We’ve all been there—waiting for a payment to process, watching the clock tick, wondering why a simple transaction seems to take longer than expected. Ironically, it’s in these moments of friction that we realize just how important smooth transactions are. The reality? Smooth financial processes go unnoticed—until they don’t happen. Good project management reduces transaction processing time, so these moments of friction are minimized.

In the fast paced world of business, especially in industries like iGaming, every interaction, every transaction matters. Yet we take flawless payment processing for granted. Whether it’s the quick payment to a vendor or the instant deposit that keeps a customer happy, these small moments fuel the bigger picture. Without them, customer satisfaction drops, operations grind to a halt and business growth stalls. Transparent communication builds trust among all parties in a transaction, and also contributes to client satisfaction, so smoother interactions and better outcomes. In real estate transactions this principle is just as important, as clear communication prevents misunderstandings and ensures a positive experience for all parties involved.

This is where the often overlooked world of effortless finance technology comes in. The right tools can create a seamless, stress free payment experience that not only improves client retention but also accelerates business growth. But when things go wrong it’s all too clear how important it is. Reviewing the transaction process regularly helps identify and fix potential issues, so these tools keep performing optimally. Document management systems give access to critical files in transactions, and reduces errors. Using transaction coordinators can reduce the time realtors spend on paperwork by hours, so they can focus on other important parts of their job.

Introduction to Effortless Finance Technology

In today’s fast-paced world, the demand for seamless financial transactions has never been higher. Effortless finance technology is the backbone of modern business operations, ensuring that payments are processed quickly, accurately, and without friction. This technology is not just a convenience; it’s a necessity for maintaining customer satisfaction, operational efficiency, and business growth. By leveraging advanced tools and systems, businesses can create a smoother transaction process, reduce errors, and enhance the overall client experience. In industries like real estate, where transactions are complex and involve multiple parties, the value of effortless finance technology becomes even more apparent. It ensures that all parties are on the same page, fostering trust and transparency throughout the transaction process.

The Kahneman Trigger (Salience): When Smooth Becomes Noticeable

Daniel Kahneman’s research into human behavior shows us a key truth about attention: we only notice when it fails. In the context of business transactions this is especially relevant. The smoothness of a payment process is something we take for granted—until it fails. It’s in these rare but impactful moments of disruption that the whole system becomes glaringly obvious. Clear and consistent communication ensures everyone is on the same page during transactions, so we prevent failures and maintain trust. A transaction coordinator keeps all parties updated during the real estate transaction process, so everyone involved is informed and aligned.

When a payment is delayed or a transaction doesn’t process as expected the consequences are immediate: frustrated customers, irritated merchants and the loss of both trust and revenue. In the world of high volume transactions—especially for payment service providers (PSPs) and iGaming platforms—a small hiccup can be catastrophic. For every second of delay businesses lose more than just a customer; they lose valuable opportunities and often have to deal with a ripple effect of dissatisfaction that can spread across their brand reputation. Transaction coordination services streamline the journey from contract to close, so processes are smoother and less likely to fail. Transaction coordinators also manage deadlines for all documents in real estate transactions, so delays and errors are minimized. Clear communication and proactive problem-solving can enhance clients' confidence in the transaction process.

This is the power of salience at work: transactions that fail or stumble stand out much more than smooth ones. And yet the failure of a payment process is rarely visible until it goes wrong. The truth is the reliability of payment technology is an invisible but essential backbone of any business—especially in industries where rapid frictionless transactions are the norm not the exception.

For PSPs, iGaming platforms and businesses that handle large volumes of payments, smooth transactions are not a luxury—they are a necessity. When these systems fail the impact is immediate and severe. The question is no longer “Is it working?” but “How long will it take for it to fail?”

The High Stakes of a Failed Transaction

Revenue Leakage and Abandoned Carts

In the world of online transactions the stakes are high. A single failed payment can ripple through the entire customer journey, causing lost sales, missed opportunities and revenue leakage. For industries like iGaming and online entertainment where user engagement happens in real-time, even the smallest disruption in the payment flow can have immediate consequences. When customers encounter friction during a transaction—whether it’s slow loading times, failed payments or confusing checkout processes—they don’t just get frustrated. They leave. Abandoned carts are one of the clearest indicators of revenue leakage. Research shows that a high percentage of cart abandonment is due to payment failures or slow systems. For an iGaming platform where users expect instant gratification any delay in processing can cause a user to walk away—and often never return. Registering in advance to take advantage of promotional offers can also help in retaining customers and reducing abandonment rates.

