According to the Field Report from the Chargeback website in 2022, by the end of 2023, the average amount of a single chargeback is going to be $190. As a progressive business owner, you understand how paramount it is to handle chargebacks and refunds efficiently. Without the fair-and-square strategies in place, you could find yourself dealing with costly losses and customer dissatisfaction. To help you secure the best of your repayment and chargeback management service, here are seven tips you should follow.

Chargeback VS Refund: How They Differ

Is a chargeback the same as a refund? No. Chargeback and refund are two terms that are often used interchangeably, but they are not the same thing. Chargeback is the bit-by-bit process of taking back a payment made to a company, while refund is the process of giving back the money to a customer.

Refunds are available for a vast number of reasons, including if the product a customer ordered never arrived, the product was defective, or if a customer was billed for a product that was never ordered. In most cases, a customer can request a refund by visiting the company's website and filling out a form.

On the other hand, chargebacks can only be issued in certain circumstances. If you have been charged for a product that you didn't order or if you have not received your order within 30 days, you can request a chargeback after a refund by applying with your bank.

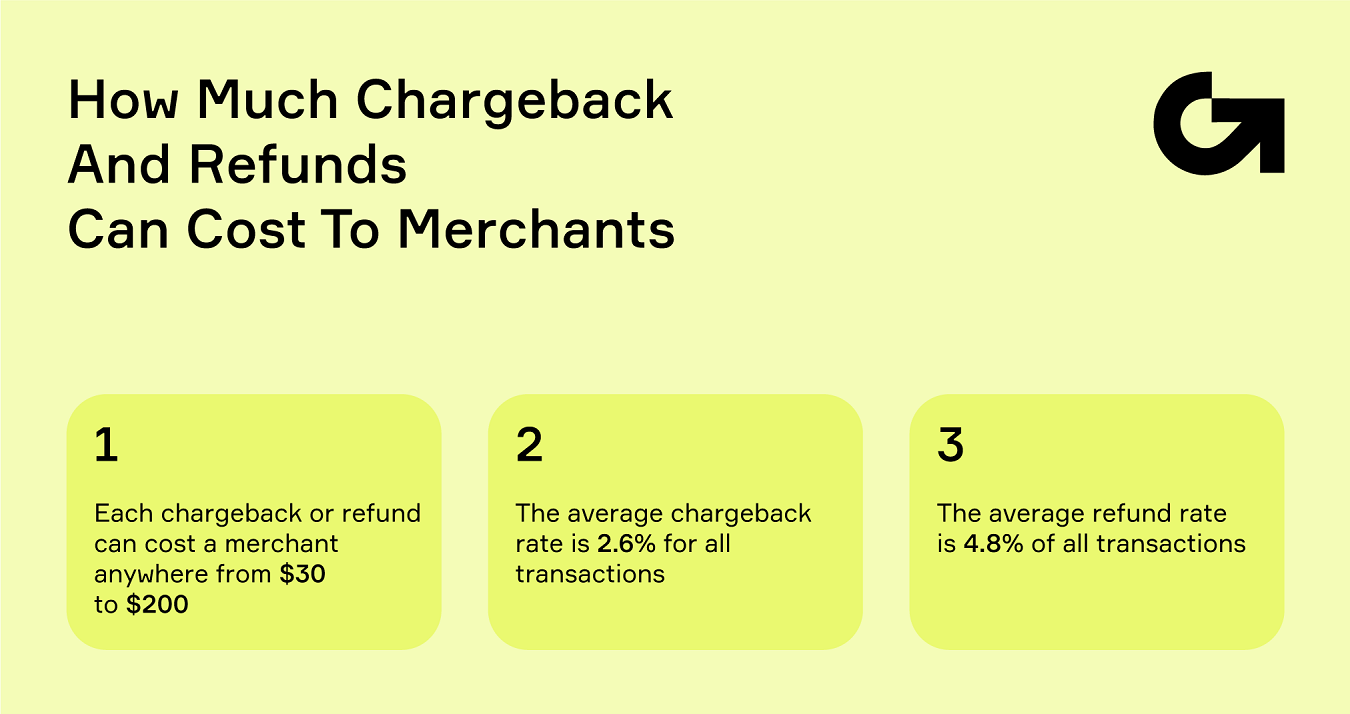

How Much Chargeback And Refunds Can Cost To Merchants

The outlay of refund and chargeback fees can be a significant burden on small businesses. Each chargeback or refund can cost a merchant anywhere from $30 to $200, depending on the size of the business. That's not to mention the time spent processing refunds and chargebacks, which can result in lost productivity. If you are a small business owner looking to diminish the cost of chargebacks and refunds, consider implementing these chargeback management solutions to decrease the number of chargebacks and refunds your business receives.

The average chargeback rate is 2.6% for all transactions, and the average refund rate is 4.8% for all transactions. This means that for every 100 transactions, there are 2.6 refunds and 4.8 chargebacks. If a retailer has a 1% chargeback rate, it would mean that for every 10,000 transactions, there would be 100 chargebacks. According to Juniper Research, Fighting Online Payment Fraud In 2022 & Beyond, eCommerce losses resulting from criminal fraud were as high as $20 billion dollars globally in 2021.

Benefits Of Chargeback And Refunds Management

The primary benefit of chargeback and refund management is reducing costs associated with disputes and refunds. Having a proactive approach to managing chargebacks and refunds can help merchants minimize the amount of time and money they spend on dealing with disputes and refunds. How long does a chargeback refund take? It depends on the issue, but anytime you take from the business will not lead you to success. This means that merchants should focus on other activities, such as providing customers with better service. It is vital as more than 80% of consumers freely admit that they’ve filed a chargeback out of convenience, according to Chargebacks911, 2018 Consumer Survey.

Another benefit of eCommerce chargeback management is that it can help traders improve their relationships with customers. By understanding customers' needs and taking proactive steps to address chargebacks and refunds, merchants can build trust and loyalty with their customers. This can result in long-term customers who are more likely to make repeat purchases.

If you implement a comprehensive chargeback and refund management system, it can help you build better customer relationships. Whether you devote time to analyzing customer complaints and developing solutions that address those complaints, you can improve customer satisfaction and generate more business.

| PRE-TRANSACTION CHARGEBACK MANAGEMENT | POST-TRANSACTION CHARGEBACK MANAGEMENT |

| Avoid Chargeback Expenses | Recover Proceeds |

| Relationships Increase Profits | Improve Industry |

| Fewer Risk | Prevent Future Chargebacks |

| Ensure Sustainability | Protect Card-Acceptance Status |

| Enhance Fraud Prevention | Enhance Customer Service |

Tips On How To Manage Chargebacks & Refunds Effectively

Chargebacks are a way for a customer to dispute the charges on their credit card. This is a common problem and you can avoid it as a business owner by taking preventative measures. Here are some tips on simplifying chargeback management and working with refunds effectively.

Learn major chargeback & refund reasons from your customers

When a customer decides to purchase on your website, they are deciding to spend their money with you. It is your job to make sure that the customer is satisfied with their purchase. If a customer decides to return their purchase, it is your job to make sure that they are satisfied with the refund management service and it is also your responsibility to make sure that they are not charged any fees. Learn the different reasons why customers may be returning their purchases and how you can manage these chargebacks and refunds effectively.

List all possible chargeback/refund sources

Chargebacks and refunds, as well as double refund chargebacks, are a part of any business, but it is meaningful to learn the major chargeback reasons from your customers to manage them effectively. Knowing the reasons why customers are requesting chargebacks or refunds can help you take steps to reduce the number of chargebacks you receive. Here are some of the common chargeback reasons you should be aware of

- Fraudulent Activity: Fraudulent activity such as stolen credit cards or unauthorized use of cards is a major cause of chargebacks. It’s important to have chargeback fraud management in place to identify and prevent fraudulent activity.

- Merchant Error: When merchants make errors such as shipping the wrong item or not providing the expected level of service, customers may request a chargeback.

- Product or Service Disputes: Customers may not be satisfied with the product or service they receive and may request a chargeback in these cases. One-quarter of online shoppers say they've disputed a transaction in the last 12 months, as PYMNTS mentioned in Tackling the Chargeback Surge.

- Subscription Cancellations: Customers may cancel a subscription but fail to receive a refund or mistakenly believe that they are still subscribed.

- Friendly Fraud: Invalid disputes filed by a cardholder. Friendly fraud chargebacks can reach between 40% and 80% of all eCommerce fraud losses, according to Forbes.

By learning the major chargeback reasons from your customers and taking steps to prevent them, you can reduce the number of chargebacks you receive and manage chargebacks and refund management services.

Develop a chargeback/refund management strategy

Chargeback and refund management is an essential task for any online business. To ensure financial success, online vendors should create an effective strategy to manage chargebacks and refunds effectively. 80% of chargebacks are fraud-connected. This includes both third-party (“criminal”) fraud, as well as first-party (“friendly”) fraud, according to Mastercard, Chronicles of the New Normal.

First, vendors should create a procedure on how to prevent criminal fraud chargebacks. This can include features like up-to-date antivirus software, strong cardholder authentication, and regular security reviews.

Besides, merchants should be ready to eliminate merchant errors. By creating a process to review and improve the customer experience, dealers can reduce the number of chargebacks resulting from mistakes.

Finally, merchants should take steps to handle customer-friendly fraud. By creating a chargeback management service to quickly and accurately respond to fraudulent or false payment claims, you can reduce the number of chargebacks resulting from friendly fraud.

Choose whether manage chargebacks/refunds in-house or outsource that

When it comes to managing chargebacks and refunds, a lot of companies choose to outsource that function to a third party. Outsourcing is often a good idea for smaller companies, but for larger corporations, it is noteworthy to have in-house chargeback management.

In-house operations can be more cost-effective but they may require more manpower and resources. On the other hand, outsourcing can help reduce the burden on the internal team by providing expertise in the field and helping them focus on core business activities.

How Corytech Can Help In Managing Chargebacks And Refunds

Chargebacks can be over the odds and time-consuming for vendors, which is why it is important to have a well-established strategy in place to manage these issues. Corytech is an online platform that helps traders control chargebacks, refunds, and chargeback disagreements by providing merchant tools like level-best chargeback management operating procedures, merchant agreements, dispute keys, and more. Corytech has helped thousands of businesses overseas organize their chargeback issues in one stroke and without a hitch.

Chargeback/Refund Management FAQ

What are the pros of managing chargebacks and refunds internally?

Managing chargebacks and reimbursements internally can have many advantages. It allows businesses to have more iron hand over the process, as they can develop their policies and procedures to best suit their needs. It can help to reduce costs associated with third-party services, as well as provide more transparency and visibility into the process. Furthermore, it can help businesses to raise awareness of their customer's needs and preferences, allowing them to better tailor their services and offerings. Finally, controlling big-ticket chargebacks and repayments deep down can help businesses to build better customer relationships and trust, as customers will be more likely to trust a business that is as clear as a bell and accountable for its processes.

Is it effective to outsource chargeback/refund management?

Outsourcing chargeback and repayment management can be an on-track way to handle customer disputes. It can help to downsize the time and effort required to process disputes, as well as provide access to experts who are experienced in confrontation resolution. Outsourcing can help to ensure that customer disagreements are handled quickly and efficiently, which can help to minimize the risk of customer dissatisfaction.

What are some tools or services that manage chargebacks and refunds?

There are numerous tools on the market to help control chargebacks and friendly fraud. Chargeback management tools include payment mainframes, top-scale fraud prevention software, and customer service software. Payment processors such as Address Verification Service (AVS), card security codes (CVV), 32D Secure 2.0 (3DS2), and Visa Account Updater (VAU) can help to prevent chargebacks by verifying customer information and tracking transactions. Modern fraud prevention software can detect fraudulent activity and help to reduce chargebacks. Automated response programs provided through card networks, like Consumer Clarity (for Mastercard) and Order Insight (for Visa) work in real-time to resolve inquiries. Using two (or all of them) together can enrich accuracy.

What’s Next?

Managing refunds and chargebacks can be a difficult process without the right tools and strategies in place. Finding the right partner to provide these services out of the box can be the best option for businesses looking to streamline their operations and ensure a smooth process. Having a suitable counterpart in place can help businesses save time, money, and resources, as well as reduce the risk of fraud and other potential issues.

Corytech is an innovative fully-featured platform that can help businesses manage chargebacks and refunds with might and main. With its powerful features, businesses can easily keep track of their transactions and protect their profits. It provides a secure and reliable way to process payments, manage refunds, and monitor chargebacks. Additionally, Corytech’s intuitive dashboard allows businesses to quickly and easily monitor their transactions and take action when necessary. With its comprehensive suite of features, Corytech is the perfect quick fix for any business looking to streamline its chargeback and refund processes. Request a personalized demo to see how Corytech can help you.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)