Digital wallets, also known as e-wallets, are electronic devices or online services that allow individuals to make electronic transactions. These wallets can store a variety of payment methods, including credit and debit cards, and can be used for both online and in-store purchases. Unlike traditional wallets, digital wallets offer enhanced security features and the convenience of managing multiple payment methods in one place.

The evolution of digital wallets has been driven by advancements in mobile technology and the increasing demand for contactless payment methods. Today, digital wallets are integrated with various devices, including smartphones, tablets, and wearables like smartwatches. This integration allows users to make secure payments with just a tap or a scan, making digital wallets an essential tool in the modern financial ecosystem.

What is a Mobile Wallet?

A mobile wallet is a digital application on your smartphone or tablet that allows you to store various forms of payment and other important information. It’s a convenient tool that eliminates the need to carry physical wallets, credit cards, or cash. By storing payment details like debit and credit card information, it protects your account information, making it harder for fraudsters to access sensitive financial details. Mobile wallets often come pre-loaded on devices sold by brands like Apple, Samsung, and Google, enhancing user convenience and making them readily accessible to users.

Mobile wallets offer a convenient way to make contactless payments, providing both security and ease of use.

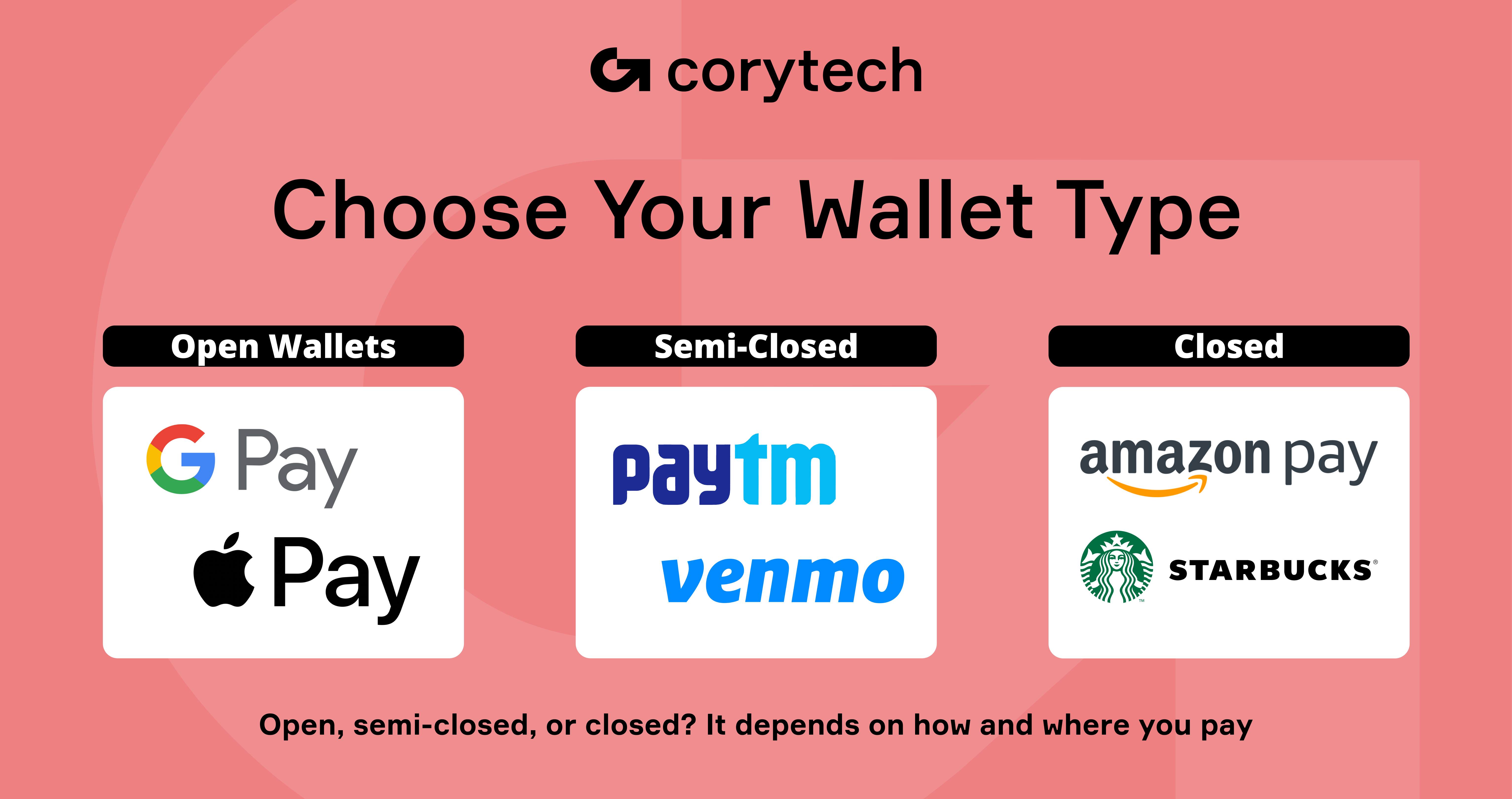

In addition to payments, mobile wallets can store digital assets such as gift cards, membership and loyalty cards, coupons, and event tickets. They are also increasingly used for peer-to-peer money transfers, making it easy to send and receive money between individuals without needing to visit a bank. There are three main types of mobile wallets: open wallets, closed wallets, and semi-closed wallets, each offering different levels of functionality and usage. Open wallets allow customers to use the funds for making payments for transactions or withdrawing the funds deposited to the account in cash.

In the event of a data breach, mobile wallets protect users by ensuring that hackers receive a one-time code instead of sensitive credit card information.

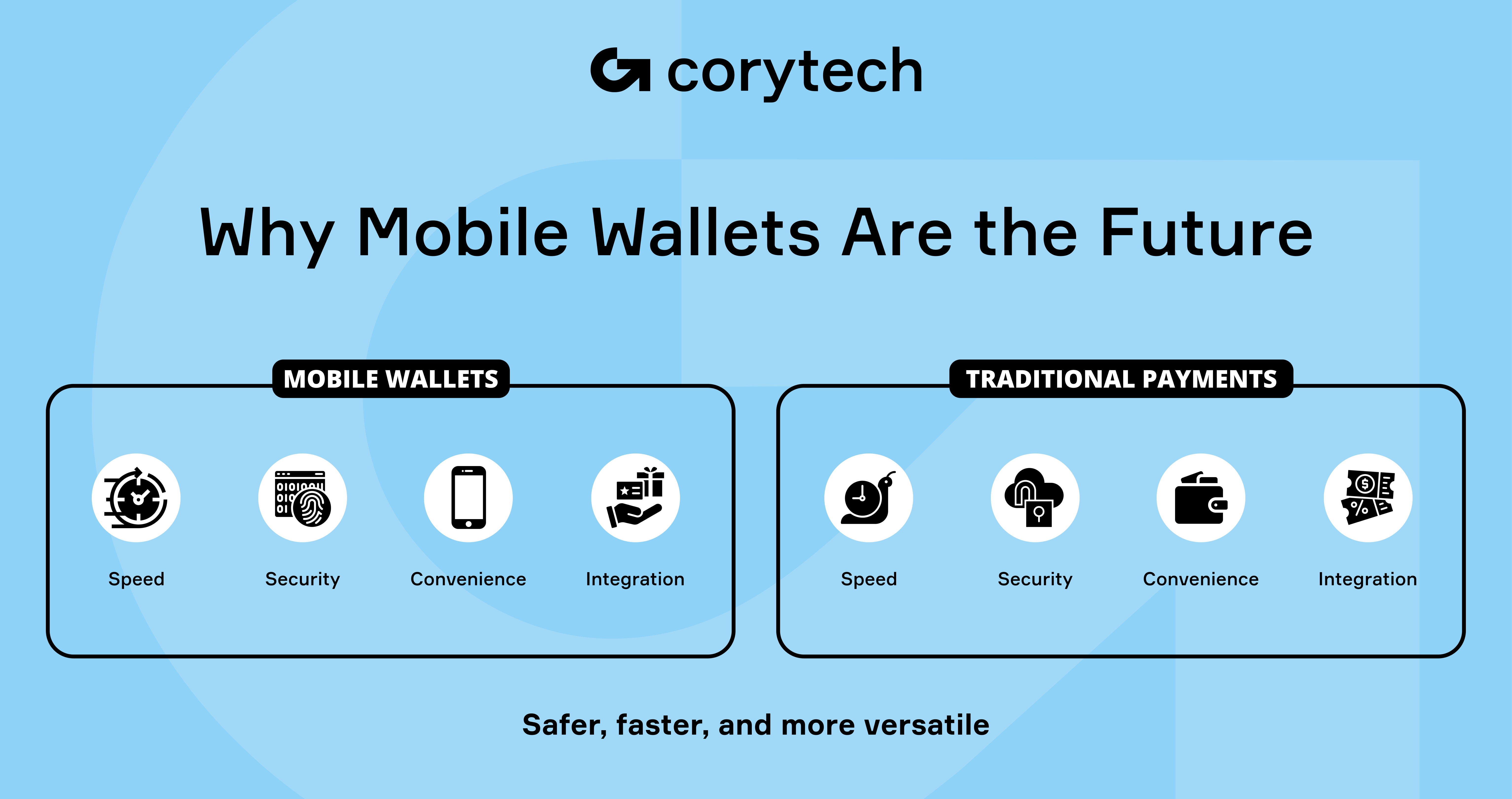

Mobile wallets provide a range of benefits, including:

-

Convenience: Easily access multiple payment methods without carrying physical cards.

-

Speed: Quick transactions through NFC (Near Field Communication) or QR codes.

-

Security: Advanced encryption and authentication protocols protect personal data. Mobile wallets use encryption to secure card information stored on the device, ensuring a high level of safety. Tokenization further enhances security by replacing sensitive card details with unique tokens during transactions. The first card added to a mobile wallet usually becomes the default card for transactions, which can be changed at any time.

-

Organization: Keep all your payment information and digital assets in one place.

Digital wallets are safe due to multiple layers of security, including encryption, tokenization, and biometric verification.

This integration of payment and personal management features makes mobile wallets a powerful tool in the modern digital economy.

How Does a Mobile Wallet Work?

Mobile wallets leverage various technologies to facilitate seamless and secure transactions. While the core purpose of these wallets is to store and manage payment information, the way they process payments can vary depending on the technology used. Here’s a breakdown of the most common methods: To set up a mobile wallet, download the app from the app store onto your smartphone or tablet. After downloading, launch the app and start adding your payment information, such as credit cards and coupons. Users can also earn rewards on their spending through mobile wallets.

-

Near Field Communication (NFC): NFC technology allows devices to exchange data when they are placed close to each other, typically within a few centimeters. This is the most commonly used technology in mobile wallets like Apple Pay and Google Pay. When you tap your smartphone or smartwatch near an NFC-enabled point-of-sale (POS) terminal, the payment details are transmitted securely through the NFC chip, making the transaction swift and contactless. Personal identification format, such as keys or scannable QR codes, is employed during transactions to facilitate communication between a mobile device and a payment terminal via NFC technology. To complete a transaction using a mobile wallet, hold your phone close to the NFC-enabled terminal and follow any prompts to confirm payment.

-

Magnetic Secure Transmission (MST): MST is a unique technology used by Samsung Pay. It simulates the magnetic stripe found on traditional credit and debit cards. MST works by transmitting a magnetic signal to the payment terminal, mimicking the action of swiping a physical card. The advantage of MST is that it works with virtually all magnetic stripe card readers, making it more widely compatible than NFC.

-

QR Codes: Some mobile wallets, such as PayPal or Venmo, use QR codes for payments. The user scans a merchant’s QR code, or the merchant scans the user’s QR code to initiate the transaction. This method doesn’t require contact or physical interaction with payment terminals, offering a flexible option for various kinds of payments, including peer-to-peer transfers.

Each of these technologies is designed to provide a fast, secure, and user-friendly experience for making in-store purchases with a mobile wallet. The specific technology chosen often depends on the device, the wallet app, and the payment terminal capabilities. The first card added to a mobile wallet usually becomes the default card for transactions, which can be changed at any time.

Understanding mobile wallets and their benefits can significantly enhance your payment experience, offering convenience, security, and efficiency.

Types of Mobile Wallets

Mobile wallets come in three main types: open, closed, and semi-closed, each offering different levels of functionality and usage.

-

Open Wallets: Open wallets, such as Google Pay and Apple Pay, allow users to make payments, transfer funds, and withdraw cash from ATMs. These wallets are widely accepted by merchants and can be used for a variety of transactions, making them highly versatile.

-

Closed Wallets: Closed wallets are specific to a particular merchant or service provider. Examples include the Starbucks app and Amazon Pay. These wallets can only be used for transactions within the merchant’s ecosystem, offering a seamless and integrated shopping experience but limited to that specific brand.

-

Semi-Closed Wallets: Semi-closed wallets, like Paytm and Venmo, allow users to make payments at a select group of merchants and service providers. While not as widely accepted as open wallets, they offer more flexibility than closed wallets and are often used for peer-to-peer transfers and specific merchant payments.

Each type of mobile wallet has its own advantages and limitations, making it important for users to choose the one that best fits their needs.

Setting Up a Mobile Wallet

Setting up a mobile wallet is a straightforward process that can be completed in a few simple steps:

-

Download the Wallet App: Start by downloading the mobile wallet app from your device’s app store. Popular options include Apple Wallet for iOS devices, Google Wallet for Android devices, and Samsung Wallet for Samsung phones.

-

Add Payment Methods: Once the app is installed, open it and follow the prompts to add your payment methods. This typically involves scanning your credit or debit cards or manually entering the card information. You can also add loyalty cards, gift cards, and other digital assets.

-

Secure Your Wallet: Set up security features such as a PIN code, fingerprint, or facial recognition to protect your wallet. These enhanced security features ensure that only you can access and use your mobile wallet.

-

Choose a Default Payment Method: Select a default payment method for quick and easy transactions. This can be changed at any time based on your preferences.

By following these steps, you can set up a mobile wallet that is both convenient and secure, ready for use in a variety of payment scenarios.

Benefits of Mobile Wallets

Mobile and digital wallets are rapidly gaining popularity for their ability to provide convenience and security in managing payments. Whether for online or offline transactions, they offer several distinct advantages:

-

Convenience: Mobile wallets streamline the payment process by allowing users to make quick and easy purchases directly from their mobile devices, such as smartphones or smartwatches. According to a report from Statista, the global mobile payment market is expected to reach $12.06 trillion by 2027, growing at a compound annual growth rate (CAGR) of 28.2%. This growth highlights the increasing reliance on mobile wallets for everyday purchases. Using a mobile wallet can enhance the shopping experience by speeding up transactions at the register.

-

Online and Offline Purchases: Mobile wallets enable users to make purchases both in-store and online, providing an integrated solution for different types of transactions. Whether shopping at physical retailers or paying for services through e-commerce platforms, users can rely on their mobile phone to handle various payment needs. In fact, a 2023 study by the National Retail Federation found that 55% of U.S. consumers had made at least one mobile payment in the past year.

-

Storing Digital Versions of Loyalty Cards and Coupons: Beyond payments, mobile wallets can store loyalty cards, gift cards, and coupons, helping users stay organized and take advantage of discounts. A report from Juniper Research predicts that by 2025, over 3.5 billion people will use mobile wallets, with a significant portion of users relying on them for loyalty programs and coupons.

-

Growing Popularity: The widespread adoption of smartphones and the increasing availability of mobile wallet services contribute to the growing popularity of these digital tools. As of 2023, mobile wallet penetration in the U.S. had reached 43%, according to research from the Digital Payments Index. This figure is expected to rise, with mobile wallets continuing to offer greater flexibility and efficiency for users globally. Popular mobile wallets like Apple Pay, Google Wallet, and Samsung Pay are becoming increasingly prevalent, offering users a variety of options for secure and convenient payments.

Mobile Wallet Security and Safety

Security remains a top priority for mobile wallet users, and these digital tools are equipped with robust measures to ensure safe transactions and protect sensitive data.

-

Tokenization: Tokenization is a key security feature that replaces your actual credit or debit card number with a unique, one-time-use token. This prevents hackers from accessing your card information during transactions, significantly reducing the risk of fraud.

-

Biometric Authentication: Mobile wallets often use biometric authentication methods, such as fingerprint scanning and facial recognition, to verify the user’s identity. This adds an extra layer of security, ensuring that only authorized users can access the wallet.

-

User Vigilance: Despite these advanced security measures, it’s important for users to remain vigilant. Keep your mobile device secure, avoid using public Wi-Fi for transactions, and regularly monitor your account for any suspicious activity. By taking these precautions, you can further enhance the security of your mobile wallet.

Studies have shown that these security features are highly effective. For example, a study by Visa found that tokenization can reduce fraud in mobile payments by up to 90%, while biometric authentication is trusted by 62% of mobile wallet users, according to a 2022 Aite Group study.

Mobile Wallets and Online Purchases

Mobile wallets have revolutionized the way we shop online, offering a fast, secure, and convenient payment method for e-commerce transactions.

-

Speed and Convenience: Mobile wallets streamline the online shopping experience by allowing users to complete purchases with just a few taps. There’s no need to manually enter credit card information, which saves time and reduces the risk of errors.

-

Enhanced Security: When making online purchases, mobile wallets use advanced security features like tokenization and biometric authentication to protect your financial information. This ensures that your payment details are secure, even if the merchant’s website is compromised.

-

Wide Acceptance: Many popular e-commerce platforms, such as Amazon, eBay, and various online retailers, accept mobile wallet payments. This widespread acceptance makes it easy to use your mobile wallet for a variety of online transactions.

By using a mobile wallet for online purchases, you can enjoy a seamless and secure shopping experience, taking advantage of the benefits that digital and mobile wallets offer.

Mobile Wallet Security and Safety

Security remains a top concern for users of mobile wallets, and for good reason. Digital wallets are equipped with robust security measures to ensure safe transactions and protect sensitive information.

-

Tokenization: One of the most significant security features in mobile wallets is tokenization, which is a key factor in keeping digital wallets safe. Tokenization replaces your actual credit or debit card number with a unique, one-time-use token. This prevents hackers from accessing sensitive card information during transactions. In the event of a data breach, tokenization ensures that hackers receive a one-time code instead of sensitive credit card information, thereby enhancing the safety of transactions made through digital wallets. According to a study by Visa, tokenization can reduce fraud in mobile payments by as much as 90%.

-

Additional Security Measures: In addition to tokenization, mobile wallets employ other security features such as PIN codes and biometric authentication (fingerprint or facial recognition) to further safeguard users. A 2022 study by Aite Group found that 62% of mobile wallet users relied on biometric authentication for payments, showcasing its effectiveness in enhancing security.

-

Exercise Caution:Despite these advanced security measures, users should remain vigilant. Keeping a close watch on your phone and ensuring the screen is covered in public spaces can prevent unauthorized access. Real-time connectivity allows permitted parties to remotely disable the wallet at the valid user’s request. The 2021 Norton Cyber Safety Insights Report revealed that 23% of smartphone users had experienced mobile wallet fraud, underscoring the importance of taking precautions when using digital wallets.

Mobile wallets provide a highly secure and convenient method of managing payments, with security innovations like tokenization and biometric authentication continuously evolving to keep users’ information safe.

Mobile Wallet Adoption and Statistics

The mobile wallet market has seen exponential growth in recent years, and this trend is expected to continue in the coming years. Here are some key statistics that highlight the rise of mobile wallets:

-

Global Mobile Wallet Market Size: The global mobile wallet market was valued at $1.40 trillion in 2020. With increasing adoption and demand for digital payment solutions, the market is projected to reach $7.58 trillion by 2027, growing at a compound annual growth rate (CAGR) of 24.8%. This rapid expansion underscores the growing reliance on mobile wallets as a primary payment method.

-

Mobile Wallet Users Worldwide: As of 2021, there were over 2.8 billion mobile wallet users globally. This number is expected to keep rising, driven by the growing number of smartphone users and the expansion of mobile payment services. By 2025, it’s estimated that the number of mobile wallet users will exceed 3.5 billion. Mobile wallet features may also be available in certain other countries, even if they are not accessible in the U.S.

The continued growth of the mobile wallet market reflects the changing landscape of financial transactions, where consumers are increasingly shifting toward digital, contactless, and secure payment methods.

Using Mobile Wallets in Different Contexts

Mobile wallets are versatile tools, and their use extends across a wide variety of contexts, making them an essential part of modern financial life.

-

In-Store Purchases: Mobile wallets like Apple Pay, Google Pay, and Samsung Pay are widely accepted in retail stores, allowing customers to make quick and secure payments directly from their smartphones, including Android phones, or smartwatches. This eliminates the need for physical cards and cash, providing a smoother checkout experience. Additionally, mobile wallets can be integrated with devices like the Apple Watch, enabling seamless transactions.

-

Online Transactions: With the rise of e-commerce, mobile wallets have become an important tool for online shopping. Users can easily store payment methods and complete purchases across a wide range of online retailers. A study by PayPal revealed that 47% of global consumers used a mobile wallet for online transactions in 2022.

-

Person-to-Person Payments: Mobile wallets also enable peer-to-peer (P2P) payments, allowing users to transfer money to family members, friends, or even businesses with ease. Apps like Venmo, PayPal, and Cash App have made this feature particularly popular by facilitating transactions through a card reader.

-

Storing Digital Assets: Beyond payments, mobile wallets are used to store digital versions of loyalty cards, gift cards, coupons, and event tickets, simplifying the management of various digital assets. In fact, a 2023 survey by LoyaltyOne found that 43% of mobile wallet users had added loyalty cards to their wallets for easier access during purchases. This process illustrates how mobile wallets work by securely storing financial information and enabling contactless transactions.

-

ATM Transactions: Mobile wallets can be used at ATMs that support NFC payments, allowing users to withdraw cash or make deposits without a physical card. This highlights the advantage of using a mobile wallet over a physical wallet, as it provides enhanced security and convenience.

Mobile wallets are becoming increasingly prevalent across different industries, particularly in retail, where the adoption of mobile payments continues to rise. Many merchants now accept mobile payments, offering their customers a more convenient and secure payment method.

Frequently Asked Questions

-

What is a mobile wallet?

A mobile wallet is a digital application that allows you to store payment information, loyalty cards, gift cards, and other digital assets on your smartphone or tablet.

-

How does a mobile wallet work?

Mobile wallets use technologies like NFC (Near Field Communication), MST (Magnetic Secure Transmission), and QR codes to enable secure and quick payments either in-store or online.

-

What are the benefits of using a mobile wallet?

Mobile wallets offer convenience, speed, and enhanced security, allowing users to make purchases and manage their digital assets without the need for physical cards or cash.

-

Is a mobile wallet secure?

Yes, mobile wallets are designed with security features like tokenization, biometric authentication, and PIN codes to protect your financial data. However, users should remain cautious and take steps to protect their devices from theft or unauthorized access.

-

Can I use a mobile wallet for online transactions?

Yes, mobile wallets can be used for online transactions, making it easier to shop on e-commerce websites and apps. They provide a secure and fast payment method that eliminates the need for entering credit card details.

-

How can I secure my online banking activities through a mobile wallet?

Securing your online banking activities through a mobile wallet involves using secured networks, regularly reviewing transactions, and enabling security features like biometric authentication. Mobile wallets and digital wallets play a crucial role in managing finances, but users should take precautions to protect their private information.

Conclusion

Mobile wallets have transformed the way people handle payments, offering a secure and convenient alternative to cash and physical credit cards. With features like fast transaction processing, enhanced security, and the ability to store various digital assets, mobile wallets are becoming an integral part of modern financial management. As the adoption of mobile wallets continues to grow, they will play an even greater role in shaping the future of payments.

The continued rise in usage statistics and growing merchant acceptance suggests that mobile wallets are here to stay, offering consumers a seamless, efficient, and secure way to manage their financial life. Key takeaways include the convenience, enhanced security, and overall efficiency that mobile wallets bring to everyday transactions.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)