In fact for many businesses revenue leakage is an invisible but persistent issue. Every failed transaction is money left on the table and when these issues are frequent the cumulative effect can be significant. This is a direct result of a broken or inefficient payment system—a critical issue that can erode profits without any immediate recognition until the damage is done. Tracking important dates, such as deadlines during a real estate transaction, is crucial for effective communication and transaction management. Staying informed about these important dates can help in mitigating potential revenue losses.

Eroded Trust and Reputation

The impact of a failed transaction is more than just monetary—it’s psychological. Trust is a delicate thing especially when it comes to real-time transactions and high-value bets. Once a customer encounters an issue with a payment that trust begins to erode. Addressing any concerns that arise during the transaction process is crucial to maintaining trust. Brand loyalty collapses in the wake of broken payment flows and customers may not give a second chance to a brand that has disappointed them once.

For businesses that rely on real-time betting and large-scale transactions—like those in the iGaming and online entertainment sectors—the damage can be even more severe. A delay or error in processing can lead to frustration and anger and once trust is damaged it’s difficult to regain. These issues don’t just affect existing customers; they also deter new clients. Potential users upon hearing about or witnessing these issues may opt for a competitor instead—someone who provides a seamless and reliable experience. Clear communication helps foster trust among all parties involved, ensuring that any issues are promptly addressed and resolved.

Moreover in industries where instant gratification is the norm a failed transaction can easily overshadow even the most sophisticated marketing efforts. No amount of clever promotions can undo the psychological damage done by a broken payment process. Customers want to know they can trust you with their money and if that trust is compromised—even once—the credibility gap can overshadow everything else.

