected to grow by 10% CAGR through 2026 (Source: H2 Gambling Capital), Corytech provides operators with compliance-ready, high-performance solutions designed to support millions of transactions per second.

Event Tie-In

Corytech’s innovations will take center stage at SiGMA Dubai 2025, where industry leaders can explore next-gen payment solutions that drive efficiency, security, and seamless user experiences.

Strategic Recommendations for Industry Leaders

Aligning Payment Systems with Business Goals

Customization and Flexibility

Every business has unique payment needs. Corytech’s modular solutions allow iGaming operators, payment service providers (PSPs), and fintech businesses to:

-

Customize their payment stack with APIs for fiat, crypto, and alternative payment methods

-

Implement geo-targeted payment preferences to maximize acceptance rates in different regions

-

Reduce operational costs by consolidating multiple PSPs into a single orchestration layer

With iGaming players using an average of 2.3 payment methods per platform (Source: Paysafe), offering flexible payment options directly correlates to higher retention and transaction volumes.

Investing in Innovation

Automation, AI, and blockchain are reshaping payments. Businesses that invest in these technologies see:

-

30% lower fraud-related losses (Source: Mastercard)

-

40% faster transaction settlements via blockchain-based payments (Source: Deloitte)

-

Up to 25% increase in conversion rates from AI-driven smart routing (Source: Visa)

To stay competitive, decision-makers must prioritize payment solutions that enhance both operational efficiency and user satisfaction—exactly what Corytech delivers.

Building Long-Term Trust and Engagement

Transparent Communication

According to Deloitte, 57% of users abandon a payment if security measures are unclear. Transparent communication, including real-time payment tracking, clear refund policies, and visible compliance certifications, builds user confidence.

Displaying security badges, providing instant support for failed transactions, and sending automated fraud alerts reduce chargebacks by up to 70%, improving both revenue and reputation.

Agile Improvements

The digital payments space evolves rapidly, and businesses that continuously refine their payment strategies see:

-

20% higher transaction success rates through optimized backend processing (Source: ACI Worldwide)

-

25% lower churn rates when implementing AI-driven customer feedback loops (Source: McKinsey)

Corytech’s agile, API-first approach ensures businesses can quickly adapt payment flows based on user behavior and market changes, staying ahead of competitors.

.png)

What’s Next?

Seamless payment experiences—powered by Corytech’s Zero-Stress Payments Approach—are critical for improving player satisfaction, reducing transaction failures, and driving business growth in the high-stakes world of iGaming and fintech.

Corytech delivers:

-

A scalable, all-in-one platform supporting fiat and crypto payments

-

AI-driven fraud prevention and cascading routing for higher approval rates

-

Seamless compliance and security features for trust and transparency

The next wave of payment innovation will focus on:

-

Embedded finance, integrating payments directly into gaming and eCommerce platforms

-

AI-powered personalization, optimizing payment methods per user

-

Real-time cross-border transactions, leveraging blockchain and stablecoins

Businesses that embrace these advancements early will gain a competitive edge in a market set to exceed $15 trillion in digital payments by 2030 (Source: PwC).

For PSPs, iGaming operators, and fintech leaders looking to optimize their payment ecosystems, Corytech offers:

-

Personalized consultations to explore tailored payment solutions

-

Comprehensive case studies showcasing real-world success stories

-

Exclusive product demos to experience the power of Corytech’s payment orchestration firsthand

Meet Corytech at SiGMA Rome 2025 for live demonstrations, networking opportunities, and deep dives into the future of digital payments.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)