Once seen as a niche novelty, accepting cryptocurrency payments has become a must-have revenue stream in the iGaming and Payment Service Providers (PSPs) world. Today, businesses that accept bitcoin and other cryptocurrencies are no longer just dipping their toes into an emerging trend; they are positioning themselves to take market share and customer loyalty.

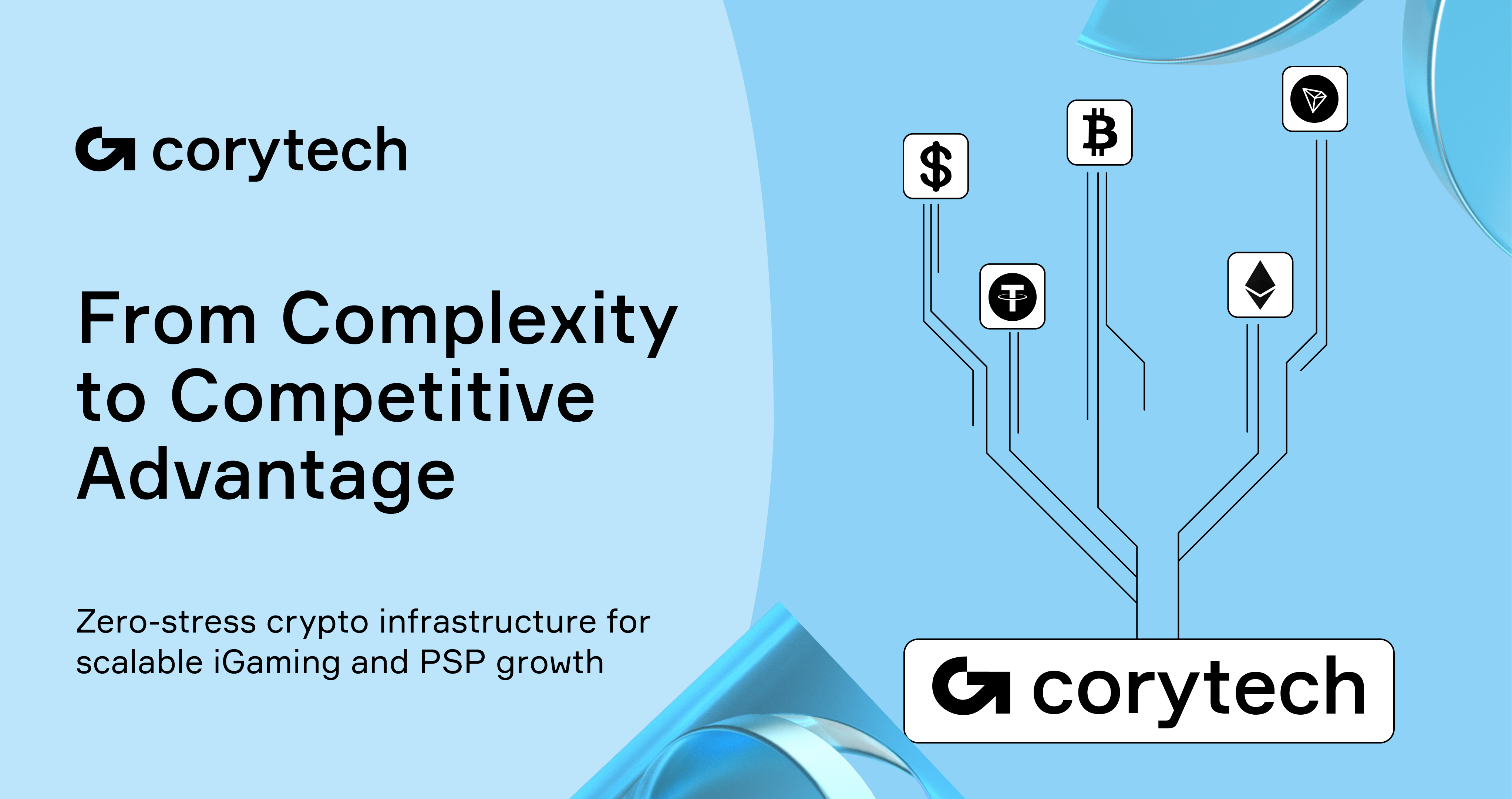

But as demand grows, so does the expectation for simplicity. PSPs and iGaming companies are calling for “zero-stress” crypto payment solutions—reflecting Corytech’s philosophy of making complex technology easy. The challenge is clear: How can businesses navigate the complexity of cryptocurrency payment gateways without compromising efficiency or customer experience?

