Today, seamless and secure payment experiences are no longer optional—they’re a strategic advantage. As global operators scale rapidly, catering to diverse player preferences across geographies, the complexity of managing multiple payment methods has become a significant hurdle. From traditional fiat to the rise of crypto and digital wallets themselves, the fragmentation of payment systems poses real challenges in terms of cost, compliance, speed, and user satisfaction.

Examining various igaming payment methods is crucial for enhancing user experience and operational efficiency, while also considering global requirements for different currencies and payment types, including digital wallets and cryptocurrencies.

To stay competitive, iGaming businesses are seeking ways to simplify digital payments without sacrificing performance or regulatory peace of mind. This is where integrated, forward-thinking platforms like Corytech come into play—offering a unified approach to simplifying business payments and driving operational efficiency.

This article explores why leading iGaming operators are rethinking their payment infrastructure and how Corytech is helping them overcome industry-specific hurdles. We’ll unpack current market trends, emerging technologies, and real-world examples that demonstrate the tangible impact of smarter, streamlined iGaming payment gateway solutions.

The Importance of Payments in iGaming

iGaming Payments: A Crucial Aspect of the iGaming Business

For online gaming platforms, the payment process is a pivotal touchpoint that can either enhance or detract from the player experience. Efficient payment systems enable players to deposit funds quickly, enjoy uninterrupted gameplay, and withdraw winnings without hassle. This fluidity is essential in maintaining player trust and loyalty.

Moreover, the ability to support multiple payment methods, including traditional bank transfers, credit cards, and alternative payment methods like Apple Pay and cryptocurrencies, caters to a broader audience. Digital wallets have become increasingly popular due to their convenience and security features. Local payment methods are essential in the iGaming sector due to varying player preferences across regions. Contactless payments enable quick and secure transactions, making them an ideal choice for retail businesses and increasingly relevant in the iGaming sector. This flexibility not only attracts a diverse player base but also ensures that players can transact in their preferred manner, further boosting user satisfaction.

The Evolving Landscape of Payments in iGaming

Shifting Market Demands for Alternative Payment Methods

Player Expectations

Today’s iGaming players are digitally native, globally connected, and more demanding than ever. They expect fast, more secure transactions, and seamless payment experiences—anything less risks immediate abandonment. The average processing times for pay-ins are quicker than for payouts in iGaming transactions, which can influence player satisfaction. Whether it’s placing a bet in real time or cashing out winnings instantly, delays or complications in the payment flow can erode trust and drive players to competing platforms.

Equally important is selecting the right payment method. Players increasingly want the option to deposit and withdraw using a mix of traditional fiat currencies and cryptocurrencies. Various payment providers offer real-time pay-ins and payouts to players in the iGaming sector, ensuring a smoother and more efficient transaction experience. Offering crypto-friendly solutions is no longer a novelty—it’s an essential component of simplifying digital payments in modern gaming environments. By providing broad payment choice and flawless execution, operators significantly enhance and boost player satisfaction, loyalty, and lifetime value.

Competitive Pressures

In a saturated and fast-growing market, the payment experience is a critical battleground. While game selection and UX still matter, it’s often the speed, security, and convenience of payments that shape a player’s long-term engagement. Leading operators are quickly realizing that streamlined iGaming payments are no longer just operational perks—they are strategic differentiators.

Efficient payment systems reduce drop-off rates, enhance regulatory compliance, and cut down on manual intervention. Simply put, simplifying business payments through an integrated platform like Corytech isn’t just about convenience—it’s about gaining and maintaining a competitive edge in an industry where player retention is everything.

