Choosing a payment provider seems like a straightforward decision for iGaming businesses and PSPs but the risks of choosing the wrong one are often underestimated. Slow or unreliable payment systems can lead to financial disaster, damage to your reputation and ultimately hinder business growth.

A payment service provider (PSP) is a third-party company that allows businesses to accept various payment methods online. PSPs allow businesses to accept multiple payment methods through one platform, enhancing customer experience at checkout by offering various options for online payment processing. The entire transaction process through a PSP involves the payment being sent to the payment gateway which sends the payment data to the acquiring bank.

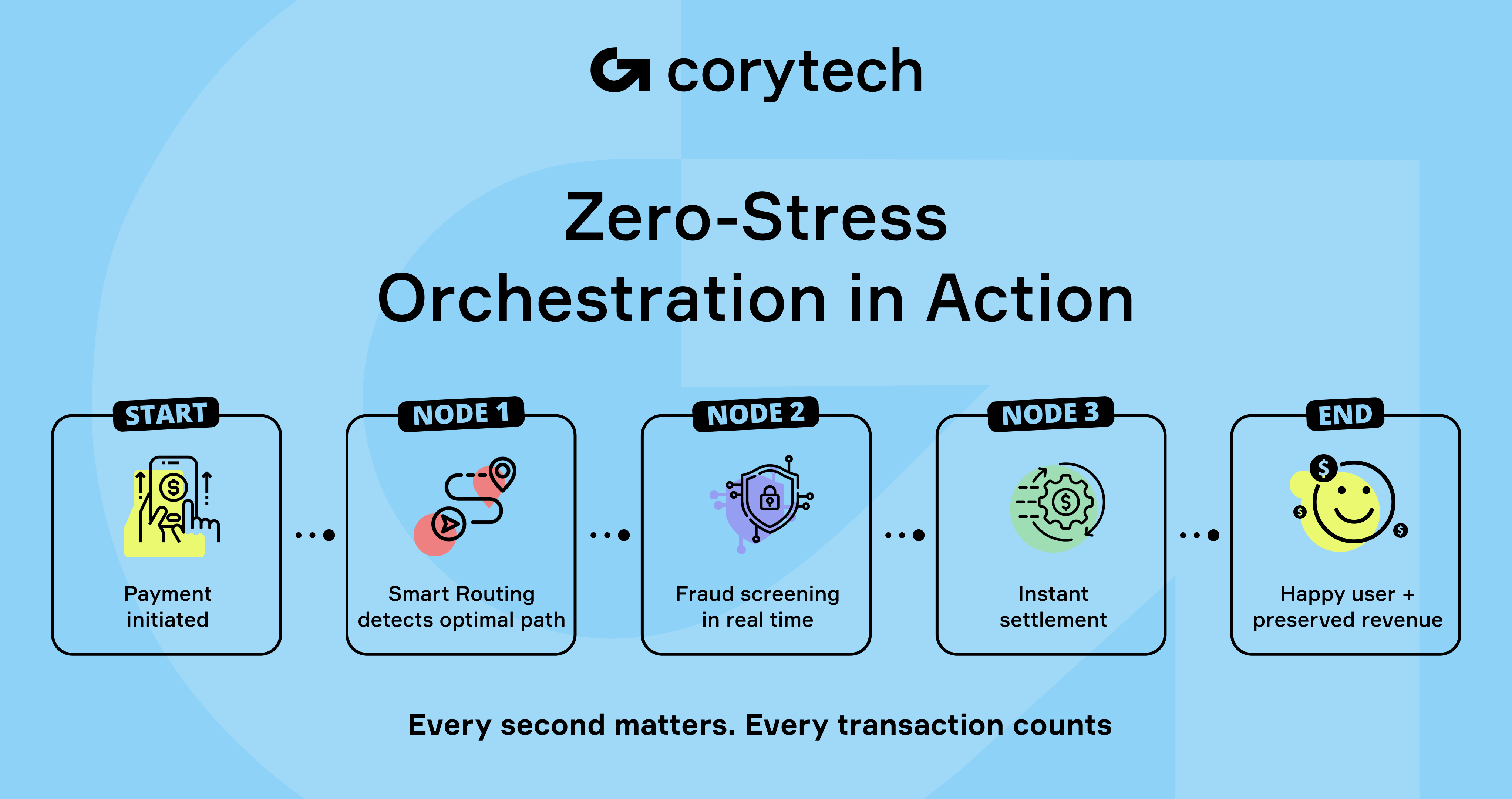

Payment processing PSPs streamline online payments by managing authorizations and currency conversions, enabling businesses to concentrate on their core operations while saving time and resources through automation in invoicing and reporting. Efficient payment orchestration is not just a necessity; it’s a strategic lever to optimise payment processes, customer experience and revenue.

Intro to Online Payments

Online payments have become an essential part of modern commerce, allowing businesses to accept payments from customers remotely. A payment service provider (PSP) plays a crucial role in facilitating online payments by connecting merchants to various payment methods, such as credit cards, debit cards, and digital wallets.

With the rise of e-commerce, online payment services have become increasingly popular, and many payment service providers offer secure and reliable payment processing solutions. By accepting online payments, businesses can expand their customer base, increase revenue, and improve customer satisfaction.

The Hidden Dangers of Slow and Unreliable Payment Providers

Revenue Leakage: The Silent Profit Killer

Transaction failures and abandoned checkouts are silent killers of profit especially in the fast paced iGaming industry. According to recent studies, the average e-commerce company loses up to 7% of revenue annually due to abandoned carts caused by payment system downtime. Verifying that customer accounts have sufficient funds is crucial to ensure safe and efficient transactions. Payment service providers connect merchants to different types of payment such as debit and credit cards, real-time bank transfers and e-wallets. They also manage the complexities of online payments including authorisations and currency conversions. Imagine the cumulative impact over the course of a year in iGaming – every minute of downtime could mean thousands of dollars in lost revenue, with some businesses reporting hourly losses of up to thousands of dollars when payment systems fail to deliver.

The financial strain doesn’t stop there. Payment interruptions can frustrate users and cause them to abandon sessions and seek alternatives. PSPs help streamline and simplify payment processing within organisations by offering an all in one solution. Many payment service providers use advanced security measures to protect customers’ payment information. Additionally, PSPs provide additional services such as fraud protection and payment gateway integration to enhance transaction security. This means a cascading loss of potential revenue that could have been easily avoided with a reliable payment provider.

Reputation Damage: Costs You Can’t Easily Recover

Reputation damage can have severe consequences for businesses, including loss of customer trust and revenue. In the context of online payments, reputation damage can occur due to security breaches, fraudulent transactions, or poor customer service. Payment service providers can help mitigate these risks by offering secure payment processing, fraud protection, and reliable customer support. By partnering with a reputable payment service provider, businesses can protect their brand and maintain customer trust. Additionally, payment service providers can help businesses comply with industry regulations, such as PCI compliance, to ensure a secure payment experience.

Reputation Damage: Costs You Can’t Easily RecoverThe long term consequences of using unreliable payment systems are more than just financial; they can also damage brand trust and customer loyalty. Players in the iGaming industry expect seamless transactions – any delay or failure creates a frustrating experience and a negative impression of your brand. PSPs allow businesses to deliver frictionless checkout experiences and increase revenue. Payment service providers work with numerous card and payment networks as well as a wide range of acquiring banks to create a seamless payments experience.

The damage is cumulative: one instance of downtime might cause a significant drop in customer retention as players are more likely to leave and seek more reliable platforms. For example, a major iGaming company found that a single 15 minute downtime resulted in a 30% decrease in their active player base for the week. Payment service providers supply aggregate merchant accounts, allowing multiple businesses to share a single merchant account. Comparing the monthly fee structures of different payment service providers can reveal significant differences in overall business costs, especially for low-volume businesses. However, payment service providers may have set limits on transaction size and processing volume. While they were able to recover, the long term trust erosion is hard to quantify and could impact future player acquisition.

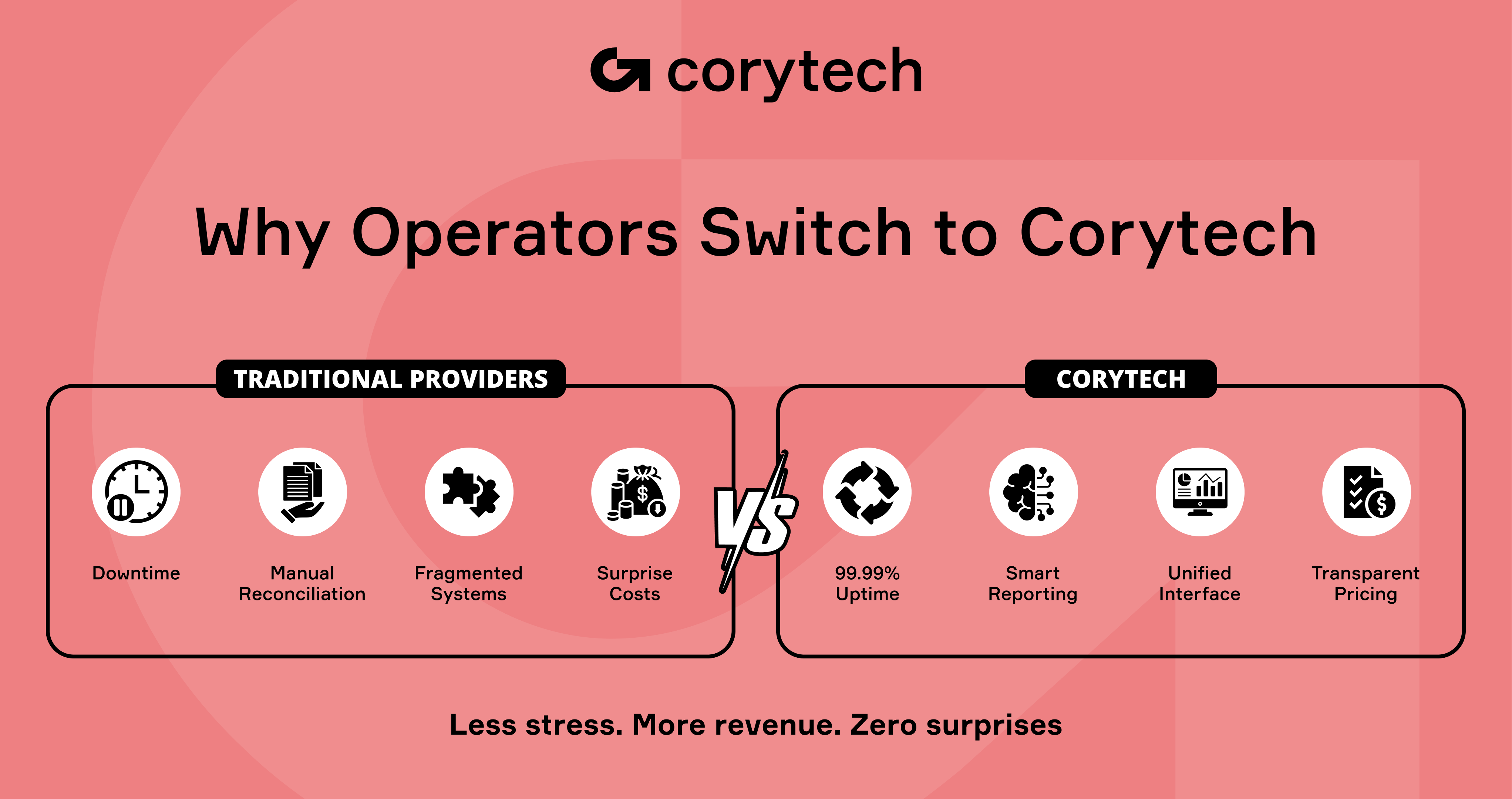

Why Traditional Providers Fail PSPs and iGaming Businesses

Legacy Infrastructure: The Root of the Problem

Traditional payment providers often rely on outdated, monolithic infrastructure that is not designed to handle the demands of modern, high volume businesses. A modern payment solution, on the other hand, can address these issues by offering scalable, flexible, and reliable services. PSPs can streamline the complexities of online payments, so businesses can focus on core operations. When choosing a payment service provider consider support, simplicity, security and price. Businesses should set aside time for planning each phase of the integration process of payment service providers. As a result businesses are forced to deal with transaction delays, payment failures and complex integrations that slow down operations and cost more in the long run.

Hidden Fees and Costs: What You Don’t See Can Hurt You

While traditional providers might seem cost effective at first glance, hidden fees and operational inefficiencies can quickly add up. Modern payment service providers often offer lower transaction fees, making them a more cost-effective option for businesses handling a high volume of transactions. These might include unexpected charges for cross border payments, compliance fines or the cost of integrating multiple payment systems to achieve full coverage. Many payment service providers offer built in PCI compliance at no additional cost. Payment service providers typically have flat rate pricing with no monthly fees. Over time these costs create significant overheads that erode profitability. A transparent, predictable pricing model is essential to help businesses make informed decisions and avoid unexpected expenses.

Payment Processing Basics

Payment processing involves several steps, including payment authorization, payment capture, and payment settlement. A payment service provider acts as an intermediary between the merchant and the customer’s bank, facilitating the transaction process. Payment processing can be done through various channels, including online payment gateways, mobile payments, and in-store payments. Payment service providers offer different payment methods, including credit card payments, debit card payments, and digital wallet payments. By understanding the basics of payment processing, businesses can choose the right payment service provider to meet their needs and ensure a smooth transaction process.

Corytech’s Proven Solution: Authority in Action

Expert Engineered Payment Orchestration

Payment orchestration refers to the process of managing multiple payment methods and providers through a single platform. Expert engineered payment orchestration involves designing and implementing a payment processing system that can handle various payment methods, including credit cards, debit cards, and digital wallets. Payment service providers can offer payment orchestration solutions that enable businesses to manage their payment processing efficiently and effectively. By using a payment orchestration platform, businesses can reduce costs, improve customer satisfaction, and increase revenue. Additionally, payment orchestration can help businesses comply with industry regulations and ensure a secure payment experience.

Corytech is a payment orchestration leader, offering solutions to overcome the inefficiencies of traditional providers. With years of experience and industry certifications, Corytech’s platform is built on a solid technological foundation, engineered to deliver reliable, scalable and seamless payment experiences. Businesses can access detailed real-time reports and data analytics through payment service providers. This expertise makes Corytech an authority in payment orchestration, recognized by businesses across industries.

Real World Impact: Corytech Success Stories

Corytech has transformed payment systems for many clients. By acting as a middleman between merchants and financial institutions, Corytech enables businesses to manage online payments without the need for direct contracts with banks and payment method companies. Through the implementation of its payment orchestration platform, businesses have seen a significant improvement in uptime, reducing downtime to almost zero. Clients have also seen a reduction in hidden fees, resulting in more predictable costs and better financial planning. Corytech’s solutions have streamlined operations, cutting complexity and boosting efficiency.

How Corytech Protects Your Revenue and Reputation

Seamless Scalability

One of the key benefits of Corytech’s payment orchestration platform is its ability to scale effortlessly. Corytech integrates with various card networks to ensure seamless scalability. As your business grows, Corytech ensures your payment system keeps up with the increasing transaction volumes without compromising on reliability. This eliminates downtime during high volume periods, so your revenue generation remains uninterrupted.

Transparent and Predictable Cost Structures

Corytech is committed to providing businesses with transparent and predictable cost structures. Corytech's payment processes work ensures that businesses can easily understand and manage their payment processes, making it simpler and more cost-effective to handle transactions. This transparency helps businesses avoid hidden fees and allows for accurate budgeting and forecasting. By offering clear pricing with no surprises, Corytech allows businesses to make informed decisions, knowing exactly what they’re paying for and how to optimise their payment infrastructure.

Industry Leading Reliability

Corytech’s reliability is backed by impressive uptime statistics, 99.99%. Corytech's credit card processing solutions offer seamless integration and reliability, ensuring smooth transactions across various sales channels. In real world scenarios this means minimal disruptions and maximum revenue continuity. For iGaming businesses where every second counts, Corytech’s reliability means players experience seamless transactions every time, building trust and loyalty.

What’s Next?

Choosing an unreliable payment provider can damage your revenue and reputation. Corytech’s platform is flexible and adaptable, integrating local payment methods alongside popular options like PayPal and digital wallets. The risks are real but with Corytech’s payment orchestration solutions you can protect your business from downtime, hidden fees and inefficiencies. As an authority in fintech, Corytech offers proven, scalable and reliable solutions to optimise your payment infrastructure.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)