Every day we use card payments as a quick and reliable payment method. Only a few people understand payment is an instant but complex process that consists of several stages and involves a payment gateway and a payment processing system. A payment gateway accepts the information about a card and cardholders, verifies it, and transfers it to a payment processing system after successful verification.

If you imagine any payment system as a net, a payment gateway is the end of every string, and a net itself is a payment processing system. Modern technologies offer cloud-based solutions, Software-as-a-Service (SaaS), which allows instant, cheap, and secure payments.

Among many valuable propositions on the market, Corytech is worth attention as the perfect solution for online businesses. It is easy to set up, affordable to subscribe to, and safe to use.

Moreover, Corytech uses blockchain processing and can offer instant cross-border payments. If you are interested in what is going on in the payment processing systems segment, how blockchain payment technologies develop, and which trends should develop in the future, read this article.

The Current State of Payment Processing

The first payment cards were created in the 1950-s. Since this time, the evolution of payment technologies has accelerated. Now, most of all deals in the world occur via different digital payment systems. The payment is a data transfer from one payment gateway to another via the payment processing system.

A modern payment processing system is usually cloud-based software, and it accepts the transaction data from a gateway and delivers it to the final point, often another gateway.

For the user, the payment is easy and instant. However, the process is complex. At the moment of payment, money goes to the payment gateway that processes the information about a card or cheque, account balance, currency, possibility to pay, and so on. A gateway sends the transaction data to a payment processing system if verification is successful.

The payment process can be split into several steps, and each step has its challenges and weaknesses. The critical stage is the identification and verification of the client. ID theft can help the criminal to access the customer’s data and money, and the payment system should prevent crime.

Also, the system should check data to reveal mistakes in the data before the payment transition. Finally, electronic payments are vulnerable to hacker attacks and a system should use protective software to prevent a crime. After the payment data enters the payment processing system, it can reach the destination immediately — if there are no obstacles like additional data check on the acceptor’s side. So, despite the external simplicity, modern payment systems are complex engines. They are much better than all previously existing systems, but they also have their weak sides.

However, modern technologies answer the challenges and provide various solutions: fast cross-border payments, integrated currency exchange, multi-factor authentication, security protocols, and so on. So, payment processing systems are evolving rapidly. In this way, new technologies help customers to pay for goods and services. The sellers and service providers, on their side, can accept payments quickly and accurately.

The evolution of payment processing systems impresses, but the process still needs to be finished. Technological development, the global economy, and geopolitics impact payment systems and shape future development trends.

The Rise of Mobile Payments

Fifty years ago, computing machines were vast and slow. However, at that time, many visioners tried to imagine a future where every human would carry a small computer in a pocket. We are right here now: the number of smartphones worldwide, according to Statista, in 2023 makes 6.92 billion. It means that 86.29% of people in the world have smartphones.

Of course, we should remember that some people have more than one smartphone, and some do not, so the number 86.29% is only the approximate evaluation. However, we cannot go on without mentioning that most of the global population uses smartphones – and correspondingly, they use mobile Internet, numerous online services, and online payment systems.

This skyrocketing mobile expansion changes the balance in global payment systems. It is hard to imagine a business that only accepts mobile payments nowadays. There are two main mobile payment options, Apple Pay and Google Wallet, and a modern online business should accept payments with both of them.

There are several benefits of mobile use for both consumers and businesses:

- Convenience – you even do not need a card;

- Speed – mobile payments are probably the fastest way to pay ever;

- Personal safety – contactless payment during the pandemic;

- Growing turnover – a business can process more deals;

- Better accounting – the system keeps records about all transactions;

- Young generation attraction – a business can engage young customers.

However, even Sun has its spots, and mobile payments have some disadvantages:

- New hardware – business should be able to afford new POS terminals;

- Format wars – payment software producers use various formats;

- Unknown risks – mobile payment technologies can have undeclared risks;

- Battery dependence – both client and business can face some problems when the device battery is low.

We do not expect the disadvantages can slow down the development of mobile technologies, but software providers and businesses should address these weak points.

The Impact of Blockchain Technology

Crypto pessimists predict that the crypto market will collapse in the near future. Really, the global economic slowdown resulted in the “crypto winter” – the decline in the crypto market and very low liquidity. However, now the market demonstrates the first signs of a revival, and Bitcoin price has overcome the psychologically significant barrier of $20 000 after a long break.

