Managing payments across multiple platforms, currencies, and regulations can quickly become a logistical nightmare. High transaction fees, failed payments, and compliance headaches? Nobody has time for that. This is where payment orchestration centralizes payment management, reduces costs, and increases success rates. With Corytech, it’s all handled in one solution.

The payment orchestration platform market is growing fast. It is valued at USD 1.2 billion in 2023 and is projected to reach USD 6.3 billion by 2032, expanding at a 19% CAGR. With the increasing demand for faster digital payments and advanced security measures, businesses are shifting toward payment orchestration providers to simplify operations and scale globally.

Let’s explore why businesses are shifting to payment orchestration platforms and how Corytech has turned this process into an effortless advantage.

Why Payment Orchestration Matters

In today’s fast-moving digital economy, businesses can’t afford payment delays, failed transactions, or clunky systems that frustrate customers. Managing various payment methods across regions, currencies, and platforms is no small feat—and doing it manually or through fragmented systems only leads to headaches. That’s where payment orchestration companies step in. They centralize and automate payment processes, making transactions faster, smoother, and more reliable.

The surge in e-commerce growth and the increasing adoption of digital payments are key drivers of expanding the global payment orchestration industry. Companies are looking for solutions that support cross-border transactions, enhance fraud prevention, and offer advanced analytics and reporting optimization operations.

The Role of Payment Orchestration in Modern Business

Imagine juggling multiple payment providers—credit card processors, digital wallets, regional payment methods—all while offering smooth transactions every time. Without a unified system, this quickly becomes a logistical nightmare. That’s precisely what payment orchestration platforms are designed to fix.

By consolidating different payment channels into a single platform, businesses gain:

- Simplified Payment Management: There is no need to build separate connections for each provider. Everything is handled through one centralized hub.

- Reduced Complexity: Businesses can handle their entire payment flow from a single dashboard instead of managing multiple configurations and compliance requirements.

- Enhanced Operational Efficiency: With automated payment routing, retries for failed transactions, and real-time monitoring, businesses can focus on growth instead of chasing technical issues.

With 60% of payment orchestration platform adoption coming from B2B enterprises, it’s clear that companies processing high transaction volumes benefit the most from automation and efficiency.

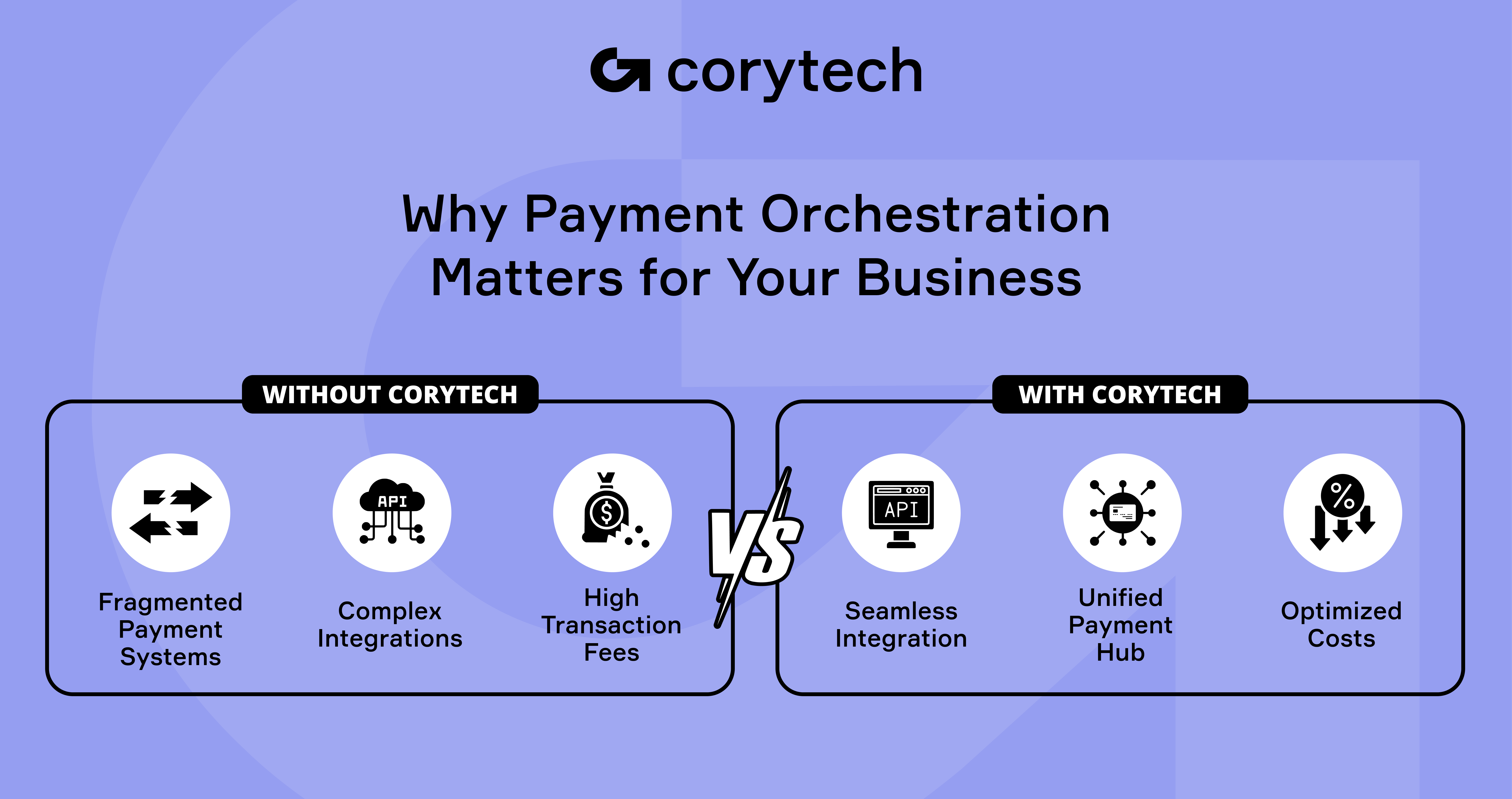

Challenges Without Payment Orchestration

Operating without a payment orchestration platform is like running a relay race with no baton—inefficient, chaotic, and prone to breakdowns. Businesses often face several challenges when managing payments across multiple systems manually:

- Fragmented Systems: Each payment method requires setup, creating a patchwork of disconnected systems that complicate tracking, reporting, and maintenance.

- High Operational Costs: Managing separate payment channels isn’t cheap. From increased infrastructure expenses to higher transaction fees, businesses pay more to keep everything running.

- Low Payment Success Rates: Without intelligent routing, failed transactions aren’t automatically retried through alternative gateways, leading to abandoned carts and lost revenue.

- Security and Compliance Risks: Navigating global regulations without centralized control raises the chances of missing crucial compliance updates, exposing businesses to potential fines or security breaches.

These challenges drain resources, hurt revenue, and create unnecessary friction in the customer experience. That’s why integrating a payments orchestration platform like Corytech isn’t just an upgrade—it’s a game-changer.

-(38).png)

The Power of One Integration with Corytech

Managing payments shouldn’t feel like solving a never-ending puzzle. Businesses often find themselves tangled in multiple systems, each with its setup requirements, technical limitations, and ongoing maintenance. This complexity slows growth, increases costs, and drains valuable resources.

Corytech changes the game by offering a unified framework that connects businesses to multiple payment gateways, acquirers, and payment methods without hassle. It’s built to simplify operations while providing flexibility for future growth. Here’s how Corytech makes scaling payments effortless.

Streamlined Setup

Integrating with multiple payment providers can feel like assembling furniture without clear instructions—frustrating, time-consuming, and prone to errors. Corytech eliminates this struggle with a simplified, all-in-one adoption process.

Here’s what makes it effortless:

- One Connection, Multiple Gateways: With just one solution, businesses can access a wide range of payment gateways and acquirers, from global credit card processors to regional payment providers.

- Reduced Complexity: No more juggling different APIs, documentation, and compliance requirements—Corytech handles it all in one place.

- Quick Implementation: Businesses save time on development and setup, reducing the typical weeks-long installation process to just a few days.

The result? Faster go-to-market times and less time spent on technical headaches.

Scalability Built In

As businesses grow, so do their payment needs. Expanding to new markets often means adding local payment methods, handling multiple currencies, and complying with regional regulations. Corytech’s platform is built with scalability in mind.

Here’s how it helps businesses grow quickly:

- Effortless Expansion: Add new payment methods and support for different currencies without additional setups.

- Global Reach: Easily tap into international markets with support for localized payment options and regulatory compliance.

- Future-Proof Flexibility: Corytech grows alongside your business, allowing you to integrate emerging payment technologies, such as a new digital wallet or cryptocurrency.

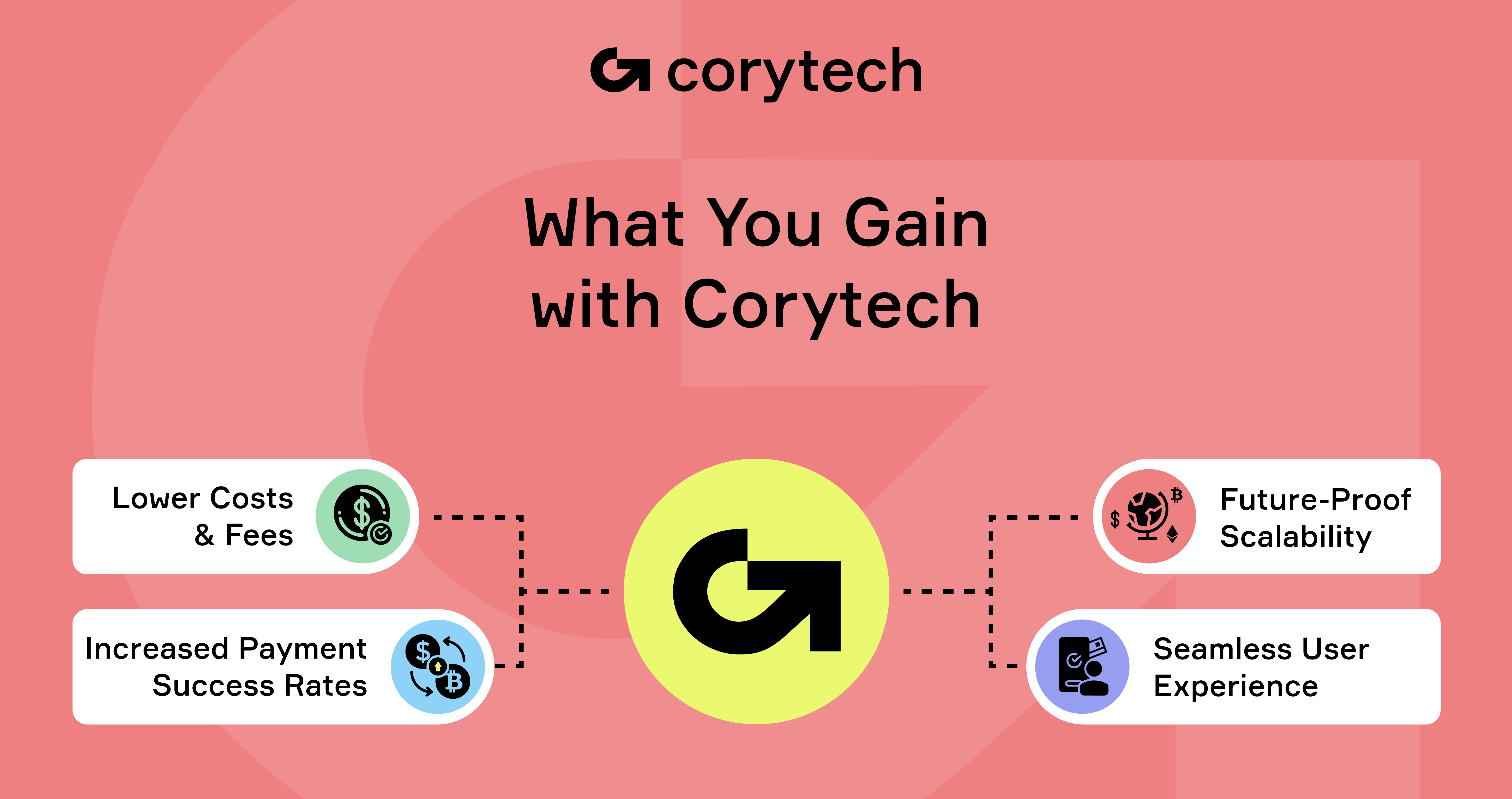

Countless Benefits of Corytech’s Payment Orchestration Platform

An excellent payment system does more than just process transactions—it should help businesses grow, cut costs, and offer customers a frictionless experience. That’s where Corytech’s payment orchestration platform truly shines. With advanced features designed to maximize efficiency and simplify payment flows, businesses gain more control, fewer failures, and a lot less hassle.

From optimizing approval rates to providing real-time insights, here’s how Corytech transforms payments orchestration from a complex task into a strategic advantage.

Increased Payment Success Rates

Failed payments hurt revenue and can damage customer trust. Corytech tackles this problem head-on with intelligent technology to keep transactions flowing smoothly.

- Intelligent Routing: Every transaction is automatically routed through the best-performing acquirer based on location, past success rates, and currency support. This increases the likelihood of approval and minimizes payment failures.

- Cascading Payments: Corytech doesn’t stop there if a transaction is declined. The system automatically reroutes payments through alternative gateways, significantly increasing approval rates and predicting fewer lost sales.

And what's the result? More successful transactions, higher revenue, and happier customers.

Reduced Operational Costs

Managing multiple payment systems can quickly drain resources. Businesses often spend more than they should between integration fees, maintenance costs, and processing charges.

Corytech offers a more intelligent solution:

- Consolidated Payment Systems: Businesses can dramatically reduce infrastructure and maintenance costs by centralizing all payments on one platform.

- Competitive Transaction Fees: Corytech’s partnerships with global payment providers allow businesses to access processing fees and better rates across various regions.

In short, you’ll save money without cutting corners on quality or security.

Simplified Compliance and Security

Finding your way through the intricate web of regional regulations and security requirements can feel like a full-time job. With Corytech, businesses don’t need to worry about staying compliant—it's already built in.

- Global Compliance: From GDPR in Europe to PCI DSS standards worldwide, Corytech automatically tracks adherence to local and international payment regulations.

- Fraud Prevention Tools: Advanced fraud detection and prevention mechanisms monitor transactions in real-time, reducing the risk of chargebacks and protecting businesses and customers from fraudulent activities.

Real-Time Insights and Analytics

You can’t improve what you don’t measure. Corytech provides businesses with deep, actionable insights to help optimize payment strategies.

- Performance Tracking: Monitor metrics like approval rates, failed transactions, and payment speed to identify bottlenecks and areas for improvement.

- Transparent Reporting Tools: Easy-to-understand dashboards make it simple for teams to track progress and adjust strategies based on actual data, not guesswork.

Data-driven decision-making has never been easier.

Complete User Experience

A clunky payment process is a surefire way to lose customers. Corytech guarantees that every payment is fast, smooth, and hassle-free.

- Frictionless Payments: Reduce wait times and simplify checkout, keeping customers happy and improving conversion rates.

- Diverse Payment Options: Corytech supports various payment methods, including traditional credit cards, digital wallets, and cryptocurrencies, offering flexibility to suit every customer.

Faster payments, fewer drop-offs, and a better overall experience for your customers.

.png)

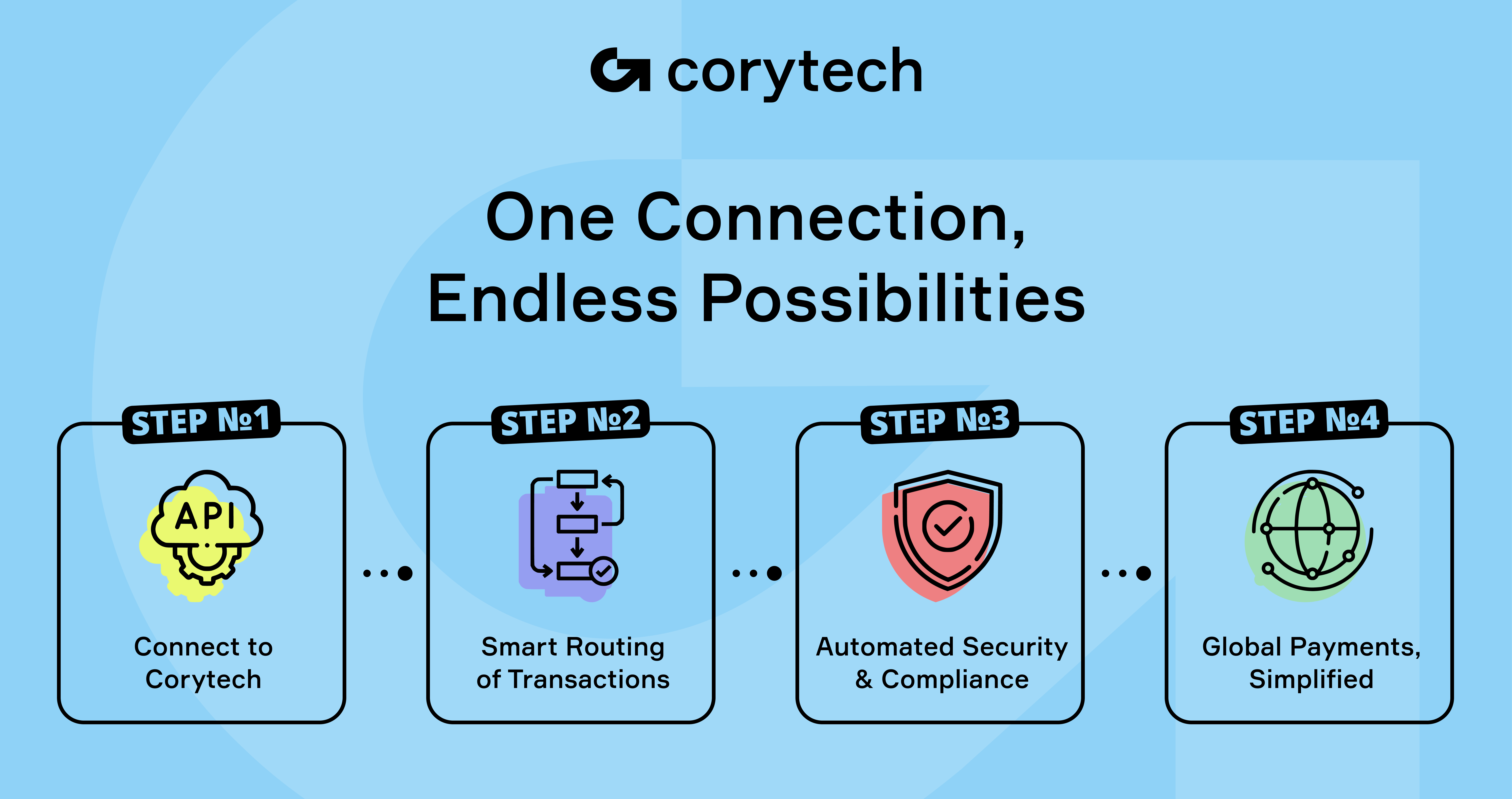

How Corytech Simplifies Integration

A payment solution is only as good as its installation process. Businesses waste valuable time and resources if the process is slow, complicated, or requires constant troubleshooting. Corytech eliminates implementation headaches with an API-first approach, flexible payment flows, and dedicated support, guaranteeing businesses can focus on what matters.

From smooth onboarding to zero-stress payments, here’s how Corytech makes payment orchestration effortless.

API-First Design

Nobody wants to spend weeks—or months—integrating a new payment system. Corytech’s API-driven approach makes the process quick, easy, and hassle-free.

- Plug & Play Compatibility: Works smoothly with existing systems, requiring minimal development effort.

- Future-Proof Flexibility: Easily add new payment methods or scale operations without reworking the setup.

- Real-Time Processing: Verifies transactions are handled instantly, improving efficiency and customer experience.

With Corytech’s API, businesses integrate faster and with fewer roadblocks.

Customizable Payment Flows

Every business is unique, and so are its payment needs. Corytech allows businesses to create custom payment journeys that align with their operations and customer expectations.

- Localized Payment Methods: Offer the right payment options for different markets, increasing conversion rates.

- Adaptive Routing Rules: Customize how transactions are processed based on business goals—minimizing costs, maximizing approval rates, or balancing both.

- Automated Checkout Experiences: Optimize payment flows to ensure customers complete their purchases without friction.

Corytech doesn’t force a one-size-fits-all approach—it adapts to what works best for you.

Dedicated Onboarding Support

Compliance shouldn’t be a struggle. That’s why Corytech provides hands-on support throughout the entire onboarding process.

- Expert Guidance: Corytech’s team helps configure payment systems to match business needs.

- Smooth Transition: Avoid downtime and operational disruptions during implementation.

- Ongoing Assistance: Support doesn’t stop after onboarding—Corytech helps businesses run payments without issues.

When payments are the backbone of your business, having a reliable partner makes all the difference.

Zero-Stress Payments Approach

Corytech’s philosophy revolves around a simple yet powerful idea: payments should be a breeze! We believe businesses shouldn’t have to stress over failed transactions, compliance headaches, or technical bumps. Instead, they can channel their energy into growth while Corytech takes care of the details.

- Payments Without the Worry: Corytech makes sure every transaction is secure, smooth, and optimized.

- No-Rush, No-Hassle Processing: Businesses can relax, knowing that their payment operations are in expert hands.

- A True Business Partner: Corytech’s mission is to let businesses thrive—without payments becoming a constant source of stress.

In short, zero-stress payments mean fewer distractions and more time to scale confidently.

Why Corytech is the Preferred Choice for Businesses

Choosing a payment orchestration platform isn’t just about processing transactions—it’s about ensuring long-term growth, reliability, and ease of operations. Businesses need a partner that doesn’t just keep up with industry changes but stays ahead of them.

That’s exactly what Corytech delivers. With cutting-edge technology, a reputation built on trust, and a customer-first approach, Corytech has become the go-to choice for businesses that want to simplify payments and focus on growth.

Here’s what sets Corytech apart.

Leading-Edge Technology

The payment industry is developing at lightning speed—what worked five years ago might not cut it today. Corytech stays ahead by offering future-proof solutions designed for scalable, flexible payment orchestration.

- AI-Driven Payment Optimization: Smart routing and automated retries increase approval rates and reduce failed transactions.

- Multi-Currency & Global Payment Support: Businesses can expand into new markets without worrying about payment infrastructure.

- Continuous Innovation: Corytech integrates emerging digital wallets, cryptocurrencies, and regional payment solutions as they gain traction.

With Corytech, businesses aren’t just keeping up with change but staying ahead.

Trusted by Industry Leaders

A payment provider is only as good as the businesses that rely on it. Corytech has built a strong reputation among companies across industries, from e-commerce giants to SaaS platforms and subscription-based services.

What makes industry leaders choose Corytech?

- Proven Reliability: High uptime, consistent performance, and secure transactions.

- Scalability for Growth: Businesses of all sizes—from startups to global enterprises—use Corytech to handle payments efficiently.

- Global Reach: Companies expanding internationally trust Corytech to navigate regional payment complexities.

If major brands trust Corytech to handle their payments, it’s clear—they deliver results.

Unmatched Support

An excellent payment platform isn’t just about the technology but the team behind it. Corytech takes a customer-first approach, ensuring businesses get the support they need, from incorporation to continuous optimization.

- Dedicated Account Management: Businesses have direct access to experts who understand their unique needs.

- 24/7 Technical Support: Payments run around the clock, and so does Corytech’s support team.

- Proactive Monitoring & Optimization: Corytech doesn’t just react to issues—it prevents them before they impact businesses.

With Corytech, companies don’t have to figure things out alone. They have a partner who ensures long-term success.

What’s Next?

Your payment system should drive growth, not slow it down. Optimizing payments means lower costs, higher approval rates, and a smoother customer experience.

With Corytech’s payment orchestration platform, you get smooth adoption, global scalability, and stress-free transactions—all in one place.

The industry is projected to grow exponentially, with innovations in API utilization, AI-driven fraud detection, and blockchain technology paving the way for even more efficiency.

Ready to simplify payments and stay ahead? Partner with Corytech today and let us handle the rest.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)