Businesses often juggle multiple payment systems to cater to diverse customer preferences. While this approach aims to enhance customer experience, a fragmented payment infrastructure can inadvertently lead to hidden costs and revenue losses. And stress, a lot of stress.

Fragmentation in payment processes often results in several inefficiencies. According to a 2023 report from the Digital Payments Institute, companies operating with disjointed payment platforms can see operational costs increase by as much as 15% compared to those using a unified system. Moreover, survey data from FinTech Insights indicates that 67% of business executives believe that integrating payment solutions could significantly streamline operations, reduce overhead, and enhance cash flow management.

Beyond the direct financial implications, fragmented payment systems can also affect customer satisfaction and long-term scalability. As the volume and complexity of digital transactions continue to rise, so does the need for a centralized, cohesive approach to payment processing. This article underscores the unseen pitfalls of fragmented payment systems and the importance of adopting a unified payment orchestration strategy.

Understanding Payment System Fragmentation

What Constitutes a Fragmented Payment System?

A fragmented payment system arises when a business employs multiple, disjointed payment processing solutions without seamless integration. This scenario often leads to inefficiencies and increased operational complexities.

For instance, consider a retail chain that uses one gateway for online sales, another for in-store transactions, and a third for mobile payments. Each system comes with its own fee structure, settlement times, and security protocols, resulting in confusion and redundancies across the business's financial processes.

A 2024 report by PaymentsSource found that organizations with fragmented payment systems experience, on average, a 20% longer reconciliation time due to the manual efforts required to align transactions from different platforms. Moreover, relying on multiple systems often means incurring duplicated costs. According to the Global Finance Institute, these overlapping fees—from setup charges to per-transaction costs—can collectively reduce profit margins by up to 5%.

Fragmentation also poses risks to data security and compliance. Disjointed systems may not uniformly adhere to critical industry standards such as PCI-DSS (Payment Card Industry Data Security Standard). In an era where data breaches can lead to significant financial and reputational damage, ensuring a consolidated and compliant payment system is more critical than ever.

Common Causes of Fragmentation

Fragmentation in payment systems often stems from several key factors:

- Rapid Business Expansion: As companies quickly enter new markets, they frequently adopt localized payment solutions without a unified strategy. This rapid expansion can lead to multiple systems operating independently, each tailored to regional demands but lacking cohesion with the company’s overall payment infrastructure.

- Integrating Third-Party Payment Processors: In an effort to cater to diverse regional payment preferences, businesses often integrate various third-party processors. While this approach addresses local customer needs, it can also create a patchwork of systems that are difficult to manage collectively, leading to increased operational complexity and hidden costs.

- Legacy Systems: Many organizations still rely on outdated payment technologies that haven't evolved to meet modern digital standards. These legacy systems can be incompatible with newer, more efficient payment solutions, causing gaps in integration and security vulnerabilities. According to a 2023 industry survey by Payment Monitor, nearly 40% of businesses identified outdated systems as a major hurdle in achieving payment system integration.

Collectively, these factors contribute to a fragmented payment landscape, making it challenging for businesses to maintain streamlined operations and optimal revenue management.

The Hidden Costs of Fragmentation

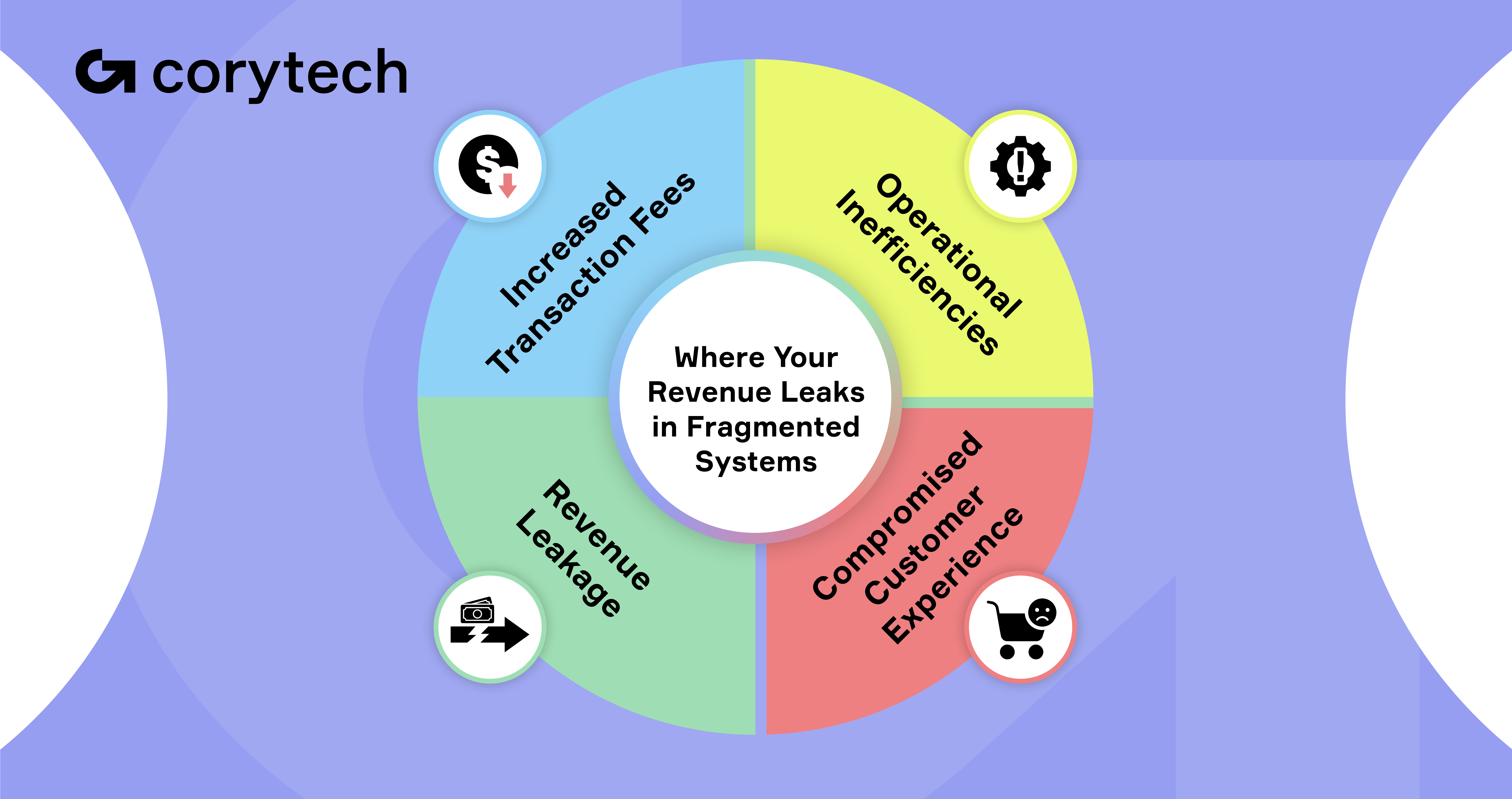

Fragmented payment systems can impose a variety of hidden costs on businesses, affecting both the bottom line and customer satisfaction. Here’s a closer look at the key financial and operational drawbacks:

Increased Transaction Fees

Utilizing multiple payment processors often results in higher cumulative transaction fees. Without a unified approach, businesses miss the opportunity to negotiate favorable rates or benefit from bulk discounts. For example, a 2023 study by PaymentCloud found that companies employing three or more disparate processors can incur up to 15% higher transaction fees compared to those using a consolidated platform. These extra costs, when compounded over thousands of transactions, can significantly erode profit margins.

Operational Inefficiencies

Fragmented systems require manual reconciliation across different platforms, leading to increased labor costs and a higher likelihood of human error. According to a 2024 report from FinTech Times, companies with disjointed payment infrastructures spend approximately 25% more time on administrative tasks, such as data entry and transaction matching, than those with integrated systems. This inefficiency not only delays financial reporting but also diverts valuable resources away from strategic business initiatives.

Elevated Risk of Revenue Leakage

Disjointed payment processes can result in missed or failed transactions, leading to unnoticed revenue losses over time. A study by RevenueWatch in 2023 revealed that businesses operating with fragmented payment systems can experience revenue leakage of 3-5% annually. Although this percentage might seem small, the cumulative impact on overall revenue, especially for high-volume enterprises, can be substantial, undermining long-term profitability and growth.

Compromised Customer Experience

Inconsistent payment experiences across various platforms can frustrate customers and lead to increased cart abandonment rates. Research from the Customer Experience Association in 2024 indicated that 42% of consumers are likely to abandon a purchase if they encounter difficulties during the checkout process. Beyond the immediate loss of a sale, a poor payment experience can damage customer loyalty and brand reputation, ultimately impacting repeat business and long-term customer retention.

Real-World Implications of Fragmented Systems

Case Study: The Restaurant Industry

Restaurants are particularly vulnerable to the financial strain induced by fragmented payment systems. Credit card processing fees, for instance, have become one of the top expenses for many eateries. With razor-thin margins, restaurants often feel the pinch when multiple payment processors—each with distinct fee structures and settlement cycles—are used across various platforms such as in-store, online, and mobile ordering systems.

A stark illustration of this issue comes from the broader U.S. market: in 2023, U.S. businesses collectively paid $172 billion in credit card processing fees. This colossal sum underscores the substantial impact these fees have, especially on small and mid-sized restaurants. As highlighted by Food & Wine, many establishments are forced to absorb these additional costs, which can erode profit margins and jeopardize overall financial stability.

The fragmented nature of their payment systems means that restaurants often lose out on the opportunity to negotiate consolidated fees or leverage volume discounts. Instead, they face a patchwork of charges that accumulate over thousands of daily transactions. Ultimately, the financial burden of these disparate systems not only affects the bottom line but also emphasizes the urgent need for a more unified, efficient approach to payment processing in the restaurant industry.

The SaaS Sector's Struggle

In the SaaS industry, a smooth order-to-cash process is vital to ensuring that recurring revenue is captured efficiently. However, many SaaS companies face significant challenges due to fragmented systems that handle order management, invoicing, payment processing, and revenue recognition separately. This disjointed approach can lead to delays in invoicing, increased manual reconciliation, and ultimately, revenue leakage.

According to a recent analysis by GrowCFO, fragmented order-to-cash processes can cause inefficiencies that result in revenue losses ranging from 2% to 5% annually. These losses stem from bottlenecks where orders may be recorded in one system but not efficiently passed to the billing and collections departments, leading to missed invoices and duplicate efforts.

Moreover, the lack of integration between systems often necessitates time-consuming manual interventions. A survey of SaaS executives revealed that nearly 60% experienced significant delays and errors in their order-to-cash cycle due to system fragmentation. These delays not only impede cash flow but also compromise the overall customer experience—customers who encounter billing errors or delays may become dissatisfied, impacting long-term retention in an industry where recurring revenue is key.

Addressing these challenges is crucial for sustainable growth. By adopting a unified payment orchestration strategy that integrates the entire order-to-cash process, SaaS companies can minimize inefficiencies, reduce administrative costs, and protect their revenue streams. This streamlined approach not only ensures faster revenue realization but also strengthens customer trust and operational resilience in a competitive market.

.png)

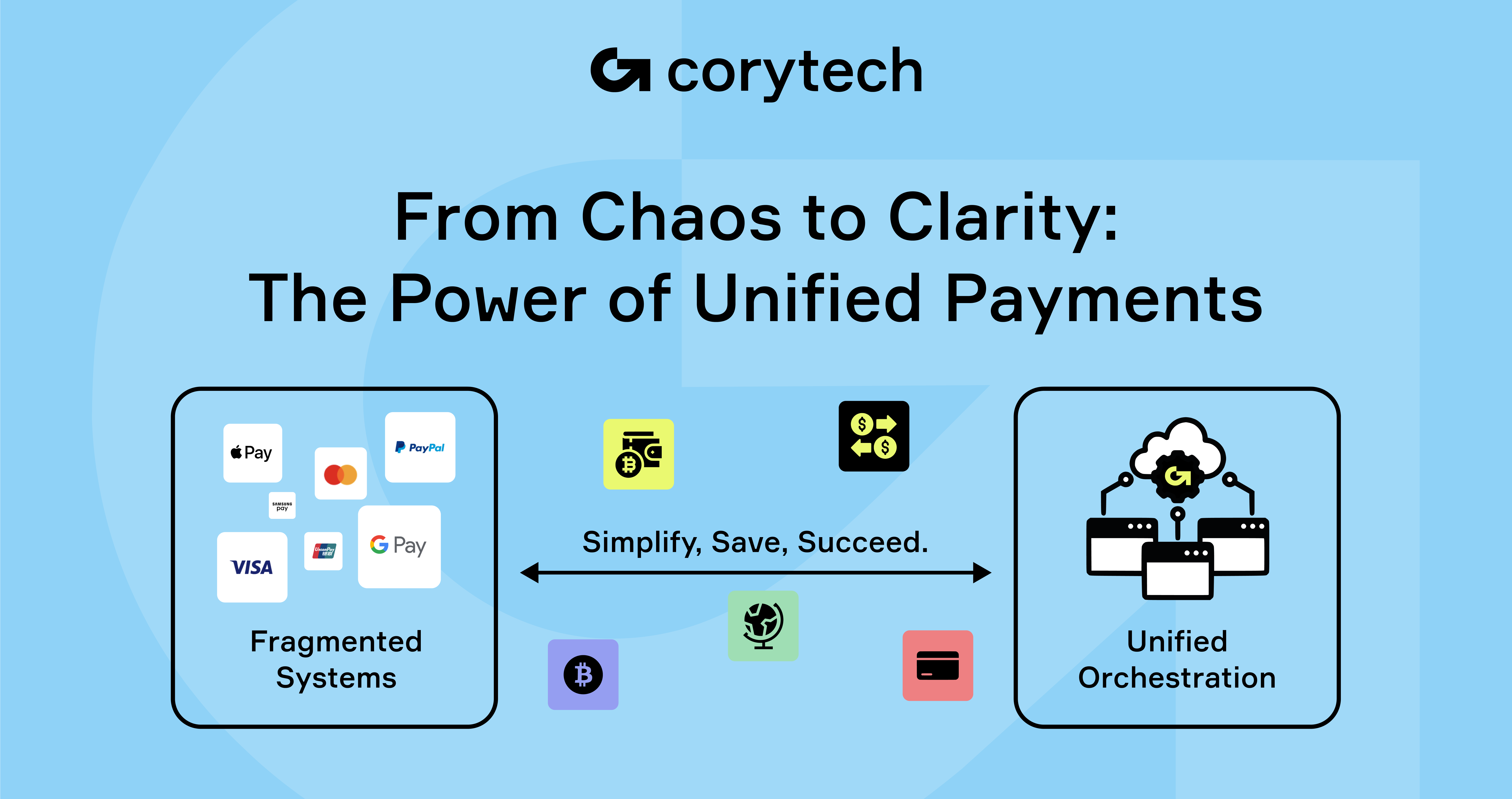

The Solution: Embracing Payment Orchestration

What is Payment Orchestration?

Payment orchestration involves streamlining and optimizing online payment processes by coordinating diverse services and providers through a unified platform. Instead of managing multiple, disjointed systems, businesses can integrate various payment gateways, fraud prevention tools, and settlement processes into a single, cohesive solution. This approach not only simplifies operations but also enables companies to dynamically adjust to customer preferences and regional requirements.

According to insights from Corytech, payment orchestration platforms have demonstrated a marked improvement in transaction success rates and operational efficiency. By centralizing the payment process, businesses can automate tasks, reduce manual errors, and achieve faster reconciliations—paving the way for more agile and responsive financial operations.

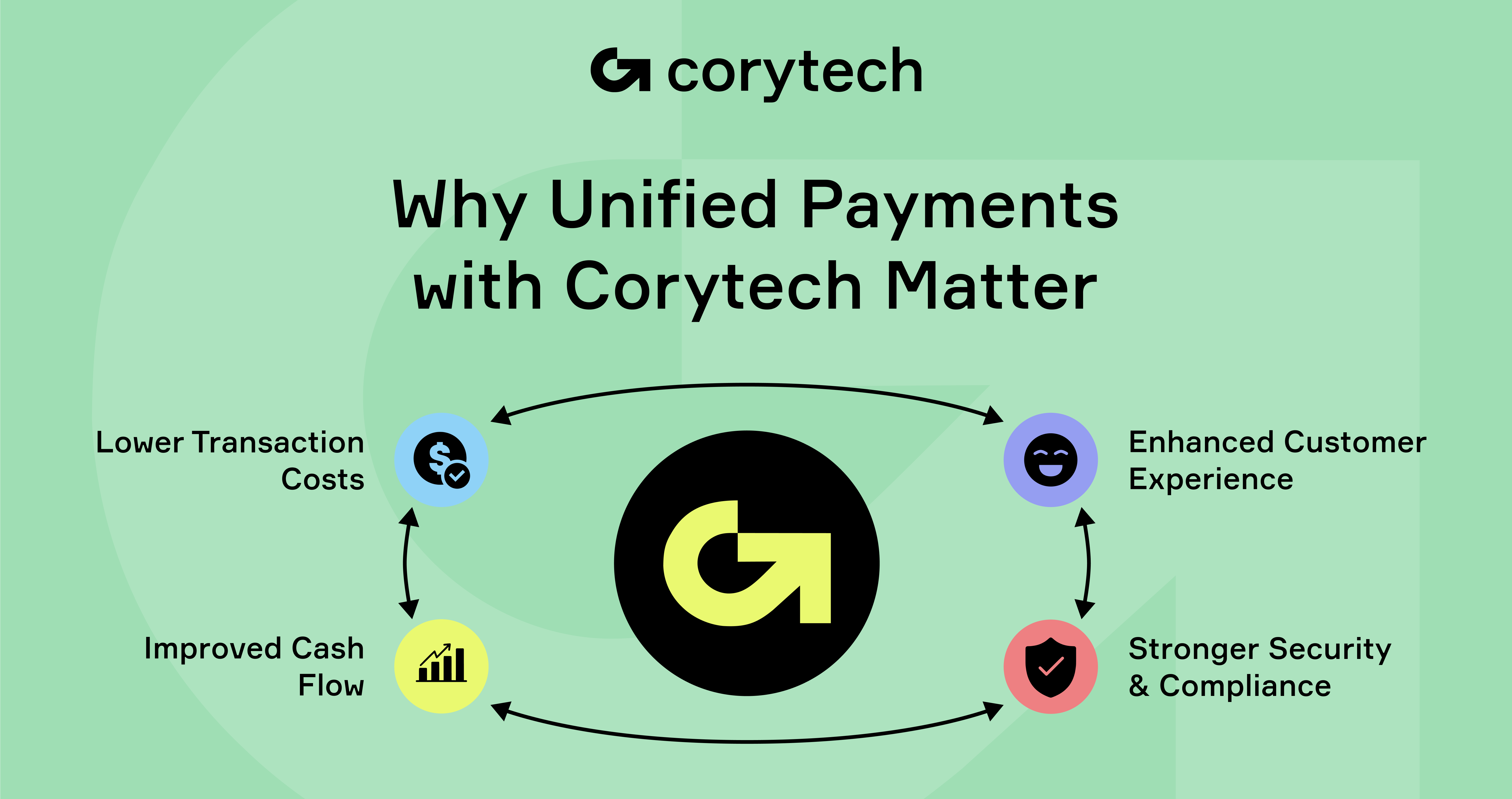

Benefits of a Unified Payment Platform

Embracing a unified payment orchestration system offers several critical advantages:

- Cost Efficiency: Consolidating payment processes can lead to significant savings by reducing redundant transaction fees and lowering operational expenses. A single platform often allows businesses to leverage bulk discounts and more favorable fee structures that aren’t available when negotiating with multiple providers.

- Enhanced Customer Experience: A unified system ensures a consistent and smooth payment process across all channels. This not only minimizes the likelihood of errors or delays but also creates a seamless experience for customers. Improved transaction success rates can lead to higher satisfaction, lower cart abandonment rates, and increased customer loyalty.

- Improved Data Insights: Centralized data collection allows businesses to consolidate financial information from various channels into one dashboard. This holistic view facilitates better analysis and reporting, enabling more strategic decision-making. With deeper insights into consumer behavior and transaction trends, companies can fine-tune their offerings and improve overall performance.

Corytech's Role in Streamlining Payments

Corytech is an innovative paytech provider specializing in developing and implementing zero-stress payment solutions for highly efficient payment systems. With a keen focus on eliminating operational friction and boosting transaction success rates, Corytech offers comprehensive solutions including a white-label payment orchestration platform, robust anti-fraud measures, and seamless back-office services.

Key Features of Corytech's Payment Orchestration Platform

Zero-Stress Unified Payment Processing:

Corytech's platform enables businesses to accept, process, and settle payments through a single provider across various channels. This unified approach simplifies the payment ecosystem, reduces integration complexities, and ensures consistency across all transactions.

Multi-Currency Support:

The platform is designed to manage transactions in multiple currencies, including emerging digital currencies such as cryptocurrencies. Its internal conversion capabilities allow businesses to seamlessly handle cross-border transactions, making it an ideal solution for companies operating in global markets.

Cascading Feature:

One of Corytech's standout features is its cascading capability. This feature increases payment conversions by automatically routing declined transactions to alternative banks for authorization. This not only minimizes revenue leakage but also ensures a higher success rate for each transaction, ultimately enhancing customer satisfaction.

By integrating these features into their payment processes, businesses can streamline operations, reduce hidden costs, and provide a frictionless payment experience. Corytech's advanced solutions empower companies to focus on growth and innovation while leaving the complexities of payment processing to the experts.

What’s Next?

While accommodating diverse payment methods is essential in today's global market, a fragmented payment system can lead to hidden costs and revenue losses. By embracing a unified payment orchestration platform—like the one offered by Corytech—businesses can address these inefficiencies head-on.

Transitioning to a consolidated payment solution not only streamlines operations but also unlocks significant benefits such as reduced transaction fees, minimized manual errors, and improved data insights. As digital transactions continue to evolve, investing in advanced payment orchestration is critical for maintaining a competitive edge. Companies that proactively integrate these systems are well-positioned to boost profitability, enhance customer experiences, and drive sustainable long-term growth.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)