Payment Anxiety Is Real (And Hurting Your Business)

Today, the experience a customer has when making a payment can be a make-or-break factor for businesses. Daniel Kahneman’s concept of loss aversion sheds light on how individuals tend to fear losses more than they value gains, influencing their decisions. When payment processes are overly complicated, customers feel an emotional burden, which can result in cognitive strain—the mental effort required to navigate confusing, lengthy, or unclear payment flows.

This stress triggers anxiety and mistrust, pushing customers away. They are more likely to abandon their purchases or, worse, never return. Complicated payment systems make customers feel as though their security and time are at risk, exacerbating feelings of unease. As businesses increasingly rely on digital transactions, understanding this emotional impact is more critical than ever. The risk of losing customer trust—and ultimately, revenue—becomes a real concern when payment flows aren’t seamless and intuitive. AI will play a pivotal role in streamlining payment processing and improving fraud detection, offering businesses a way to enhance both security and customer experience.

Digital transformation is enhancing customer convenience and operational efficiency in payment processes. Financial institutions are leveraging digital technologies to streamline processes and create customer-centric experiences, thereby integrating seamless payment solutions into everyday applications and enhancing accessibility.

Intro to Digital Payments

Digital payments have revolutionized the way we make transactions, offering a convenient, secure, and efficient alternative to traditional payment methods. The payments industry has undergone significant transformations in recent years, driven by technological innovation, evolving consumer behaviors, and the need for enhanced digital experiences. Financial institutions, central banks, and payment processors are adapting to these changes, investing in digital payment technologies and customer-centric solutions. The rise of digital payments has also led to increased focus on financial inclusion, with digital wallets and mobile payments enabling consumers to access credit and financial services more easily.

Understanding Payment Friction

Why Complexity Equals Anxiety

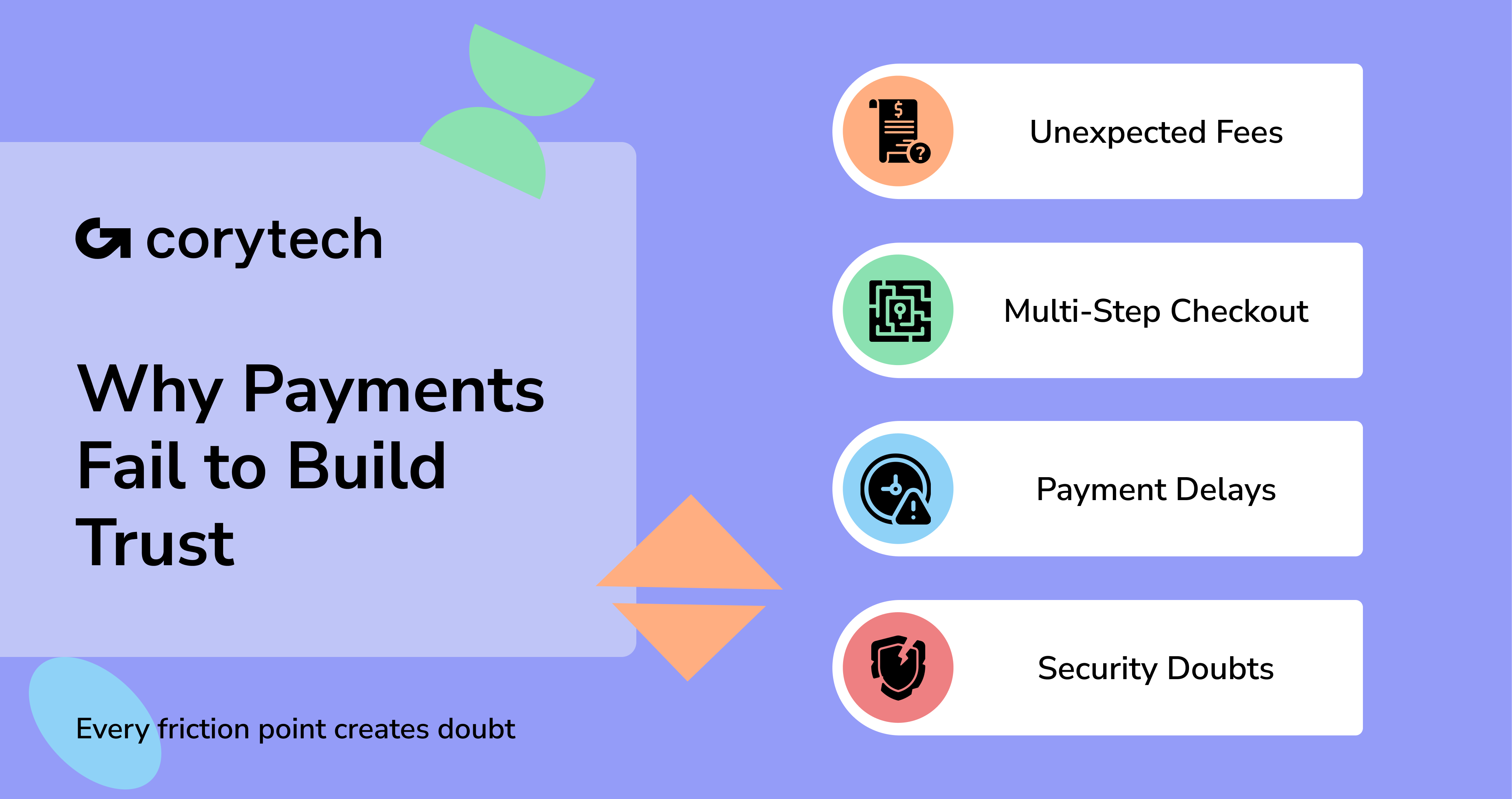

Overly complicated payment processes often lead to frustration, confusion, and significant emotional friction for customers. This anxiety arises as they navigate through an overly complex or unclear checkout experience. In the iGaming and Payment Service Provider (PSP) sectors, this is especially prevalent. For example, a player attempting to deposit funds on an iGaming platform might encounter a multi-step authentication process, each page seemingly introducing new hurdles. Whether it’s confusing instructions or a lack of clarity about the available payment methods, the cumulative effect is overwhelming. Consumers are increasingly favoring buy now, pay later (BNPL) options over more traditional credit cards and personal loans, as BNPL options offer the benefit of spreading costs with little to no interest, aiding cash flow and mitigating debt risk.

The emotional strain is compounded by the uncertainty of not knowing whether the payment will go through smoothly or if unexpected fees will appear. As the customer struggles with this uncertainty, they may start to second-guess their choices, leading to increased stress. This stress is felt both on a cognitive level (effortful thinking and decision-making) and emotionally, as customers anticipate potential frustration or financial loss. Numerous payment systems now incorporate biometric identification like fingerprint scans to enhance security and reduce fraud risk, addressing some of these concerns and building customer confidence. Biometric payment methods are gaining rapid adoption as they provide faster and more secure verification for transactions, further improving the user experience. Implementing robust security measures, including advanced technologies like biometric authentication, is crucial in reducing customer anxiety and protecting transaction integrity against cyber threats.

For businesses in these industries, such friction directly impacts conversion rates and customer satisfaction. Simplifying the process—by eliminating unnecessary steps, using clear language, and offering intuitive payment options—can drastically reduce the friction that causes stress and increases the chances of successful, repeat transactions.

Loss Aversion at Checkout

When customers encounter unclear fees or experience payment delays, the emotional impact is felt intensely. Loss aversion, as proposed by Daniel Kahneman, explains why people are more averse to losing money than gaining an equivalent amount. This principle applies directly to the checkout process. If customers are unsure about the total cost or face unexpected charges, they may perceive these uncertainties as financial losses, even if the actual amounts are small.

For instance, in an iGaming scenario, if a player experiences a failed transaction or a delay in processing their payment, they may fear losing both their time and money. These kinds of situations can erode trust in the platform. Even small payment issues, such as hidden fees or unclear terms, can lead to significant mistrust and result in a customer deciding to abandon their purchase, seek a refund, or, worse, never return. This fear of loss creates a major barrier to customer loyalty. Implementing buy now pay later options can reduce loss aversion by providing a clear and structured payment plan, thus minimizing the perceived risk. Additionally, buy now pay later helps consumers access otherwise prohibitively expensive goods, making larger purchases more manageable and enhancing overall sales for retailers.

Digital Payment Trends

The digital payments landscape is constantly evolving, with emerging technologies such as biometric authentication, machine learning, and distributed ledger technology enhancing security, speed, and accessibility. Cross-border payments are becoming increasingly seamless and secure, with instant payments and regulatory compliance being key priorities. The future of payments is expected to be shaped by central bank digital currencies, digital payment platforms, and embedded finance, which will integrate financial services into non-financial businesses. Consumers are driving the demand for digital payments, with expectations for fast, secure, and convenient transactions. Payment processors and financial institutions alike must adapt to these changing customer expectations and invest in digital payment technologies to remain competitive.

Building Trust with Zero-Stress Payment Solutions

Simplicity as a Trust Builder

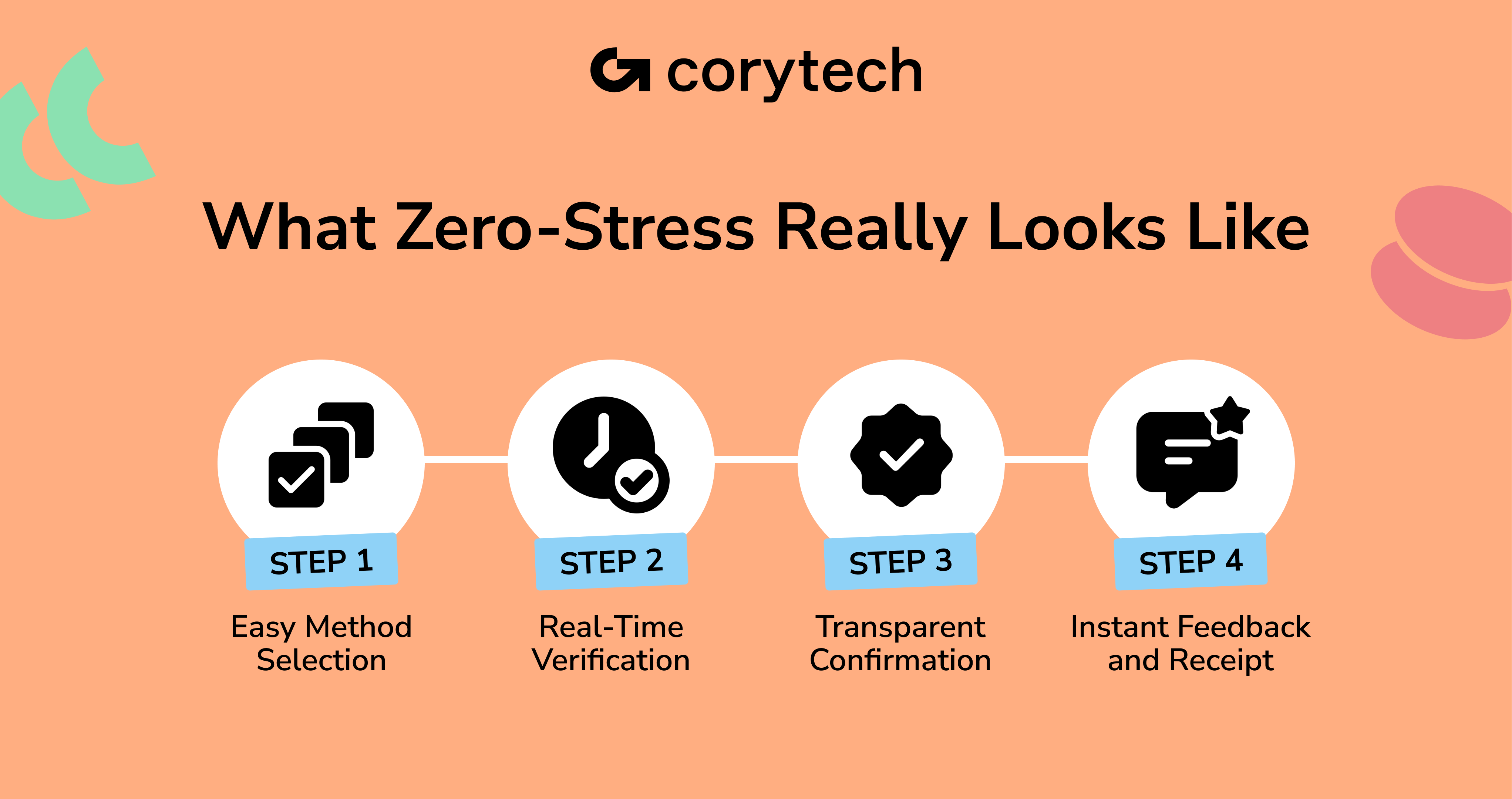

The antidote to payment friction is simplicity. Streamlined payment flows are not only more efficient but also build customer trust by eliminating unnecessary complications. A clear, easy-to-understand payment process helps customers feel more in control of their financial decisions, reducing anxiety and fostering confidence in the platform.

For iGaming and PSP businesses, simplified checkout experiences directly correlate with higher conversion rates and long-term loyalty. By eliminating confusion and reducing the cognitive load required to complete a transaction, customers can focus on what matters most: enjoying the game or service. The fewer the steps and decisions required, the more likely the customer will proceed through to completion and return in the future. Embedded payment solutions will continue to grow across industries, integrating payments directly into various software ecosystems to further streamline the customer experience. Leveraging AI in payment systems can provide a competitive edge by enhancing transaction approval rates, improving fraud detection, and personalizing customer experiences. Embedded finance is becoming increasingly common in B2B2C and B2B2B business models like platforms and marketplaces, offering businesses new opportunities to enhance customer satisfaction and operational efficiency.

Corytech’s Approach to Seamless Digital Payments

At Corytech, we understand that a seamless payment experience is essential for customer satisfaction. By offering transparent, intuitive payment orchestration solutions, we address these pain points head-on. Corytech simplifies complex payment systems, ensuring that every step in the process of making payments is easy to understand and reliable.

Our payment technology solutions are designed to eliminate stress, reduce friction, and create a smooth experience for customers—ensuring both transparency and ease of use. We help businesses avoid the pitfalls of cumbersome payment flows, offering a stress-free solution that builds trust and increases customer retention. Corytech ensures seamless and secure transactions, adapting to new technological advancements and consumer needs. Our goal is simple: make payments as easy as possible for everyone involved.

Cross Border Transactions

Cross-border transactions are a critical component of the digital payments ecosystem, with businesses and individuals requiring fast, secure, and cost-effective ways to make international payments. The rise of digital payment platforms and payment processors has simplified cross-border transactions, reducing the need for traditional bank accounts and enabling faster settlement times. However, regulatory compliance and fraud detection remain key challenges in cross-border payments, with payment providers and financial institutions needing to balance security with convenience. Emerging technologies such as blockchain and distributed ledger technology are expected to play a key role in enhancing the security and efficiency of cross-border transactions.

Testimonials That Speak Louder Than Claims

Real Stories, Real Trust

The true measure of Corytech’s impact lies in the experiences of our clients. Our payment orchestration platform has helped many PSPs and iGaming businesses reduce payment friction, leading to enhanced customer satisfaction and loyalty.

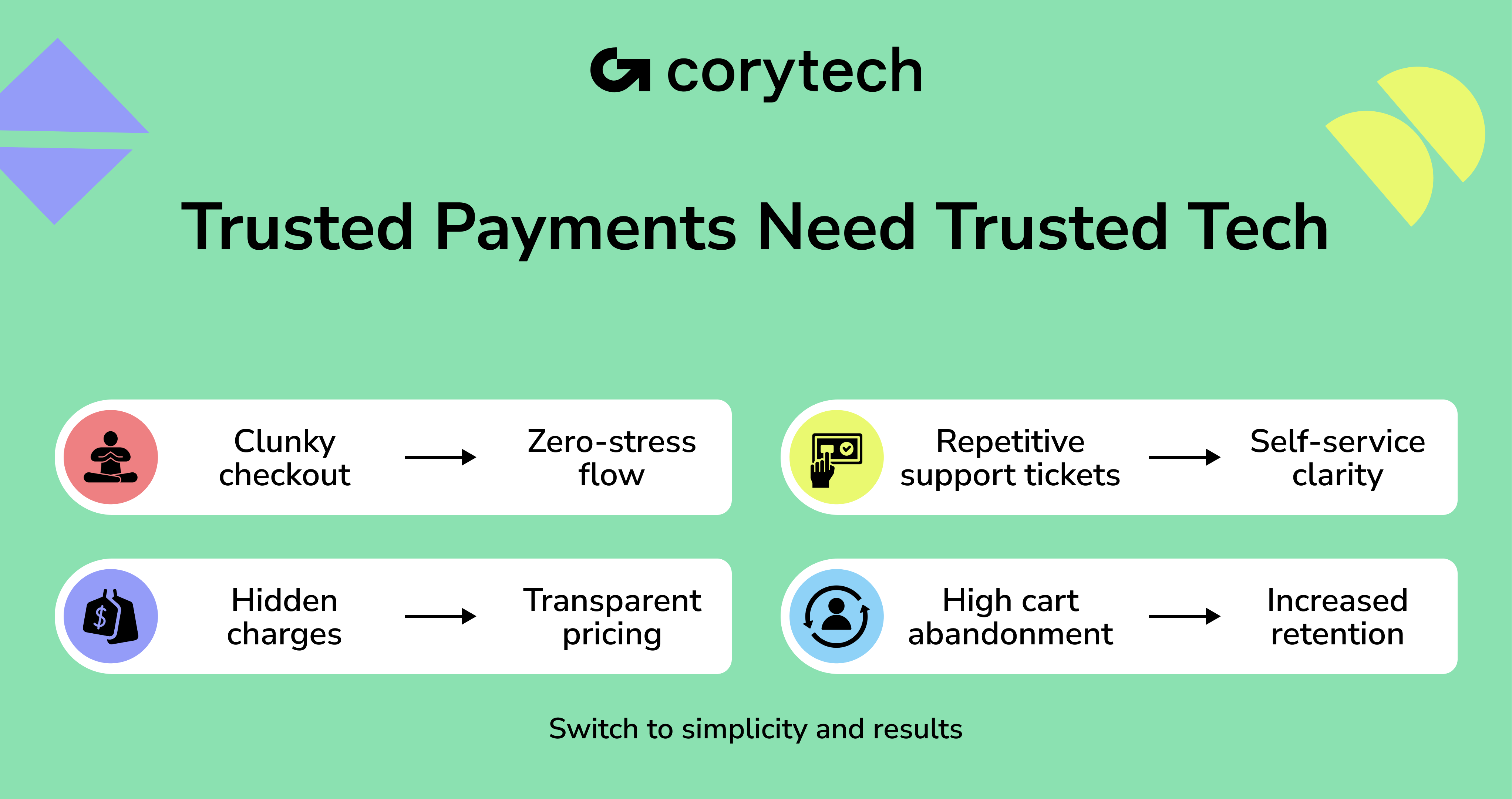

For example, one of our iGaming clients reported a 30% reduction in cart abandonment after switching to Corytech’s seamless payment flow. Similarly, a leading PSP shared how Corytech’s intuitive platform decreased customer service inquiries related to payment issues by over 40%. These real-world examples showcase our ability to simplify complex processes and build trust through transparent, zero-stress payments.

Leveraging Social Proof for Growth

Social proof is one of the most powerful tools for influencing customer behavior. Clients are more likely to trust and adopt solutions that have been positively endorsed by others, especially those with similar needs and challenges. At Corytech, our clients’ success stories serve as powerful testimonials that illustrate the effectiveness of our solutions. When PSPs and iGaming businesses see others in their industry succeeding with Corytech, they feel more confident in making the same choice. Liking also plays a role here—people tend to gravitate toward brands that are endorsed by their peers or colleagues.

The Business Case for Stress-Free Payments

Higher Conversion, Lower Abandonment

It’s simple: when payments are easy and stress-free, customers are more likely to complete their transactions. Offering multiple payment options enhances customer experience by catering to diverse preferences and needs. Data consistently shows that reducing friction in the payment process directly correlates with higher conversion rates and lower abandonment rates. Additionally, the way consumers access credit has evolved, with the rise of buy now, pay later (BNPL) providers offering more flexible payment options that improve cash flow and reduce debt risk. Businesses that invest in seamless, intuitive payment systems see tangible improvements in profitability.

For example, a study of PSPs revealed that simplifying the payment flow led to a 25% increase in successful transactions. Similarly, iGaming platforms that adopted Corytech’s solution saw significant growth in both conversion rates and customer retention, proving that streamlining payment processes leads to long-term success.

Future-Proofing Trust with Payment Security

As the fintech and iGaming industries continue to evolve, the need for stress-free payment technologies becomes even more critical. By embracing intuitive payment solutions today, businesses ensure they remain resilient in a rapidly changing landscape. Adopting these technologies not only enhances trust in the short term but also prepares businesses to meet the demands of tomorrow’s digital economy. Staying informed about the latest payment technologies is crucial for businesses to adapt to emerging payment trends and maintain a competitive edge. Real-time payment systems, now available in over 100 countries, are expected to grow significantly in the coming years, further transforming the payment landscape. Consumers using applications like Uber benefit from payments being a seamless, built-in part of their experience, highlighting the importance of integrating payments into everyday platforms for convenience and efficiency.

The Role of Central Banks

Central banks are playing an increasingly important role in shaping the digital payments landscape, with the development of central bank digital currencies (CBDCs) expected to enhance financial inclusion and reduce the risk of unmanageable debt. CBDCs will enable faster cross-border payments, reduce the need for traditional intermediaries, and provide a more secure and efficient alternative to physical cash. Central banks are also investing in digital payment infrastructure, including payment platforms and payment processors, to support the growth of digital payments. The role of central banks in regulating and overseeing digital payments will be critical in ensuring the stability and security of the financial ecosystem.

Technological Infrastructure and User Adoption

The technological infrastructure underlying digital payments is complex and multifaceted, with payment processors, payment networks, and financial institutions working together to facilitate secure and efficient transactions. The adoption of digital payments by consumers and businesses is driven by the convenience, speed, and security offered by digital payment technologies. However, the digital payments landscape is not without its challenges, with fraud detection, regulatory compliance, and interoperability being key priorities.

Technological Infrastructure

The technological infrastructure supporting digital payments includes payment processors, payment networks, and financial institutions, which work together to facilitate secure and efficient transactions. Emerging technologies such as blockchain, distributed ledger technology, and machine learning are enhancing the security and efficiency of digital payments, while payment platforms and digital wallets are simplifying the payment experience for consumers. The development of application programming interfaces (APIs) and software development kits (SDKs) is enabling third-party developers to build new payment solutions and services, further expanding the digital payments ecosystem. However, the complexity of the technological infrastructure underlying digital payments requires careful management and oversight to ensure the stability and security of the financial ecosystem.

Trust Isn’t Optional—It’s Essential

A zero-stress payment experience does more than just streamline the transaction process—it builds lasting customer trust. By reducing anxiety, eliminating uncertainty, and offering transparent payment solutions, businesses can create loyal customers who return time and time again. Corytech’s unique approach to payment orchestration offers the simplicity and security customers crave, leading to measurable business outcomes. The integration of biometric authentication in payment systems enhances security and improves user experience by replacing traditional methods like passwords, further contributing to a seamless experience.

If you’re a PSP or iGaming decision-maker, it’s time to explore Corytech’s stress-free payment solutions. Don’t let complex payment flows undermine your trust and profitability. Connect with us today to discover how we can help you create smoother, more reliable payment experiences for your customers.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)