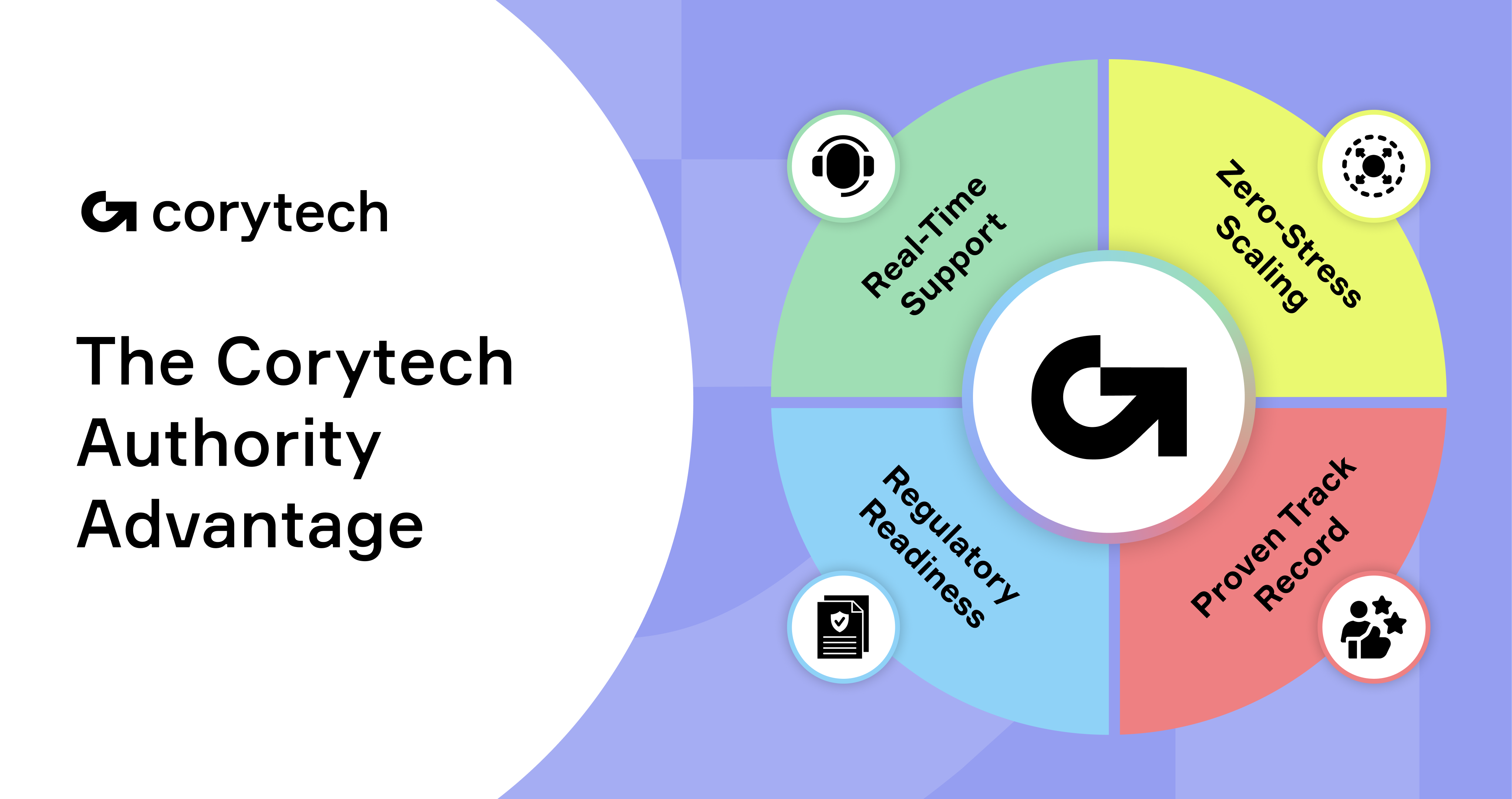

The Cialdini Trigger (Authority): Positioning the Expert Solution

In the competitive world of fintech and payments technology authority plays a key role in decision making. According to Robert Cialdini’s principle of authority people are naturally inclined to follow the lead of experts and rely on proven solutions. When it comes to choosing a payment system or financial technology businesses don’t want to take risks—they want a partner with a track record of success and demonstrable expertise.

In an industry like iGaming or online entertainment where high-volume real-time transactions are the norm, relying on a partner with deep knowledge and experience is essential. This is where the Corytech advantage comes in. As a leader in zero-stress payments, Corytech offers the proven reliability and seamless operations that businesses demand. Our technology isn’t just a new solution—it’s an expertly crafted tool backed by years of experience and customer success stories. Just as real estate agents facilitate smooth transactions by fostering trust and transparency, Corytech ensures that every payment process is handled with the utmost care and precision.

Businesses in sectors with high stakes—where a single failed transaction can lead to significant revenue loss—need to trust their payment provider. Authority in this case means not just having a great product but having a history of successfully solving complex high-volume payment challenges. Proven reliability isn’t just a luxury; it’s a necessity. When your business depends on rapid, frictionless transactions to keep customers satisfied and revenue flowing, you can’t afford to work with unproven or unreliable providers. Corytech helps clients navigate these intricate processes with clear communication and expert support, ensuring smooth and successful outcomes.

Why Corytech Commands Authority

Proven Track Record and Real-Time Problem-Solving

When it comes to payment solutions, especially in the fast-paced worlds of PSPs and iGaming, timing is everything. Corytech has built its reputation on delivering consistent on-time payouts and scalable solutions that grow with your business. Our proven track record of success isn’t just about technology—it’s about our unwavering commitment to transparency and immediate support when businesses need it most. By proactively identifying and addressing potential challenges, we ensure smoother transactions and stronger client relationships.

In high-pressure environments where real-time transactions are the norm, Corytech stands out as a reliable partner that delivers results when it matters. Whether it’s an urgent payout to a player or an emergency transaction that needs immediate resolution, we offer real-time monitoring and proactive problem-solving. Our ability to address payment issues instantly sets us apart from competitors who can’t guarantee the same level of customer-focused responsiveness. We know for iGaming platforms and PSPs, seamless payments are critical not just for business continuity but for user experience. By delivering fast, reliable, and scalable payment solutions, Corytech has become the go-to choice for businesses that can’t afford downtime. Real-time monitoring helps us address issues as they arise, ensuring uninterrupted service and satisfaction.

Innovation and Ongoing Adaptation

In the world of fintech, staying ahead of the curve is not just about having a good product—it’s about continuous innovation and being able to adapt to changing regulatory landscapes. Corytech has led the way by investing in research and development to ensure our solutions are always up to date. Effective organization is crucial in ensuring smooth business transactions, and Corytech excels in providing structured and efficient strategies that enhance overall business performance.

We know the need to stay compliant with evolving regulatory standards, especially in industries like iGaming where the stakes are high. With Corytech’s flexible APIs and robust integration capabilities, businesses can rest easy knowing they’re working with a solution that adapts to new compliance requirements without disrupting business. Continuous innovation ensures an efficient process, contributing to operational efficiency and client satisfaction.

Being proactive about regulatory changes is just one way Corytech mitigates transactional risks before they even emerge. Our forward-thinking approach to payment orchestration means our partners aren’t just meeting today’s standards—they’re ready for tomorrow’s challenges. As regulations change and new requirements emerge, Corytech is there leading the charge and providing businesses with the tools they need to stay ahead of the competition.

Transaction Management and Streamlining Business Transactions

In the realm of business, transaction management is a critical component of operational success. Streamlining business transactions involves implementing strategies and tools that reduce friction, minimize errors, and enhance efficiency. This can include the use of advanced software systems, automated processes, and clear communication protocols. By focusing on transaction management, businesses can ensure that each step of the transaction process is handled smoothly and efficiently, from initial contact to final closing. This not only improves the client experience but also reduces the risk of errors and delays, which can have significant financial implications. In industries like real estate, where transactions are often complex and involve multiple parties, effective transaction management is essential for achieving successful outcomes.

Real-World Scenarios: Avoiding Headaches and Hidden Costs

iGaming Operators: Split-Second Transaction Failures and Reputational Damage

In the high-stakes world of iGaming where players expect instant gratification, even a split-second failure in a transaction can have significant consequences. Imagine a player placing a real-time bet during a live event only to have their transaction fail due to a payment glitch. The result? The player is left frustrated, possibly loses faith in the platform, and may never return. This seemingly small failure can lead to not just a lost customer but a damaged reputation that’s hard to recover from. Identifying and addressing potential challenges in real-time transactions is crucial to prevent such issues and maintain player trust.

In an industry driven by customer trust where players spend real money on the outcome of each bet, every interaction counts. Transaction failures—whether it’s during deposits, withdrawals, or in-game purchases—create negative experiences that ripple through the community. A single bad review or social media post about a failed transaction can snowball into a much larger issue. Operators can’t afford to risk reputation damage or player drop-off.

PSPs: Uptime and Onboarding

For payment service providers (PSPs), uptime is non-negotiable. A payment failure not only impacts the business directly but also erodes trust with their merchant network. Merchants rely on smooth payment flows to run their business and any downtime or delay causes operational chaos. Transaction coordinators provide peace of mind by managing deadlines accurately, ensuring all processes are completed on time and with no stress. They play a crucial role in addressing potential challenges by proactively identifying and resolving issues before they escalate.

Imagine a scenario where a merchant’s payment system goes down just as they’re onboarding new customers. If a new user experiences friction during registration or first payment, they might abandon the platform. If existing merchants experience payment disruptions, it damages trust in the PSP. Uptime and anti-fraud are critical to maintaining good relationships with merchants and ensuring transactions flow without interruption. A PSP must not only provide smooth payment solutions but also ensure these solutions scale and adapt to the demands of their growing network. Transaction coordinators are essential for organizing files and broker compliance, which further supports complex transactions.

Cross-Border Payments: Removing Manual Verification and Currency Complexity

In cross-border payments, currency exchange, manual verification, and compliance checks create significant friction. Consider a business that operates internationally and relies on cross-border transactions to pay vendors, employees, or suppliers. The traditional way of processing these payments involves manual verification steps that delay transfers and incur hidden costs—time, effort, potential errors, and fees associated with managing these transactions.

By removing manual processes and simplifying currency exchanges, businesses can offer frictionless global transfers. With automated systems in place that handle compliance and verify transactions in real-time, businesses save time, reduce costs, and improve cash flow. Corytech’s solution allows for seamless cross-border payments that avoid the manual headache of currency conversions, compliance checks, and transaction delays. The result? Faster, more cost-effective transactions that improve global business operations and customer experience. Automated systems contribute to an efficient process, ensuring operational efficiency and client satisfaction.