“Turning complexity into competitive advantage” isn’t just a nice idea; it’s a business imperative. Being able to turn volatile crypto billing into predictable transaction flows is not just operational relief but competitive differentiation. And the window to be the first to market with cryptocurrency payments is closing fast, so action needs to be swift.

This paper will show how businesses can turn crypto payment processing from a headache into a growth driver, and future-proof their operations.

Introduction to Crypto Payments

Cryptocurrency payments, also known as crypto payments, have revolutionized the way businesses and individuals accept and make payments around the world. With the rise of cryptocurrencies like Bitcoin, Ethereum, and others, crypto payments have become a popular alternative to traditional payment methods like credit cards and bank accounts. In this section, we will delve into the world of crypto payments, exploring the basics, benefits, and impact on growth.

Understanding the Basics

To get started with crypto payments, it’s essential to understand the basics. Crypto payments involve the use of cryptocurrencies, which are digital or virtual currencies that use cryptography for secure financial transactions. Cryptocurrencies are decentralized, meaning they are not controlled by any government or financial institution. This decentralization allows for peer-to-peer transactions without the need for intermediaries like banks. To accept crypto payments, businesses can use a crypto payment gateway, which facilitates transactions and converts cryptocurrencies into fiat currencies.

The Complexity Barrier: Why Crypto Processing Feels Scary

Common Problems

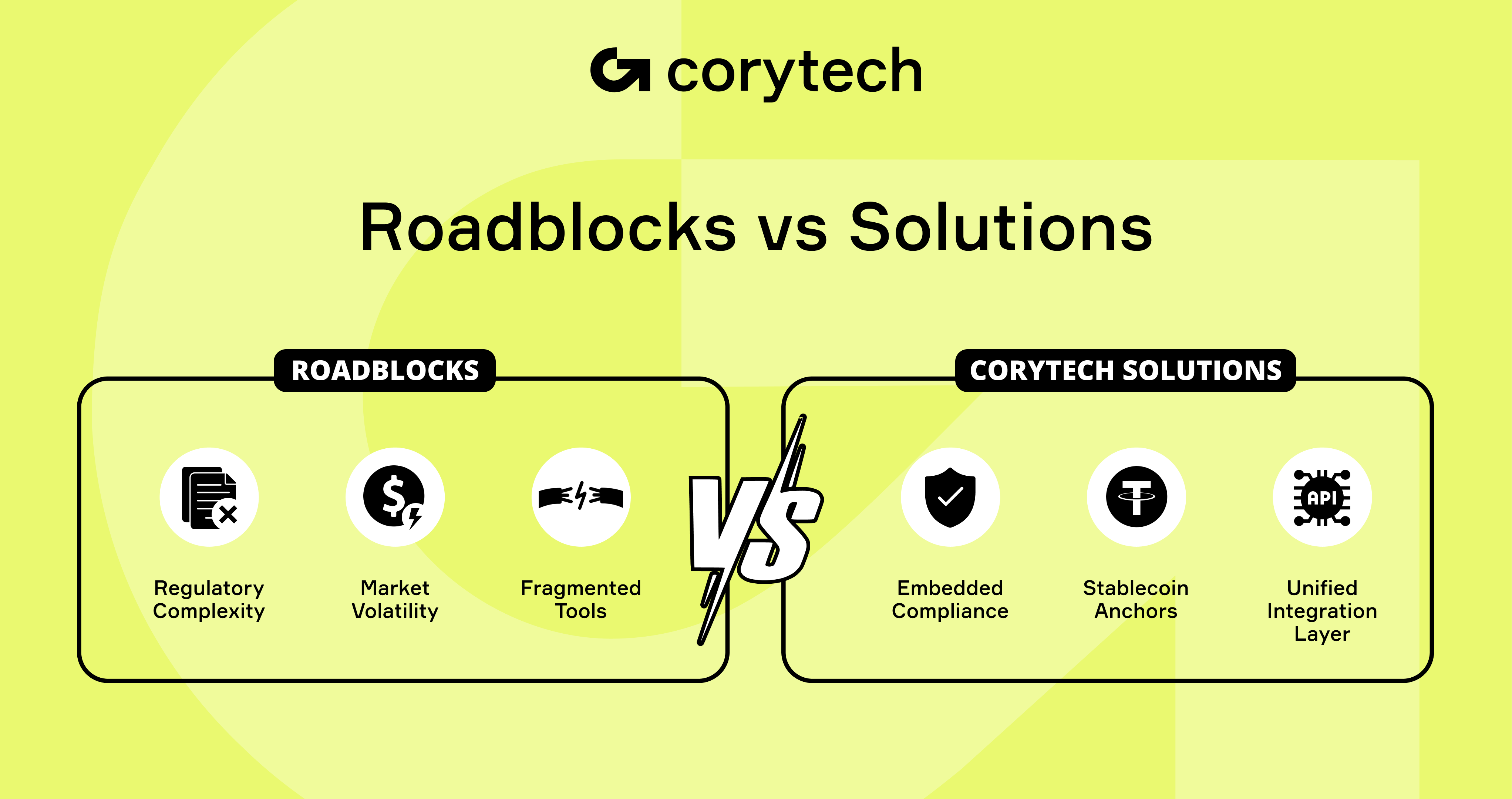

Cryptocurrency payment processing introduces several scary hurdles, chief among them being compliance confusion, volatile currency values and fragmented market solutions. Compliance regulations around crypto are inconsistent across jurisdictions, so businesses don’t know how to navigate. Check your country’s cryptocurrency regulations before setting up payment gateways. Understanding local regulations is crucial to ensure compliance, especially in regions with strict rules. The volatility of cryptocurrency values poses a big financial risk, complicating budgeting and stability. Cryptocurrency payment processors are compared based on fees, features and supported cryptocurrencies, which adds another layer of complexity for businesses choosing the right solution.

