Imagine this: You're at the airport, boarding pass in one hand, coffee in the other. Just then, a notification pops up — your rent’s been paid, a credit card’s due tomorrow, and your savings app just invested your spare change into a low-risk ETF. All of that? Done without lifting a finger. That’s fintech in action.

Let’s unpack the term, explore the types of fintech companies, and figure out why they’re not just reshaping finance — they’re rewriting the rules altogether.

So, What Is Fintech Really?

Short for “financial technology,” fintech refers to digital tools that let you handle money stuff on your phone, laptop, or any device with a screen and signal. Think apps that track your budget, platforms that let you invest in crypto, or services that make sending money overseas less painful than airport security.

But here’s the kicker — fintech isn’t just about the tech. It’s about solving problems the old-school finance world either ignored or overcomplicated.

The Evolution of a Trending Topic

Once upon a spreadsheet, “fintech” was something banks mumbled in their IT departments. Then came smartphones, cloud services, and a generation that’d rather Venmo than visit a branch. Financial technology companies were suddenly everywhere — from Silicon Valley garages to Nairobi coworking hubs.

Now, whether you're paying for coffee, checking your credit score, or buying Ethereum at 2 a.m., there's a fintech firm behind it. Sometimes, they're big names. Other times, they're lean financial tech firms building niche solutions that quietly improve your financial life.

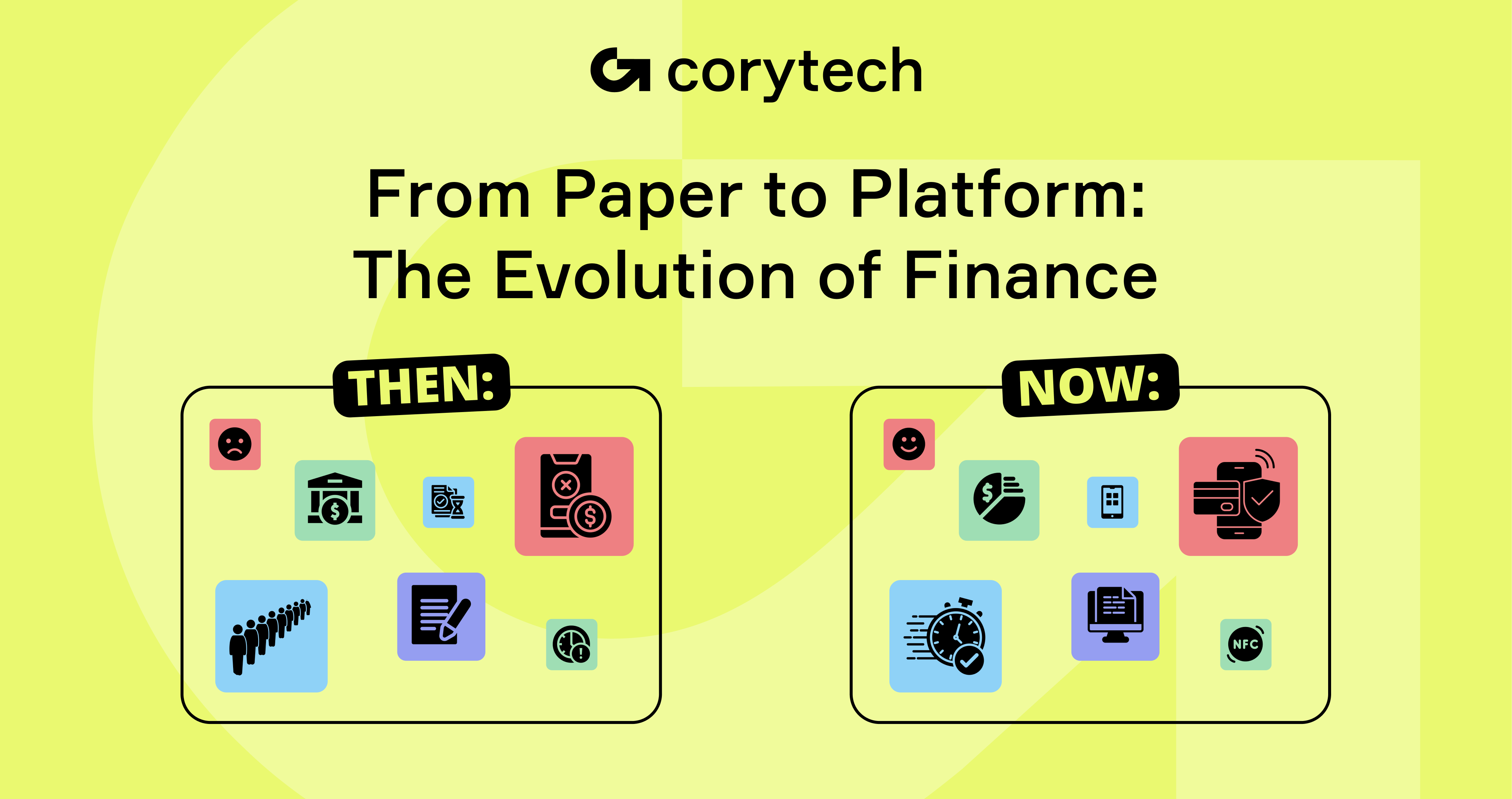

Why the Finance Industry Needed a Shake-Up

Banks weren’t broken, but they weren’t exactly built for everyone. Long wait times. Paperwork mountains. Hidden fees. You get the picture.

That’s where fintech brands stepped in — with a fresh perspective. Their goal? To make financial services more accessible, affordable, and intuitive.

- They reduced fees and simplified banking (just look at Chime).

- They took the edge off investing and made saving feel doable (Qapital nailed that).

- They also created new lending options for people who might have been overlooked by traditional banks (like Upstart).

It wasn’t about replacing the old system but making it work better for more people.

And yeah — when fintech stumbles, people remember. The FTX collapse? It didn’t just dominate headlines; it etched itself into the public’s memory as a cautionary tale. That’s the Availability Bias, a concept from psychologist Daniel Kahneman. It explains why dramatic failures like FTX stick in our minds, even if dozens of other fintech companies are doing everything right. We tend to judge the whole space by the stories that shocked us most — not by the quiet ones that worked.

What Makes Up a Fintech Business?

Let us break it down real quick:

- Finance component: banking, insurance, loans, investments — you know, the usual suspects.

- Technology component: apps, machine learning, data analytics, blockchain, cloud services — the geek squad making money smarter.

Together, they create something genuinely useful — and, dare we say, people-friendly.

Fintech Industry Overview: A Fast-Moving Machine

A Quick Trip Through History

- 1918: The Fedwire system moves money electronically.

- 1950: The first universal credit card.

- 2009: Bitcoin happens.

- Today: Your watch can tell you how much you’ve spent on lattes this week.

Who's Who in Fintech

Everyone’s fighting for a slice of your digital wallet, from fintech giants to fast-growing startups. You’ve got:

- Challenger banks like N26 or Monzo

- Crypto exchanges like Coinbase

- P2P lenders like LendingClub

- Digital insurers like Lemonade

And then there’s Corytech, powering the pipes under the whole system, helping businesses build reliable fintech tools without reinventing the wheel each time.

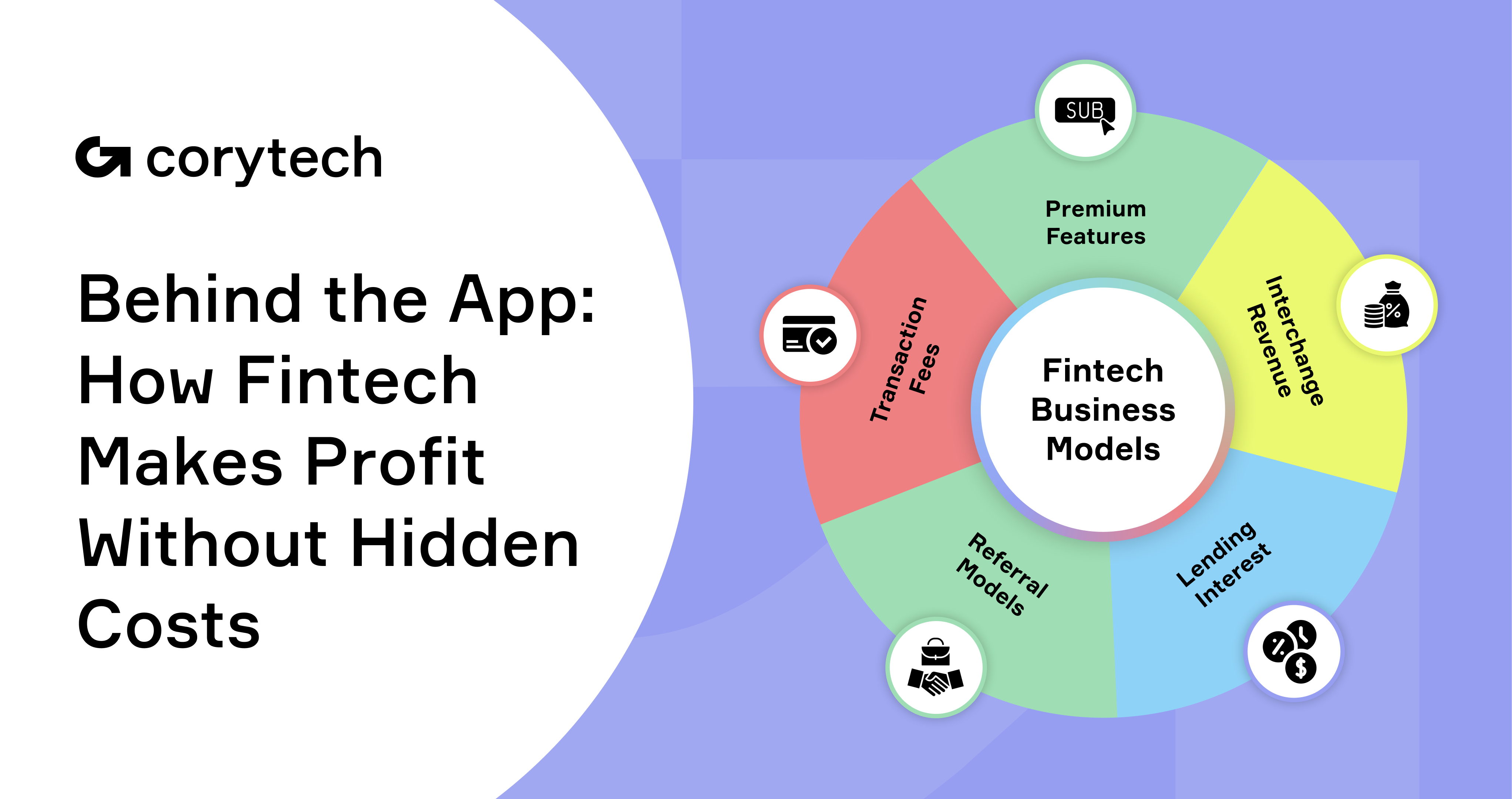

How Do Fintech Companies Make Money?

Let’s be honest — fintech companies aren’t running on good vibes and open tabs. They may offer free apps, no-fee accounts, or zero-interest loans, but behind the scenes, the business model is very much alive and kicking. The trick? Monetizing value without scaring you off with hidden charges or outdated fees.

Here’s how it really works:

Transaction fees

Whenever you send money, buy something online, or use a digital checkout, someone skips a fraction off the top. Not you, usually — but the business that accepted your payment. Platforms like Stripe, Square, or PayPal make a percentage off each transaction. It’s a volume game — millions of micro-fees add up fast.

Interchange fees

Ever swipe your debit card at a coffee shop and wonder who’s paying for the privilege? That tiny sliver of the sale — called the interchange fee — goes to the card issuer. Fintech firms offering branded cards often share in that revenue. The more you swipe, the more they make. It’s invisible to you, but lucrative for them.

Subscriptions and “freemium” upgrades

Think of those handy budgeting apps or robo-advisors that are “free to use.” That’s usually true — for basic features. But the real magic happens when users level up. Want advanced insights? Automated investing? Priority support? Time to go premium. This freemium model works wonders when people love the product enough to pay for the perks.

Lending interest and origination fees

Some fintech brands act as lenders themselves — offering small business loans, payday advances, or peer-to-peer credit. They make money on the interest you repay, often using algorithms to minimize risk and maximize margins. Sometimes they also charge an origination fee upfront (a fancy term for “starting cost”).

Referral partnerships

Fintech apps often recommend credit cards, savings accounts, or investment tools — and get paid when you sign up. It’s like affiliate marketing, but for your finances. As long as it’s transparent and actually useful, most users don’t mind.

Now, here’s the important part: the best fintech companies don’t trick you into spending more. They earn by offering tools that work so well, you choose to stick around — or even pay for more.

And yes, they often mix multiple models. A money transfer app might charge a flat fee, upsell you premium features, and earn on currency conversion. A savings app might be free but quietly earn interest by holding your funds in partner accounts.

