As cryptocurrency adoption grows, iGaming operators and other online businesses are integrating crypto payments to meet evolving customer preferences and stay competitive. According to a report by TripleA, over 420 million people worldwide use cryptocurrency, with more than 15,000 businesses already accepting crypto payments. The global crypto payments market is projected to reach $4.92 billion by 2030, driven by the demand for secure, fast, and borderless transactions.

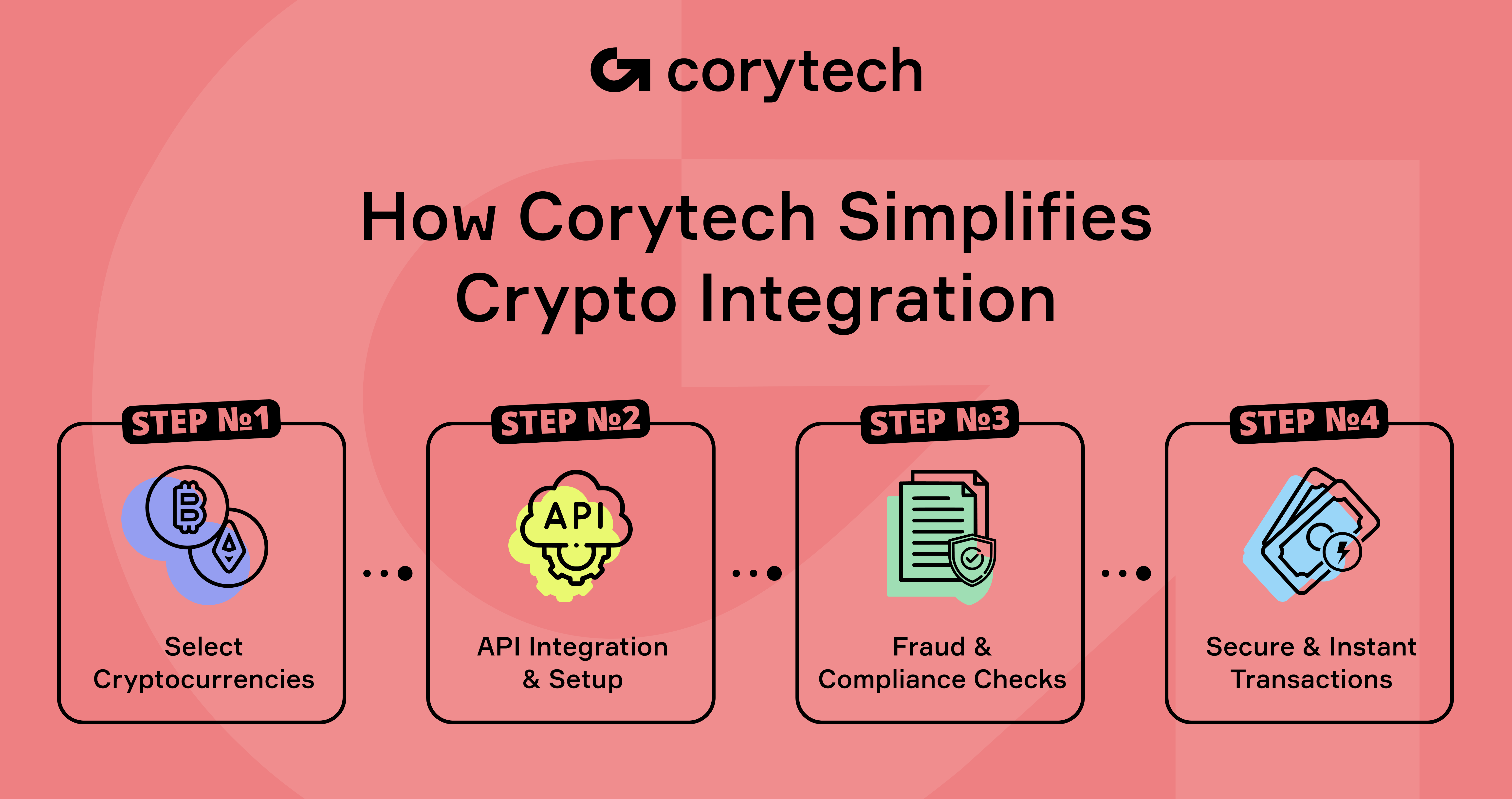

While the concept of crypto integration might seem complex, Corytech simplifies the process, offering a payment orchestration platform that allows businesses to efficiently accept and manage multiple crypto payment methods. This guide provides a clear, step-by-step walkthrough of how businesses can integrate crypto payments using Corytech’s powerful technology.

Why Integrate Crypto Payments?

Market Trends and Demand

The adoption of cryptocurrency as a payment method has been growing rapidly, driven by consumer demand for faster, more secure, and cost-effective transactions. Businesses that integrate crypto payments can access a global, tech-savvy audience, reduce transaction fees, and enhance security.

- Global Crypto Adoption: Over 420 million people worldwide own cryptocurrency (TripleA, 2023), and this number continues to rise.

- Crypto-Friendly Businesses: More than 15,000 companies now accept crypto, including major brands like Microsoft, Starbucks, and Gucci.

- Market Growth: The crypto payments market is expected to reach $4.92 billion by 2030, growing at a CAGR of 16.6% (Allied Market Research, 2023).

The Role of Crypto in iGaming

The iGaming industry is at the forefront of crypto adoption, with over 50% of crypto transactions linked to online gambling and gaming platforms (SoftSwiss, 2023). Key benefits for iGaming operators include:

- Attracting Global Players: Crypto payments remove geographic restrictions and currency conversion hassles.

- Enhanced Security & Privacy: Players favor crypto for its anonymity and security compared to traditional payment methods.

- Lower Fees & Faster Transactions: Unlike bank transfers or credit cards, crypto payments reduce fees and enable instant deposits/withdrawals.

By integrating crypto payments, iGaming operators and online businesses stay ahead of industry trends, enhance customer experience, and boost revenue potential.

Benefits for Businesses

Integrating crypto payments enhances customer experience, reduces costs, and expands global reach.

- Lower Fees: Crypto transactions cost 0.5%–1%, compared to 2%–5% for traditional payments.

- Faster Transactions & No Chargebacks: Crypto payments are instant and irreversible, eliminating fraud risks.

- Global Accessibility: Businesses can reach unbanked populations and bypass currency exchange fees.

- Enhanced Security & Privacy: Blockchain encryption protects against fraud, and no banking details are required.

- Better Customer Experience: Digital-savvy users prefer crypto for speed and convenience, boosting loyalty.

By adopting crypto integration, businesses future-proof their operations while increasing efficiency and profitability.

Understanding Corytech’s Role in Crypto Integration

Corytech’s Payment Orchestration Platform

Corytech is a leading paytech solutions provider, specializing in streamlined payment processes, including crypto payment methods. Its payment orchestration platform enables businesses to accept and manage multiple payment options through a single, unified system.

By integrating crypto payments with Corytech, businesses gain access to fast, secure, and cost-effective transactions while ensuring compliance with industry standards.

Key Features for Crypto Payments

Corytech’s platform offers essential features that simplify crypto integration for businesses:

- Multi-Currency Support: Accepts a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), USDT, and more.

- Fraud Protection: Uses advanced encryption, risk monitoring, and anti-fraud tools to ensure secure transactions.

- Seamless Integration: Easily connects with existing payment infrastructure, supporting APIs and plug-and-play solutions for hassle-free adoption.

With Corytech’s crypto payment solutions, businesses can optimize their payment processes, enhance security, and expand into global markets.

Step 1: Assess Business Readiness

Evaluate Your Business Model

Before integrating crypto payment methods, businesses must assess whether digital currencies align with their target audience and operational goals. Industries like iGaming, e-commerce, travel, and digital services benefit significantly from crypto integration, as customers in these sectors prefer fast, secure, and global payment options.

- iGaming: Over 50% of crypto transactions are linked to online gambling (SoftSwiss, 2023).

- E-commerce: Crypto adoption in online retail grew by 60% in 2023 (CoinPayments).

- Digital Services: Freelancers and subscription-based platforms are increasingly accepting crypto to avoid high banking fees and payment delays.

Regulatory Considerations

Understanding the legal and tax implications of accepting crypto is crucial. Regulations vary by country, so businesses should:

- Check compliance requirements (e.g., licensing, KYC/AML rules).

- Understand tax obligations (e.g., capital gains, VAT on crypto transactions).

- Stay updated on government policies regarding crypto payments.

Countries like El Salvador and the UAE have embraced crypto payments, while others impose restrictions. Using Corytech’s compliance tools, businesses can navigate regulatory landscapes smoothly.

Step 2: Choose Supported Cryptocurrencies

Popular Crypto Options

Selecting the right cryptocurrencies ensures broad customer adoption and transaction stability. The most widely accepted options include:

- Bitcoin (BTC): The most recognized and used cryptocurrency.

- Ethereum (ETH): Preferred for smart contract-based transactions.

- Stablecoins (USDT, USDC): Minimize volatility, offering a stable value for payments.

Accepting a mix of major and stablecoins helps businesses reduce risk and attract a diverse customer base.

Market-Specific Preferences

Different regions favor different cryptocurrencies based on adoption rates and regulatory environments:

- Latin America: High demand for USDT and Bitcoin due to inflation concerns.

- Asia: Preference for Ethereum and Binance Coin (BNB) in gaming and DeFi.

- Europe & North America: Businesses often support BTC, ETH, and stablecoins for mainstream adoption.

By offering region-specific crypto payment options, businesses can maximize customer convenience and engagement.

Step 3: Partner with Corytech for Seamless Integration

Platform Setup

Corytech simplifies crypto payment integration with a user-friendly dashboard and dedicated support team, ensuring a smooth onboarding experience. Businesses can:

- Set up an account quickly with guided onboarding.

- Access real-time analytics for monitoring transactions.

- Rely on expert support for compliance and technical assistance.

With no complex setup required, Corytech makes integrating crypto payments efficient and hassle-free.

API Integration

Corytech’s API solutions allow businesses to integrate crypto payment methods seamlessly into their existing systems without disrupting workflows. Key benefits include:

- Plug-and-play APIs for fast integration.

- Customizable payment flows tailored to business needs.

- Seamless compatibility with e-commerce platforms, gaming sites, and SaaS solutions.

With Corytech’s robust APIs, businesses can accept crypto payments effortlessly while maintaining operational efficiency.

Step 4: Optimize User Experience

Simplified Checkout Flow

A smooth checkout experience is crucial for conversion rates. Corytech’s platform reduces cart abandonment by offering:

- One-click crypto payments for fast transactions.

- QR code support for mobile-friendly payments.

- Instant confirmations to enhance user trust.

By streamlining the crypto payment process, businesses can improve customer satisfaction and increase conversions.

Real-Time Conversion Rates

Crypto’s volatility can pose risks, but Corytech’s real-time currency conversion ensures stable transactions by:

- Locking in exchange rates at the time of purchase.

- Supporting instant fiat conversions to reduce exposure to price fluctuations.

- Providing automated settlement options for hassle-free payouts.

With real-time conversion tools, businesses can accept crypto payments while minimizing risk and ensuring pricing stability.

Step 5: Ensure Security and Compliance

Fraud Prevention Tools

Security is a top priority when integrating crypto payments, and Corytech offers a suite of advanced fraud prevention tools to ensure both businesses and customers are protected. With cryptocurrency transactions being irreversible, securing payment flows is essential for mitigating fraud risks. Corytech’s comprehensive fraud detection features include:

- Real-Time Transaction Monitoring: Corytech continuously tracks every transaction to detect patterns indicative of fraud, such as unusual transaction sizes or frequency. This monitoring allows for immediate alerts in case of suspicious activity, enabling businesses to respond quickly.

- Risk Assessment Algorithms: Corytech’s intelligent algorithms analyze each transaction’s risk level by looking at factors such as transaction history, customer behavior, and IP geolocation. High-risk transactions can be flagged for additional review before being processed.

- Two-Factor Authentication (2FA): To ensure only authorized parties are making payments or withdrawals, Corytech incorporates multi-factor authentication (MFA) methods such as 2FA, adding an extra layer of security. Customers must verify their identity via a secondary channel, such as an email or mobile device, before completing a transaction.

- Multi-Signature Wallets: For added security, businesses can use multi-signature wallets, which require multiple signatures (from different parties or devices) to authorize a transaction. This significantly reduces the risk of a fraudulent withdrawal.

These fraud prevention measures help safeguard businesses from crypto-related fraud, such as chargebacks, hacking attempts, and account takeovers, providing a secure environment for both the business and their customers.

AML and KYC Integration

With the global rise of cryptocurrency, regulatory bodies are increasingly focused on anti-money laundering (AML) and know-your-customer (KYC) practices. These regulations are crucial to ensuring that businesses do not become platforms for illicit activity. Corytech integrates both AML and KYC processes directly into its platform, ensuring businesses remain compliant with both local and international regulations.

- AML Compliance: Corytech’s AML tools help businesses detect, prevent, and report suspicious activity, such as money laundering or the financing of terrorism. The platform monitors transactions to identify patterns that may indicate illegal activity, including large transactions, transfers to high-risk countries, and rapid movement of funds between wallets.

- KYC Integration: Corytech’s KYC integration ensures that businesses verify the identity of their customers to meet regulatory standards. The platform provides a comprehensive KYC solution that checks government-issued IDs, validates customer details, and cross-references with global sanction lists. This identity verification process reduces the risk of fraud, identity theft, and money laundering.

- Automated Compliance Reporting: Corytech automatically generates compliance reports required for regulatory submission, reducing the administrative burden on businesses. Reports include transaction history, flagged activities, and verified customer information, ensuring that businesses can meet the requirements of financial authorities and avoid penalties.

By incorporating AML and KYC measures, Corytech ensures businesses can continue to accept crypto payments with confidence, meeting legal obligations and safeguarding their operations.

Step 6: Test, Launch, and Monitor

Pre-Launch Testing

Before launching the crypto payment system, businesses need to conduct comprehensive pre-launch testing to ensure that the integration runs smoothly without any glitches. Testing is crucial for identifying potential issues, ensuring compatibility, and fine-tuning the process. Key aspects to focus on during the testing phase include:

- Simulating Payment Scenarios: Businesses should run multiple test transactions to simulate real-world payment scenarios. This helps identify any issues with transaction processing, such as failures, delays, or incorrect amounts being processed. Testing different types of crypto payments (e.g., Bitcoin, Ethereum, stablecoins) will ensure all options work seamlessly.

- Transaction Confirmation Testing: Corytech’s platform ensures that payment confirmations are sent instantly upon completion. During testing, businesses should check if confirmations are received promptly and whether customers are informed of the transaction status in real-time. This helps maintain trust and transparency in the payment process.

- Mobile and Cross-Platform Testing: A significant portion of crypto transactions occurs via mobile devices, so testing on various devices and browsers is crucial. Ensure that the crypto payment solution works across multiple platforms, including smartphones, desktops, and tablets. This also includes testing QR code functionality for mobile payments.

- Security Checks: In addition to functional testing, businesses should conduct security testing to ensure that there are no vulnerabilities that could compromise the system. This includes stress testing the platform’s fraud detection tools and testing two-factor authentication (2FA) systems.

By thoroughly testing before launch, businesses can mitigate the risk of disruptions and ensure a smooth customer experience when accepting crypto payments.

Post-Launch Monitoring

Once the crypto payment integration goes live, it’s essential to closely monitor the system’s performance and customer behavior. Post-launch monitoring helps businesses identify issues early, optimize processes, and ensure the crypto payment system is running smoothly. Key monitoring activities include:

- Transaction Analytics: Corytech’s real-time analytics dashboard provides businesses with insights into the transaction volume, payment success rates, and types of cryptocurrencies being used. This data can help identify trends, assess payment method popularity, and track revenue growth from crypto payments.

- Conversion Rates and Customer Behavior: Tracking conversion rates and customer behavior is vital to understanding how well the crypto payment system is performing. Businesses can identify areas where customers are abandoning the checkout process or where friction occurs, allowing them to fine-tune the user journey and improve conversion rates.

- Fraud Alerts and Security Monitoring: Corytech’s fraud detection tools remain active post-launch, continuously monitoring for suspicious activities. If any unusual behavior is detected (such as high-risk transactions or abnormal patterns), businesses are immediately alerted so they can take action. Monitoring also includes checking for potential chargeback fraud or unauthorized access attempts.

- Performance Optimization: With data insights from the analytics tools, businesses can refine their crypto payment strategy, optimize checkout flows, and adjust which cryptocurrencies are accepted based on customer preferences. These insights are crucial for enhancing user experience and ensuring the platform evolves with customer needs.

By continuously monitoring and optimizing the crypto payment system, businesses can ensure that they are providing the best experience for their customers while maintaining high levels of security and operational efficiency.

The Future of Crypto Payments with Corytech

Innovation-Driven Solutions

Corytech is committed to providing cutting-edge solutions that keep businesses ahead of the curve in the rapidly evolving world of crypto payments. With continuous innovation at the heart of its operations, Corytech ensures that businesses are always equipped with the latest technology and features to meet the needs of tomorrow’s customers.

As the crypto landscape evolves, Corytech will continue to adapt, offering:

- Support for emerging cryptocurrencies and blockchain innovations.

- New features that enhance transaction speed, security, and customer experience.

- Seamless updates that ensure businesses stay compliant with global regulations.

By partnering with Corytech, businesses not only stay ahead of payment trends but also future-proof their operations, opening up new growth opportunities.

How to Get Started

Ready to integrate crypto payments into your business? Corytech’s team is here to guide you through every step of the process, from consultation to full integration.

Contact Corytech today to:

- Discuss your business model and crypto payment needs.

- Explore how Corytech’s platform can simplify the integration process and enhance your payment systems.

- Learn how to leverage multi-currency support, advanced security tools, and compliance solutions.

Take the first step toward innovation by contacting Corytech and revolutionize your payment infrastructure with crypto integration.

What’s Next?

Integrating crypto payments is no longer a complex challenge for businesses. With Corytech’s advanced payment orchestration platform, businesses can easily adopt cryptocurrency solutions, streamline payment processes, and unlock new growth opportunities. Whether you're in iGaming, e-commerce, or any other industry looking to expand your payment options, Corytech offers the tools and support to ensure your success in the crypto payment landscape.

Take the first step towards innovation with Corytech today, and future-proof your business with seamless crypto payment integration!

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)