Cryptocurrencies have witnessed a remarkable surge in adoption within the realm of business transactions. This surge is driven by various factors, including heightened awareness of blockchain technology and the desire for more efficient, secure, and borderless payment methods. As a result, businesses across diverse industries are increasingly turning to crypto payment solutions to streamline their financial operations and capitalize on the opportunities presented by this emerging digital asset class.

The importance of cool crypto payment solutions for businesses cannot be overstated. Beyond simply facilitating transactions, these solutions offer businesses access to a global market of cryptocurrency users, enabling expansion without the constraints of geographical boundaries. Moreover, crypto payment solutions provide businesses with enhanced financial flexibility, enabling quicker and more cost-effective transactions compared to traditional banking systems. As businesses navigate the evolving landscape of digital commerce, integrating crypto payment solutions has become essential for staying competitive and meeting the demands of modern consumers.

Crypto Payment Solutions on the Market

Over-the-counter (OTC) trading in the context of business transactions

Over-the-counter (OTC) trading plays a crucial role in facilitating large-scale cryptocurrency transactions for businesses. Unlike traditional exchanges, OTC trading involves direct negotiations between buyers and sellers, often conducted through brokers or specialized trading desks. This approach offers several advantages for businesses, including

- increased privacy,

- reduced price volatility,

- and the ability to execute large orders without impacting market prices.

By leveraging OTC trading, businesses can efficiently manage their cryptocurrency holdings and execute transactions tailored to their specific needs, whether it's acquiring digital assets for investment purposes or facilitating payments to suppliers and vendors.

Business wallets and their role in managing crypto assets

Business wallets are specialized digital wallets designed to securely store and manage cryptocurrency assets on behalf of businesses. These wallets offer enhanced security features and functionality tailored to the unique needs of businesses, such as multi-signature authentication, cold storage options, and integration with accounting and financial management systems. By using business wallets, businesses can effectively safeguard their crypto assets against theft, fraud, and cyber-attacks while maintaining full control and visibility over their holdings. Additionally, business wallets streamline the process of sending and receiving cryptocurrency payments, making it easier for businesses to transact in the digital economy while adhering to compliance and regulatory requirements.

Crypto Software as a Service (SaaS) for businesses

Crypto Software as a Service (SaaS) platforms offer businesses access to a wide range of tools and services for managing their cryptocurrency operations. These platforms provide features such as cryptocurrency payment processing, accounting and reporting, tax compliance, and risk management tools. By leveraging Crypto SaaS solutions, businesses can streamline their cryptocurrency-related workflows, automate routine tasks, and mitigate operational risks associated with managing digital assets. Additionally, Crypto SaaS platforms often integrate with existing business systems and workflows, enabling seamless integration with other financial management tools and processes. As businesses continue to adopt cryptocurrencies, crypto SaaS solutions are becoming indispensable for optimizing efficiency, enhancing security, and ensuring compliance in the management of digital assets.

.png)

Benefits of Crypto Payment Solutions for Businesses

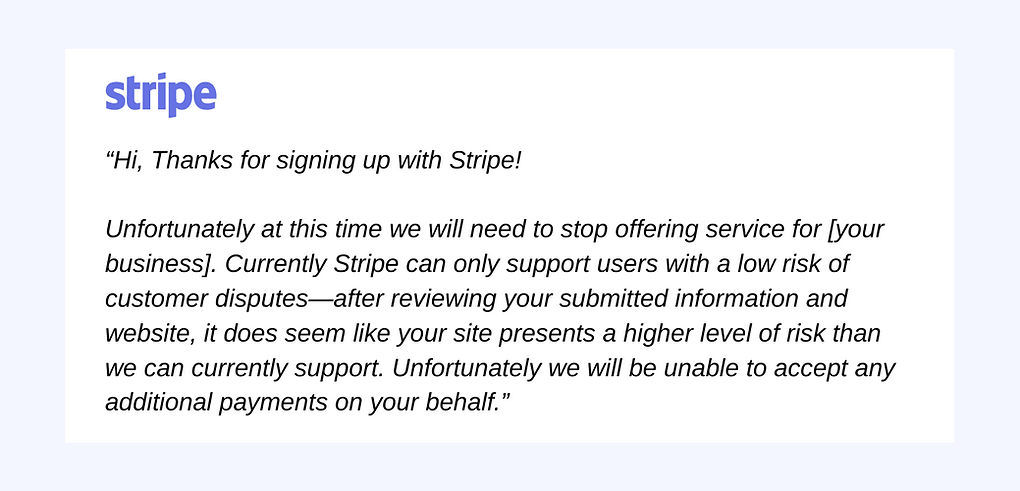

Extended opportunities for high-risk and emerging businesses

Crypto payment solutions offer opportunities for high-risk and emerging businesses that may face challenges obtaining traditional banking services. Due to the decentralized nature of cryptocurrencies and their independence from traditional financial institutions, businesses operating in industries deemed high-risk or emerging can access financial services without the same level of scrutiny or restrictions. This inclusivity enables businesses to thrive in sectors such as digital goods, gambling, and adult entertainment, where traditional banking services may be limited or unavailable.

Effortless compliance

Cryptocurrency transactions can streamline compliance efforts for businesses by providing transparent and immutable records on the blockchain. With crypto payment solutions, businesses can easily track and verify transactions, ensuring adherence to regulatory requirements and compliance standards. Additionally, some crypto payment platforms offer built-in compliance tools and features, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, to further simplify compliance efforts and mitigate regulatory risks.

Lower transaction fees compared to traditional payment methods

One of the significant advantages of crypto payment solutions for businesses is the lower transaction fees compared to traditional payment methods. Traditional financial transactions often incur fees for processing, currency conversion, and intermediary services. In contrast, cryptocurrency transactions typically involve lower fees, as they bypass intermediaries and rely on decentralized networks for validation and verification. This cost-saving benefit is particularly advantageous for businesses engaged in high-volume transactions or international trade, where traditional payment fees can significantly impact profitability.

.png)

Global accessibility and borderless transactions

Crypto payment solutions enable businesses to tap into a global market and conduct borderless transactions seamlessly. Unlike traditional banking systems that may impose geographical limitations or require currency conversion, cryptocurrencies operate on a global scale, allowing businesses to transact with customers and partners anywhere in the world without barriers. This global accessibility enhances market reach and facilitates international expansion opportunities for businesses seeking to grow their customer base and explore new markets.

Reduction of chargeback fraud and payment disputes

Cryptocurrency transactions offer businesses greater protection against chargeback fraud and payment disputes compared to traditional payment methods. In traditional banking systems, customers can initiate chargebacks, claiming unauthorized or fraudulent transactions, which can result in financial losses and administrative burdens for businesses. With cryptocurrencies, transactions are irreversible once confirmed on the blockchain, eliminating the risk of chargebacks and providing businesses with greater certainty and security in their payment transactions. This reduction in fraud-related risks contributes to improved financial stability and operational efficiency for businesses utilizing crypto payment solutions.

.png)

Implementation of Crypto Payment Solutions

Integration of payment gateways into existing business infrastructure

Integration of payment gateways into existing business infrastructure is a pivotal step in implementing crypto payment solutions. This process involves establishing a seamless connection between the chosen payment gateway and the business's existing systems, such as websites, e-commerce platforms, or point-of-sale (POS) terminals. Here's a detailed breakdown of the key aspects involved in this integration:

- Selecting the Right Payment Gateway: Businesses need to research and choose a suitable crypto payment gateway that aligns with their requirements in terms of supported cryptocurrencies, transaction fees, security features, and compatibility with their existing infrastructure.

- Understanding Technical Integration Requirements: Before integration, businesses must understand the technical specifications and integration methods provided by the chosen payment gateway. This includes APIs (Application Programming Interfaces), SDKs (Software Development Kits), or plugins that facilitate communication between the business's systems and the payment gateway.

- Customization and Branding: Depending on the flexibility offered by the payment gateway, businesses may have the option to customize the payment experience to align with their brand identity. This could involve customizing payment pages, adding logos or branding elements, and configuring payment confirmation messages.

- Ensuring Security and Compliance: Security is paramount when dealing with cryptocurrency transactions. Businesses must ensure that the chosen payment gateway adheres to industry-standard security protocols and compliance regulations, such as PCI DSS (Payment Card Industry Data Security Standard) compliance. Additionally, measures like two-factor authentication (2FA) and encryption should be implemented to protect sensitive customer data.

- Testing and Quality Assurance: Before deployment, thorough testing of the integration is essential to identify and resolve any technical issues or bugs. This includes testing various scenarios such as successful payments, failed payments, refunds, and handling of errors gracefully.

- Training and Support: Once the integration is complete, businesses should provide training to their staff on how to use the new payment gateway effectively. Additionally, access to technical support resources provided by the payment gateway provider can help address any issues or queries that arise during day-to-day operations.

- Monitoring and Optimization: Continuous monitoring of transactional data and performance metrics is essential for optimizing the crypto payment solution over time. Businesses can use analytics tools provided by the payment gateway or third-party platforms to gain insights into transaction trends, customer behavior, and overall payment performance.

By following these steps, businesses can seamlessly integrate crypto payment gateways into their existing infrastructure, enabling them to tap into the growing market of cryptocurrency users while providing their customers with convenient and secure payment options.

Utilizing OTC services for large-scale transactions and liquidity management

For businesses engaging in large-scale transactions or requiring liquidity management, utilizing over-the-counter (OTC) services is essential. OTC desks and brokers specialize in facilitating large cryptocurrency trades outside of traditional exchanges, providing businesses with access to liquidity and personalized services. By leveraging OTC services, businesses can execute large orders without impacting market prices and manage their cryptocurrency holdings more effectively. OTC services also offer greater privacy and flexibility compared to public exchanges, making them ideal for businesses with specific transactional requirements.

Setting up and managing business wallets for secure storage and transactions

Setting up and managing business wallets is critical for secure storage and transactions of cryptocurrency assets. Business wallets are specialized digital wallets designed to safeguard cryptocurrency holdings and facilitate secure transactions on behalf of the business. Businesses can choose from various types of wallets, including hardware wallets, software wallets, and custodial wallets, depending on their security preferences and operational requirements. Properly configuring and managing business wallets is essential to protect against theft, unauthorized access, and other security risks associated with managing digital assets.

Adoption of Crypto SaaS platforms for accounting, invoicing, and other business operations

The adoption of Crypto Software as a Service (SaaS) platforms streamlines various aspects of business operations related to cryptocurrency management. These platforms offer a range of tools and services, including accounting, invoicing, tax compliance, and risk management, tailored to the needs of businesses dealing with digital assets. By leveraging Crypto SaaS platforms, businesses can automate routine tasks, ensure compliance with regulatory requirements, and optimize efficiency in managing their cryptocurrency operations. Integration with existing business systems and workflows further enhances productivity and scalability, enabling businesses to navigate the complexities of the digital economy with ease.

Challenges and Considerations

Regulatory compliance and legal considerations

One of the primary challenges businesses face when implementing crypto payment solutions is navigating regulatory compliance and legal considerations. Cryptocurrency regulations vary significantly across jurisdictions, with some countries embracing digital currencies while others impose strict regulations or outright bans. Businesses must stay abreast of evolving regulatory requirements and ensure compliance with anti-money laundering (AML), know-your-customer (KYC), and taxation laws. Failure to comply with regulatory standards can result in legal penalties, reputational damage, and operational disruptions for businesses operating in the cryptocurrency space.

-(9).png)

Risk management strategies

Effective risk management strategies are essential for businesses utilizing crypto payment solutions to mitigate potential risks associated with digital assets. Cryptocurrencies are inherently volatile and subject to price fluctuations, cyber threats, and operational risks. Businesses must implement robust risk management practices, including diversification of cryptocurrency holdings, secure storage solutions, and insurance coverage where available. Additionally, businesses should conduct thorough due diligence when engaging with third-party service providers, such as payment gateways, OTC desks, and wallet providers, to mitigate counterparty risks and safeguard their interests.

Integration and compatibility with existing financial systems

Integrating crypto payment solutions with existing financial systems poses technical challenges and compatibility issues for businesses. Traditional financial systems operate on centralized architectures and may lack support for cryptocurrency transactions or require significant customization to accommodate digital assets. Businesses must evaluate the compatibility of crypto payment solutions with their existing infrastructure and invest in appropriate integration tools and resources. Additionally, interoperability between different cryptocurrency platforms and protocols may present challenges, requiring businesses to adopt standardized protocols and protocols to ensure seamless interoperability and data exchange across systems.

Security and fraud prevention measures

Security is a paramount concern for businesses utilizing crypto payment solutions, given the prevalence of cyber threats and fraud in the digital asset ecosystem. Businesses must implement robust security measures to protect against unauthorized access, theft, and fraud, including multi-factor authentication, encryption, and secure wallet storage solutions. Additionally, businesses should educate employees and customers about best practices for securely managing cryptocurrency assets and detecting potential security threats. Collaborating with cybersecurity experts and leveraging industry-standard security protocols can help businesses fortify their defenses and safeguard their digital assets against evolving cyber threats.

What’s next

Crypto payment solutions offer numerous benefits for businesses, including opportunities for high-risk industries, effortless compliance, lower transaction fees, global accessibility, and reduced fraud. However, businesses must also contend with challenges such as regulatory compliance, risk management, integration with existing financial systems, and security concerns. Despite these challenges, the potential advantages of adopting crypto payment solutions far outweigh the risks for businesses willing to navigate the evolving landscape of digital commerce. As the crypto ecosystem continues to evolve rapidly, businesses must stay informed and adaptable to capitalize on emerging opportunities and mitigate potential risks. This requires staying abreast of regulatory developments, technological advancements, and market trends shaping the crypto landscape.

By maintaining a proactive approach and leveraging insights from industry experts, businesses can effectively navigate the complexities of crypto payment solutions and position themselves for success in the digital economy of the future. Embracing innovation, fostering collaboration, and prioritizing security and compliance will be key to unlocking the full potential of crypto payment solutions and driving sustainable growth for businesses in the years to come.

Ask Corytech experts how we can help your business with our robust crypto solutions range.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

-(20).png)