In iGaming and PSP sectors, these problems are even more acute. The stakes are high due to large transaction volumes which amplify the impact of any market fluctuations or technical issues. High volume transactions require robust payment gateways to handle the increased turnover effectively. Fraud and security concerns increase operational complexity and risk. Businesses involved in crypto transactions are subject to strict AML and KYC regulations, which adds another layer of compliance. But cryptocurrency payments have advanced security features that make it hard to alter transactions, which can help mitigate some of these risks.

Impact on Growth

The impact of crypto payments on growth is significant. By accepting crypto payments, businesses can expand their customer base and increase revenue. Crypto payments also provide a secure and transparent way to conduct transactions, which can help build trust with customers. Additionally, crypto payments can reduce transaction fees and processing times, making them an attractive option for businesses and individuals alike. With the increasing adoption of cryptocurrencies, the demand for crypto payment gateways and processors is on the rise, providing opportunities for companies to innovate and provide enhanced security measures.

Corytech’s mission addresses these pain points by turning turbulent cryptocurrency processes into smooth, reliable mechanisms so businesses can keep momentum and grow confidently in a safe and innovative environment. This includes setting appropriate conversion rates to ensure that cryptocurrency systems align with business operations, providing a seamless experience for customers.

By enabling businesses to accept transactions in multiple cryptocurrencies, Corytech leverages blockchain technology to ensure security and transparency. This infrastructure not only allows businesses to process transactions efficiently but also to tap into a global market, bypassing traditional banking limitations.

Anchoring in Stability: Finding Predictable Solutions in a Volatile World

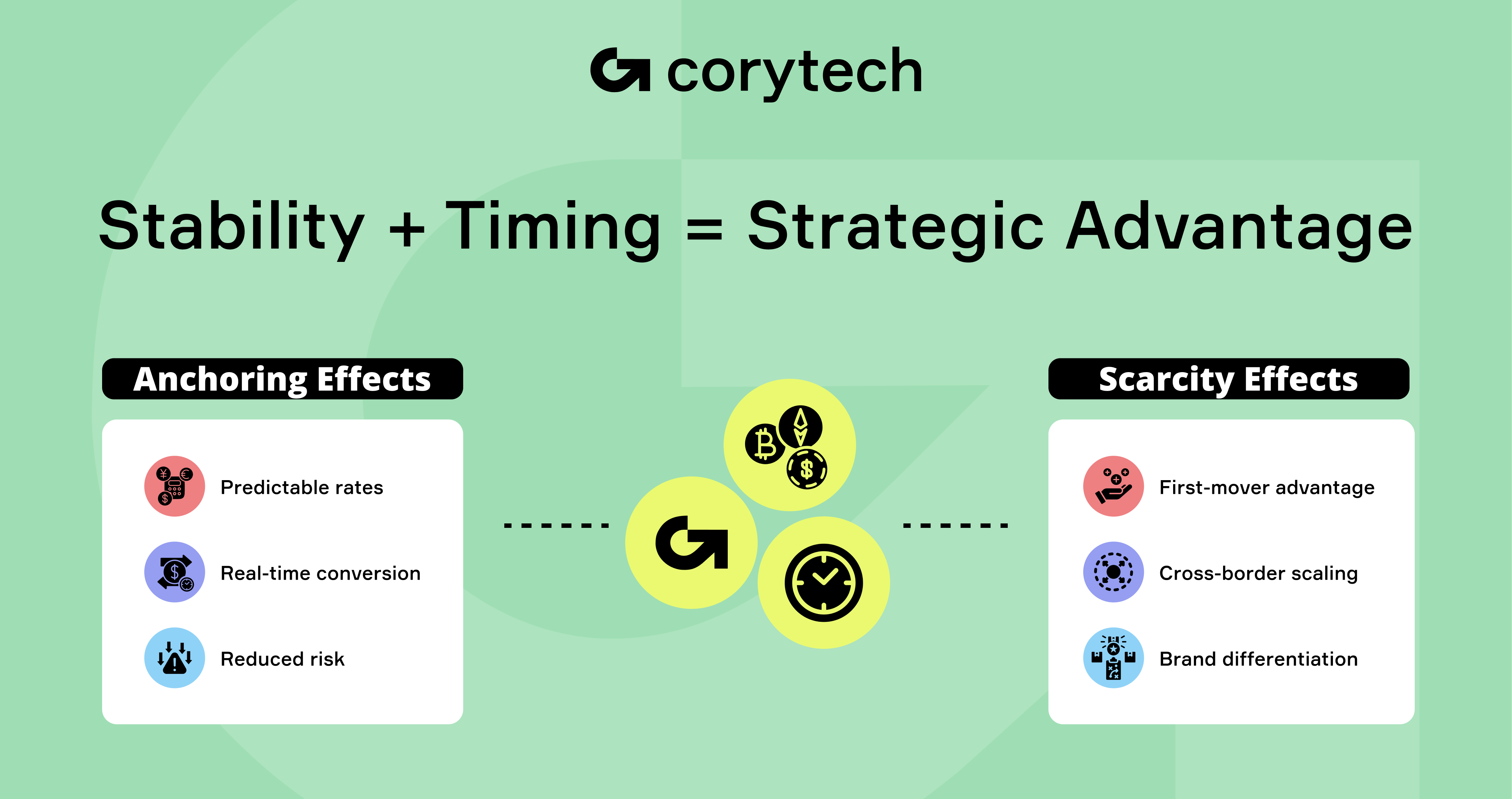

Kahneman’s Anchoring Insight

In the fast changing financial world, the concept of “anchoring” plays a big role in decision making. Psychologists Daniel Kahneman and Amos Tversky introduced the anchoring effect, which shows how we rely heavily on the first piece of information we get when making decisions. This initial reference point influences our subsequent judgments and behaviour. In the context of cryptocurrency’s volatility, businesses often look for a stable reference to guide their financial strategy, such as fixed exchange rates.

Corytech addresses this need by providing a predictable roadmap that’s an anchor against the perceived instability of digital currencies. By offering consistent and reliable crypto payment solutions, Corytech enables businesses to navigate the crypto world with confidence and turn uncertainty into a growth strategy through seamless exchanges.

Real-World Anchors

The adoption of stablecoins—cryptocurrencies pegged to stable assets like the US dollar—has grown, providing businesses with a reliable medium for transactions. In 2024, stablecoin transaction volumes reached $15.6 trillion, rivaling the Visa Network’s totals, proving their growing role in global payments.

Payment Service Providers (PSPs) that have integrated stablecoins into their operations report improved transaction efficiency and lower costs. For example, the iGaming industry has seen a big shift, with stablecoins accounting for 35.5% of all crypto transactions in 2024, a 29.6% increase in overall transaction volume. This efficiency is largely due to the decentralized network of blockchain technology, which verifies transactions through network nodes, ensuring security and transparency.

Corytech embodies this principle by rethinking financial technology to create a consistent, zero-stress experience. Their focus on stability and innovation means businesses can adopt crypto payment solutions without the usual turbulence of digital currencies. By anchoring in stability, businesses can mitigate the challenges of crypto volatility and turn obstacles into opportunities for growth and competitive advantage. ## The Scarcity Factor: Seizing a Limited Window for Competitive Advantage

Cialdini’s Scarcity Principle

Renowned psychologist Dr. Robert Cialdini showed us the power of scarcity: people value things that are perceived as limited or fleeting. In the world of crypto payments, the “window of opportunity” is exactly that—a narrow but powerful moment to stand out before mass adoption erodes early-mover advantages.

The clock is ticking. In 2024, over 420 million people worldwide owned cryptocurrency, expected to surge past 580 million by the end of 2025. Crypto-friendly transactions are no longer futuristic—they’re fast becoming expected. Businesses that wait risk becoming irrelevant, while those who act now lock in market share, save money on transaction fees, build long-term user trust, and shape consumer expectations before competitors catch up.

First-Mover Benefits

For high-growth sectors like iGaming and payment service providers (PSPs), embracing crypto early comes with big advantages:

- User Acquisition: Crypto-savvy players and merchants are looking for platforms that support flexible, anonymous and cross-border payments. Accepting cryptocurrency can increase new user sign-ups by up to 27% (source: Coingate, 2024).

- Brand Differentiation: In crowded markets, standing out is everything. Supporting crypto payments means innovation, modernity and global readiness—three traits that resonate with today’s digital-native audiences.

- Cross-Border Expansion: Cryptocurrency removes the friction of FX rates, international banking delays and compliance overhead, enabling fast, low-fee expansion into new markets without costly infrastructure changes.

To accept cryptocurrency payments businesses need to create digital wallets to manage incoming funds, ensure smooth and secure transactions.

- User Acquisition: Crypto-savvy players and merchants are looking for platforms that support flexible, anonymous and cross-border payments. Accepting cryptocurrency can increase new user sign-ups by up to 27% (source: Coingate, 2024).

- Brand Differentiation: In crowded markets, standing out is everything. Supporting crypto payments means innovation, modernity and global readiness—three traits that resonate with today’s digital-native audiences.

- Cross-Border Expansion: Cryptocurrency removes the friction of FX rates, international banking delays and compliance overhead, enabling fast, low-fee expansion into new markets without costly infrastructure changes. Corytech takes the friction out of change. With modular integrations, intuitive dashboards and robust compliance support businesses can go from crypto-curious to crypto-capable in record time. Whether you’re a PSP launching multi-currency settlements or an iGaming operator tapping into global liquidity, Corytech helps you stay ahead of the curve. Many crypto payment gateways allow businesses to convert cryptocurrency earnings into fiat currency, providing flexibility and reducing exposure to market volatility. Businesses can accept cryptocurrency payments by connecting their website to a crypto payment processor’s API, streamlining the integration process and enhancing operational efficiency.

From Complexity to Growth Engine: The Building Blocks of a Winning Strategy

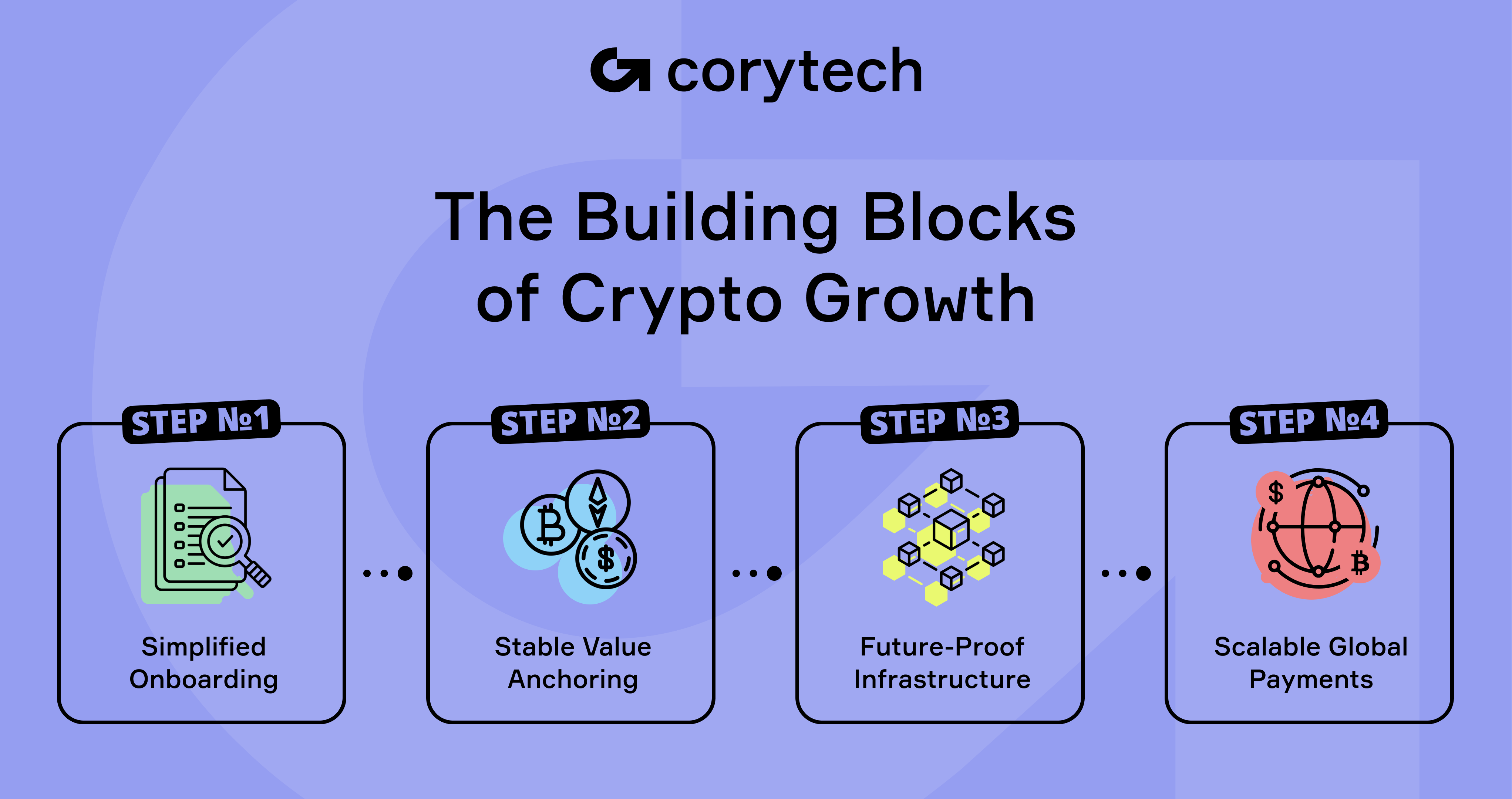

Step 1: Simplified Onboarding

The crypto ecosystem can be a compliance minefield, but Corytech eliminates the friction from the start. Through automated compliance checks, seamless wallet integrations and built-in KYC flows, businesses can get started without drowning in paperwork or regulatory ambiguity. Users need to submit the necessary documentation for verification, whether as an individual or a business. For PSPs and iGaming platforms processing large volumes, this zero-stress onboarding ensures they’re compliant, connected and customer-ready from day one.

Step 2: Bridging Volatile to Stable Value

Volatility has long been the dealbreaker for many crypto-curious businesses. Corytech solves this by offering access to stablecoins, real-time hedging tools and instant fiat conversions. These tools act as a financial stabilizer—ensuring that a $1 transaction today remains a $1 value tomorrow. Whether settling player winnings or processing merchant transactions, Corytech anchors your operations in financial predictability. CoinGate provides automated cryptocurrency payment gateway solutions for businesses, further simplifying the process of managing crypto transactions. For those seeking the best crypto payment gateway, these solutions offer seamless cryptocurrency integration, ensuring secure and efficient transactions across various industries.

Step 3: Future-Proof Infrastructure

Crypto is evolving fast and today’s solution can quickly become yesterday’s limitation. Corytech’s infrastructure is built with tomorrow in mind—supporting seamless integration of new coins, tokens and blockchain upgrades. Businesses gain the agility to adapt as the ecosystem evolves, ensuring their crypto capabilities stay current, scalable and competitive.

Selecting the right provider is crucial for businesses looking to integrate crypto payment solutions. These providers facilitate secure payment transactions, manage fees associated with cryptocurrency exchanges, and offer tailored solutions. This future-ready foundation positions brands as forward thinkers and allows them to capitalise on the limited window of differentiation in the market. In short, it’s not just about staying in the game—it’s about leading it.

Crypto Payment Gateway

A crypto payment gateway is a platform that enables businesses to accept crypto payments and convert them into fiat currencies. It acts as a bridge between the merchant and the customer, facilitating transactions and providing a secure and reliable way to accept payments.

Facilitating Transactions

A crypto payment gateway facilitates transactions by providing a secure and reliable way to accept crypto payments. It typically involves the following steps:

- Integration: The merchant integrates the crypto payment gateway into their website or online store.

- Payment: The customer selects the crypto payment option and sends the payment to the merchant’s wallet.

- Conversion: The crypto payment gateway converts the cryptocurrency into the merchant’s preferred currency.

- Settlement: The merchant receives the payment in their bank account or wallet.

By using a crypto payment gateway, businesses can accept crypto payments from customers around the world, without the need for intermediaries like banks. This can help increase revenue, reduce transaction fees, and provide a secure and transparent way to conduct transactions. With the rise of e-commerce and online stores, crypto payment gateways have become an essential tool for businesses looking to expand their customer base and increase revenue.

Corytech’s Role: Reliable Innovation at the Core

Tailored SolutionsCorytech offers purpose-built tools to make crypto payment processing accessible, reliable and scalable. From multi-currency settlement layers to integrated crypto wallets and real-time transaction monitoring, each solution is designed with practical business needs in mind. Rather than burden clients with technical deep dives, Corytech focuses on outcomes: smoother operations, fewer manual touchpoints and faster time to revenue.

But technology is only half the story. Corytech’s continuous support model ensures businesses have expert guidance not just during launch—but long after. Their comprehensive services, including dedicated onboarding specialists, crypto payment services, invoice generation services, and 24/7 technical support, eliminate guesswork, keeping clients confident and proactive.

Zero-Stress Implementation

Where crypto payment gateways are often tangled with friction, Corytech’s approach minimizes common blockers like compliance misalignment, fragmented toolkits or settlement delays. With embedded KYC flows, robust AML modules and streamlined integration APIs, the technical lift becomes minimal—and so does the stress. This ensures a smooth experience for customers during the integration of cryptocurrency processing into existing payment systems.

For decision-makers, this means peace of mind: complexity is handled under the hood, so they can stay focused on growth, not logistics. With Corytech, adding crypto payments to your stack isn’t a risk—it’s a strategic move made easy.

Roadblocks vs. Opportunities: Choosing Predictability over Paralysis

Common Reservations

Despite the momentum, several reservations still hold businesses back:

- Volatility: Fear of rapid price swings impacting revenue.

- Regulatory uncertainty: Constantly shifting global compliance requirements.

- Steep learning curve: Lack of internal expertise or crypto fluency.

- Credit card comparison: Concerns about how cryptocurrency transaction fees compare to traditional credit card processing fees.

Many countries require specific licenses for companies involved in cryptocurrency transactions, adding another layer of complexity for businesses considering crypto adoption.

- Volatility: Fear of rapid price swings impacting revenue.

- Regulatory uncertainty: Constantly shifting global compliance requirements.

- Steep learning curve: Lack of internal expertise or crypto fluency.

But with the right partner and framework these hurdles become manageable. As Kahneman’s anchoring principle suggests, adopting a stable and reliable solution reframes these risks. Corytech acts as that anchor—transforming crypto acceptance from a gamble into a calculated, strategic move.

Opportunity Snapshot

The market signals are clear. Crypto gaming transactions grew by over 50% in 2024, with forecasts pointing to continued double-digit expansion through 2026. The crypto-enabled economy isn’t just growing—it’s accelerating. According to Cialdini’s scarcity principle, hesitation today may cost you tomorrow’s leadership. The brands that move now gain early-adopter advantages, define new customer expectations, and set themselves apart in an increasingly crowded space. Additionally, merchants can save on costs associated with cashing out crypto payments by efficiently managing withdrawals. Practical guidance on setting up withdrawal addresses and initiating the withdrawal process is essential for optimizing financial transactions.

Predictability isn’t just possible—it’s available. And Corytech is here to make it simple.

What’s Next?

Turning crypto complexity into a growth engine is a strategic advantage, not just a tech add-on. Businesses that anchor their operations in a stable, scalable solution while seizing today’s shrinking window of opportunity will unlock new revenue, market share, customer loyalty, and facilitate seamless purchases.

By aligning predictability with urgency and pairing tailored support with future-ready infrastructure Corytech helps businesses confidently get into the crypto economy—with zero stress.

Let’s talk about your zero-stress path to competitive advantage. Contact us to learn more about Corytech’s crypto payment solutions, including easy-to-use payment buttons, or schedule a consultation today. Your opportunity to lead starts here.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources