One of the most compelling advantages of crypto payments in the iGaming sector is the heightened security they offer. Traditional payment methods, such as credit cards and bank transfers, are vulnerable to chargebacks, fraud, and data breaches. In contrast, cryptocurrencies like Bitcoin, Ethereum, and stablecoins operate on decentralized blockchain networks that offer unparalleled security features.

Blockchain technology ensures that all transactions are immutable, transparent, and cryptographically secured. Once a transaction is recorded, it cannot be altered or reversed, drastically reducing the risk of chargeback fraud—a common issue in the iGaming industry. This transparency not only protects operators from fraudulent activities but also builds trust with players, who can verify their transactions on the blockchain.

According to a Chainalysis report, over $20 billion worth of crypto was sent to addresses associated with illicit activities in 2022, but the majority was linked to scams and thefts outside of regulated platforms. iGaming operators that integrate crypto payments through licensed, reputable platforms can mitigate these risks while benefiting from blockchain's inherent security.

Moreover, using cryptocurrencies reduces the need for operators to store sensitive user data, minimizing the risks associated with data breaches. As data protection regulations like GDPR become stricter, crypto payments offer a compliant, secure alternative that aligns with modern privacy expectations.

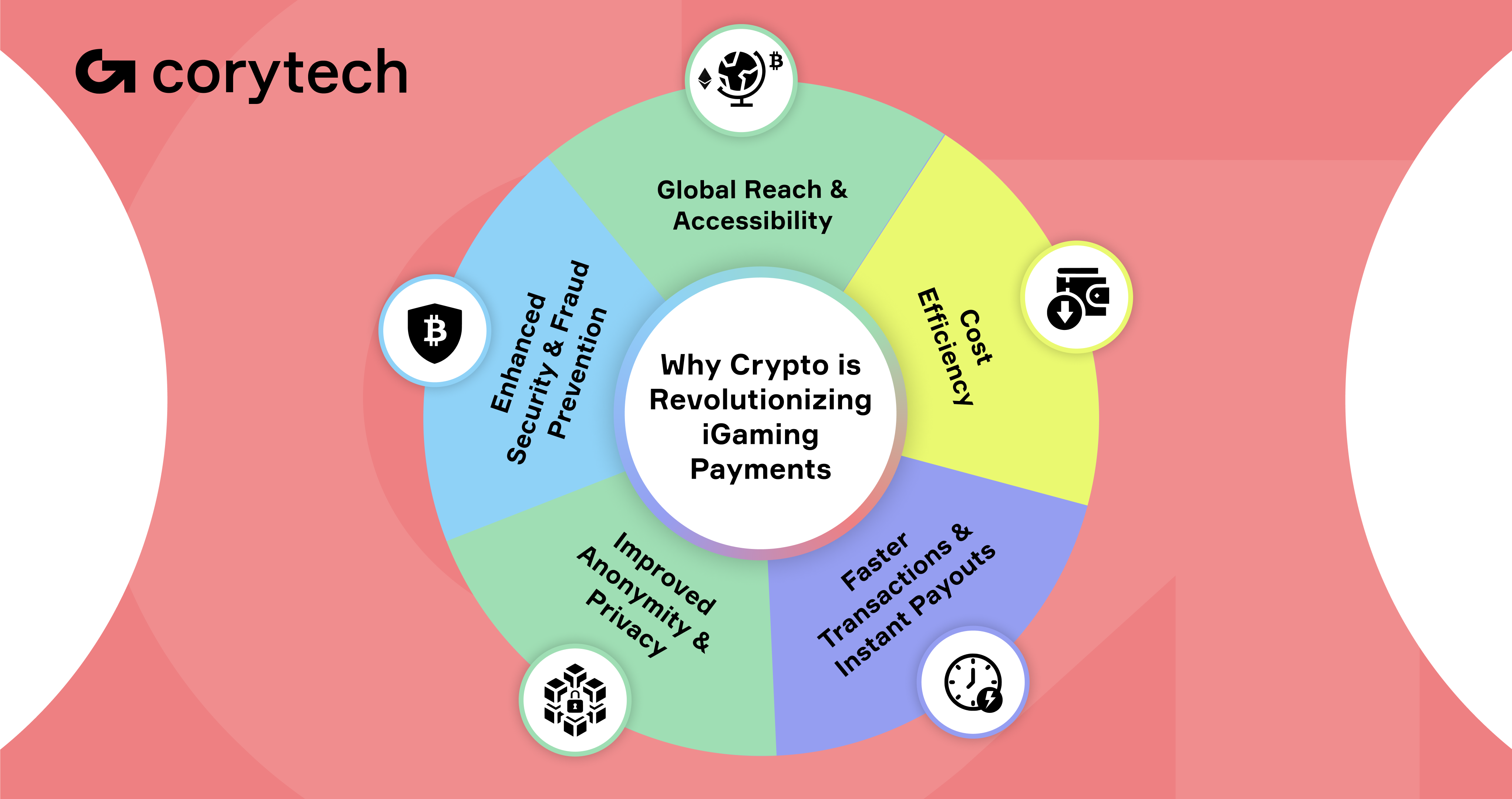

Enhanced Security and Fraud Prevention

The Role of Blockchain Technology in Securing Transactions

Blockchain technology is at the core of cryptocurrency’s security advantage. Every transaction made using cryptocurrencies is recorded on a decentralized ledger that is immutable, transparent, and tamper-proof. Once a transaction is added to the blockchain, it cannot be altered or reversed, virtually eliminating the risk of chargebacks—one of the biggest challenges for iGaming operators.

In the traditional payment system, chargebacks can be exploited by fraudulent players who claim unauthorized transactions, leading to financial losses for operators. With crypto payments, the concept of chargebacks becomes obsolete, as all transactions are final. This not only saves money but also reduces the administrative burden of handling disputes.

Additionally, the transparency of blockchain means that both operators and players can independently verify transactions, fostering trust on both sides. Every transaction detail—amount, date, and wallet addresses—is publicly accessible while still protecting user anonymity.

A 2023 Deloitte report highlights that blockchain-based transactions reduce fraud rates by up to 60% in industries heavily reliant on online payments, such as iGaming. Furthermore, the reduced reliance on storing sensitive user data, like credit card numbers and personal identification, minimizes the risk of data breaches. This aligns with global data protection regulations, including GDPR and PCI DSS, offering a more secure, compliant payment option.

Eliminating Chargeback Fraud

Chargeback fraud has long been a thorn in the side of iGaming operators, costing the industry millions annually. In traditional payment systems, players can dispute transactions—whether legitimate or not—resulting in chargebacks that force operators to refund payments, often without recourse.

Cryptocurrency transactions, however, are irreversible. Once a payment is confirmed and recorded on the blockchain, it cannot be undone. This feature eliminates chargeback fraud entirely, providing financial security and peace of mind to iGaming operators.

According to a 2022 study by the Merchant Risk Council, chargeback fraud accounts for nearly 70% of all fraud-related losses in online businesses, with iGaming operators being particularly vulnerable due to the digital nature of their transactions. By integrating crypto payments, operators can effectively eliminate this risk, protecting their revenue streams and reducing the need for complex fraud management systems.

The elimination of chargebacks also translates to operational efficiency. Without the need to investigate and process disputes, operators can focus resources on improving the player experience, enhancing platform features, and expanding their offerings. This financial predictability is a game-changer, allowing for more strategic growth in an increasingly competitive market.

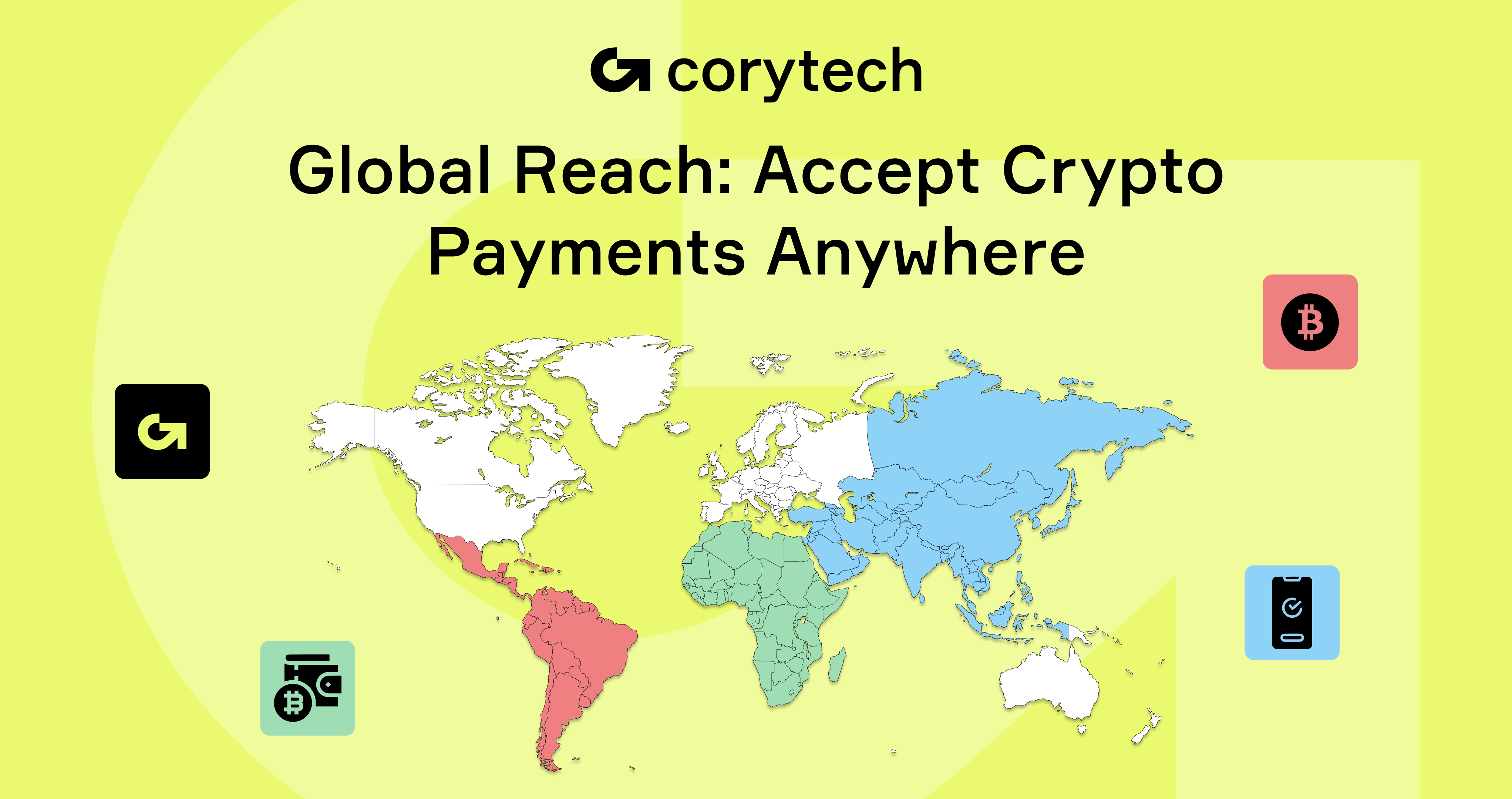

Global Reach and Accessibility

The iGaming industry is inherently global, attracting players from every corner of the world. However, traditional payment methods often limit operators due to regional restrictions, currency conversion fees, and regulatory hurdles. Cryptocurrencies eliminate these barriers, allowing iGaming platforms to broaden their reach and tap into new markets effortlessly.

Serving a Borderless Audience

One of the standout advantages of crypto payments is their ability to facilitate seamless cross-border transactions. Cryptocurrencies operate independently of national borders and traditional financial systems, enabling iGaming platforms to accept payments from players worldwide without the typical headaches associated with international transactions.

Operators no longer need to worry about fluctuating exchange rates, currency conversion fees, or delays caused by international bank processing times. Transactions are processed almost instantly, regardless of where the player is located, and are settled in the agreed cryptocurrency, providing consistency and predictability.

According to Statista, the number of global cryptocurrency users surpassed 420 million in 2023, with adoption rates soaring in regions like Asia-Pacific, Africa, and Latin America. This widespread adoption enables iGaming platforms to attract a more diverse player base without the friction of traditional financial systems.

Additionally, crypto payments help operators navigate complex regulatory environments. While certain countries impose strict regulations on traditional gambling payments, cryptocurrencies often fall into more flexible legal frameworks, allowing operators to continue servicing players in otherwise restricted markets.

Unbanked Players Gain Access

An often-overlooked advantage of crypto payments is their ability to reach the unbanked and underbanked populations worldwide. According to the World Bank’s Global Findex Database, around 1.4 billion adults globally remained unbanked as of 2022, with the highest concentrations in Africa, Southeast Asia, and Latin America. For these individuals, traditional banking services are either inaccessible or unreliable, limiting their ability to participate in online gaming.

Cryptocurrencies offer a solution. All that’s needed to participate in crypto-based transactions is a smartphone and internet access—both of which have higher penetration rates than banking services in many developing regions. Players can fund their accounts and withdraw winnings without the need for a traditional bank account or credit card.

This opens up entirely new markets for iGaming operators, allowing them to engage players who were previously excluded from the industry. It also fosters inclusivity, giving more people the opportunity to participate in online gaming activities, from betting and casino games to fantasy sports.

Moreover, the use of cryptocurrencies helps operators avoid the high transaction fees often associated with credit cards or international transfers, making microtransactions more feasible and appealing to players in developing economies.

Cost Efficiency

In the highly competitive iGaming industry, operational costs can significantly impact profit margins. Traditional payment methods often come with hidden fees, third-party charges, and high administrative overhead. By adopting cryptocurrencies, iGaming operators can streamline payment processes, cut costs, and improve overall efficiency.

Lower Transaction Fees

One of the most immediate financial benefits of crypto payments is the reduction in transaction fees. Traditional payment processors, such as credit card companies and banks, often charge hefty fees for processing deposits and withdrawals. These fees can range from 2% to 5% per transaction, depending on the payment provider and the geographic location of the player.

Cryptocurrencies, on the other hand, drastically reduce these costs by eliminating intermediaries. Transactions are processed directly between the player and the operator on decentralized blockchain networks, where fees are minimal. For example, the average Bitcoin transaction fee fluctuated between $1 and $5 in 2023, while Ethereum transactions, even during high-traffic periods, averaged around $2 to $10. These fees are significantly lower compared to traditional banking fees, especially for high-value transactions.

For operators handling thousands of transactions daily, these savings add up quickly. By cutting down on transaction fees, iGaming businesses can either pass the savings on to their players through better bonuses and rewards or retain the extra revenue to boost profitability.

Operational Savings

Beyond lower transaction fees, cryptocurrencies offer substantial operational savings. Traditional payment systems often involve multiple intermediaries—banks, payment gateways, and processors—each adding layers of complexity and administrative overhead. Managing these relationships, ensuring compliance, and handling disputes require significant resources, both in terms of time and money.

Crypto payments simplify this process by reducing the number of intermediaries involved. Transactions occur directly between the player and the operator, which minimizes the need for extensive back-office operations dedicated to payment reconciliation, fraud prevention, and dispute resolution.

A 2023 PwC report highlighted that businesses integrating blockchain-based payment systems experienced a 30% reduction in administrative costs related to payment processing and compliance management. For iGaming operators, this means more resources can be allocated to growth initiatives, such as marketing campaigns, platform development, and customer engagement strategies.

Additionally, faster transaction settlements—often completed within minutes—improve cash flow management. Operators no longer need to wait days for funds to clear, allowing them to reinvest capital more efficiently and respond quickly to market opportunities.

Faster Transactions and Instant Payouts

In the fast-paced world of iGaming, speed is everything. Players expect quick deposits and even quicker payouts, and any delays can lead to frustration and a loss of trust. Traditional payment methods, bogged down by banking hours, international processing times, and intermediary approvals, often fail to meet these expectations. Cryptocurrencies, however, revolutionize transaction speed, offering near-instant processing that benefits both players and operators.

Speeding Up Deposits and Withdrawals

One of the biggest pain points for iGaming players is the time it takes to process deposits and withdrawals through conventional payment methods. Bank transfers can take several days, especially for cross-border transactions, while credit card payments might be delayed due to fraud checks or banking hours. These delays can deter players from continuing to engage with a platform, impacting both user satisfaction and revenue.

Crypto payments eliminate these delays by leveraging blockchain technology, which processes transactions around the clock, without relying on traditional banking infrastructure. Whether it’s Bitcoin, Ethereum, or stablecoins like USDT, transactions can be completed within minutes, regardless of the player’s location or time zone.

For example, the Bitcoin Lightning Network—a second-layer solution designed to speed up Bitcoin transactions—enables near-instant transfers with minimal fees. Similarly, Solana and Ripple (XRP) offer rapid transaction speeds, processing thousands of transactions per second. This means players can deposit funds and start playing immediately, and more importantly, they can withdraw their winnings without enduring lengthy wait times.

A 2023 report by Crypto.com revealed that 72% of crypto-using iGaming players cited faster withdrawals as their primary reason for choosing crypto-enabled platforms. This speed not only enhances the gaming experience but also gives operators a competitive edge in attracting and retaining players.

Building Player Trust

Instant payouts are more than just a convenience—they’re a critical factor in building player trust and loyalty. In an industry where trust is paramount, the ability to deliver quick, hassle-free payouts sets an operator apart from the competition. Players who receive their winnings promptly are more likely to view the platform as reliable and trustworthy, leading to higher retention rates.

Trust is a key driver of long-term player engagement. When players know they can withdraw their winnings without delays or complications, they’re more likely to reinvest in the platform, participate in higher-stakes games, and recommend the site to others. According to a 2022 survey by the European Gaming and Betting Association (EGBA), platforms that offer instant payouts see a 40% increase in player retention compared to those with traditional payout systems.

Moreover, fast transactions reduce the likelihood of disputes and negative reviews, which can tarnish an operator’s reputation. By ensuring quick and transparent payment processes, iGaming operators foster a positive player experience that translates into brand loyalty and organic growth.

Improved Anonymity and Privacy

Privacy is an increasingly important concern for online gamers, especially in regions where gambling regulations are stringent or where players prefer to keep their financial activities discreet. Cryptocurrencies offer a unique advantage by balancing privacy with compliance, giving players the anonymity they seek while ensuring operators meet regulatory standards.

Catering to Privacy-Conscious Players

One of the primary attractions of cryptocurrencies for iGaming players is the enhanced privacy they offer. Unlike traditional payment methods, which require players to share sensitive information such as credit card numbers, bank account details, and personal identification, crypto transactions can be completed with minimal disclosure. Players only need a digital wallet address, allowing them to deposit and withdraw funds without exposing personal financial data.

This level of privacy appeals to a wide range of players, from those in countries with restrictive gambling laws to individuals who simply prefer to keep their gaming activities separate from their primary financial accounts. A 2023 survey by Statista found that 48% of crypto users valued privacy and anonymity as their top reasons for using digital currencies, making it a key factor in attracting privacy-conscious gamers to iGaming platforms.

Furthermore, cryptocurrencies like Monero (XMR) and Zcash (ZEC) are designed with advanced privacy features, offering even greater levels of anonymity. While not as widely accepted as Bitcoin or Ethereum, these privacy-focused coins cater to a niche segment of players seeking maximum confidentiality.

Meeting Legal and Regulatory Needs

While cryptocurrencies offer enhanced privacy, iGaming operators still need to navigate complex regulatory landscapes to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements. Fortunately, crypto payments can strike a balance between privacy and regulatory compliance.

Blockchain’s transparent ledger system allows for traceable transactions without compromising user anonymity. While wallet addresses are visible on the blockchain, they are not directly linked to personal identities unless voluntarily disclosed. This transparency helps operators monitor transactions for suspicious activity, ensuring compliance with AML regulations while respecting player privacy.

Additionally, many crypto payment processors and iGaming platforms integrate KYC procedures at the onboarding stage. Players may be required to verify their identity when registering or making large transactions, satisfying regulatory requirements without compromising the anonymity of routine transactions.

According to a 2023 report by the Financial Action Task Force (FATF), integrating blockchain analytics tools has helped businesses in regulated industries, like iGaming, maintain compliance while benefiting from the efficiencies of crypto payments. These tools allow operators to track transaction patterns, flag unusual activity, and ensure that their platforms are not being used for illicit purposes.

By offering a payment solution that prioritizes both privacy and compliance, iGaming operators can appeal to a broader audience while maintaining the trust of regulators and financial partners.

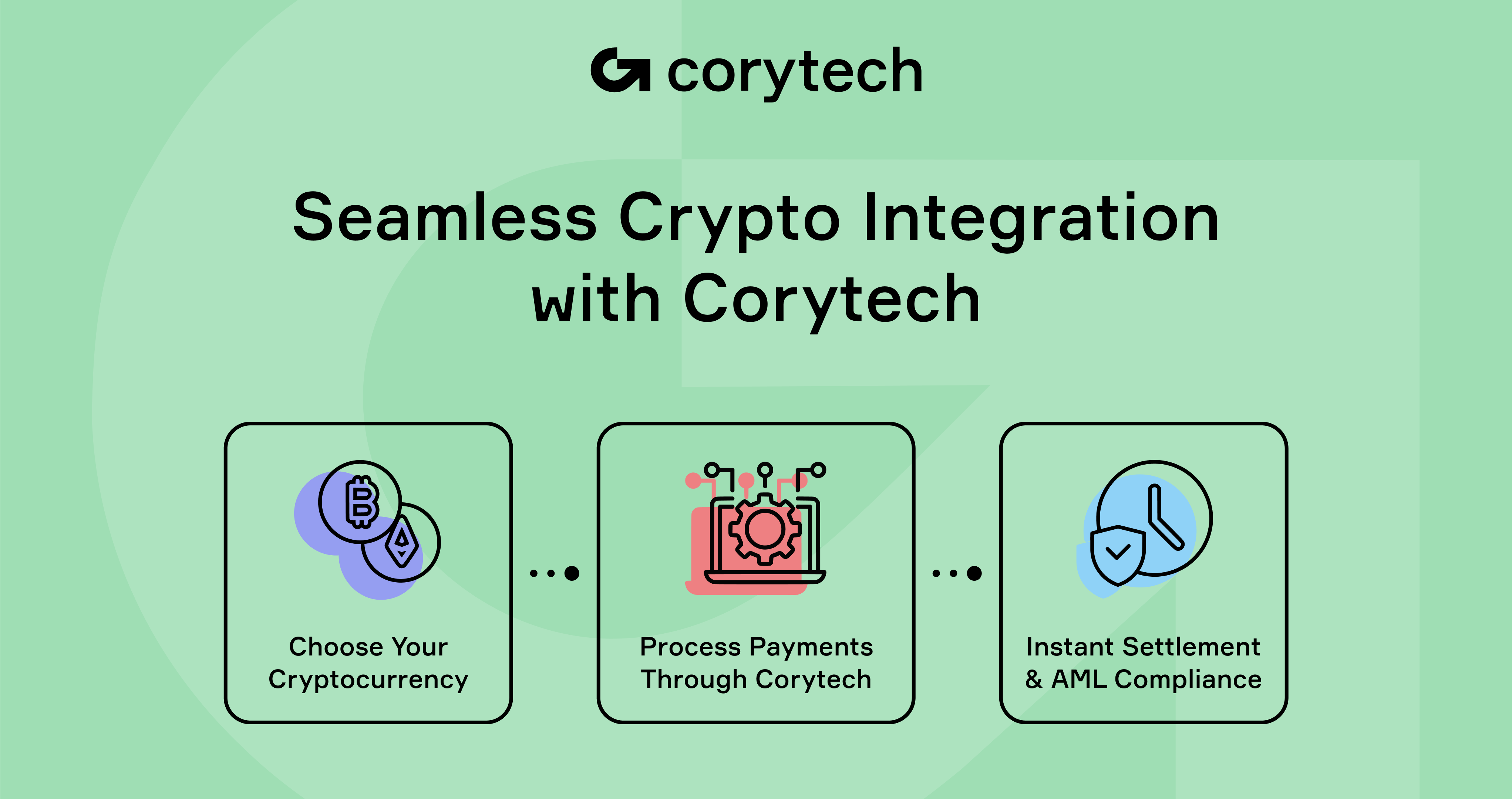

Corytech’s Role in Crypto Payment Integration

As the iGaming industry evolves, the demand for flexible, secure, and efficient payment solutions grows. Cryptocurrencies have emerged as a game-changing option, but integrating them into existing payment infrastructures can be complex. That’s where Corytech steps in. As a leading payment orchestration platform, Corytech simplifies the integration of crypto payments, providing iGaming operators with a seamless, secure, and scalable solution.

How Corytech Supports Crypto Payments

Corytech’s payment orchestration platform is designed to bridge the gap between traditional financial systems and emerging digital payment technologies like cryptocurrencies. By offering a unified platform that supports both fiat and crypto transactions, Corytech enables iGaming operators to diversify their payment options without the headache of managing multiple systems.

The platform facilitates smooth integration of various cryptocurrencies, ensuring quick deployment and minimal disruption to existing operations. Operators can manage all transactions—whether in Bitcoin, Ethereum, or stablecoins like USDT—through a single, intuitive dashboard. This centralized approach not only enhances operational efficiency but also provides a consistent experience for both operators and players.

Moreover, Corytech ensures that all crypto transactions are secure and compliant with global regulations. The platform integrates advanced AML (Anti-Money Laundering) and KYC (Know Your Customer) procedures, helping operators meet regulatory requirements while maintaining the privacy and security benefits of blockchain technology.

Key Features for iGaming Operators

Corytech’s crypto payment integration isn’t just about enabling digital currency transactions—it’s about optimizing the entire payment ecosystem for iGaming operators. Here are some of the key features that make Corytech the ideal partner for crypto payment integration:

Multi-Currency Support: Corytech allows operators to accept and manage multiple cryptocurrencies alongside traditional fiat payments. This flexibility ensures that players have a wide range of payment options, enhancing user satisfaction and broadening the potential player base.

Customizable Payment Flows: Every iGaming platform is unique, and Corytech’s customizable payment flows allow operators to tailor the payment journey to their specific needs. Whether it’s streamlining the deposit process or optimizing withdrawal speeds, operators can create seamless, user-friendly experiences that keep players engaged.

Fraud Prevention Tools: Security is at the core of Corytech’s platform. Advanced fraud prevention tools, powered by machine learning and blockchain analytics, protect iGaming platforms from fraudulent activities while ensuring that legitimate transactions are processed smoothly. This dual focus on security and efficiency gives operators peace of mind and players confidence in the platform.

What’s Next?

For iGaming operators, crypto payments present a wealth of opportunities—from global accessibility and cost savings to enhanced security and player satisfaction. As the industry continues to grow and evolve, integrating cryptocurrency payment options is no longer a luxury but a necessity for operators looking to stay competitive.

By partnering with Corytech’s advanced payment orchestration platform, operators can seamlessly integrate crypto payments into their systems, unlocking new revenue streams and improving operational efficiency. With features like multi-currency support, customizable payment flows, and robust fraud prevention tools, Corytech empowers iGaming businesses to harness the full potential of cryptocurrencies.

In a dynamic and rapidly changing industry, staying ahead means embracing innovation. Crypto payments are the future of iGaming, and with Corytech, that future is just a click away.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources