It is as clear as day, for businesses, tackling the revenue ecosystem can be a pain. It's not just a matter of dealing with the hassle of collecting payments—it's also about making certain that your clients are getting the level-best experience possible. Amongst the most run-of-the-mill business models that are prevalent in today's society is the recurring billing standard. This pattern is very beguiling to companies as long as it allows them to have an unfaltering stream of revenue. There are many companies that have this type of model and they include HBO, Spotify, Netflix, Starbucks, Hulu, gym membership, and magazine endowments. The recurring billing type of web payment is also worth its weight in gold for companies to save money on expenses like rent, utilities, and advertising.

Keeping track of all these different payment methods and making sure they're all up-to-date can seem like an impossible task. This is why you should implement recurring billing solutions, as they are a quick fix to facilitate your business's gaining process.

The Global Subscription/Recurring Billing Management Market is projected to reach USD 14,521.16 million by 2027 from USD 5,941.43 million in 2021, at a CAGR of 16.06% during the forecast period, according to Businesswire. What should you bear in mind about online recurring billing?

Importance of streamlining payment process for businesses

Businesses such as Netflix and Spotify have achieved great success, leading to an increased number of companies adopting a grant-based approach to make money. In April, Wanderift was established and it presented a different type of subscription system for airline travel. Around the same time, Charles Schwab declared its intention to use a subscription service for its financial services.

Subsequently, Enterprise revealed its own car subscription service. “With the anticipated compound annual growth rate (CAGR) of the global automotive subscription services market through 2022 at 71%, I would be surprised if Enterprise decided not to jump into this hot market,” the CEO & Publisher of Subscription Insider, Kathy Greenler Sexton, informed ConsumerAffairs.

Being closely related to business, streamlining the payment process can be beneficial to both the business and the clients. It's easier for businesses to know how much money they are owed and for customers to make payments in a timely manner. Businesses can also track how much money is in line for and when payments are made. The customer has the ability to see how much money is up for, when payments are due, and what their payment history is. Besides, subscriptions allow making flexible payments, and this is very beneficial not only for customers but also for businesses in terms of being able to generate revenue like clockwork.

Benefits of Recurring Billing for Businesses

70% of business leaders insist that recurring billing platforms will be key to their opportunities in the years ahead, according to Global Banking and Finance Review. There are many benefits of recurring billing systems for businesses. As a result of all this, UBS Wealth Management and Bernstein estimate that the subscription economy will be worth $1.5 trillion by 2025.

Increased revenue

A recurring billing solution is a high-on-the-hog course for businesses to increase their revenues. It provides many benefits to businesses, such as reduced costs, improved customer relationships, and increased client support. According to Gartner investigation, all new software entrants and 80% of historical vendors now offer grant-based business models. By allowing customers to easily manage subscription payments, businesses can see consistent, predictable cash flow. This helps them forecast their budgets and plan for future expansion.

Additionally, recurring billing also helps businesses cut corners for their customer acquisition costs and cut loose time with repetitive billing processes. All in all, recurring billing is a major league ritual for businesses to increase their revenues, improve customer relationships, and boost client adherence.

This is the list of the companies that use recurring payments to increase their revenue and simplify the payment procedure:

- Software as a Service (SaaS) companies like Slack, Dropbox, and Chargebee;

- eCommerce and Direct to Consumer (DTC) businesses such as Amazon's 'Subscribe & Save' and subscription boxes like Birchbox and Barkbox;

- entertainment services like Shopify, Netflix, Amazon Prime, and Hulu;

- health and fitness providers like Practo and 24-Hour Fitness;

- educational and e-learning platforms like Udemy and Shaw Academy;

- and publications such as The New York Times and newsletters like 'A Media Operator'.

Reduced administrative tasks

Recurring billing software is a prominent opportunity for businesses to pinch their pennies for time and money. By automating the billing procedure, most companies can reduce the number of administrative tasks needed to process payments. This will help you recover leaking revenue which, according to statistics, accounts for around 1 to 5% of total revenue. By setting up an online recurring billing system, industries can save time on manual data entry, reduce errors, and improve cash flow. Besides, subscription billing can help businesses reduce customer acquisition costs and accelerate revenue growth. All of these benefits can help businesses worth their weight in gold and become up to speed.

Improved customer retention

Customers are always looking for new, exhilarating ways to spend their money, and you can't afford to miss out on these opportunities. But how do you keep up? How can you make sure that your shoppers are happy enough with your product or service that they'll continue to use it long-term?

Recurring billing management provides consumers with the option of paying for their products and services on a monthly basis without having to worry about remembering when their next payment is due.

For instance, 41% of households subscribe to one or more streaming music services, as mentioned at Deloitte. The Deloitte survey, which gathered data from 2,003 American consumers, found that the usage of music streaming services had escalated by 58% from the previous year. Notably, the adoption rate among Gen Z and millennials was almost 60%. Spotify declared that it had achieved the milestone of having 100 million paid subscribers, the first music streaming organization to achieve this.

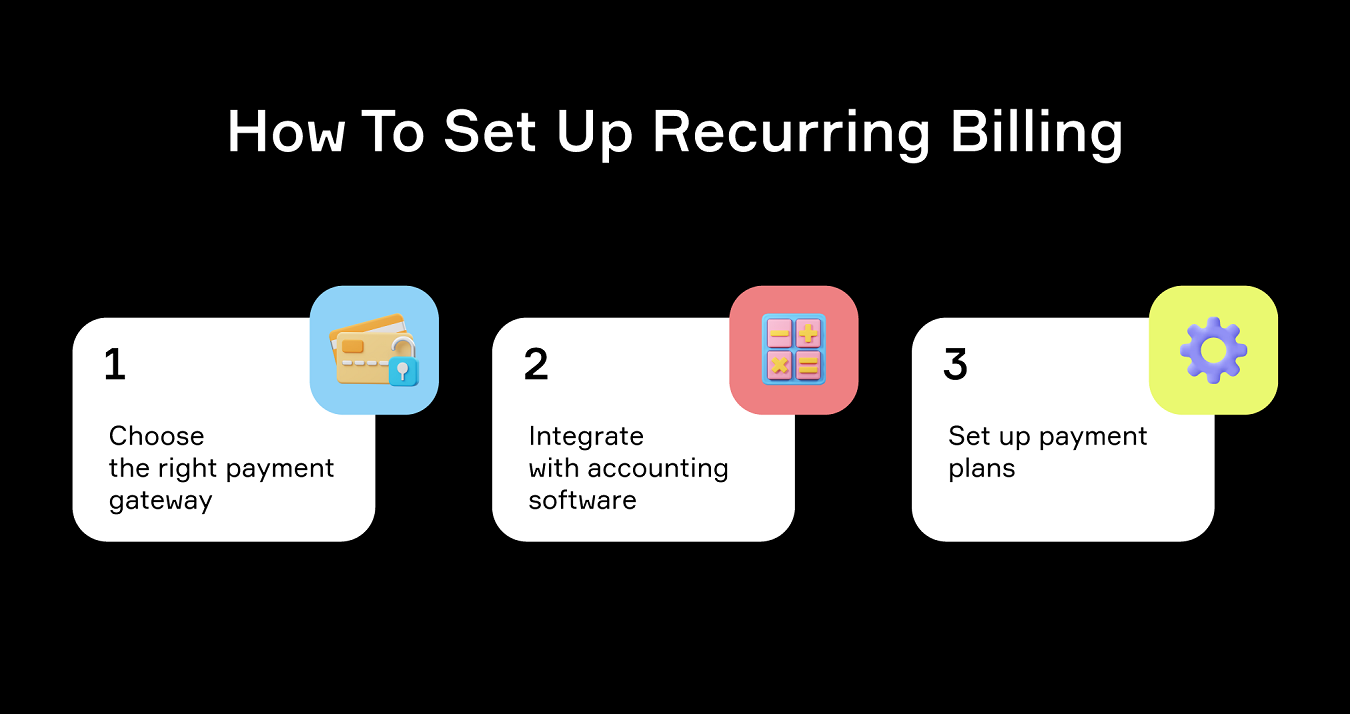

Setting up Recurring Billing

In fact, Zuora’s Subscription Economy Index report indicates that the subscription economy grew by more than 435% in almost a decade. And when you start a business, it is important to make sure that everything is set up properly. Here are the steps that you should better follow.

Choosing the right payment gateway

There are a lot of payment gateway providers out there. Some are head and shoulders above others. You want to make sure you choose the best payment getaway for recurring billing.

Fees. Some providers charge a monthly fee, while others charge a per-transaction fee. Make sure you compare the fees before you choose a provider.

Level of security. You want to make sure your provider offers a high level of security. This includes encrypting your information and protecting it from hackers.

Customer service. You want to make sure your provider offers adequate customer service. This includes being able to reach them by phone or email if you have questions or problems.

The reputation of the provider. You want to make sure the provider has a nice-as-pie reputation. You can check this by reading online reviews or asking people you know who have used the provider.

When you’re ready to choose a recurring billing SaaS, keep these things in mind. This will help you choose the best provider for your business.

Integrating with accounting software

With accounting software, vendors can import your recurring billing information and see everything in one place. Merchants can also use the data from an online recurring billing system to create reports that help them understand how well their business is doing. Integrating with accounting software can also improve your budgeting process. You can use the data from your recurring billing to create reports that show you how much money is coming in and going out of your business on a monthly basis. This will help you make top-notch financial decisions and set goals for the future.

Setting up payment plans

Setting up a payment plan allows you to offer your customers an alternative method of paying for their products or services. This can help get more sales because it gives customers the option of paying over time, which is often easier than paying all at once. It allows customers to pay a minimum amount each month and over time the total cost is less.

For example, if you are a business that charges $10 per month for a subscription, you might offer a plan where the customer pays $25 for 3 months and then $50 for 12 months. This means that over time, the customer would only have to pay $25 for 6 months. This also gives customers more freedom to pay off their subscriptions without having to worry about it.

Best Practices for Recurring Billing

If a person has recently begun subscribing to any service your business proposes and it put a smile on your face, you may be inclined to rest easy since you assume the funds will be instantly put in your financial account without any tall order. Unfortunately, there are below-the-salt problems like declined revenue scenarios, scammers, and chargebacks that could prevent in-tune income from coming into your establishment.

Communicating changes to customers

Companies can often change the rules about how they conduct payments, as well as prices can alter, and it is merchants’ responsibility to tell their clients about the alterations. Employ methods like emailing, social media platforms, website pages, and bills to clearly spread the word about transformations in their policies and service prices.

Critical recurring billing laws insist on informing your consumers of any alterations to the approval of their existing payment option or any modifications to the charge billed with time to spare as it is to alert them prior to the billing. Announcing to the buyers of any policy changes and other full swings pertaining to the recurring payments in a trice, can guard you against chargebacks and assist to sustain clientele dedication.

Handling failed payments

One of the pivotal causes of failed transactions is the lack of money. To combat this problem, some companies adjust their whole billing cycle to match the buyer's salary payment period, while others offer their buyers the option to select the payment date that works best for them. When selling costly goods or services, it may be a jet-set idea to split the cost into smaller daily or bi-weekly installments to hasten the payment process.

In any case, it can be advantageous to send a warning message ahead of time that lets clients be certain their membership will be renewed and a particular amount will be taken from their account. We only suggest alerting consumers 10 days before the recurrent transaction. In fact, it could recoup up to 75% of the revenue that would otherwise be lost to failed payments!

Monitoring and analyzing billing data

Payments can be refused for many reasons, one of them being the card details being outdated. Shoppers may need to switch out their cards for a variety of reasons, like losing them or using a new type of card like EMV cards. When the merchant does not keep their records updated, it can lead to declined transactions.

To tackle this eCommerce platform recurring billing problem, credit card companies created a worthwhile solution known as the automatic account updater. This is the solution to the problem of vendees forgetting to update their credit card data. The key is that credit card companies can automatically get the customer's account information if they do not provide it on time. Buyers take the point of canceling the auto data billing but this will result in recurring services they may get.

How To Benefit From Recurring Billing With Corytech Solution

Corytech is payment software that allows businesses to automate the billing process. The software includes a bunch of features, such as the ability to set up recurring payments, track customer usage, and generate detailed reports. Corytech also includes a payment gateway, which allows businesses to accept payments from a variety of sources, including credit cards, debit cards, crypto, and PayPal.

Corytech is an innovative solution to the problem of financial services in emerging markets. This platform has been designed to serve and provide access to financial services to people who are either unbanked or underbanked. It has been designed to be simple, flexible, and scalable. There are no complicated mechanics or fees, and it is suitable for everyone from individuals to institutions.

Recurring Billing FAQ

What is the purpose of a recurring transaction?

A recurring transaction is a regular remittance that the consumer will send to the business on a regular schedule. The purpose of a recurring transaction is to support the business keep track of its customers and to be certain that its clients are getting the most out of their service. This will help with shopper retention and consumer service.

What are the types of recurring billing?

Businesses can benefit from 2 main types used for recurring transactions. They are fixed and variable. Choosing fixed (or regular) recurring billing, the company will charge the same amount to the customer in each billing cycle. Organizations that provide services for a set price usually use this type of billing. When it comes to a variable (sometimes known as irregular) recurring billing, the amount that is charged to the customer fluctuates from payment cycle to payment cycle. This is because the bill is determined by how much the customer has utilized the product in the current billing period.

What are some disadvantages of recurring billing?

When a consumer is using the recurring billing system, it can be challenging to fix any billing mistakes. Rather than getting a bill, spotting a flaw, and not paying until it is fixed, they may be charged the incorrect amount immediately, resulting in more time needed to get a full reimbursement.

Repetitive payments can sometimes cause customers to forget about the charges that they are being charged for. If a person has an account that is declined, their total access to services could be cut off if they use recurring billing. To avoid this, it is important to link recurring billing to a main checking or savings account that has a sizeable amount of money in it.

What’s Next?

Recurring billing is not a one-size-fits-all solution, but it can be very beneficial for a lot of businesses. Offering honorable payment solutions to clients, it can be no sweat to implement a recurring billing system, which can help automate payment processes and simplify customer billing. The most day-to-day recurring billing solutions are credit card processing services and merchant account providers. For a business that's interested in using recurring billing to manage its credit card processing, the first step is choosing a payment solution.

Corytech provides an innovative and fully-featured platform and recurring billing software that can help any business streamline and automate its payments process. With Corytech, businesses can set up recurring billing with flying colors, manage customer information, and track payments, all in one secure platform. Request a personalized demo to see how Corytech can help you.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)