The Challenge of Complexity in Payment Systems

Today, businesses face a daunting challenge: managing increasingly intricate payment systems. According to Juniper Research, the global market for payment gateway solutions is projected to exceed $48 billion by 2025, driven by the exponential growth of online transactions. Yet, this rapid expansion is paired with an alarming rise in complexity.

Fragmented payment ecosystems, differing regional regulations, and a growing variety of payment methods—from e-wallets to cryptocurrencies—introduce inefficiencies that strain operational capacity and stunt growth. Businesses often find themselves bogged down in a tangle of disjointed systems, resulting in higher operational costs, delayed transactions, and dissatisfied customers.

Enter Corytech, a leader in payment integration services. With its philosophy of Zero-Stress Payments, Corytech transforms the chaos of fragmented systems into a seamless, scalable, and unified payment infrastructure. By offering cutting-edge payment gateway integration solutions, Corytech empowers businesses to focus on growth, leaving the complexities of payment management behind.

The Growing Complexity of Payment Integration

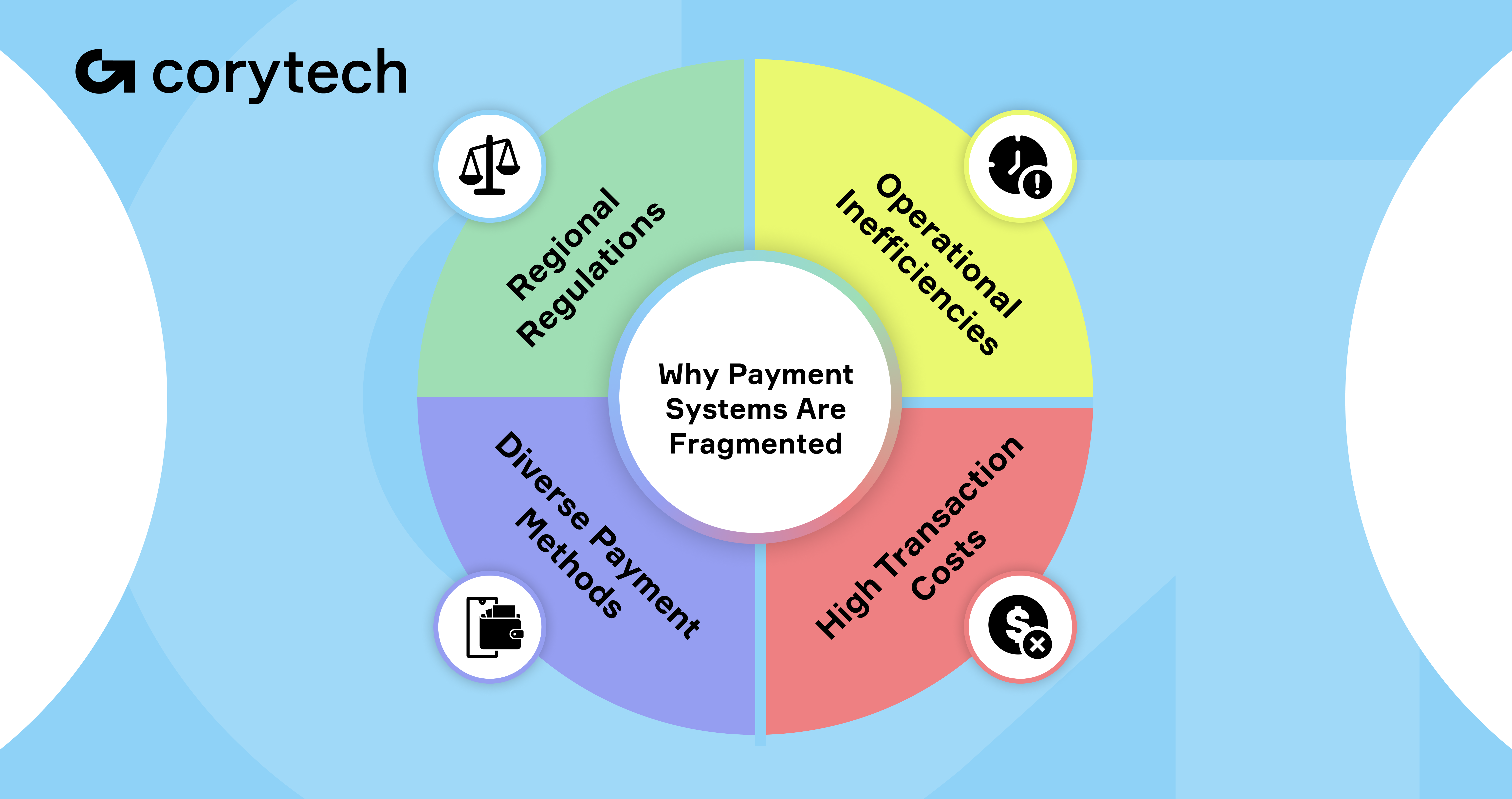

Why Payment Systems are Fragmented

In the global marketplace, businesses often face the daunting task of integrating diverse payment methods, currencies, and platforms tailored to different regions. Each payment provider operates with unique technical requirements, compliance standards, and processing rules, leading to fragmented payment systems that are difficult to manage cohesively.

