Payments are an essential part of each business as the most important connection between the seller and customer. A payment method can vary: a business can accept payments by phone, via wire transfer, bank card, cryptocurrency, or all of them if needed. In the 21st century, it is normal for a business to have a high transaction volume and process a hundred thousand payments daily.

With time, a business accumulates various business and private information about the processed payments. If used correctly, this data can be a valuable source of business insights and help to reduce operational costs, mitigate business risks and increase revenues. Payment analytics software collects, processes, stores, and analyzes payment information to provide an upper-level view of the payments in the company or organization.

Why Is Payment Analytics Important

Payment data is any personal or business information about the payment sender, acceptor, location, bank, cards, mobile wallets, and payment amount. Payment analytics integrates and processes this data to get valuable business insights allowing business owners to check an acquirer's health, set up fraud protection protocols, investigate the customer’s behavior, and find the flaws in payment processes.

Payment data analysis is important for business growth. While the company can process thousands of transactions per day, every flaw can also cost thousands. However, this analytics not only discovers the problems but also shows the future development directions.

Money flows show the potential points of growth. Using the payment analytics dashboard, online merchants can make more well-thought and informed operational decisions, reduce costs and generate higher revenues. Consider just two examples of typical business tasks and their solutions with analytical tools.

Acquirer health check

An acquirer is an object that acquires a payment from a person or company, like a bank. Usually, online merchants use a multi-acquirer setup. Payment analytics software can make a health check for each of them: the percentage of unsuccessful transactions, conversion rates, and historical track records.

The acquirers invest a lot in flawless work to stay in business, but sometimes the processes go wrong, especially for work in multiple currencies. An acquirer can block a payment because of currency issues, and a merchant loses a client. If a significant percentage of unsuccessful transactions relates to one acquirer, it is a warning for a merchant.

Webstore Analytics

Website analytics is helpful even without integration with payment analytics solutions. The integration increases the helpfulness of the data, provides a complete view of shoppers, and helps see new patterns and insights. For example, a merchant can see that many customers leave the website with a card drop because the user interface is unclear, and they just cannot finish a purchase. A merchant can see the whole customer journey on one dashboard.

So, payment analytics is important and useful for business development, it helps find the bottlenecks and issues in work and keeps the payment processes healthy.

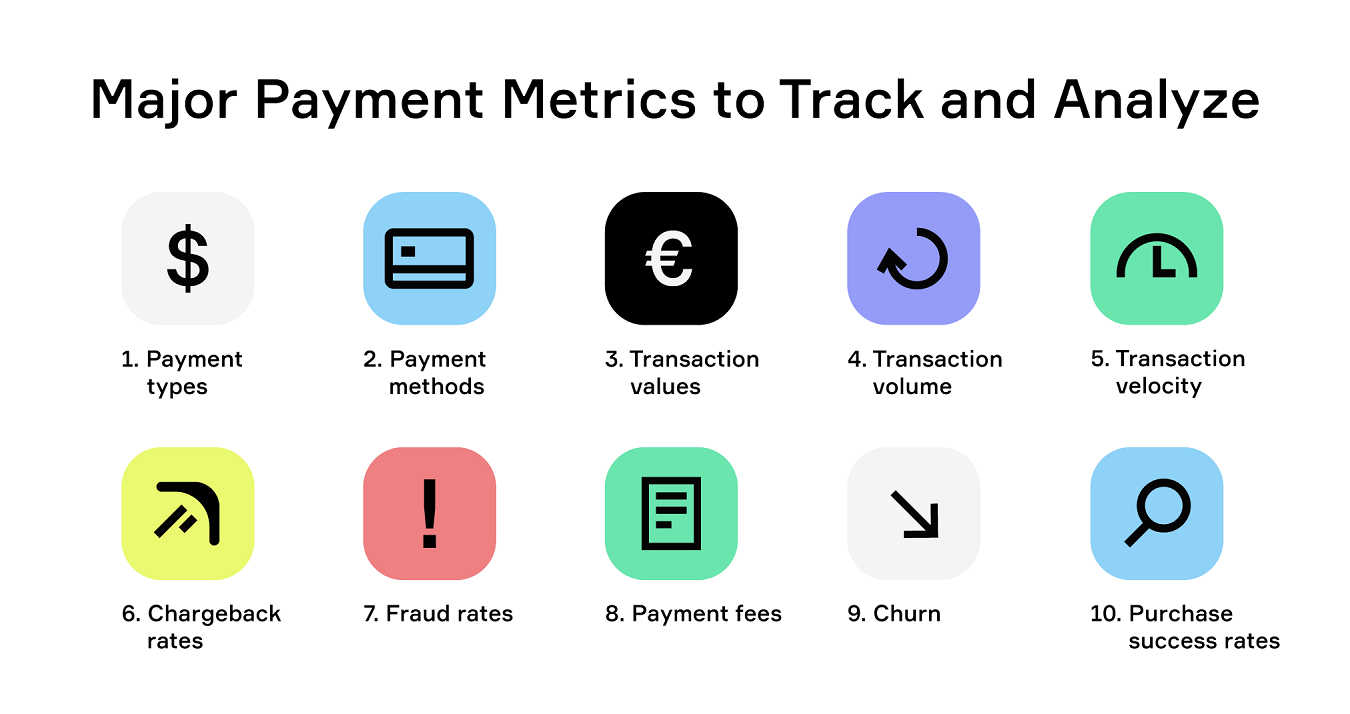

Major Payment Metrics to Track and Analyze

Payment analytics allows tracking, measuring, and analyzing all the important metrics related to payments. Most of the metrics are provided in percent, for example, a chargeback rate is the number of chargebacks for 1000 payments. The best practice is to collect and analyze metrics monthly. Here is the list of major metrics.

Payment types

Information about the popular payment types can become an important insight. For example, if the clients prefer debit cards over credit cards, the merchant can negotiate lower payment fees for one of these categories.

Payment methods

Analysis of payment methods helps to identify the most used ones and understand the recent trends. For example, if the number of NFC payments grows, the merchant should consider investments in mobile terminals.

Transaction values

Transaction values (minimum. maximum, average) can be calculated with the division of total sales by the number of transactions. This is valuable marketing information because it shows the way to increase an average purchase amount.

Transaction volume

Transaction volume can hardly be the same day by day. Some days it shrinks and on the peak days, it skyrockets. Payment data analytics discovers and highlights periods of abnormal payment volume. With multichannel analysis, it is possible to find the reasons for highs and lows and adapt the business processes to this rhythm.

Transaction velocity

The check of transaction velocity is important for fraud prevention. For example, a recurring transaction with the same card in a short period can be a signal of fraud. Payment analytics discovers the standard payment velocity and finds any anomalies.

Chargeback rates

The chargeback rate is a share of chargebacks in the total transactions number. Usually, businesses measure the chargeback rate on a monthly basis. Across the industries, the healthy chargeback rate is 0.6% or 6 chargebacks for 1000 transactions. If this number is higher, it is important to make a health check.

Fraud rates

According to the latest statistics, 70+% companies face payment fraud attempts in 2020-2021. The companies deny revealing the number of successful payment frauds; however, it is clear that it is also significant. Collect and analyze information about fraud attempts to define the latest payment fraud trends, the vulnerable spots in the security system, and the general ability of your business to resist online fraud.

Payment fees

No matter, if a merchant sets a payment fee or the payment system does it: a business owner should always look for a balance with payment fees: high fees reduce the number of clients, and low fees negatively impact profits. Payment analytics can show the fee range that is appropriate for the clients and profitable for the merchant.

Churn

Business constantly loses clients; it is a natural process called churn. A healthy churn rate depends on the industry, for example, in the IT industry it is 11%, and in telecommunications, it is 31%. If a churn rate grows, it means some issues in the business should be addressed urgently.

Purchase success rates

The purchase rate is the percentage of customers who visited a website and purchased something. A merchant can get this rate by dividing the number of visitors by the purchase number, usually monthly. If the purchase success rate is lower than average, something should be fixed – it can be traffic or the process of payment, further analysis can provide additional insights.

.png)

How To Use Payment Analytics Insights & Benefits at Once

After the payment analytics solution collected the information and created many dashboards with graphs and numbers, a merchant can start using the given insights. Here is a list of the most effective actions with the data analysis results.

#1. Discover payment trends across sales channels and locations

A merchant should use multifunctional analysis to see the results and metrics for all payment acquirers, sales channels, and locations it works with. Using cross-filters, it is possible to see the data for a selected location or channel and compare the metrics with others.

#2. Uncover payment methods and ways

The customer is a King, claims the popular saying. A merchant should provide the customers with various options to pay, otherwise, they will leave for competitors. Payment analytics can provide some tips on customer engagement via payments.

Here is a simple example: your business still accepts payments by phone. With all respect to traditions, this payment method requires some trained staff. If the analysis shows many uncompleted payments, like card drop-out, it means this payment channel is too narrow. Self-pay terminal integrated with a payment system can become a win-win solution for clients and businesses.

#3. Explore frauds, chargebacks, and refunds

Payment frauds, chargebacks, and refunds are the risks for your business. Unlike other problems, this is a direct money loss, so it should be addressed at the first turn. Payment analytics can show if the chargeback and refund rates in the company are healthy. If the rates are higher than average, it is a sign of the existing problems.

Fraud analytics can show if a merchant loses money because of the frauds, and how much, reveal the most frequent fraud patterns and schemes, and point out the security issues to address to save money.

#4. Learn customer behavior

The investigation of customer behavior with payment analytics software reveals customers’ shopping patterns and highlights the area that needs improvement. A merchant can learn the average payment amount, peak hours and days for payments, favorite currencies, number of returning customers, and so on.

This information can better understand customer preferences and use this information for a more effective marketing strategy, boost conversions, and reduce the number of card drop-outs. Besides, it helps resist payment fraud: any unusual transaction is visible.

#5. Find ways to optimize payments

360 degrees payment analytics investigates the payment process at all stages and finds ways to optimize payment. For example, in the international e-shop customers from one country prefer wire transfers while in another country they gravitate to crypto payments. A business owner can work on payment improvement, for example, add more cryptocurrencies to pay.

#6. Improve customer loyalty and customer experience

Customer behavior analysis helps to segment the target audience and define the groups of the most loyal customers. The merchant can directly address some customers to keep them loyal, and other groups to increase their loyalty. It is also possible to improve the customer experience if the payment analytics show some flaws, for example, the higher chargeback rate for some products.

Unveil How Corytech’s Advanced Analytics Solution Can Grow Your Business

Corytech offers a broad range of specialized services available on the Corytech payment platform. Small and medium businesses value affordable pricing and easy installation that does not require a team of software engineers.

Enterprises choose Corytech because of its scalability, high transaction processing speed, and high load resistance. Corytech payment system can process thousands of payments with a stable transaction processing speed.

Corytech works with several conventional and cryptocurrencies, its security protocol complies with the highest international financial standards, and it meets the requirements for a reliable payment platform. The anti-fraud system protects all transactions from hacker attacks.

Corytech also has a native payment analytic module. It goes together with a payment system and does not require complex installation and setting up. The merchant can use dashboards that show metrics and graphs for analysis.

Payment Analytics FAQ

What can we do with payment data?

With payment data, you can see the upper-level picture of your business from the payment point of view. With this data, you can detect and prevent fraud, analyze customer behavior, optimize marketing investments, and get many useful business insights.

How can I optimize resource allocation with the help of payment analytics?

Optimizing resource allocation means the focus on profit-generating activities. For example, if the graph shows the regular peak hours, a merchant can schedule extra shifts for this time. Another example: launch marketing campaigns in different locations and comparing the number of payments from each of them to evaluate the effectiveness.

Can I assess payment data quality with payment analytics insights?

With these insights, you can define flaws, blind spots, and bottlenecks in payment processes and in this way assess data quality. Moreover, you can remove all issues and increase payment data quality.

What’s Next?

Analytics in the payment industry is a powerful tool that can save costs, increase revenues, optimize resource allocation, and open room for business improvements. Corytech offers a payment analytic solution for businesses of all sizes. This fast and user-friendly solution can add value to your business. Contact us and request a demo to see how Corytech can help you!

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)