You know what’s worse than losing a sale? Losing trust. And when your payment infrastructure buckles under pressure, you lose both—instantly. The payment processing ecosystem consists of multiple stakeholders that work together to enable seamless and secure transactions, making its reliability critical for maintaining trust.

In a world where every millisecond counts, especially in industries like iGaming and PSP, a payment delay isn’t just a hiccup—it’s a disaster. One frozen transaction, one failed gateway, and your users are gone. Angry tweets fly. Refund requests pile up. And just like that, your carefully built reputation unravels.

And let’s be clear—the pressure isn’t easing up. As we head into 2025, the casino and iGaming sectors are doubling down on speed, privacy, and global reach. 67% of players now favor platforms offering real-time withdrawals. Over 35% of online casinos accept Bitcoin. Cross-border payments are expected to reach over $250 trillion by 2027, further emphasizing the need for robust and scalable payment systems. And with embedded payments, AI-powered fraud detection, and biometric verification going mainstream, the bar for reliability and innovation has never been higher.

Here’s the thing—payment systems aren’t just back-end tech. They’re the beating heart of digital businesses. And when that heart skips a beat during a regulatory shift, server overload, or global crisis? You feel it—hard.

The Cost of Ignoring the Warning Signs

Most businesses don’t realize they’re vulnerable until something breaks. By then, it’s too late. The warning signs were there—slow approvals, rising chargebacks, minor glitches shrugged off as “just bad luck.” But when you ignore the cracks, they widen fast. And in this space, the fallout isn’t just technical—it’s financial, reputational, and deeply human. Authorization, clearing, and settlement are the three main components of the payment process, and any failure in these stages can lead to significant disruptions.

Memorable Meltdowns: When Payments Fail

Remember when a major online betting platform crashed during a championship weekend? Transactions stalled mid-bet. Thousands of users couldn't cash out. What followed? A PR nightmare, a slap from regulators, and a wave of users jumping ship to competitors.

Why does this example stick in our heads? That’s availability bias at work. When people recall a failure this vivid, it’s not just memory—it’s a cautionary tale burned into collective memory. And here’s the kicker: it’s not a rare event. Payment failures like this pop up more often than we’d like to admit. You’ve probably lived through one.

The Ripple Effect on Trust

Trust takes years to build and seconds to lose—especially when money’s involved. A glitch in your payment gateway infrastructure, and suddenly your most loyal customers are rechecking your reviews or worse, looking elsewhere. Word travels fast, and competitors love a good scandal (especially when you hand them one on a silver platter).

Understanding Future-Proofing: What It Really Means

The term gets thrown around a lot—but what does it actually mean to “future-proof” your payments? It’s not some trendy buzzword or a shiny tool you install and forget. It's a mindset. A design principle. A survival tactic. And for PSPs and iGaming operators, it can mean the difference between thriving in uncertainty—or constantly playing catch-up.

Beyond “Keeping Up”

Let’s clear something up: future-proofing isn’t about slapping on the latest tech and calling it a day. It’s about building digital payment infrastructure that flexes with the market—expanding when demand spikes, adapting when laws change, and defending itself as fraud tactics evolve. Payment processors play a crucial role in this by managing the flow of transactions between the payer's bank, payment networks, and merchant accounts, ensuring smooth operations.

It’s like having an immune system that not only fights off current threats but anticipates what’s next. And it doesn’t come from shortcuts or trends—it comes from strategy.

Common Misconceptions

One of the biggest myths?

Sure, adding Apple Pay or crypto checkout might look good on paper, but if your backend’s a mess, more options just multiply the points of failure.

Or how about this one:

More money without a clear strategy is like putting premium gas in a leaking tank.

The Corytech Blueprint: Authority & Social Proof

Talk is cheap. Results aren’t. That’s why future-proofing isn’t just about what you could do—it’s about who you trust to help you do it. Corytech brings more than tech to the table. They bring credibility, track records, and a no-fluff approach that’s earned them the confidence of leading PSPs and iGaming brands around the world.

Established Expertise

Corytech isn’t just another provider—they’ve been in the trenches. From enterprise payment infrastructure design to regulatory compliance and global integrations, they’ve helped businesses sleep better at night.

Their systems are engineered not for vanity metrics, but for zero-stress performance. Real uptime. Real protection. Real results.

.png)

Success Stories That Inspire

One major PSP turned to Corytech to overhaul their fraud detection setup. The result? A 30% drop in fraudulent transactions and a significantly higher approval rate across key markets—proof that the right infrastructure delivers more than just peace of mind.

Or consider the iGaming company that launched in three new markets without a second of downtime—thanks to Corytech’s cross border payment infrastructure and geo-redundant setup. Try pulling that off with a patchwork solution.

Behind the Scenes: Expert Insights

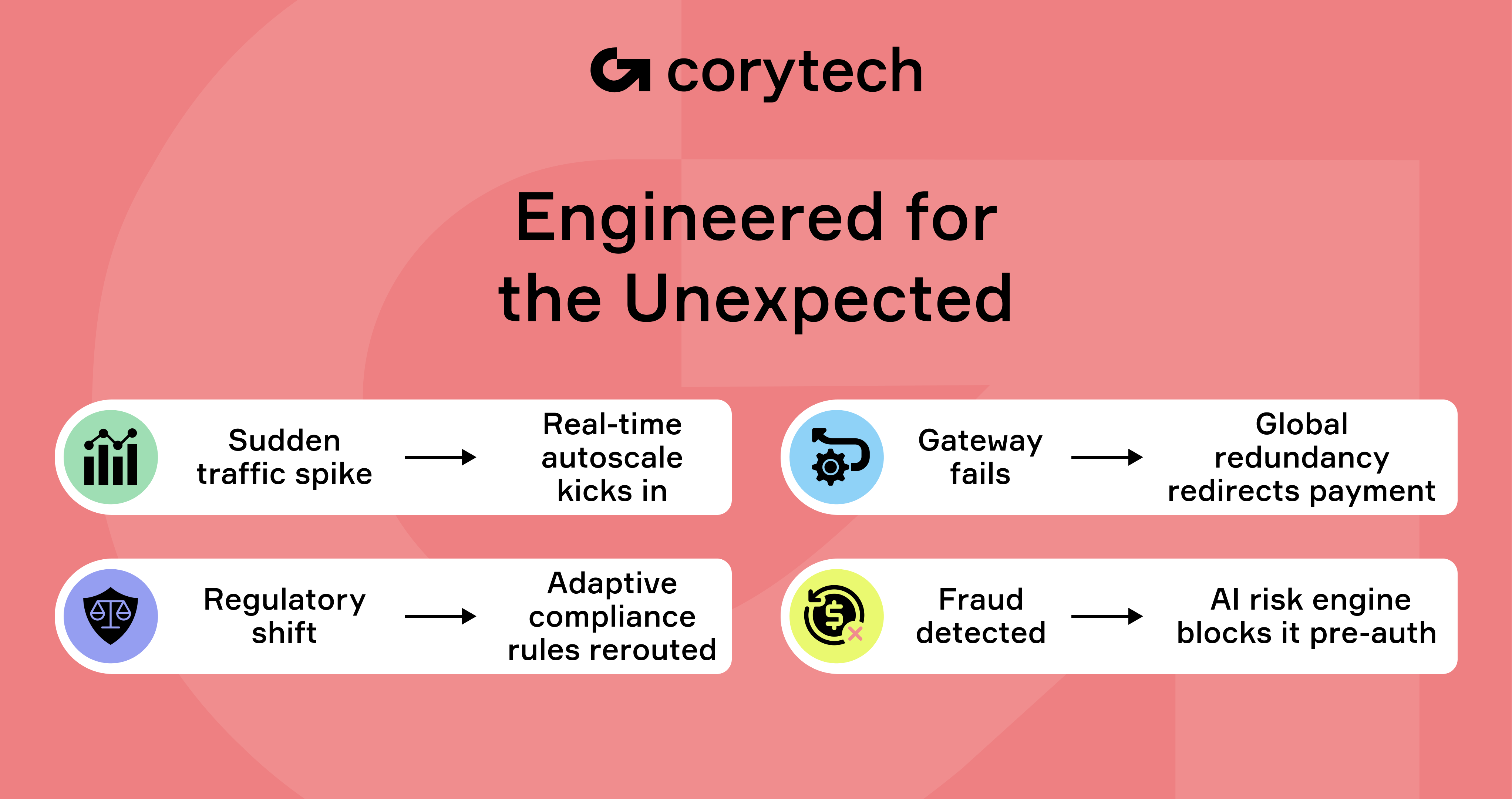

“We designed our infrastructure to act like a living organism,” says one of Corytech’s senior engineers. “It adapts in real-time—whether it’s risk scoring a transaction, auto-adjusting for regional compliance, or rerouting payments when latency spikes.”

Their mantra? “If the system doesn’t think ahead, you’re already behind.”

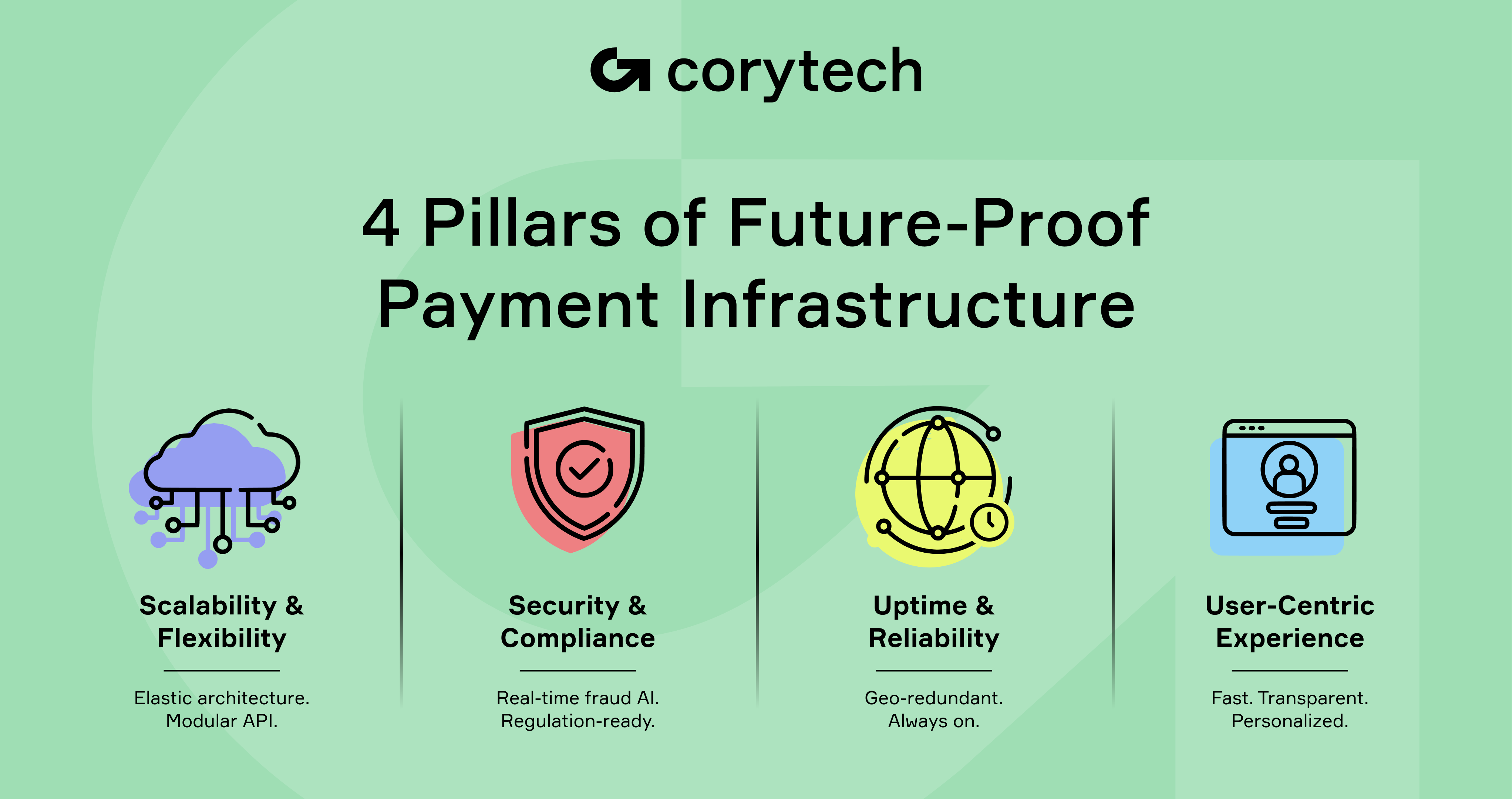

Critical Pillars of a Resilient Payment Infrastructure

So, what separates a future-proof system from a ticking time bomb? Let’s break it down. Four pillars, zero fluff.

Scalability & Flexibility

Elastic Architecture

Need to handle a surge during global esports final? Or the holiday rush in a new market? Systems that grow with your business—rather than drag behind it—aren’t optional anymore. Corytech’s pay-as-you-grow setup doesn’t just keep up; it clears the path ahead.

API-First Strategy

You want new payment methods, loyalty integrations, risk modules? You’ll need APIs that play nice with others. Think LEGO, not duct tape. Corytech’s modular API architecture lets PSPs and operators slot in what they need, when they need it—no overhaul required. A payment gateway, as a software application, transmits transaction data between the payer, payee, and payment processor, making seamless integration essential for success.

Security & Compliance

Regulatory Maze Navigation

Compliance headaches are real, especially if you're juggling licenses across Europe, LATAM, or Asia. Corytech stays ahead of regional requirements—so you don’t have to learn every acronym in 12 languages.

Fraud Detection & Prevention

Static rules are toast. Corytech’s AI learns on the fly—spotting fraud before it happens, not after. Their adaptive risk engine evolves with each transaction. Because the moment you stop evolving, fraudsters don’t.

Uptime & Reliability

Geo-Redundant Infrastructure

Downtime in one region? Another picks up the slack. Corytech spreads infrastructure across continents, ensuring your payments keep flowing—even when the unexpected hits.

Disaster Recovery & Response Plans

They’ve got protocols for the worst-case scenario—and they’ve tested them. Continuity isn’t a checkbox—it’s muscle memory.

User-Centric Experience

Personalization at Scale

What’s better than fast checkout? A checkout that remembers your preferences. Corytech’s system personalizes the experience without getting creepy—just smooth, smart, and right on time.

Transparent Transactions

Users hate being left in the dark. Corytech’s platforms keep communications clean: real-time updates, clear receipts, and an easy way to challenge mistakes—without waiting three days for a vague email from an automated helpdesk.

Building a Robust Risk Management Framework

Let’s be honest—hope isn’t a strategy. Payment systems don’t fail in a vacuum. There are always signals: a pattern, a slowdown, a red flag buried in the logs. The key is having a framework that catches those signals early and acts on them fast. That’s where true resilience begins.

Early Warning Systems

Glitches don’t announce themselves. But with real-time monitoring and intelligent alerts, you catch fires before they spread. Corytech’s backend acts like a smoke detector for your payment gateway infrastructure—watching latency, approvals, failure rates, and threat signals around the clock.

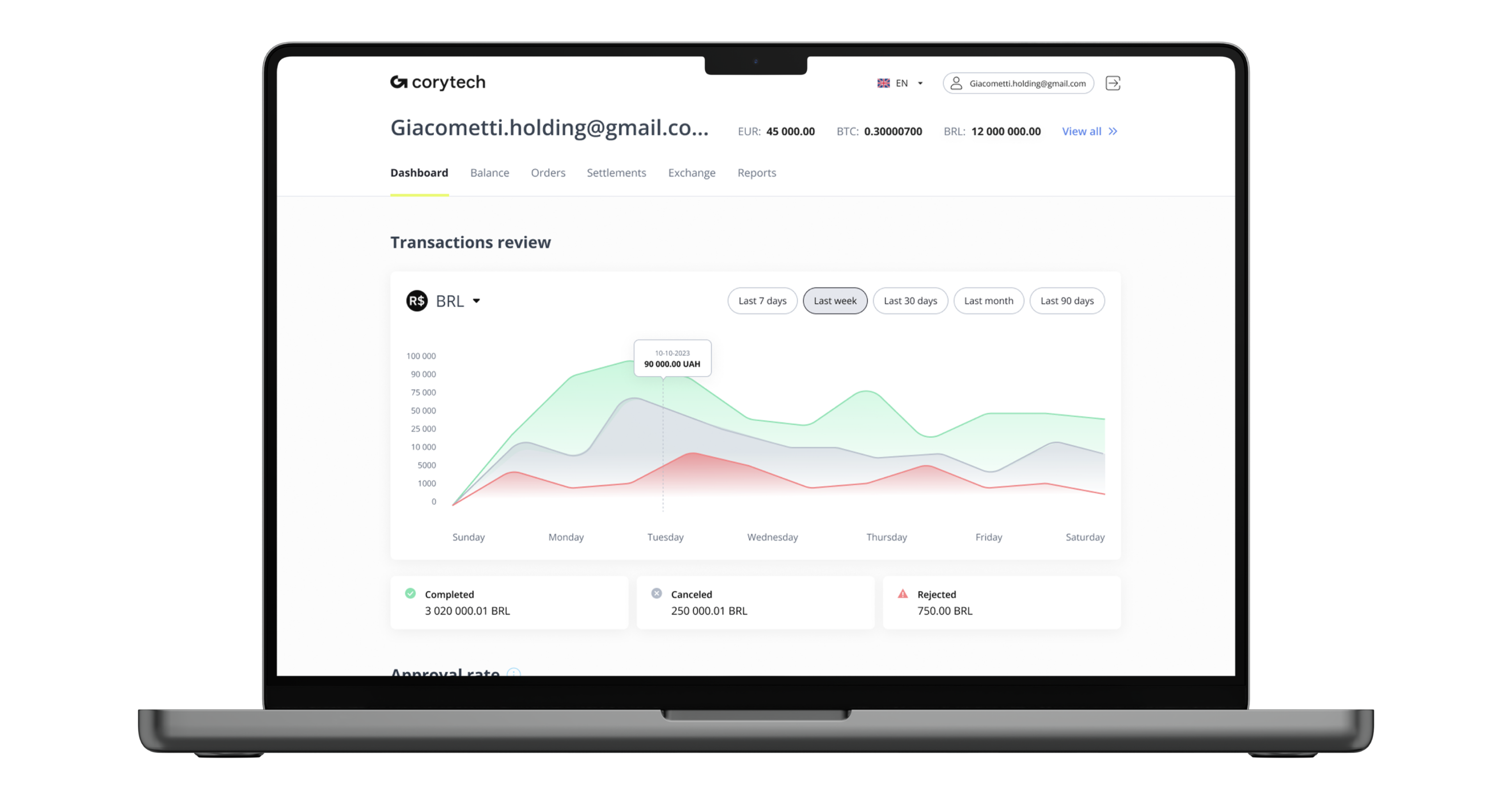

Data-Driven Decision-Making

You can’t fix what you don’t understand. Corytech's dashboards bring in predictive analytics, pattern recognition, and market alerts—giving you a 360° view of your risk exposure. It's like radar for your revenue.

Creating a Culture of Constant Evolution

Technology’s moving fast. People? Not always. That’s where culture kicks in.

Regular Skill Upgrades

A resilient payment infrastructure starts with teams that know what’s next. Corytech encourages PSPs and operators to train up—on AI, compliance shifts, behavioral patterns in fraud—so they’re not just keeping up; they’re leading the charge.

Feedback Loops & Innovation

Ever sat in a meeting thinking, “Why are we doing it this way?” Corytech’s partners don’t just ask that—they test it. With built-in feedback channels and “idea sprints,” they bake innovation into the process. Good ideas don’t get buried—they get launched.

Strategic Partnerships for Long-Term Growth

Future-proofing isn’t a solo mission. The most resilient companies don’t just invest in tools—they invest in relationships. Strategic partnerships with the right players can turn complexity into clarity and uncertainty into opportunity. Corytech isn’t here to compete with your stack—they’re here to complete it.

Reinforcing Your Core Infrastructure

Corytech doesn’t replace your systems—they strengthen them. Whether you’re a PSP looking to scale or an iGaming operator breaking into new regions, their modular approach integrates cleanly, reduces overhead, and minimizes risk. Corytech will also be participating in SiGMA Europe this year, one of the most prestigious events in the iGaming industry.

Case in Point: Transformative Partnerships

One global PSP saw a 40% improvement in transaction approval times after implementing Corytech’s adaptive gateway logic. Another operator eliminated cascading fraud issues by linking Corytech’s risk module with their loyalty platform—turns out fraudsters don’t like being profiled in real time.

Conclusion: Embrace Innovation, Secure Your Future

So here’s the deal: Payment disasters don’t wait for the perfect moment. They hit during a product launch. Or a global tournament. Or Black Friday. And when they do, you’ll either have an infrastructure that bends… or one that breaks.

Let those past meltdowns stay in the past. The next one doesn’t have to be yours.

With Corytech’s proven expertise, adaptive tech, and zero-stress mindset, future-proofing isn’t just a buzzword—it’s a business model.

Curious how your current system stacks up? Schedule a zero-pressure consultation with Corytech. Or grab our whitepaper to dig into how forward-thinking companies are future-proofing payments—without burning out their teams or their budget.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)