For example, a business operating across Europe, Asia, and North America must reconcile transactions processed through credit cards, digital wallets like PayPal, and regional options such as Alipay or M-Pesa. This fragmentation leads to inefficiencies such as duplicate reconciliation efforts, gaps in real-time data visibility, and disjointed reporting mechanisms.

Such operational strain hampers scalability. As businesses expand into new markets, the burden of managing disparate systems grows exponentially. A unified payment gateway API integration that consolidates these processes becomes critical to maintaining efficiency and fostering growth.

The Cost of Inefficiency

The operational inefficiencies of fragmented systems come with a heavy price tag. Studies reveal that businesses lose up to 20% of their revenue potential due to payment-related delays and errors. Manual workflows, redundant reconciliation, and unresolved errors slow down operations, creating bottlenecks that ripple across the organization.

These delays directly impact customer satisfaction. For instance, a customer unable to complete a transaction due to system downtime is not only frustrated but also less likely to return. In competitive industries like e-commerce and iGaming, seamless online payment integration is essential to retain customer loyalty.

Furthermore, managing multiple payment providers often results in increased transaction costs. Each gateway charges its own fees, and reconciling these charges across platforms adds administrative overhead. Businesses need a payment integration service that reduces these inefficiencies by consolidating payment workflows into a single, streamlined platform.

Corytech’s payment system integration addresses these pain points, enabling businesses to reduce costs, improve customer satisfaction, and scale efficiently across geographies and payment methods.

Corytech’s Approach to Seamless Integration

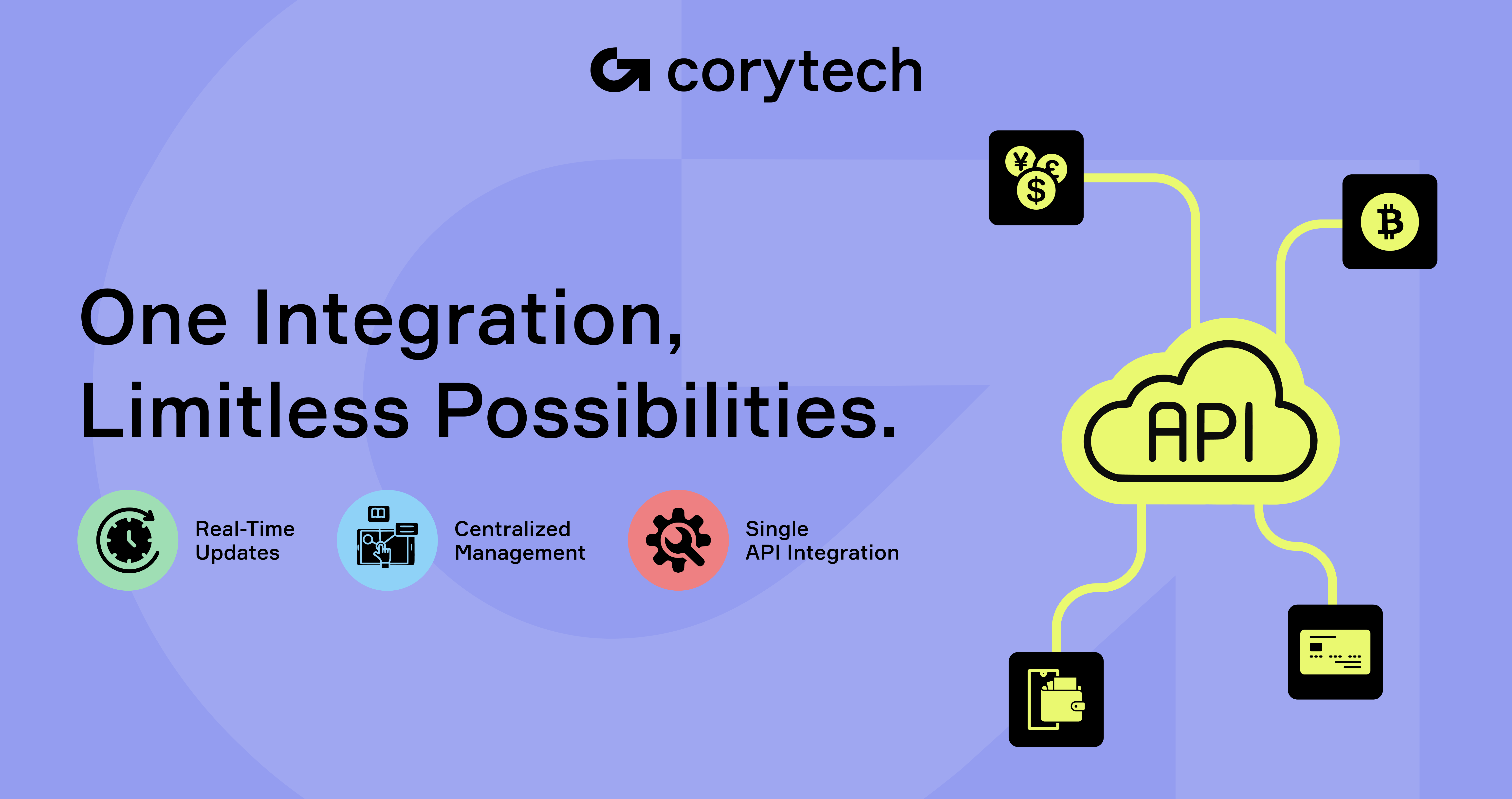

Unified Platform for All Payment Needs

Corytech redefines payment gateway integration by offering a unified platform that consolidates multiple payment providers, currencies, and methods into one seamless system. This approach eliminates the inefficiencies of juggling disjointed platforms and reduces the strain on operational workflows.

Key features of Corytech’s platform include:

- Single API Integration: Businesses can connect their systems to a wide range of payment gateways with just one integration, eliminating the need for multiple, time-consuming setups. This enables businesses to support a broad spectrum of payment methods, from traditional credit cards to cryptocurrencies.

- Real-Time Updates and Centralized Management: Corytech provides businesses with a comprehensive dashboard where they can monitor transactions, generate reports, and address issues in real-time. This transparency fosters greater control and trust in payment operations.

By streamlining these processes, Corytech allows businesses to focus on growth rather than payment complexities.

Adaptive Integration for Business Growth

Corytech’s modular infrastructure is designed to grow with businesses, making it an ideal choice for companies at any stage of development. Whether a startup expanding into new markets or an established enterprise scaling operations, Corytech ensures seamless payment system integration without interruptions.

Benefit: The platform supports businesses as they scale globally, enabling the integration of new currencies, payment providers, and compliance protocols without requiring a complete system overhaul. This flexibility ensures that companies can adapt to changing market demands quickly and efficiently.

For instance, an iGaming operator leveraging Corytech’s payment integration services can expand to new jurisdictions while maintaining compliance with regional regulations and offering players localized payment options. This adaptability ensures business continuity and operational efficiency.

Customizable Integration Solutions

Recognizing that every industry has unique requirements, Corytech offers tailored solutions to meet specific business needs. From high-frequency transactions in e-commerce to compliance-heavy environments in fintech, Corytech’s solutions are designed with versatility in mind.

For example, in the iGaming and esports sectors, businesses require fast, secure, and seamless online payment integration to support real-time deposits and withdrawals. Corytech’s platform delivers customized integrations that prioritize low latency, advanced fraud detection, and multi-currency support. Similarly, fintech companies can rely on Corytech’s compliance-driven approach to meet regulatory standards while ensuring smooth payment flows.

By combining robust features, scalability, and industry-specific customization, Corytech empowers businesses to achieve operational excellence while simplifying payment integration challenges.

Scalability: Supporting Businesses as They Grow

Built for Rapid Expansion

Corytech’s platform is designed with scalability at its core, enabling businesses to enter new markets with ease. Expanding into global territories often requires navigating complex regulations, currency conversions, and diverse payment preferences. Corytech simplifies this process through its integrated solutions.

Key Features:

- Multi-Currency and Cross-Border Payment Support: Businesses can process transactions in multiple currencies, ensuring smooth cross-border operations. Whether accepting payments in euros, dollars, or cryptocurrency, Corytech facilitates seamless currency conversion and compliance with regional standards.

- Localization Capabilities: The platform adapts to regional payment preferences, offering customers their preferred payment methods, such as digital wallets or bank transfers. This localized approach enhances customer satisfaction and increases conversion rates in new markets.

By reducing the technical and operational barriers to global expansion, Corytech’s payment gateway integration ensures businesses can scale rapidly without losing efficiency.

Flexible Architecture for High Volumes

Scalability isn’t just about entering new markets—it’s also about handling the increasing transaction volumes that come with growth. Corytech’s flexible architecture ensures businesses can manage spikes in demand without compromising performance or reliability.

For example, during peak periods like holiday sales or major gaming tournaments, high-growth clients in the e-commerce and iGaming industries have leveraged Corytech’s platform to process thousands of simultaneous transactions without system delays. The platform’s ability to scale dynamically ensures that businesses can maintain smooth operations even during surges in activity.

Use Case: An iGaming operator using Corytech’s online payment integration experienced a visible increase in transaction volume during a global esports event. With Corytech’s infrastructure, the operator handled the surge seamlessly, ensuring uninterrupted service and enhanced player satisfaction.

Future-Ready Infrastructure

Corytech’s platform is built to evolve alongside the payment industry, incorporating emerging technologies and adapting to new payment methods. This future-ready infrastructure ensures that businesses remain competitive in an ever-changing market landscape.

Benefit: The modular design of Corytech’s platform allows businesses to integrate cutting-edge solutions such as blockchain-based payments, AI-driven fraud detection, and biometric authentication without major overhauls. This adaptability guarantees that companies can stay ahead of trends and customer expectations.

As new payment technologies emerge, such as Central Bank Digital Currencies (CBDCs) or enhanced payment gateway API integration, Corytech’s infrastructure ensures seamless adoption, positioning businesses for long-term success in a competitive global economy.

By providing robust support for rapid expansion, handling high transaction volumes, and adapting to future innovations, Corytech’s payment integration services empower businesses to grow sustainably while maintaining operational excellence.

Efficiency: Simplifying Operations for Better Results

Streamlined Workflows

Operational efficiency is vital for businesses aiming to scale and succeed in competitive industries. Corytech’s platform enhances efficiency by automating key processes, reducing manual intervention, and minimizing errors.

Example: Real-time reporting tools provide businesses with instant insights into transaction statuses, trends, and anomalies. Automated reconciliation processes match transactions across systems seamlessly, eliminating discrepancies that previously required time-consuming manual resolution.

By streamlining workflows, Corytech’s payment system integration allows businesses to focus on strategic growth rather than operational firefighting.

Faster Market Entry

Expanding into new regions is often hindered by lengthy integration processes and the complexities of onboarding new payment methods. Corytech addresses this challenge with its quick and efficient integration capabilities.

Benefit: The platform’s streamlined payment gateway API integration enables businesses to onboard new payment providers and methods with minimal delays. This acceleration not only reduces time-to-market but also ensures businesses can capitalize on emerging opportunities without administrative bottlenecks.

For example, a fintech startup utilizing Corytech’s payment integration services launched in a new region in record time by leveraging its modular infrastructure. The ability to integrate localized payment options quickly provided a competitive edge and improved customer acquisition.

Reducing Overheads

Corytech simplifies operations by consolidating payment systems, significantly reducing the reliance on multiple third-party providers. This unified approach not only decreases operational complexity but also lowers costs associated with vendor management.

Benefit: Businesses can streamline their payment operations, reducing overheads and improving ROI. A single platform capable of handling diverse payment methods, currencies, and compliance requirements removes the need for redundant systems and associated fees.

For instance, an e-commerce business that previously managed multiple gateways for domestic and international payments transitioned to Corytech’s unified platform. The shift resulted in a 25% reduction in operational costs, as well as improved efficiency in vendor management and support.

By offering tools to streamline workflows, accelerate market entry, and reduce operational costs, Corytech empowers businesses to operate more efficiently and effectively, delivering better results and enhancing overall profitability.

.png)

The Corytech Difference: Simplifying Payments for All

Industry Expertise

Corytech has established itself as a leader in payment integration services with a proven track record of success in industries such as iGaming, fintech, and esports. These high-demand sectors require payment solutions tailored to their unique challenges, from handling high transaction volumes to ensuring regulatory compliance.

Insight: By focusing on industry-specific needs, Corytech delivers customized solutions that enhance operational efficiency and user satisfaction. For example, in the iGaming sector, the platform supports rapid deposits and withdrawals, ensuring players experience seamless transactions. Similarly, in fintech, Corytech integrates advanced fraud prevention tools to address stringent security standards.

Comprehensive Support

Payment systems must operate flawlessly around the clock, especially in global industries where downtime can lead to significant losses. Corytech’s 24/7 expert assistance ensures uninterrupted operations and seamless payment system integration.

Benefit: Clients benefit from proactive monitoring, rapid issue resolution, and dedicated support teams that address technical and operational concerns. This comprehensive support creates a truly stress-free experience, enabling businesses to focus on growth rather than troubleshooting.

For instance, a Corytech client in the esports industry highlighted the value of round-the-clock support during a major tournament. With real-time assistance, the client avoided downtime during peak transaction periods, maintaining trust and satisfaction among users.

Continuous Innovation

Corytech’s commitment to innovation keeps its platform ahead of the curve. By integrating the latest technologies and aligning with evolving industry standards, Corytech ensures that its solutions remain future-ready.

Highlight: Recent updates include enhanced payment gateway API integration capabilities, multi-blockchain support for cryptocurrency transactions, and AI-driven fraud detection. These innovations not only improve operational efficiency but also empower businesses to stay competitive in a rapidly changing market.

For example, Corytech’s adoption of biometric authentication for enhanced security reflects its focus on aligning with cutting-edge payment trends, ensuring businesses are equipped to meet modern consumer expectations.

By combining deep industry expertise, unparalleled support, and a focus on continuous innovation, Corytech delivers a unique value proposition that simplifies payments for businesses of all sizes and industries. This holistic approach cements Corytech as a trusted partner in achieving operational excellence and sustainable growth.

Simplify, Scale, and Succeed with Corytech

In today’s complex digital economy, managing payment systems shouldn’t be a source of stress. Corytech’s innovative solutions provide a clear path to seamless payment integration, enabling businesses to overcome the challenges of fragmented systems, scale globally with ease, and operate more efficiently. With its unified platform, scalable architecture, and commitment to continuous innovation, Corytech empowers businesses to focus on what truly matters: growth and success.

Whether you’re a startup expanding into new markets or an established enterprise looking to optimize your payment operations, Corytech offers the expertise and tools you need to simplify and thrive. From tailored solutions for industries like iGaming and fintech to real-time support and future-ready infrastructure, Corytech ensures your payment systems work as hard as you do.

Ready to simplify your payment integration? Discover how Corytech can help your business thrive by scheduling a consultation with our experts today. Your journey to stress-free payments starts here!

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)