For payment processing systems, the crypto market revival is good news. Many payment systems, including Corytech, use blockchain technology to break cross-border barriers and increase payment security. The blockchain is hard to hack, so it meets modern security standards.

Moreover, modern blockchain technologies use the Proof-of-Stake protocol. It is more environment-friendly than the previous Proof-of-Work protocol and allows reduced transaction fees and instant payment.

It is reasonable that governments will investigate blockchain systems. On the one hand, they want to prevent money laundering and other criminal activities with blockchain systems. On the other hand, the governments test the central bank digital currencies – CBDC. No country has launched full-scale national digital currencies, but we will see this in the next few years.

The Future of Payment Processing

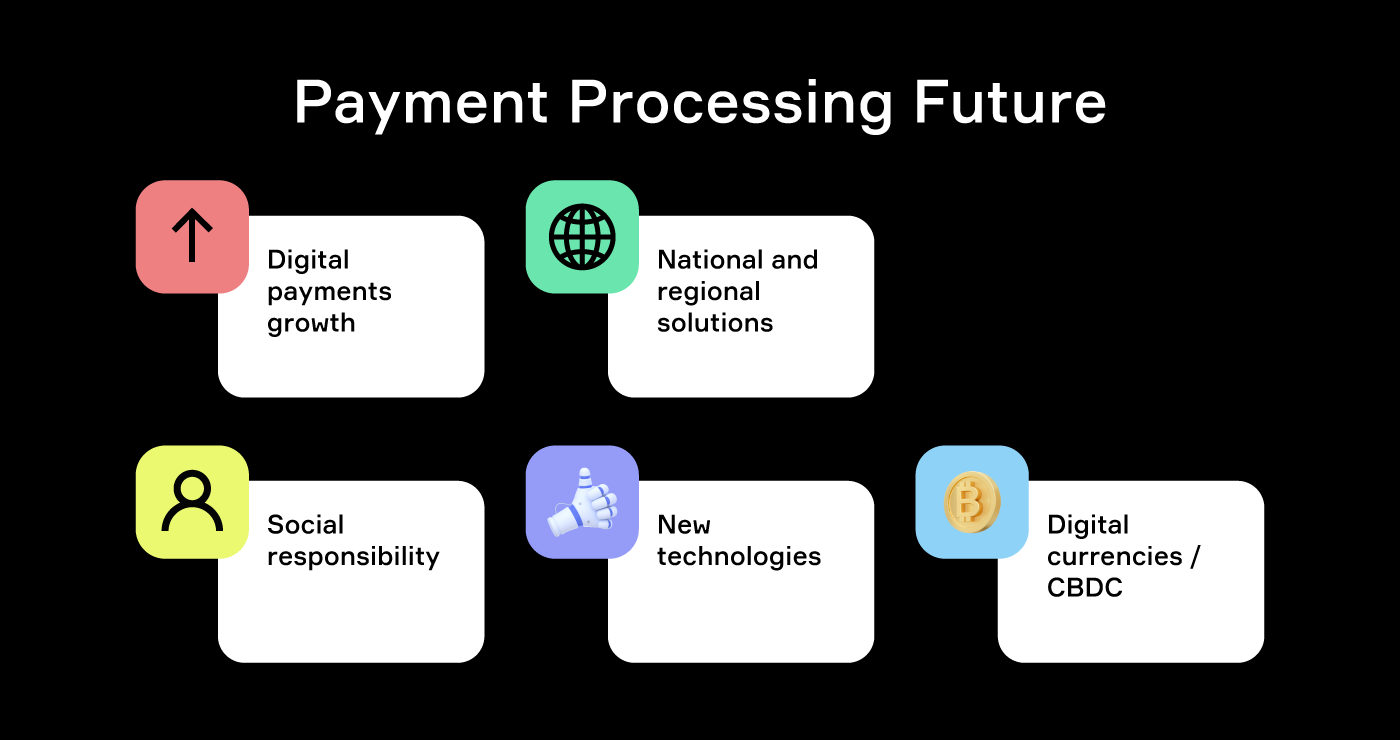

In October 2022, global management consulting firm McKinsey & Company issued a comprehensive review of the current trends in payment processing and the future of payment processing. Here are the most interesting conclusions that we can feel also.