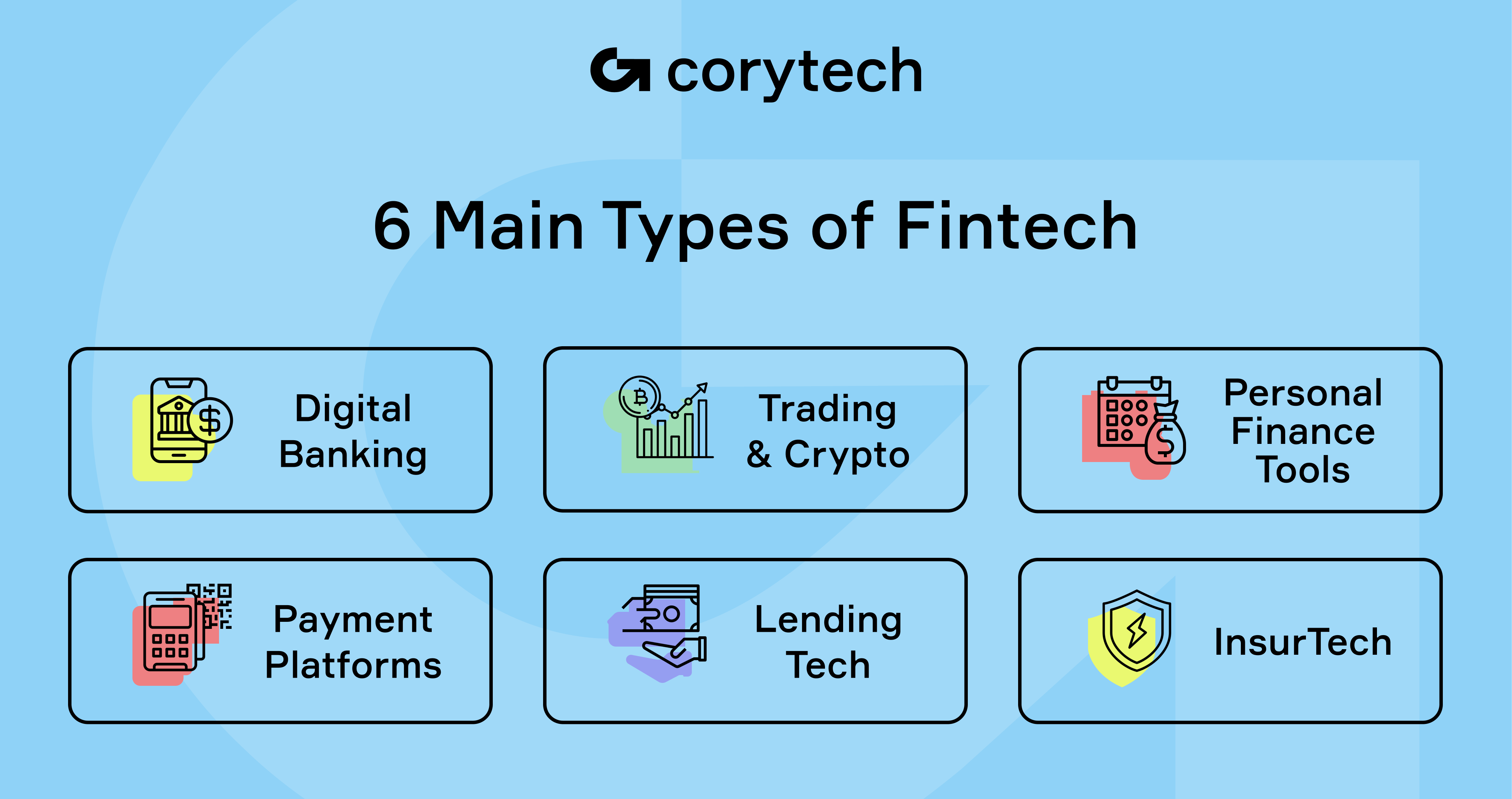

Let’s Talk Types: The 6 Main Kinds of Fintech

Digital Banking

Skip the branch. Open accounts, pay bills, transfer money — all online. Platforms like Revolut and Chime have made tech finance companies feel more like life companions than old-school banks.

Bonus? Financial inclusion. If you’ve got a smartphone, you’re in.

Payment Platforms

Remember when you had to physically go to a bank to pay bills? Now it’s just a tap or two.

Mobile wallets, QR codes, Apple Pay, Google Pay… even grandma’s catching on.

And yes, fintech firms like Corytech power a lot of this quietly in the background, making sure nothing crashes when millions hit "Pay Now."

Trading & Crypto

Stocks, coins, NFTs — oh my. Whether you’re a Wall Street vet or just someone who bought Dogecoin for the memes, financial technology firms like Robinhood or eToro have made investing wildly accessible.

InsurTech

No one likes dealing with insurance. That’s why startups like Lemonade ditched the jargon and built apps that explain things in plain English and pay claims in minutes, not months.

Personal Finance Tools (PFM)

Apps like Brigit or Qapital track your income, suggest savings goals, and even remind you when rent’s due. These tools turn your chaotic wallet into a neatly organized dashboard.

Lending Tech

Forget awkward bank meetings. Fintech corporations analyze your financial data faster than you can say “credit score,” then offer loans from real humans or peer lenders. Great for small business owners who just need a break — not another rejection.

What’s Actually in Your Fintech Stack?

- Digital wallets (Apple Pay, Cash App)

- Cryptocurrency (Bitcoin, Ethereum, stablecoins)

- Robo-advisors (Wealthfront, Betterment)

- P2P lending (Prosper, Funding Circle)

Each of these tools simplifies, automates, or improves the money game in some way.

Benefits of Fintech: Why People Are Hooked

For Consumers:

- Do stuff on your own time

- Feel safer with real-time fraud detection

- Get credit without jumping through hoops

For Businesses:

- Save time with automation (Corytech's bread and butter)

- Launch products faster

- Keep customers happier with personalized experiences

That last one? Huge. People don’t just want services—they want services that feel like they get them.

The Tech (and Red Tape) Behind It All

AI is changing the game

AI isn’t just a buzzword — it’s the quiet workhorse helping fintech apps learn from your behavior. From smarter fraud detection to personalized loan approvals, it’s how finance technology companies stay one step ahead.

And the regulators?

Let’s not kid ourselves. Finance is one of the most tightly regulated spaces. Between GDPR, PSD2, and new crypto laws, fintech brands walk a legal tightrope daily. But the good ones don’t just comply — they use compliance as a trust signal.

.png)

Real-World Fintech Stories

It’s one thing to talk about the potential of fintech companies — it’s another to see what happens when they deliver.

Let’s look at a few stories showing how the right mix of tech, empathy, and smart design can completely change how people interact with money.

Chime: Rethinking What a Bank Should Be

Traditional banks have made a lot of money from overdraft fees, penalizing customers who are often already in financial trouble. Chime flipped the script. They eliminated overdraft fees altogether and gave users early access to their paychecks. There were no gimmicks, just a genuine effort to put customers first.

The result? Millions of users ditched their old banks and moved to Chime. Because when a financial technology firm offers real breathing room — not fine-print traps — people take notice.

Brigit: Helping People Breathe Easier Between Paychecks

Budgeting apps aren’t new. But Brigit went beyond simple calculators and charts. It understood that many people don’t need a lecture on saving — they need support when life throws curveballs.

With features like interest-free cash advances, personalized budgeting tools, and smart alerts for upcoming bills, Brigit quietly became a lifeline for users living paycheck to paycheck. It didn’t shame them — it supported them. And that emotional intelligence? That’s what builds loyalty.

Placid Express: Rewriting the Remittance Rulebook

Sending money abroad meant high fees, frustrating delays, and far too much paperwork. Placid Express decided to fix that. Their platform made cross-border transfers faster, safer, and more affordable — especially for immigrant communities who send money to family members back home.

No flash, no fuss — just a system that worked better than the one before. And sometimes, that’s all people want: something that actually works.

.png)

Fintech FAQs: Quick Answers to Big Questions

What is fintech?

Fintech (short for financial technology) is any tech solution that makes managing money faster, easier, or more accessible — sending payments, investing, budgeting, or borrowing.

How does fintech work?

It uses technology — apps, AI, APIs, and more — to replace or enhance traditional financial services.

What are the benefits of fintech?

Lower costs, faster access, better personalization, and broader financial inclusion. Also, fewer paperwork headaches.

What are the risks of fintech?

Poor regulation, data breaches, and shady companies. But with strong oversight and better design, most risks are manageable.

How is fintech regulated?

Through a mix of local and international laws, licensing frameworks, and digital compliance tools that keep customer safety front and center.

So, What’s Next for Fintech?

Growth. Disruption. Inclusion.

Whether you’re a small shop owner tired of old-school terminals, or a product manager trying to build the next big thing, fintech companies are here to make finance suck less.

And Corytech? It quietly supports many of these success stories — handling the behind-the-scenes essentials like APIs, payments, and compliance, so businesses can stay focused on building what’s next.

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources