In the rapidly evolving landscape, customizing merchant payment solutions for high-risk niche markets is a critical strategy. This approach involves tailoring payment processing systems to meet specific needs and mitigate the risks inherent in various specialized sectors, such as online education and digital goods. These customized solutions address challenges like diverse customer preferences, international payment regulations, and sector-specific fraud risks.

Highlighted by Dwayne Gefferie (the Payment Strategist at DataBright) in his LinkedIn post, real-world examples from these sectors illustrate the necessity for businesses to adopt payment systems that are not just functional (Stripe, for example) but also aligned with the unique dynamics of their market. This strategic customization enhances customer experience, ensures transactional security, and drives business growth in these niche markets.

Niche Markets Basics & Examples

A niche market is characterized by its specific focus, catering to a unique segment of consumers with particular needs and preferences. This specialization allows businesses within a niche market to offer tailored products or services, differentiating themselves from broader markets. The appeal of niche markets lies in their ability to address distinct customer requirements, often overlooked by larger, more generalized markets. By concentrating on a narrower audience, companies can establish a strong foothold, often enjoying a loyal customer base and reduced competition.

Two notable examples of niche markets are online education, including coaching, ‘training schedules, diet programs, crypto or stock tips, video editing, betting, or OnlyFans consultants, etc.,’ and other digital goods. The online education and coaching sector has experienced significant growth, accelerated by the global shift towards remote learning and digital platforms. This market caters to diverse needs ranging from academic tutoring to professional skill development and personal interest courses. The digital goods market, encompassing products like eBooks, online courses, software, and digital media, has similarly seen a surge in demand. This market benefits from the digitalization of content, offering ease of access and distribution, and appealing to the growing consumer preference for digital formats over physical ones. These markets demonstrate the potential and growth opportunities within niche sectors, driven by evolving consumer behaviors and technological advancements.

Challenges in Payment Processing for High-Risk Niche Markets

In high-risk niche markets, payment processing can be fraught with challenges. One major issue is the handling of chargebacks. Chargebacks occur when customers dispute a transaction and ask their credit card issuer to reverse it, often due to reasons like dissatisfaction, non-receipt of services, or fraudulent activity. In niche markets, where products or services are unique and often intangible, the frequency of chargebacks can be higher. This is partly because customers may have different expectations or not fully understand what they purchase. Dwayne Gefferie's LinkedIn post highlights this issue, with examples from the digital goods sector where customers often dispute charges due to misunderstanding the nature of the product or service.

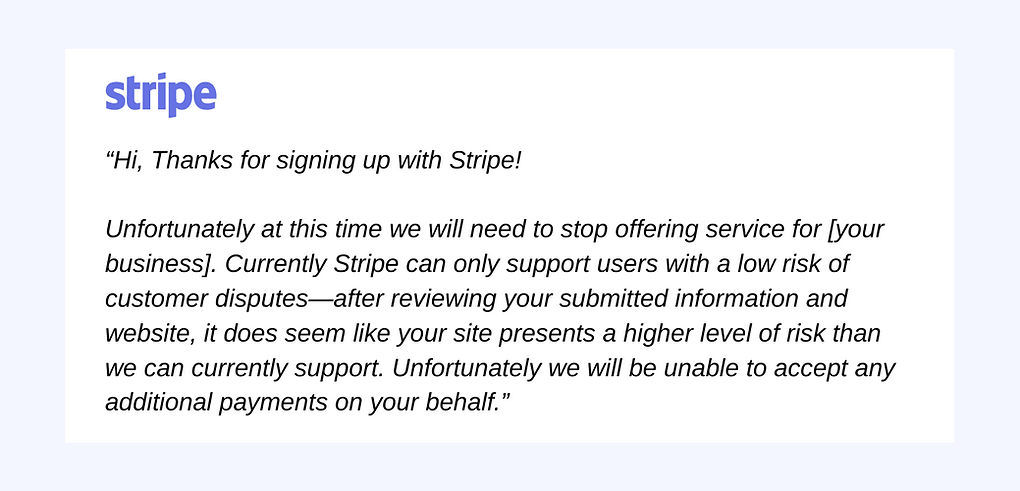

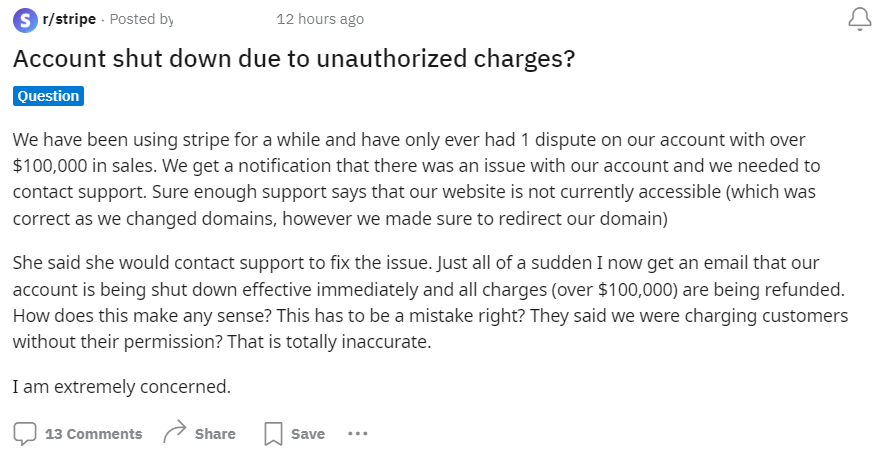

Another challenge is 'suspicious transactions'. Such payment systems as Stripe could assume that a business runs those 'suspicious transactions' by using stolen credit cards. That's a real-world example from the beauty salon owner, whose account got blocked by Stripe due to this reason: 'Stripe blocked the account of my beauty salon due to 'suspicious transactions' as they assumed that we were using stolen credit cards 😅 the thing is - we provide physical service with contact with customers and we know every single customer and all the transactions were done using POS terminal with 3DS 😏 and 0.000% chargebacks or disputes...' - said the owner of the beauty salon in the comments to the Dwayne Gefferie's LinkedIn post. There's one more example from the Stripe user posted in their Reddit thread a few hours ago:

Fraud prevention is another significant challenge. Niche markets are often targeted by fraudsters due to the high-value transactions and the digital nature of the products or services. This requires robust fraud detection and prevention mechanisms. Additionally, compliance issues add another layer of complexity. Niche markets must navigate various international laws and regulations, including data security, consumer rights, and financial transactions. These regulations can vary widely, making compliance a moving target that requires constant vigilance and adaptation. The combination of these challenges necessitates a specialized approach to payment processing in niche markets, underscoring the need for customized and flexible payment solutions.

Payment Solution Needs for Online Education & Related Businesses

Overview of Online Education Market

The online education market is characterized by its diversity and flexibility, offering a wide range of courses that cater to various educational needs and interests. This market includes everything from academic courses for K-12 and higher education to professional development programs, skill-based training, and personal interest or hobby courses. The payment models in this sector are as varied as the courses themselves. Subscriptions are common for platforms offering a range of courses or continuous learning paths, allowing students to access multiple courses over a set period. On the other hand, one-time payments are typical for individual courses or specialized training programs, where students pay a single fee for access to specific content. This variety in course offerings and payment models requires a versatile payment processing system that can handle different pricing structures and payment methods.

Customized Payment Features

For the online education market, certain payment features are essential to meet the specific needs of both course providers and students. Recurring billing is vital for subscription-based models, allowing for hassle-free, automatic renewals. This feature benefits providers by ensuring a steady revenue stream and students by providing uninterrupted access to learning materials. Multi-currency support is another crucial feature, given the global nature of online education. It allows students from different countries to make payments in their local currency, simplifying the transaction process. Moreover, an easy refund process is important to build trust and provide flexibility, catering to situations where course offerings might not meet student expectations. Alongside these features, a user-friendly interface is paramount. For course providers, it should offer easy management of courses, payments, and student data. For students, the interface should be intuitive, making it straightforward to enroll in courses, make payments, and access learning materials. These features collectively enhance the overall experience, making transactions smooth and reliable for all parties involved.

Adapting Payment Solutions for Digital Goods

Characteristics of the Digital Goods Market

Digital goods encompass a broad range of intangible products delivered electronically, such as eBooks, software, digital art, and online gaming content. Unlike physical goods, these products are characterized by their non-tangible nature and the immediacy of their delivery upon purchase. The market dynamics of digital goods are unique due to several factors.

Firstly, there's virtually no inventory or physical shipping involved, allowing for instant delivery and global reach without geographical limitations. Secondly, the pricing model for digital goods can vary significantly, from one-time purchases for items like software to subscription models for ongoing services like digital magazines or cloud storage. In his LinkedIn post, Dwayne Gefferie highlights these dynamics, noting the rapid growth and evolving nature of this market, driven by technological advancements and changing consumer preferences. The demand for digital goods is also influenced by the rise of mobile devices and increased internet accessibility, making digital content more readily available to a wider audience.

Required Payment Functionalities

In adapting payment solutions for the digital goods market, certain functionalities become paramount. Quick processing of transactions is essential due to the instantaneous nature of digital goods delivery. Customers expect a seamless and rapid checkout experience, mirroring the immediate access they get to the purchased product. This need for speed also extends to microtransactions, which are small-value transactions often used in the purchase of in-game items, app features, or digital media. The ability to process these transactions efficiently and cost-effectively is crucial in markets where micro-purchases are frequent.

Security features are another critical aspect. Given the digital format of these products and the sensitive nature of online transactions, robust security measures are needed to protect against fraud and unauthorized access. This includes secure payment gateways, data encryption, and fraud detection mechanisms. Additionally, integrating payment solutions with digital delivery systems is vital. This integration ensures that the delivery of digital goods is contingent upon successful payment, automating the process and enhancing customer satisfaction.

For example, once a customer purchases a digital art piece or an eBook, the system should immediately provide access to the product, ensuring a smooth and efficient transaction experience. These functionalities collectively address the unique needs of the digital goods market, ensuring that payment processes are as streamlined and secure as the digital products they support.

Risk Management in High-Risk Niche Markets

Balancing Risk and Accessibility

In high-risk niche markets, particularly those dealing with online transactions like digital goods and online education, balancing the risk of fraud with the need for accessible payment options is a critical aspect of risk management. On one hand, businesses must implement robust fraud prevention strategies to safeguard against unauthorized transactions and data breaches. This involves deploying advanced security measures such as two-factor authentication, SSL encryption, and continuous monitoring of transactional patterns to detect and prevent fraudulent activities. On the other hand, it's equally important to maintain the accessibility and ease of payment for legitimate customers. Overly stringent security measures can lead to a cumbersome payment process, potentially deterring genuine customers. Therefore, businesses need to find a middle ground where security protocols are strong enough to prevent fraud but not so invasive as to hinder the user experience. This balance is crucial for building customer trust and loyalty in niche markets, where the customer base, though smaller, is often more dedicated and engaged.

Case Studies

Successful implementation of payment solutions in niche markets can be seen through various case studies. For instance, an online education platform may implement a payment system that offers multiple currencies and payment methods, catering to its international student base. This approach not only expands the market reach but also incorporates necessary security measures to protect against fraud. Another example could be a digital goods marketplace that integrates its payment system with immediate digital delivery, ensuring a seamless transaction experience. This marketplace might use advanced fraud detection algorithms to monitor transactions and quickly flag any suspicious activity, thus balancing security with efficiency.

Choosing the Right Payment Service Provider

Criteria for Selection

Choosing the right payment service provider (PSP) for niche markets involves considering several factors. First of all, consider only those PSPs working with high-risk businesses. Don’t know if your business is high-risk? Consult with a professional before signing any agreements with PSPs. Avoiding this essential step can lead to a situation when you start using a payment system of your choice, and everything goes smoothly for a few months, but at some point, your account just gets blocked after additional checkups.

Then look at everything else and consider more general factors of choice.

Fees are also a primary consideration; businesses must evaluate transaction fees, monthly fees, and any hidden charges that might affect profitability. Customer support is another critical factor, as timely and effective support can be crucial in resolving payment issues and maintaining customer satisfaction. Integration capabilities are essential for ensuring the PSP can seamlessly integrate with the business's existing systems, such as shopping carts, accounting software, or customer management systems.

Finally, scalability is important to ensure that the payment system can grow and adapt with the business, accommodating increased transaction volumes or expansion into new markets or product lines.

Recommendations

For high-risk niche markets like online education and digital goods, PSPs that offer a combination of flexibility, security, and user-friendly interfaces are ideal. Providers that support multiple currencies and payment methods are recommended to cater to a global customer base. PSPs that offer customizable fraud prevention tools and have a strong track record in data security should be prioritized. Additionally, providers that offer scalable solutions can accommodate the growth and evolving needs of niche businesses. While specific PSP recommendations may vary based on the unique needs of each niche market, businesses should thoroughly evaluate potential providers against these criteria to ensure a successful and sustainable payment solution implementation.

Future Trends in Payment Solutions for Niche Markets

Emerging Technologies

The future of payment solutions in niche markets is set to be heavily influenced by emerging technologies such as blockchain, artificial intelligence (AI), and mobile payments. Blockchain technology, with its inherent security and transparency features, holds particular promise for enhancing transactional integrity. In markets like digital goods, where authenticity and rights management are paramount, blockchain could offer an immutable record of transactions, reducing fraud and enabling secure peer-to-peer sales. AI, on the other hand, is poised to revolutionize payment processing through advanced fraud detection algorithms and personalized customer experiences. By analyzing vast amounts of transaction data, AI can identify patterns indicative of fraud, significantly reducing the risk of fraudulent transactions. Additionally, the growing prevalence of mobile payments is transforming consumer expectations, necessitating the adoption of mobile-friendly payment solutions that offer convenience and speed.

Predictions for Niche Market Evolution

As these technologies continue to evolve, the landscape of niche markets like online education and digital goods is expected to undergo significant changes. In the realm of online education, AI and blockchain could collaborate to offer more secure and personalized payment options, tailoring the pricing and payment plans to individual needs and preferences. For the digital goods market, blockchain technology could become a cornerstone for ensuring the authenticity of digital assets, particularly with the rise of digital art and collectibles. Furthermore, as mobile payments become more ingrained in consumer habits, niche markets will likely see a shift towards mobile-first payment solutions, emphasizing ease of use and integration with mobile apps and platforms. This evolution will require payment solutions to be not only technologically advanced but also highly adaptable, ensuring they can meet the changing needs and expectations of both businesses and consumers in these specialized sectors.

High-Risk Merchant Payment Solutions FAQ

Does Corytech offer paytech solutions for online education and other niche businesses?

Yes, Corytech provides specialized paytech solutions designed for various niche markets, including online education. Their services are tailored to meet the unique needs of these sectors, offering features like flexible payment plans, multi-currency support, and integration with digital platforms, ensuring a seamless transaction experience for both providers and consumers.

Where to learn more about Corytech offerings for niche markets?

The best way to understand Corytech's offerings for niche markets is through a personalized demo. This allows potential clients to see firsthand how Corytech's solutions can be tailored to their specific business needs and gain insights into the functionality and benefits of their paytech services.

What’s Next?

In summary, the article underscores the importance of customizing merchant payment solutions to address the specific requirements of high-risk niche markets, especially those considered to be high-risk, such as online education and digital goods. With the rapid evolution of payment technologies and the unique challenges presented by these specialized sectors, businesses must select payment solutions that offer flexibility, security, and ease of use. The integration of emerging technologies like blockchain, AI, and mobile payments is set to further transform these markets, highlighting the need for businesses to stay informed and adaptable.

Corytech’s offerings exemplify this approach, providing tailored solutions that align with the diverse demands of the high-risk niche markets. As the landscape continues to evolve, staying abreast of technological advancements and shifting market demands will be key to success in the dynamic world of niche market payment solutions. Consult our experts and get pro answers to all your questions regarding a PSP for high-risk businesses.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources