Expanding Across Borders Without the Stress

In the dynamic world of iGaming, global expansion offers immense opportunities. By 2029, the global iGaming market is projected to surpass USD 133 billion, growing at a steady rate of 6.46% annually. Emerging markets in regions like Southeast Asia, Latin America, and Africa are leading this charge, driven by increasing internet penetration and smartphone usage. However, these opportunities come with significant challenges, particularly when it comes to managing payments across borders.

For operators, the appeal of entering new territories often collides with the complexities of handling diverse currencies, regulatory frameworks, and user expectations. Fragmented payment systems, compliance hurdles, and fraud risks further complicate the process, leaving businesses grappling with inefficiencies and lost revenue.

This is where Zero-Stress Payment Solutions emerge as the cornerstone of successful global expansion. These solutions streamline payment systems, ensuring businesses can scale seamlessly while mitigating risks, improving efficiency, and enhancing the customer experience. In this article, we explore why Zero-Stress Payment Solutions are essential for thriving in a global iGaming market and how they empower operators to turn complexity into opportunity.

The Opportunities and Challenges of Geographic Expansion

The Global Boom in iGaming

The iGaming industry is experiencing unprecedented growth, driven by technological advancements, rising internet penetration, and a shift in consumer behavior toward digital entertainment. Emerging markets like Latin America, Asia, and Eastern Europe are at the forefront of this boom, presenting lucrative opportunities for operators willing to expand their reach.

In Latin America, the online gaming market is expected to grow by 10.9% annually, fueled by countries like Brazil, where regulatory advancements are opening doors for operators. Similarly, Asia-Pacific, with its vast population and increasing adoption of mobile gaming, is projected to become the largest iGaming market globally by 2030, accounting for over 40% of global revenue. In Eastern Europe, countries like Poland and Ukraine are creating regulatory frameworks that favor iGaming, providing fertile ground for growth.

For operators, entering these regions promises access to millions of potential players and the chance to tap into rapidly expanding economies. For instance, Asia alone is home to 1.4 billion mobile gamers, a statistic that highlights the massive potential for gaming platforms and their associated payment solutions.

However, these opportunities are accompanied by significant challenges. The diversity in regulations, payment preferences, and currencies across regions demands sophisticated payment processing solutions capable of adapting to local requirements. Without the right infrastructure, operators risk operational inefficiencies, compliance breaches, and poor customer experiences.

The next section will explore these challenges in greater detail, setting the stage for understanding why Zero-Stress Payment Solutions are critical for overcoming them.