Continuing growth of digital payments

The demand for digital payments will grow by 19% annually, at least until 2026. The skyrocketing market during the Covid-19 pandemic opened the window for modern technologies, even in the most conservative businesses. This trend will not reverse in the foreseeable future, and the growth tempo will continue.

National and regional solutions

The growing demand for digital payment systems raised a question of dependency on global payment processing systems like Visa or Mastercard. Large countries develop regional payment systems — Pix in Brazil and UPI in India. Multinational solutions like Corytech grows and successfully compete with major providers.

Social responsibility

Payment processing systems become the buffer between businesses and criminals of all levels, from small card thieves to global money laundering. The payment processing system works as a gatekeeper, improving the economic systems' security and stability.

New technologies

Many countries have already implemented national digital ID – the dingle profile that allows using numerous services, including payment systems. The next step is the implementation of new technologies like face recognition and biometric authentication, and modern payment systems require better authentication technologies for better data protection.

Digital currencies

Again, the interest in cryptocurrencies will not disappear, and this market will not collapse. We see two strong trends: the growing regulative pressure for the crypto market and the development of CBDC (central bank digital currencies).

How Corytech Helps Businesses to Benefit

Corytech is a multifunctional payment solution that offers businesses a wide range of services. Corytech is a payment processor that delivers money from a payment gateway to a merchant account. However, that is not all.

All businesses that work worldwide face the cross-border payments problem. The information exchange between the payer and payee bank can go slowly, especially when there are additional issues like different languages or payment processors in one transaction, like Visa and Mastercard. Sometimes a payment delay can take two to three days, and the money remains frozen during this time, and no customer or merchant can access it.

Corytech offers immediate cross-border payment. Corytech operates in almost all points of the world, so the money will reach the destination account even across several borders and time zones. Corytech is a multi-currency system supporting payment in all major and minor currencies.

Moreover, if the customer's and merchant's account currencies differ, Corytech offers instant currency exchange with the market currency price.

Additionally, Corytech offers crypto payment processing. The world faces a delayed economic crisis due to a COVID-19-related economic slowdown. The Fed raises the basic interest rate, and fiat money becomes less available. In this situation, the growing interest in cryptocurrencies is reasonable. However, global financial regulators do not want to see cryptocurrencies as equivalent to fiat currencies and issue new and new regulations for crypto money.

In this situation, Corytech can be a good choice for businesses. We work with both fiat and cryptocurrencies, and we can exchange them. With us, you can accept payments in digital currencies or traditional currencies.

We'd also like to mention reasonable fees and simple setup and maintenance as the benefits for your business. If you work globally or need a reliable payment solution for your local business, contact us for details.

Payment Processing FAQ

How does payment processing work?

A series of actions occur when a customer buys something using a debit or credit card. First, a payment gateway verifies a card and the possibility of payment. Then it connects to a payment processing network and delivers information about a payment. A payment processor transfers data to the merchant's bank or payment system. The process can take from several seconds to several hours.

What is a payment processing center?

A payment processing center is a software that accepts information from numerous payment gateways and delivers it to the merchant's banking account. A payment processing center works instantly and flawlessly, allowing businesses to get money from their customers immediately. A payment processing center manages the transaction security between a payment processor and a destination account.

What's the difference between payment processing and payment gateway?

A payment gateway is the start and end of any transaction, and a gateway software checks and verifies a planned transaction. A payment processing center is a virtual tunnel that transfers money from a payment gateway to the destination amount and allows businesses to accept digital payments. PayPal is a payment gateway, while Visa and Mastercard are payment processing systems.

What's Next?

As you see, the development of payment systems is a considerable step nowadays. Businesses are still shifting to modern payment methods, and at the same time, the IT industry offers new and unique technologies. While enterprises solve the problems of security, social responsibility, and profitability, customers look for convenience and low commissions.

The business should find a reliable and modern payment processing system in this quickly changing and highly competitive environment. This system can remove the burden of routine payment monitoring, increase payment security, and improve customer loyalty.

Corytech can help any business with its innovative, fully-featured payment platform that makes payment processing easier. Request a personalized demo to see how Corytech can help your business.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)