.png)

Future-Proof Your Payments

The world of payments is moving fast driven by new technology and customer expectations. In this environment staying ahead means not just meeting today’s demands but future-proofing your payment systems to scale frictionlessly as new trends emerge. The benefits of future-proofing your payment systems include enhanced customer satisfaction, reduced operational stress, and fostering positive business relationships. Here’s a look at some of the key trends shaping the future of payment solutions:

Faster Payouts

As businesses in iGaming and eCommerce grow, faster payouts become more important. Players and customers expect near-instant withdrawals and the rise of digital wallets and crypto payments has accelerated this trend. Consumers today are used to instant gratification—whether it’s for a simple online purchase or a real-time bet. By offering faster payout methods, businesses can improve customer satisfaction, reduce churn, and stay competitive in a market where speed matters. Adopting advanced payment systems can make a significant difference in business operations, ensuring smoother transactions and better client experiences.

For businesses, staying ahead means adopting payment systems that can handle these faster payouts. Corytech’s seamless technology means businesses aren’t just reacting to these changes, they’re leading the charge, setting up their payment infrastructure to scale with the increasing demand for fast transactions.

Digital Wallets

Digital wallets are growing globally, making them one of the biggest trends in payments. Digital wallets like Apple Pay, Google Pay, and even cryptocurrency wallets allow users to store and manage their payment methods digitally, offering enhanced security and convenience. As these wallets become more widespread, businesses must ensure they can accept and integrate them seamlessly into their payment systems. Getting pre-approved for a mortgage can also be streamlined through digital wallets, helping buyers understand their financing options more effectively.

This shift to digital-first payments means companies must choose partners who not only understand the current landscape but are also prepared to evolve with it. Corytech offers flexible API solutions that integrate seamlessly with the digital wallet ecosystem, giving businesses the ability to offer the payment methods their customers prefer without the friction of integration. Additionally, digital wallets can facilitate loan payments, ensuring a smoother transaction process.

Multi-Currency Acceptance

As global commerce expands, understanding market conditions becomes crucial for businesses. The need for multi-currency acceptance is growing. Businesses that operate internationally or engage in cross-border transactions must be able to accommodate customers from different regions with different currency preferences. The complexity of managing multiple currencies can be a big barrier but it doesn’t have to be.

Future-proof payment systems must provide easy automated solutions for multi-currency processing that eliminate manual interventions and streamline conversion rates. By embracing these capabilities and developing effective pricing strategies, businesses can serve a global customer base without losing out to competitors who are slower to adapt. Corytech’s scalable platform is designed to support multi-currency acceptance so businesses can go global without the hassle of managing complex payment systems.

Scale Frictionlessly for the Future

It’s not just about effortless technology today; it’s about being able to scale frictionlessly as the payment landscape evolves. The future of payments isn’t about keeping up—it’s about staying ahead of trends like faster payouts digital wallets and multi-currency acceptance. By partnering with Corytech businesses can future-proof their payment systems so they’re ready for whatever comes next.

At Corytech we understand the need for resilience in an ever-changing world. Our platform is designed not just to meet today’s demands but to scale smoothly into the future so your business is always ready for what’s next. Maintaining regular communication with a real estate professional can ensure that your needs and preferences are always aligned with the best property options available.

A knowledgeable real estate agent can help navigate market conditions and negotiate offers, ensuring a smooth transaction and successful sale of your property.

Conclusion: The Value of Frictionless Transactions

Seamless transactions often go unnoticed, blending into the background of business operations. But the reality is simple: smooth payments are only truly noticed when they fail. When these systems falter, the damage is immediate, severe, and often irreversible. Whether it’s lost revenue, frustrated customers, or reputational damage, the consequences of failed transactions can’t be ignored. Ensuring a smooth closing process is crucial to mitigate these challenges and lead to successful business transactions.

Corytech is the authority that preempts these issues before they become emergencies. With our proven track record, expertise in real-time problem-solving, and commitment to innovative, scalable solutions, we offer businesses a way to avoid the costly headaches of payment failures. We ensure transactions are not only smooth but also resilient, future-proofed, and ready to scale as the market demands evolve. Legal compliance is also a key focus, helping to avoid transaction failures and minimize liabilities.

For PSPs, iGaming business owners, and C-level executives, now is the time to make frictionless technology a top strategic priority. In a world where seamless payment processing is no longer just a convenience but a competitive advantage, it’s time to invest in systems that work without interruption. Don’t wait for a failure to make you realize how important smooth transactions are to your business success.

Act now—future-proof your payment systems with Corytech and be ready to thrive in the fast-paced world of tomorrow.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)