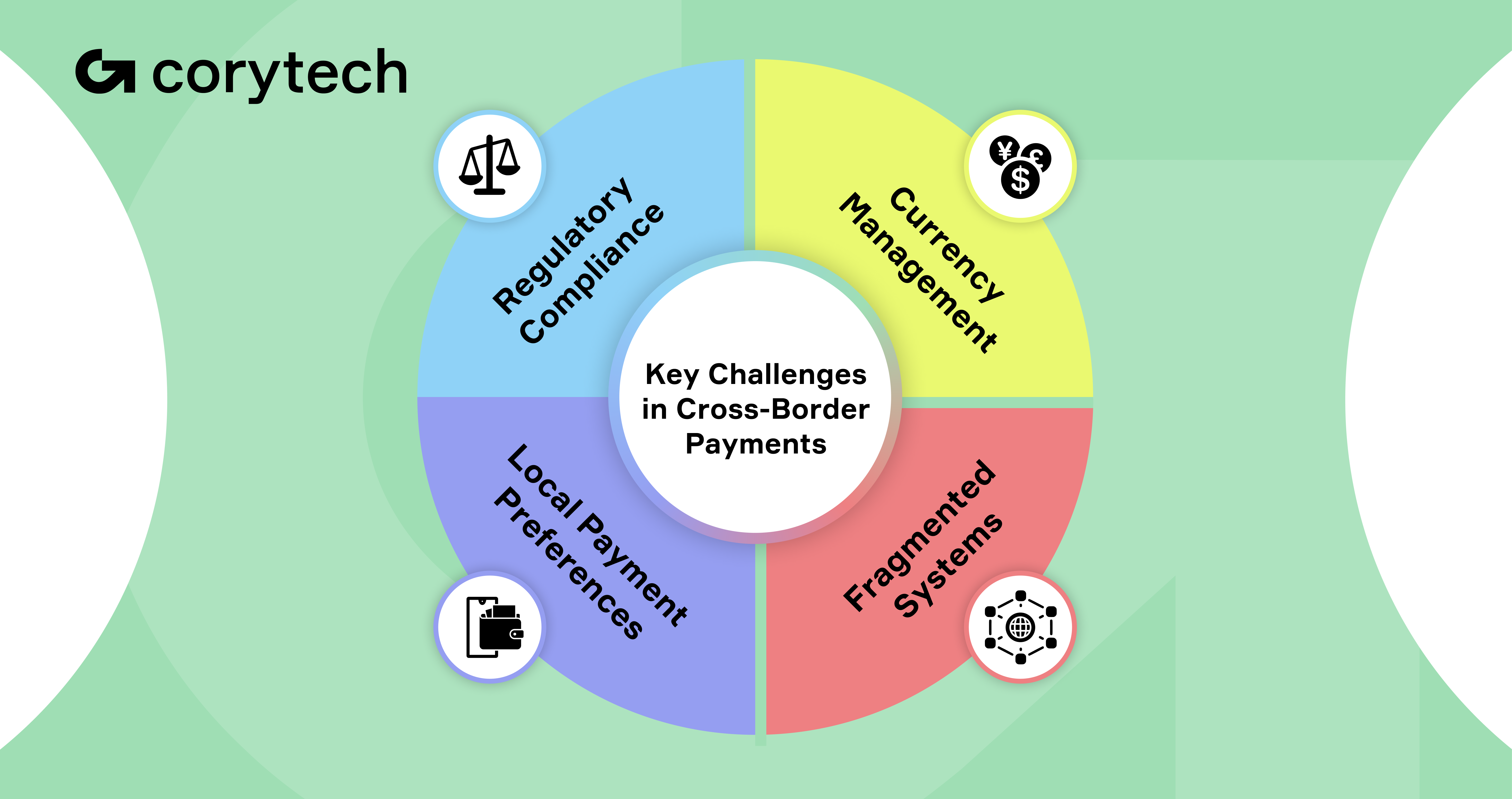

Challenges of Cross-Border Expansion

While the potential for growth in emerging markets is immense, the complexities of cross-border expansion pose significant hurdles for iGaming operators. Successfully navigating these challenges requires meticulous planning and robust payment solutions to ensure smooth operations.

Regulatory Compliance

Every country has its own set of rules governing online gaming, and staying compliant can be a daunting task. For instance, Brazil has recently passed regulations for online gaming, while countries in Asia, like India, have fragmented and region-specific gaming laws. Failure to meet these requirements can result in hefty fines, license revocations, or legal disputes.

Moreover, compliance extends beyond gaming-specific laws to include financial regulations, such as anti-money laundering (AML) policies and data protection rules like the GDPR in Europe. Without a robust system for regulatory reporting, operators risk falling out of compliance in multiple jurisdictions simultaneously.

Currency Management

Operating in diverse markets necessitates the ability to handle a wide range of currencies. This goes beyond simple conversions—operators must account for fluctuating exchange rates, transaction fees, and local banking practices. For example, Latin America’s reliance on localized payment methods, like boleto bancário in Brazil, demands payment systems that can integrate these options seamlessly.

Additionally, offering cryptocurrency payment solutions has become increasingly vital. Cryptocurrencies like Bitcoin and Ethereum are gaining traction in regions where traditional banking systems are underdeveloped or where users prefer the anonymity and speed of blockchain transactions.

Adapting to Local Payment Preferences

Player preferences for payment methods vary widely across regions. In Europe, credit cards and e-wallets dominate, while in Southeast Asia, bank transfers and mobile wallets like GCash and Dana are more popular. Catering to these preferences is critical for building trust and enhancing the user experience.

However, fragmented payment systems make it challenging to manage multiple providers, reconcile payments across platforms, and ensure consistency in the player experience. Operators often face increased operational complexity, leading to inefficiencies, delayed transactions, and dissatisfied customers.

The Stress of Fragmented Systems

The use of fragmented payment systems amplifies these challenges. Operators juggling multiple providers for online payment solutions face inefficiencies, higher costs, and a lack of centralized visibility. This fragmented approach also increases the risk of fraud, with gaps in security creating vulnerabilities in the system.

These challenges underscore the need for streamlined, global payment solutions that unify fragmented systems, ensure compliance, and adapt to local payment preferences. In the next section, we’ll explore how Zero-Stress Payment Solutions address these pain points and transform the cross-border expansion process.

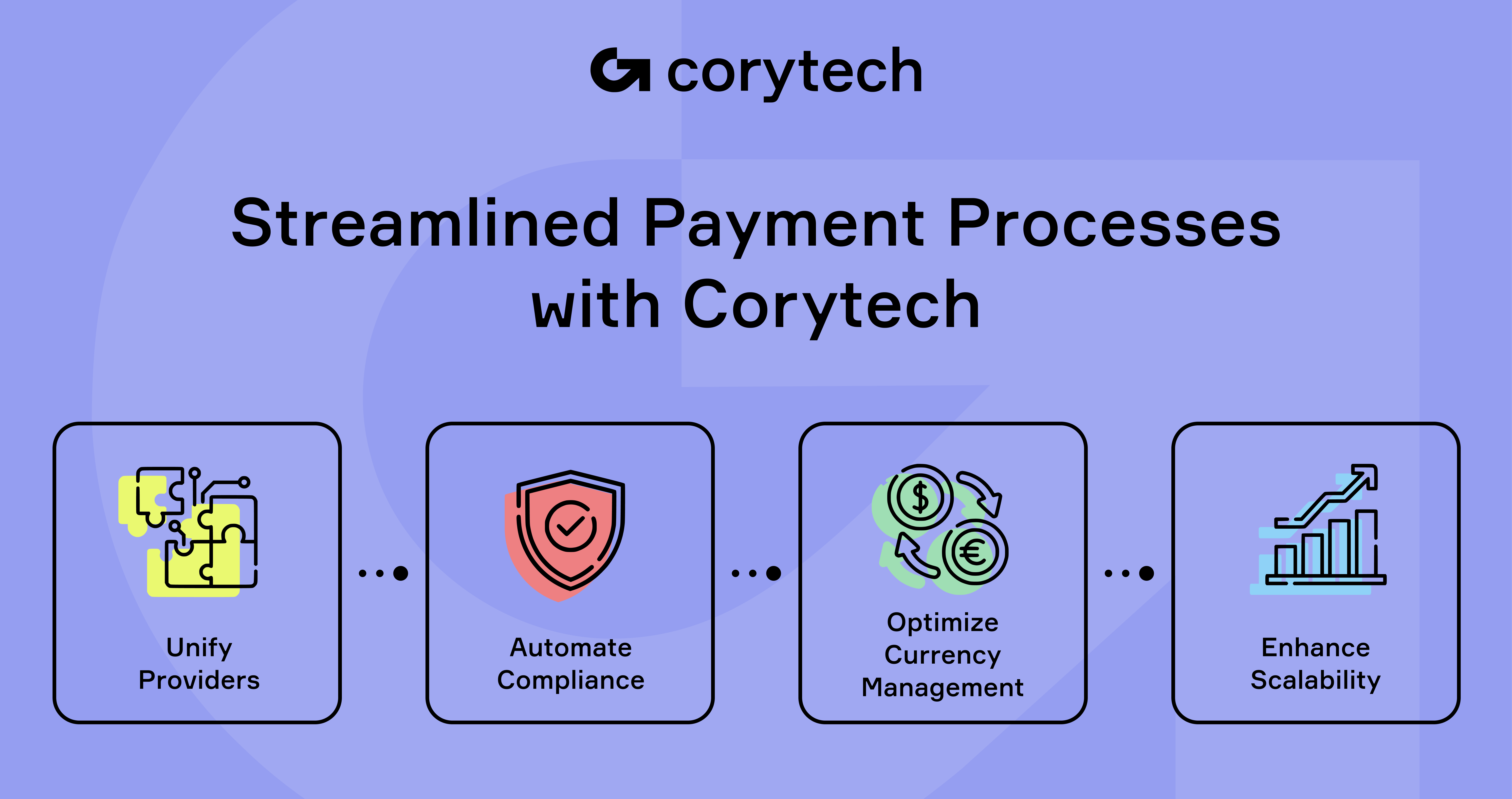

Why Zero-Stress Payment Solutions are Essential for Expansion

Expanding into global markets requires iGaming operators to tackle a myriad of challenges in payments. From managing multiple providers to ensuring compliance with diverse regulations, the complexities can quickly escalate. Zero-Stress Payment Solutions simplify these processes, enabling operators to focus on growth rather than administrative hurdles. Here’s how these solutions address the key pain points of cross-border expansion:

Simplifying Multinational Payment Processes

Operating in multiple markets often involves juggling a web of providers, currencies, and systems, leading to inefficiencies and higher operational costs. This fragmentation increases the risk of errors, delayed transactions, and customer dissatisfaction.

Corytech provides a single, unified platform that integrates diverse payment processing solutions into one seamless system. This includes support for credit cards, e-wallets, cryptocurrencies, and local payment methods, all consolidated into an intuitive dashboard. By automating processes like currency conversion and reconciliation, Corytech eliminates redundancies and enhances operational efficiency.

For instance, one operator using Corytech’s platform reported a remarkable reduction in transaction processing time and a significant drop in payment-related disputes, allowing their team to redirect resources to strategic initiatives.

Ensuring Regulatory Compliance Across Borders

Every market has unique regulatory requirements, and keeping up with these laws can be overwhelming. Non-compliance not only incurs penalties but also erodes trust and disrupts operations.

Corytech’s platform includes built-in compliance tools designed to adapt to regional financial regulations. This includes automated AML checks, GDPR-compliant data handling, and real-time reporting for regulatory audits. Additionally, Corytech’s global network of payment solution providers and legal experts ensures that businesses stay ahead of changing laws in their target markets.

In a recent case, an operator expanding to Southeast Asia leveraged Corytech’s compliance capabilities to navigate country-specific requirements, ensuring a smooth and legally compliant entry into the market.

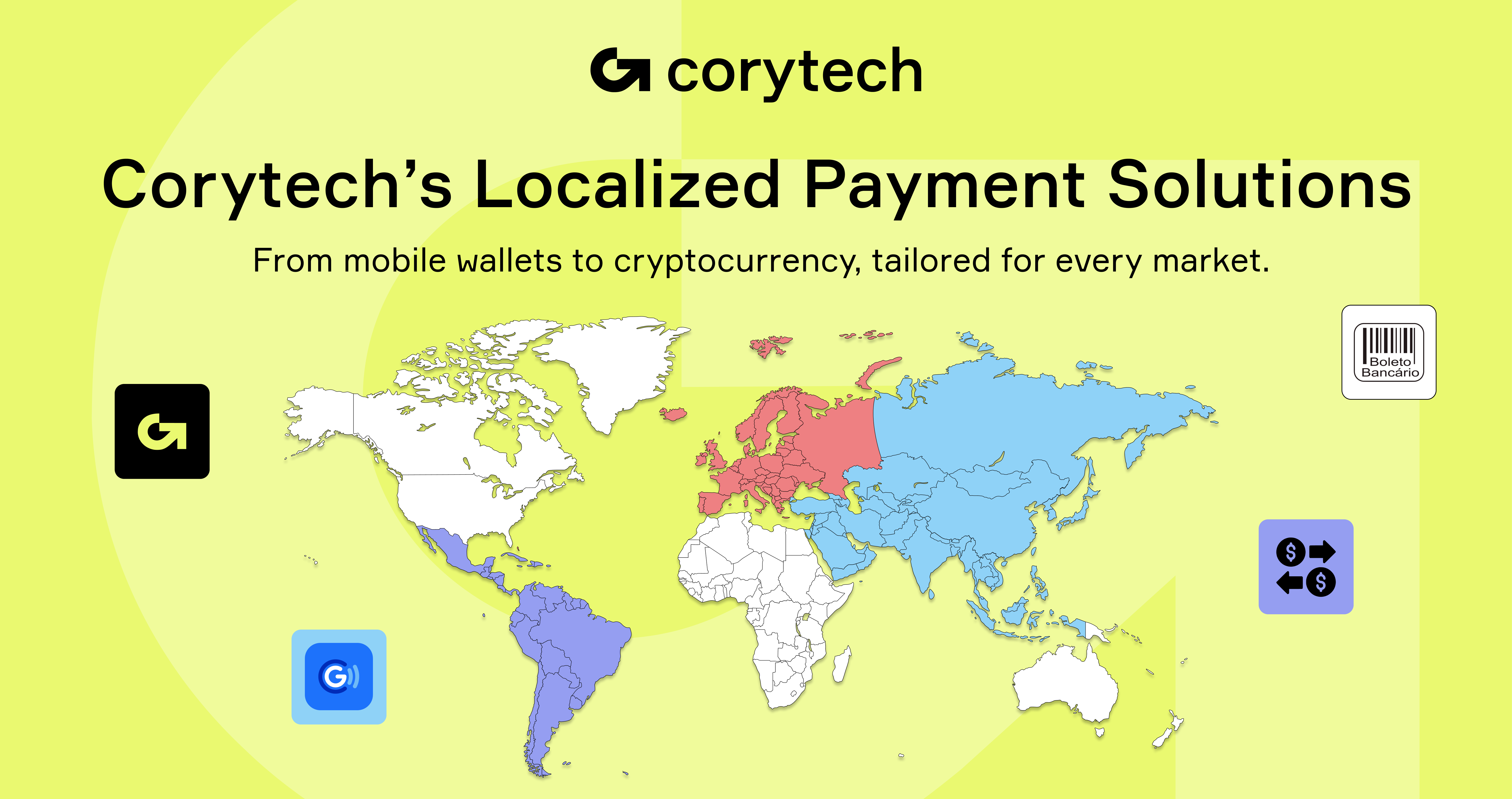

Adapting to Local Payment Preferences

Players demand online payment solutions that resonate with their local habits, such as mobile wallets in Asia or bank transfers in Latin America. Failing to offer these familiar options can hinder player adoption and retention.

Corytech supports region-specific payment methods while maintaining global standards, enabling operators to cater to local preferences without sacrificing operational efficiency. The platform integrates with mobile wallets in EEA, as well as popular bank transfer systems in Latin America.

This adaptability fosters trust and loyalty. For instance, operators offering local payment options saw a significant increase in player retention rates, as transactions became smoother and more accessible.

Scaling with Confidence

Legacy systems often struggle to handle the demands of rapid growth, resulting in downtime, bottlenecks, and lost revenue. Expanding into new regions only compounds the pressure on these outdated infrastructures.

Corytech’s scalable infrastructure is designed to support businesses as they grow, ensuring smooth operations even during peak periods. The platform’s cloud-native design allows for quick scaling, while robust load-balancing features prevent downtime and ensure reliable performance.

Operators using Corytech’s global payment solution to expand into high-growth regions like Eastern Europe reported a 99.9% system uptime, even during high-traffic events, significantly boosting player satisfaction.

Actionable Advice for Stress-Free Geographic Expansion

Expanding into new markets requires a proactive approach to payment management. To ensure a smooth entry and sustainable growth, businesses must address key areas that can make or break their global ambitions. Below are actionable steps operators can take, supported by Corytech’s advanced solutions.

Perform a Payment Readiness Assessment

Begin by auditing your existing payment infrastructure to identify gaps in scalability, compliance, and performance. Pay special attention to how well your system handles cross-border transactions, multiple currencies, and regulatory requirements.

Corytech offers expert consultation services and payment readiness assessment tools to evaluate your system’s capability for global expansion. These tools highlight areas for improvement and recommend solutions tailored to your business needs. For instance, Corytech’s assessments can pinpoint inefficiencies in currency conversions or gaps in fraud protection, giving operators a roadmap for optimization.

Prioritize Localization in Payments

Localization is critical for building trust with new audiences. Research payment preferences in each target market and ensure your system supports popular local methods, such as mobile wallets in Asia or bank transfers in Latin America.

Corytech provides a comprehensive catalog of localized payment solutions to meet the diverse preferences of players worldwide. Whether it’s integrating mobile wallets like AliPay in China or regional options like Boleto Bancário in Brazil, Corytech ensures operators can deliver frictionless transactions tailored to local habits.

For example, an operator targeting Southeast Asia used Corytech’s platform to integrate mobile wallets, resulting in a tangible increase in new player sign-ups due to the ease of making deposits.

Focus on Security and Fraud Prevention

Expanding into new regions often exposes businesses to increased fraud risks, particularly in high-risk markets. Invest in advanced fraud detection tools and real-time monitoring to protect your transactions and maintain player trust.

Corytech’s fraud detection tools analyze transaction patterns, identifying and preventing suspicious activity before it impacts operations. Features like multi-factor authentication and end-to-end encryption add an extra layer of security, ensuring safe transactions for players and peace of mind for operators.

In one case, a Corytech client operating in Eastern Europe saw a significant reduction in fraudulent activities within the first quarter of implementing Corytech’s anti-fraud system.

Optimize for Scalability from Day One

Choose a payment processing solution that can scale with your business as you enter new regions. Ensure the infrastructure supports multi-region operations and peak traffic without disruptions.

Corytech’s modular and scalable infrastructure is designed to grow alongside your business. Its cloud-native architecture allows operators to handle increased transaction volumes seamlessly while minimizing downtime. With built-in support for multi-region operations, Corytech ensures your payment system can scale effortlessly as you expand.

One operator, after leveraging Corytech’s scalable solutions, was able to handle a significant surge in transactions during a promotional campaign without any downtime, improving both player satisfaction and revenue.

Predictions for Payment Solutions in Geographic Expansion

Increasing Demand for Unified Platforms

As operators expand globally, the demand for unified payment platforms that integrate all methods into a single interface will grow. Juggling multiple systems leads to inefficiencies, higher costs, and operational complexity, driving the need for seamless orchestration.

Corytech offers comprehensive payment orchestration with one-click integrations, enabling operators to manage global payment solutions through an intuitive platform. By consolidating payment methods—including traditional options, cryptocurrencies, and localized solutions—Corytech simplifies processes and enhances reliability.

Greater Emphasis on Regulatory Support

With regulations tightening worldwide, compliance will become a decisive factor when selecting payment solution providers. Operators will look for partners that simplify the regulatory burden and ensure seamless adherence to evolving laws.

Corytech’s platform includes expert compliance tools, such as automated AML checks, real-time reporting, and global regulatory updates. These features not only keep businesses compliant but also reduce the resources spent on navigating legal complexities. Corytech’s proactive approach allows operators to focus on growth instead of legal hurdles.

Rise of Alternative Payments in Emerging Markets

Emerging markets with limited traditional banking infrastructure will see cryptocurrencies and mobile payments dominate. These alternatives are faster, more accessible, and resonate with younger, tech-savvy populations.

Corytech supports crypto payments and popular mobile payment methods, ensuring operators can cater to the unique demands of these regions. The platform’s multi-blockchain compatibility and ability to integrate mobile wallets provide operators with a future-proof solution to meet diverse payment needs.

The Corytech Advantage: Empowering Expansion with Zero-Stress Payments

A Proven Partner for Global Success

Corytech has a track record of enabling iGaming operators to navigate the complexities of geographic expansion with ease. From regulatory compliance to supporting local payment preferences, Corytech’s expertise ensures smooth and stress-free entry into new markets. By providing tailored solutions for operators in high-growth regions like Latin America and Southeast Asia, Corytech has positioned itself as a trusted partner in the iGaming industry.

Future-Ready Solutions for iGaming Businesses

Corytech’s platform is designed with the future in mind. Its scalable infrastructure, real-time fraud detection, and ability to integrate emerging payment methods ensure that businesses are equipped for both current challenges and future growth. Whether it’s supporting alternative payments or handling massive transaction volumes during high-traffic periods, Corytech empowers businesses to thrive in a competitive landscape.

What's Nest? Start Expanding Without the Stress

Global expansion offers unparalleled opportunities for growth, but it requires overcoming significant challenges in payment management. With Zero-Stress Payment Solutions, operators can simplify processes, stay compliant, and meet the needs of diverse markets without the burden of complexity.

Ready to simplify your global expansion? Visit Corytech.com to learn how our solutions can help you succeed. Schedule a consultation today and start your journey toward stress-free growth!

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources