The digital payments market is growing at an unprecedented pace, projected to increase from USD 125.94 billion in 2024 to USD 137.43 billion in 2025, with a compound annual growth rate (CAGR) of 9.1%. By 2029, this figure is expected to reach USD 198.99 billion, reflecting the accelerating shift toward cashless transactions.

As more businesses and consumers transition to digital-first financial solutions, non custodial crypto wallets are becoming the preferred choice for security-conscious users. Unlike traditional custodial models, these wallets allow individuals to maintain full control over their assets, mitigating risks associated with third-party mismanagement and centralized security breaches.

Who Controls the Money?

Traditional payment systems rely on intermediaries—banks, exchanges, and processors—forcing users to trust third parties with their funds. This model has become increasingly vulnerable to cyber threats, fund freezes, and financial mismanagement. Businesses and consumers are looking for alternatives that offer greater autonomy and security.

With global cashless payment volumes expected to grow by more than 80% from 2020 to 2025, businesses and consumers alike are seeking greater autonomy and security in financial transactions.

Non-custodial wallets are emerging as the answer. By eliminating third-party custody, they enhance security, prevent fraud, and build trust while aligning with global financial regulations. With SiGMA Eurasia 2025 in Dubai set to showcase the next wave of fintech, the focus is on how businesses can implement secure, future-ready payment solutions.

The Need for Security and Trust in Digital Payments

Growing Risks and Compliance Pressures

According to the 2025 Crypto Crime Report, cybercriminals stole approximately USD 2.2 billion through crypto-related hacks in 2024 alone, a 17% increase from the previous year. With total losses exceeding USD 3.5 billion, custodial payment systems remain highly vulnerable. Centralized platforms—where third parties control user funds—remain prime targets for breaches, account freezes, and financial losses.

At the same time, regulations such as AML and KYC are tightening, making compliance a complex challenge for businesses. For PSPs and iGaming operators, security failures and non-compliance don’t just lead to fines—they drive users away.

What Users Expect Today

Security-conscious consumers are demanding more control over their funds. They want immediate access to their money, transaction transparency, and assurance that their assets won’t be frozen or mismanaged. Traditional custodial wallets struggle to meet these expectations, forcing businesses to explore decentralized alternatives that put users in control.