The Complexity Challenge

Legacy Systems vs. Modern Needs

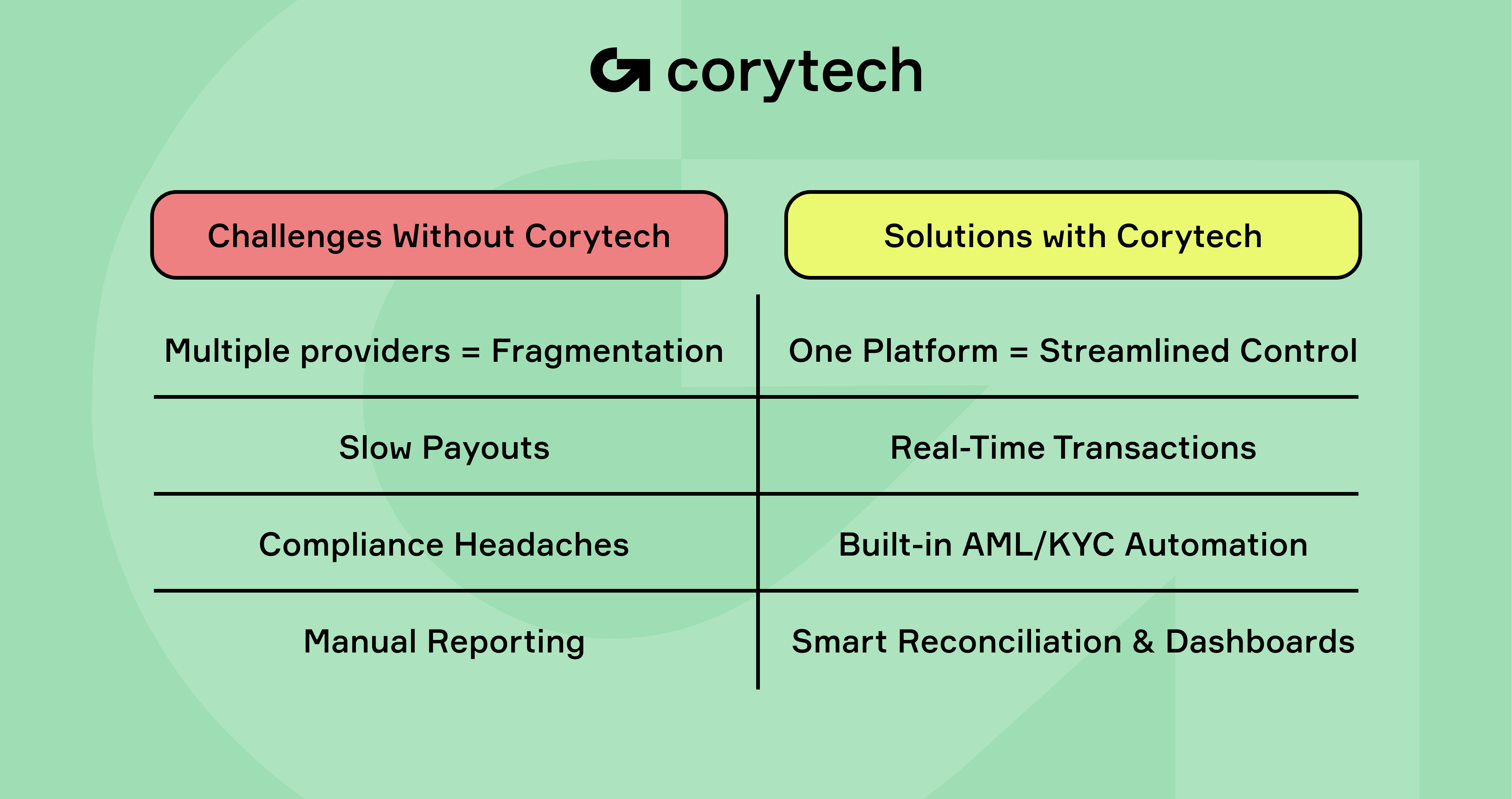

Many iGaming operators still rely on outdated or fragmented payment infrastructures that struggle to keep up with the demands of today’s digital-first players. These legacy systems are often siloed, require significant manual oversight, and lack the agility needed to integrate with new technologies or alternative payment methods—particularly crypto.

Legacy systems also complicate the management of online gaming accounts, making it difficult for players to deposit and withdraw funds efficiently. As the industry evolves, the gap between traditional systems and modern payment needs is widening. Operators now require platforms that support real-time payment processing solutions, multi-currency handling, and intelligent automation. Without seamless integration, inefficiencies mount—leading to increased costs, delayed transactions, and lost revenue opportunities.

To compete, operators must shift toward payment solutions that are not only powerful but also intuitive and scalable—solutions that can simplify business payments without adding technical debt.

Regulatory and Security Pressures

On top of operational complexity, iGaming businesses face growing regulatory scrutiny. From anti-money laundering (AML) directives to Know Your Customer (KYC) requirements, compliance is non-negotiable—and constantly evolving. Failing to meet these standards can result in hefty fines, reputational damage, or even license suspension.

At the same time, players expect airtight payment security, particularly when transacting with large sums or using cryptocurrency. Balancing these twin pressures—compliance and security—demands a payment ecosystem that’s built for both control and flexibility.

This is where simplifying digital payments becomes more than a convenience. With integrated systems that automate KYC checks, enable secure payment data and handling, and support regulatory reporting, operators can significantly reduce operational risk and focus on growth—not firefighting.

Corytech’s Integrated Payment Solutions

Unified Payment Processing Platform

All-in-One Capabilities

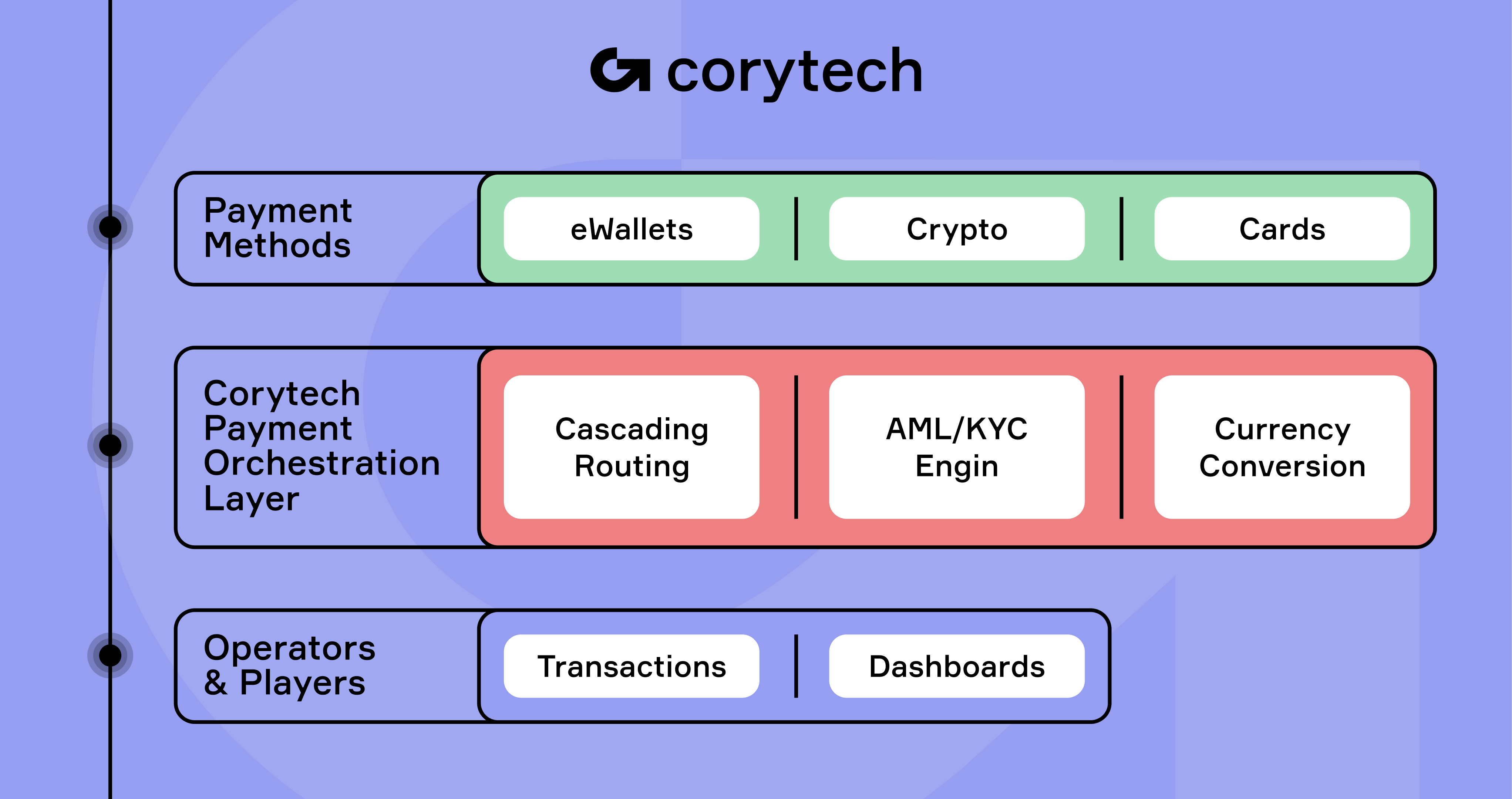

Corytech was built to meet the modern iGaming industry’s most pressing need: simplifying payments. Its unified platform consolidates both fiat and crypto transactions, giving operators a single access point to manage diverse payment methods efficiently. No more juggling multiple providers, interfaces, or reconciliation processes—Corytech streamlines everything into one cohesive system.

Whether players prefer credit cards, e-wallets, bank transfers, or digital assets, Corytech makes it easy to integrate and manage them all. This all-in-one infrastructure empowers operators to offer a frictionless, flexible, and scalable payment experience, tailored to global player preferences.

Innovative Technologies

Under the hood, Corytech leverages powerful features designed to drive performance and reduce friction. With cascading transaction routing, the platform automatically selects the most optimal payment path—minimizing failures and ensuring higher approval rates. Multi-currency bank accounts along with internal conversion allow operators to receive and manage funds in multiple currencies without relying on third-party tools.

Add to that real-time processing, and operators gain the speed and reliability needed to enhance both user experience and back-office efficiency. Together, these innovations directly contribute to higher conversion rates, lower chargebacks, and smoother operations across markets.

Advanced Security & Anti-Fraud Measures for Secure Transactions

Robust Security Framework

Security is a cornerstone of the Corytech platform. By combining end-to-end encryption, multi-factor authentication (MFA), and advanced fraud detection algorithms, Corytech provides a payment environment that’s not just compliant—but trusted by both players and operators alike. Two-factor authentication adds an extra layer of security to the payment process, ensuring that transactions are safeguarded against unauthorized access. Payment providers utilize encryption and tokenization to ensure secure transactions in iGaming, further enhancing trust and reliability in the payment process.

These protections work behind the scenes to proactively detect and prevent fraudulent behavior, ensuring transactions remain secure without slowing down the user experience. Regular security audits are essential for identifying and addressing vulnerabilities in payment systems, further strengthening the reliability of the platform. This is especially critical in the high-risk, high-volume world of iGaming payments, where trust and speed are equally essential.

Compliance Without Compromise

Corytech makes it easier for operators to stay on the right side of regulations without burdening their internal teams. Integrated AML and KYC protocols are built directly into the payment flow, ensuring compliance from day one. These tools automatically screen users, flag anomalies, and maintain up-to-date audit trails—all without creating unnecessary friction at checkout.

The result? Operators stay protected, regulators stay satisfied, and users enjoy a seamless, secure experience from deposit to deposit and withdrawal process throughout.

Back-Office and Support Services

Operational Efficiency

Behind the sleek front-end, Corytech equips operators with a powerful suite of back-office tools. These include intuitive dashboards for real-time transaction tracking, detailed reporting, and automated reconciliation—making it easy to manage payment operations at scale.

By eliminating manual workflows and data silos, operators can simplify business payments and reduce administrative costs, freeing up resources to focus on growth and player engagement.

Dedicated Partnership

More than just a platform, Corytech acts as a strategic partner to every operator it supports. Clients benefit from personalized onboarding, dedicated account managers, and hands-on technical support. This collaborative approach ensures seamless integration, fast issue resolution, and a long-term relationship built on performance and trust.

In a fast-changing industry where support can make or break success, Corytech stands out by offering both cutting-edge tech and human expertise.

Tangible Benefits for Online Gaming Platforms

Enhanced User Experience

Speed and Convenience

In the iGaming industry, milliseconds matter. A lag in deposit processing or a confusing checkout experience can cause players to abandon ship. Corytech solves this with instant transaction processing, intuitive user flows, and minimal manual input—making deposits and withdrawals feel seamless.

Research from Statista shows that 73% of online gamers cite fast payments as one of their top three expectations from a platform. By eliminating delays and simplifying interfaces, operators can significantly boost player retention and lifetime value.

Trust and Transparency

Trust is a key consideration of player loyalty, especially in high-stakes environments. Corytech builds confidence with visible security protocols (such as multi-factor authentication and real-time fraud alerts), as well as transparent fee structures and real-time transaction statuses.

According to PwC, 88% of consumers say transparency in payment processes directly influences their decision to stick with a platform. When players feel informed and protected, they’re far more likely to return.

Increased Conversion and Revenue Growth

Optimized Transaction Flows

Corytech’s cascading transaction routing plays a direct role in increasing payment success rates. Instead of rejecting failed transactions, the platform reroutes them through alternative providers in real time—dramatically reducing drop-offs.

This routing system has been shown to improve conversion rates by up to 21%, based on internal benchmarks from multi-provider payment ecosystems. For iGaming operators processing thousands of daily transactions, even small percentage gains translate into significant revenue lifts.

Global Reach and Flexibility

Supporting both fiat and cryptocurrency payments enables operators to tap into broader global markets, including crypto-savvy regions like Southeast Asia, LATAM, and Eastern Europe. With multi-currency merchant account and support, players can deposit and withdraw in their local currencies, enhancing satisfaction and reducing conversion barriers.

Data from Juniper Research forecasts that iGaming-related crypto transactions will surpass $150 billion globally by 2026, making crypto support a strategic advantage—not just a tech trend.

.png)

Cost Reduction and Operational Efficiency

Lower Processing Costs

Operating with multiple, disconnected payment providers often means high transaction fees, redundancy in services, and more internal resources to manage them. Corytech reduces that overhead with its fully integrated system, enabling operators to cut down on provider fees, streamline reconciliations, and reduce labor costs.

On average, integrated payment orchestration platforms can reduce operational costs by 15–25%, especially for high-volume businesses like online gaming.

Scalable Infrastructure

Corytech is designed with scalability in mind. Whether an operator is managing 10,000 or 1 million monthly transactions, the platform adapts without performance dips. Cloud-based payment solutions offer scalability and flexibility, allowing businesses to adapt to changing demands. This ensures that payment performance grows in tandem with business needs—no need for constant system overhauls or expensive upgrades.

With flexible APIs, modular architecture, and automated compliance updates, Corytech future-proofs operators against emerging trends and regulatory shifts—making it an ideal partner for long-term growth.

Strategic Recommendations for Industry Leaders

Assessing Your Payment Infrastructure

Gap Analysis

Before adopting any new solution, leading operators must begin by evaluating their existing payment infrastructure. This includes assessing current provider performance, reviewing failure rates, auditing processing fees, doing risk management and understanding user complaints or support issues.

Operators should ask:

- Are we offering enough payment flexibility (fiat + crypto)?

- Where are we losing users in the transaction flow?

- Are compliance processes integrated or manually handled?

- Can our current system scale with user and market growth?

By conducting a comprehensive gap analysis, businesses can pinpoint where integration, automation, and modernization can deliver the most value. Most importantly, this analysis helps align payment improvements with player expectations and operational goals.

Choosing the Right Payment Solution

Selecting the right payment provider is a strategic decision that can influence an operator’s operational efficiency, compliance standing, and overall player satisfaction. With numerous options available, it’s crucial to evaluate providers based on several key factors.

Factors to Consider When Selecting a Payment Provider

When selecting a payment provider, online gaming companies should consider the following factors:

- Security: The payment provider should offer secure transactions, ensuring that customer data is protected. This includes robust encryption methods and advanced fraud detection systems to safeguard against potential threats.

- Payment processing solutions: The provider should offer a comprehensive range of payment processing solutions, including alternative payment methods, bank transfers, and credit card payments. This versatility ensures that players have multiple options to choose from, enhancing their overall experience.

- Customer satisfaction: Prioritizing customer satisfaction is essential. The payment provider should offer a user-friendly payment process, with efficient deposit and withdrawal processes that minimize delays and complications.

- Compliance: The provider must comply with relevant regulations, ensuring that online gaming companies meet their regulatory obligations. This includes adhering to AML and KYC requirements to prevent fraud and money laundering.

- Cost: iGaming companies should consider the fees associated with payment processing, including transaction fees and hidden costs. Competitive pricing is crucial. The payment provider should offer cost-effective solutions that help online gaming companies minimize their operational costs without compromising on service quality.

By considering these factors, online gaming companies can select a payment provider that meets their needs and enhances their customers’ experience.

Roadmap for Implementation

Step-by-Step Integration

Transitioning to a new payment solution may seem daunting, but Corytech is designed for fast, modular integration. Here's a simplified roadmap to get started:

- Initial Consultation: Understand your current setup and business needs.

- Custom Configuration: Tailor Corytech’s platform to match your payment flows and preferred providers.

- API Integration: Plug into existing systems using well-documented APIs and SDKs.

- Compliance Sync: Implement automated AML/KYC protocols and reporting tools.

- Testing & Go-Live: Launch in sandbox, resolve edge cases, and deploy smoothly.

- Ongoing Optimization: Monitor performance and fine-tune the setup with Corytech’s support team.

Throughout the process, operators benefit from dedicated onboarding specialists, technical assistance, and post-launch optimization strategies—ensuring minimal disruption, customer satisfaction, and quick time-to-value.

.png)

Long-Term Benefits and Future-Proofing

Continuous Innovation

Payment technology doesn’t stand still—and neither should your platform. Corytech is committed to continuous product innovation, ensuring its partners always stay ahead of industry demands. From expanding crypto support to adding AI-driven fraud detecting, the platform evolves with market needs and player behavior.

In a rapidly shifting regulatory landscape, agility is essential. Corytech’s architecture is built to adapt quickly to new AML/KYC rules, regional licensing changes, and emerging payment technologies.

By investing in a forward-thinking solution today, operators are not just solving current problems—they're future-proofing their businesses against whatever comes next.

The Future of iGaming Payments

As the iGaming industry continues to expand, the future of payment processing is set to be shaped by emerging trends and technologies. Staying ahead of these developments is crucial for operators looking to maintain a competitive edge.

Emerging Trends and Technologies in iGaming Payments

The landscape of iGaming payments is constantly evolving, driven by technological advancements and changing player preferences. Some of the key trends and technologies set to shape the future include:

- Cryptocurrency Adoption: With the growing acceptance of cryptocurrencies, more players are looking for platforms that support crypto transactions. This trend is expected to continue, with operators integrating more crypto-friendly payment solutions to cater to this demand.

- AI and Machine Learning: These technologies are being leveraged to enhance fraud detection and streamline payment processes. AI-driven systems can identify suspicious activities in real-time, ensuring secure transactions and reducing the risk of fraud.

- Mobile Payments: As mobile gaming continues to rise, the demand for mobile payment solutions like Apple Pay and Google Pay is increasing. Operators are focusing on optimizing their platforms for mobile transactions to provide a seamless experience for players on the go.

- Instant Payments: The expectation for instant deposit and withdrawal processes is becoming the norm. Operators are investing in technologies that enable real-time transactions, reducing wait times and enhancing player satisfaction.

- Regulatory Compliance: With regulations constantly evolving, staying compliant is a moving target. Future payment solutions will need to be agile and adaptable, ensuring that operators can quickly adjust to new regulatory requirements without disrupting their operations.

By embracing these trends and technologies, iGaming operators can future-proof their payment systems, ensuring they remain competitive and continue to meet the evolving needs of their players.

.png)

What’s Next?

As the iGaming industry continues to evolve, leading operators are recognizing that simplifying payments isn’t just a nice-to-have—it’s a critical success factor. With growing competition, rising player expectations, and complex regulatory demands, payment performance can make or break a platform.

That’s why forward-thinking businesses are turning to Corytech. Its integrated, future-ready platform delivers:

- Enhanced user experiences through fast, seamless, and flexible payment flows.

- Robust security and compliance, including end-to-end encryption and built-in AML/KYC tools.

- Higher conversion rates, thanks to cascading routing and real-time processing.

- Operational efficiency and cost savings from unified infrastructure and reduced provider sprawl.

The future of iGaming belongs to platforms that embrace intelligent, agile and local payment methods and systems. As new markets open, cryptocurrency adoption grows, and regulations evolve, having a scalable and secure payment solution is key to long-term success.

Simplifying digital payments today sets the stage for resilience, expansion, and profitability tomorrow.

Ready to take your payment operations to the next level?

Explore how Corytech can help you simplify payment flows, scale effortlessly, and unlock new revenue opportunities.

📈 Visit Corytech’s website to learn more, or schedule a personalized demo with our team of experts.

👉 Connect with Corytech today and discover the smart way to manage iGaming payments—securely, efficiently, and with zero friction.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)