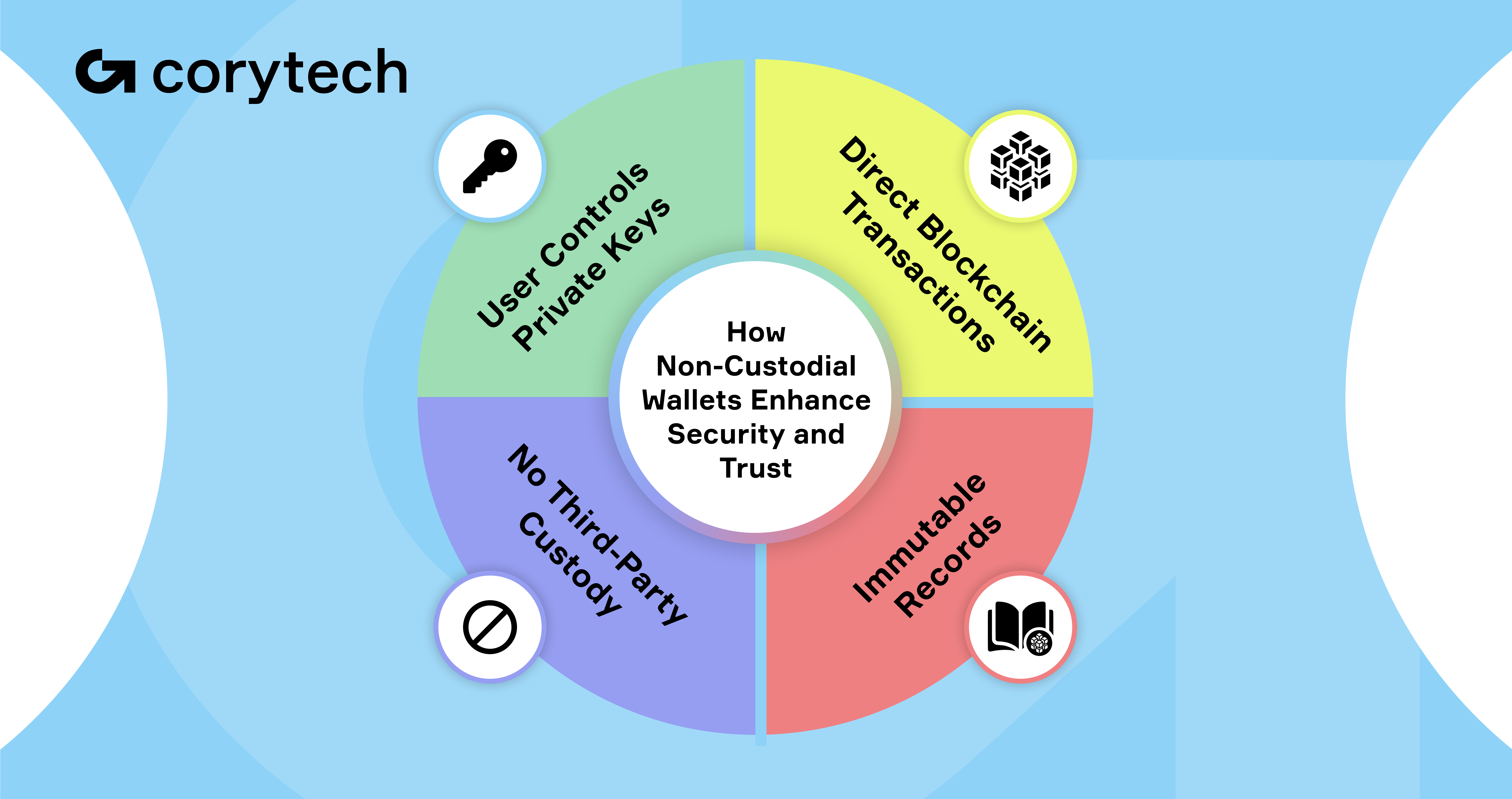

The Role of Non-Custodial Wallets

What Is Non Custodial Wallets?

A non custodial crypto wallet allows users to store, send, and receive digital assets while maintaining complete control over their private keys. The best non custodial wallet example is its incorporation into iGaming platforms, where instant deposits and withdrawals are essential for player retention. Unlike custodial wallets—where funds are held by a third party—non-custodial wallets eliminate external control, ensuring that users have access to their assets.

This shift is reshaping digital payments, moving away from centralized models introducing risks such as account freezes, fund mismanagement, and data breaches. Instead of relying on intermediaries, non-custodial wallets give users direct ownership and responsibility over their financial assets, enhancing security and autonomy.

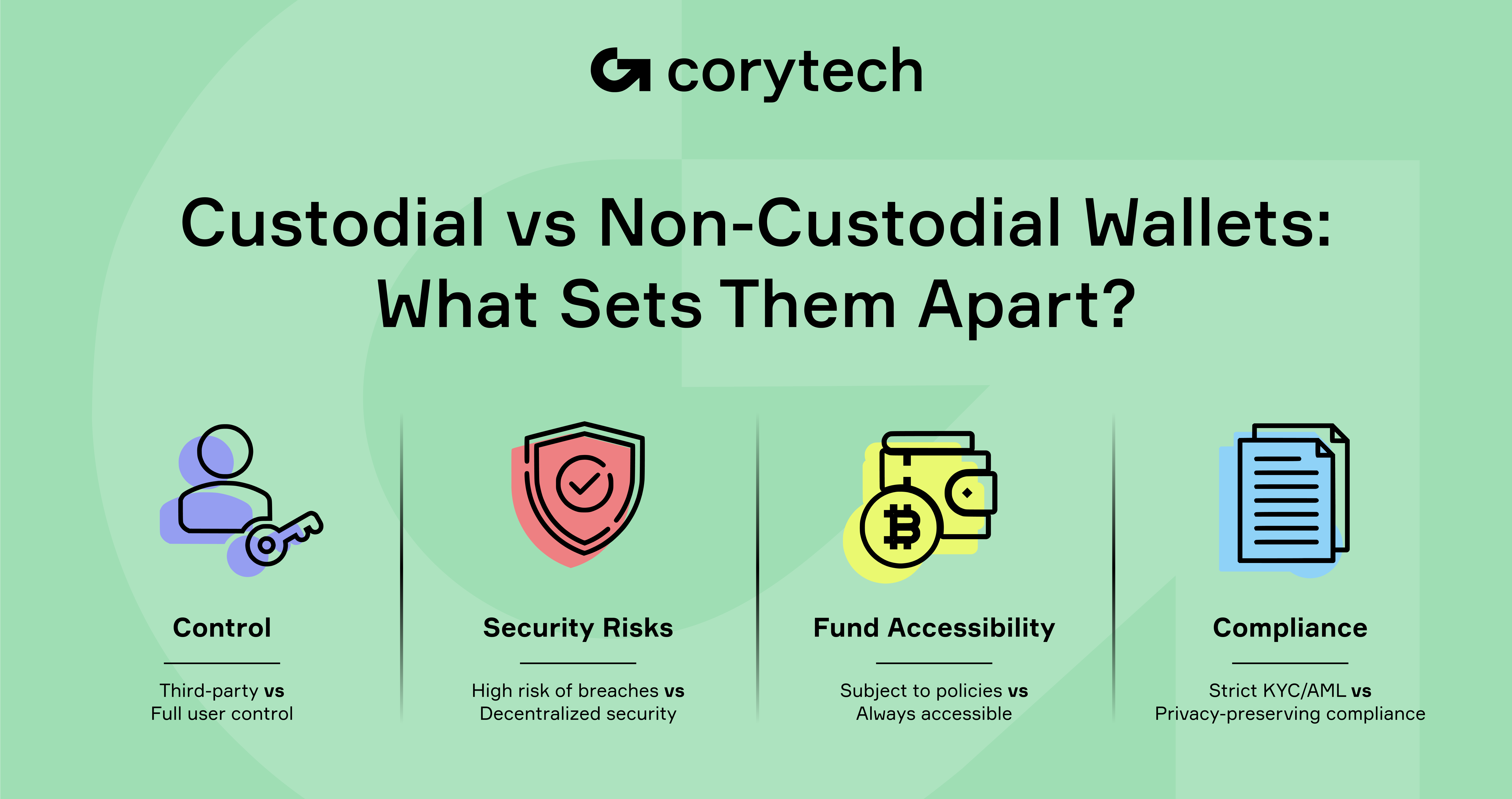

Non Custodial vs Custodial Wallet

|

Feature |

Custodial Wallets |

Non-Custodial Wallets |

|

Control |

Held by a third party |

The user has full control |

|

Security Risks |

Centralized storage, a higher risk of hacking |

No central point of failure, stronger security |

|

Fund Accessibility |

Subject to platform policies and restrictions |

The user retains full access at all times |

|

Regulatory Compliance |

Requires extensive KYC/AML and reporting |

Aligns with regulations while preserving user privacy |

|

Fraud Protection |

Relies on the platform’s security measures |

Users secure their assets |

Security and Compliance Benefits

Security concerns and the need for compliance-friendly payment solutions drive the growing adoption of non-custodial wallets. By removing third-party custody, these wallets:

- Reduce hacking risks, as funds aren’t stored on centralized servers vulnerable to breaches.

- Provide greater transparency, with all transactions recorded immutably on the blockchain.

- Guarantee unrestricted access, ensuring users are never locked out of their assets due to platform policies or government intervention.

- Align with AML/KYC regulations, allowing businesses to meet compliance requirements without exposing excessive user data.

For businesses operating in high-risk financial environments, non-custodial wallets protect against cyber threats and regulatory bottlenecks, making them a preferred choice for secure digital transactions.

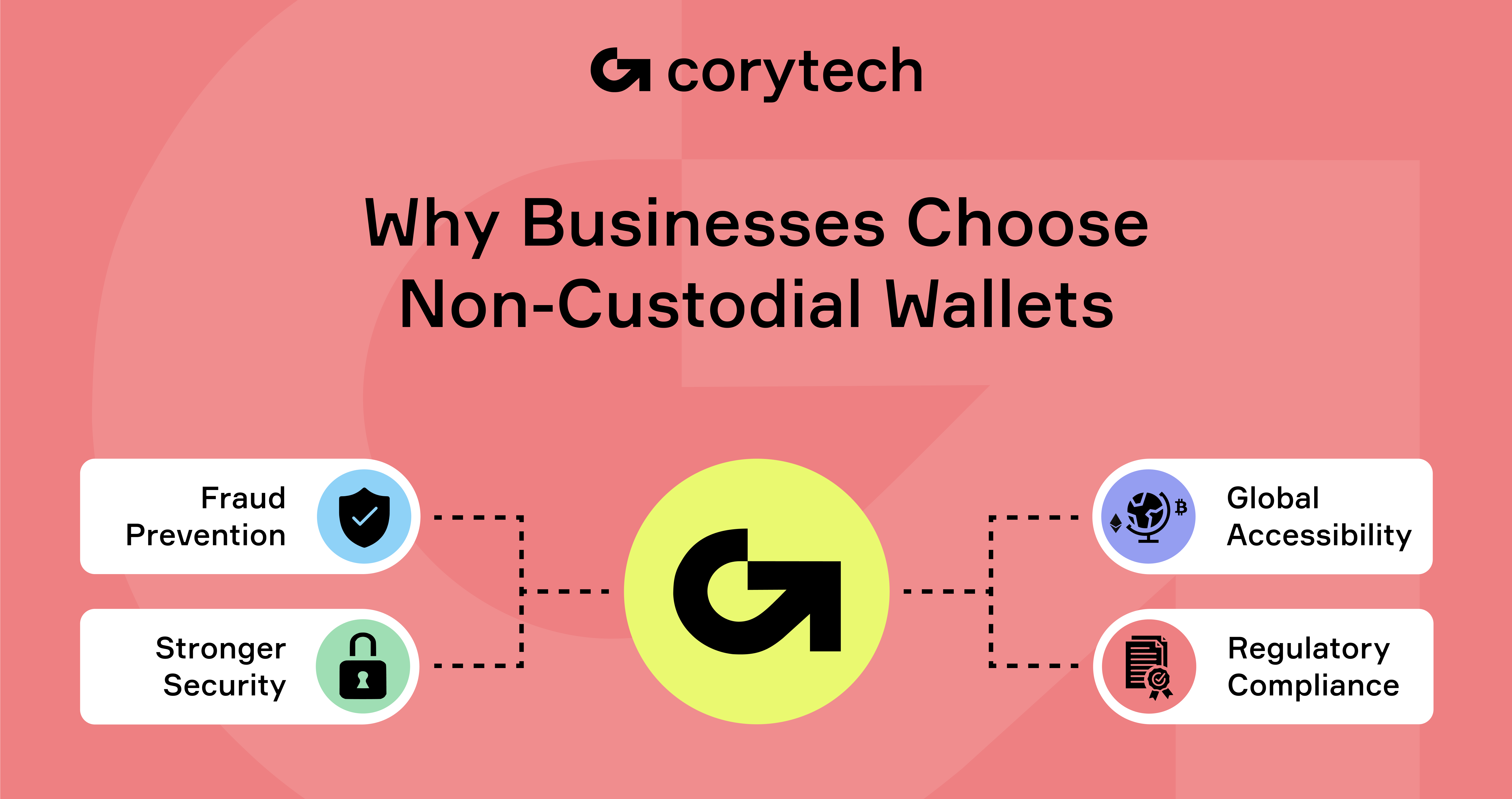

Why PSPs and iGaming Operators Are Adopting Non-Custodial Solutions

Non-custodial wallets provide a more secure, scalable alternative to traditional payment for industries that process high transaction volumes and require instant, fraud-resistant payments.

Fraud Prevention and Chargeback Elimination

Chargeback fraud is a significant issue in online transactions, particularly in iGaming and digital commerce. Because non-custodial transactions are immutable, funds cannot be reversed or withdrawn fraudulently after a service has been provided. This protects businesses from fraudulent disputes and reduces financial losses from chargeback abuse.

Unified Cross-Border Transactions

Non-custodial wallets remove geographical limitations by allowing users to send and receive payments instantly without relying on banking networks. Unlike traditional payment methods, which often involve long processing times, high conversion fees, and banking restrictions, non-custodial solutions facilitate frictionless global transactions. This mainly benefits PSPs and iGaming platforms, which serve international markets with varying regulatory landscapes.

Competitive Edge and Market Differentiation

With increasing consumer demand for secure and private financial transactions, businesses that offer non-custodial wallet support gain a trust advantage over competitors still reliant on traditional custodial models. Security-conscious users are likelier to choose platforms that provide financial autonomy, leading to higher retention rates and stronger brand loyalty.

Additionally, as digital wallets continue to dominate e-commerce and in-game transactions, incorporating non-custodial solutions ensures that businesses stay ahead of emerging payment trends.

Why Non-Custodial Wallets Matter for Business

Stronger Security and Fraud Prevention

Traditional payment models create a single point of failure. If a platform is hacked, every user is at risk. Non-custodial wallets eliminate this concern by ensuring that only users control their private keys. Funds remain safe, accessible, and untouchable by third parties.

Regulatory Compliance Without Compromising Privacy

Tighter financial regulations mean businesses must meet compliance requirements without undermining user privacy. Non-custodial wallets allow AML/KYC verification at the transaction level while preserving financial autonomy. This approach:

- Reduces compliance risks and potential fines.

- Offers auditable transaction records without requiring a centralized authority.

- Supports a more decentralized, user-first financial model.

Building Trust and Increasing Retention

Security isn’t just a regulatory issue—it’s a brand reputation issue. In industries where trust is everything, non-custodial wallets provide users with peace of mind, ensuring they never lose access to their funds due to platform failures, policy changes, or security breaches.

For iGaming platforms, this is a key competitive advantage. Players prefer instant deposits and withdrawals with no unnecessary restrictions. Offering a non-custodial payment option increases user confidence and long-term loyalty.

The Future of Payments Is Decentralized

The non-custodial wallet market is expanding rapidly, projected to grow from USD 1.5 billion in 2023 to USD 3.5 billion by 2031, with an 8% annual growth rate. This surge reflects a fundamental shift in how businesses and consumers approach financial security, driven by rising demand for data privacy, financial sovereignty, and protection against fund mismanagement.

A Rising Demand for Financial Autonomy

In July 2024 alone, nearly 5 million mobile crypto wallets were downloaded, indicating a clear shift toward user-controlled financial solutions. Consumers are moving away from traditional banking models, favoring decentralized options that grant them complete ownership over their funds.

A 2023 Consensys survey highlights this trend, with 83% of users stating that privacy and financial control are top priorities. This growing preference for self-sovereign financial solutions reflects a broader demand for digital transaction transparency, independence, and security.

The Business Case for Non-Custodial Wallets

Adopting non-custodial wallets isn’t just a consumer trend—it’s a strategic advantage for businesses. As regulatory frameworks emerge and digital wallets become the dominant method for online transactions, companies that offer secure, user-first payment options will gain a competitive edge in a rapidly shifting market.

- Digital wallet transactions are projected to grow from USD 9 trillion in 2023 to over USD 16 trillion by 2028, marking a significant surge in adoption and transaction volume.

- Global cashless payment volumes are projected to reach about USD 1.9 trillion by 2025, highlighting a clear need for borderless, secure, and frictionless payment systems.

For PSPs and iGaming operators, this means setting up future-proof payment infrastructures that meet consumer expectations for speed, security, and financial control.

Implementation Considerations for PSPs and iGaming Operators

Direct Cooperation with Existing Systems

Corytech offers a structured incorporation process, ensuring businesses can adopt non-custodial solutions (check out Deffio powered by Corytech) without disrupting their infrastructure. The rollout includes:

- Step-by-step implementation guidance.

- API-based deployment for smooth adoption.

- Dedicated support teams to manage the transition.

Regulatory Compliance and Risk Management

Navigating AML/KYC compliance is simpler with Corytech’s built-in compliance features. These include:

- Transparent transaction reporting for audits.

- Automated risk assessment tools.

- Flexible identity verification processes.

This ensures businesses remain compliant while offering users financial autonomy.

Ongoing Support and Security Updates

Corytech provides continuous technical support and security enhancements, ensuring businesses:

- Stay protected against new cyber threats.

- Receive regular software updates to maintain system integrity.

- Benefit from real-time fraud monitoring and detection tools.

What’s Next?

The Business Case for Non-Custodial Wallets

Adopting non-custodial solutions isn’t just about security, but long-term growth and regulatory flexibility. Businesses that implement them today will:

- Future-proof their payment systems against regulatory shifts.

- Attract security-conscious users looking for control over their assets.

- Enhance brand trust in a rapidly expanding digital economy.

Get Started with Deffio powered by Corytech

Explore how Deffio non-custodial wallets can revolutionize your payment system.

- Schedule a demo with Sam Kaploushenko, Head of Crypto.

- Talk to our specialists about customized solutions.

- Meet us at SiGMA Eurasia 2025 in Dubai to see our latest innovations.

The future of payments is decentralized—businesses that adapt now will lead tomorrow’s financial landscape.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)